Price action is the king of the Forex technical world.

It offers traders essential knowledge that strengthens any technical strategy, and enhances forecasting ability.

Have you ever just wanted to look at a naked price action chart and be able to tell where price is likely to move next… with confidence?

This lesson is going to help you understand what is price action, and explain why it is the most popular trading methodology with Forex participants.

Price action is widely considered a compulsory learning step for Forex traders, as it’s the life blood, soul, and backbone of the technical analysis world.

With a serious adoption of price action analysis, a trader can be accelerated towards becoming a ‘master chart reader’ – no doubt.

Most retail and institutional traders use it, or at the very least use the skill of price action to enhance their own technical trading strategies.

Price action analysis is very dominant in the industry because:

- Price action trading methods are easy to understand

- Price action analysis is very minimalistic, so there is no ‘analysis paralysis’

- No indicators or extra data are required

- It can be a very stress free way of trading

- Consumes very little of your time once you know the strategy

- Any form of technical analysis is reinforced by the understanding of price action

- Most importantly – It works

It’s not hard to see why traders fall in love with it easily – it’s a type of trading that doesn’t care ‘why’ something happened on the chart, but more ‘what is likely’ to happen next.

This is the motto I follow: “Trade what you see, not what you think”.

If you’re keen to learn more, read on…

Price Action Explained for Beginners

Price action analysis is a big compliment to technical analysis.

The term “price action” refers to making trading decisions exclusively from a “naked” chart – a chart which has no indicators or other data loaded (which may influence the trader’s decision).

It is all about going back to basics and working with key elements on the charts like:

- Market structure

- Support & Resistance

- Channels, Ranges, Trends

- Price and candlestick patterns

- Breakouts and fake outs

All this information is readily available to us in a simple candlestick chart!

One of the main reasons traders are drawn to a price action system is because of the simplicity and minimalism.

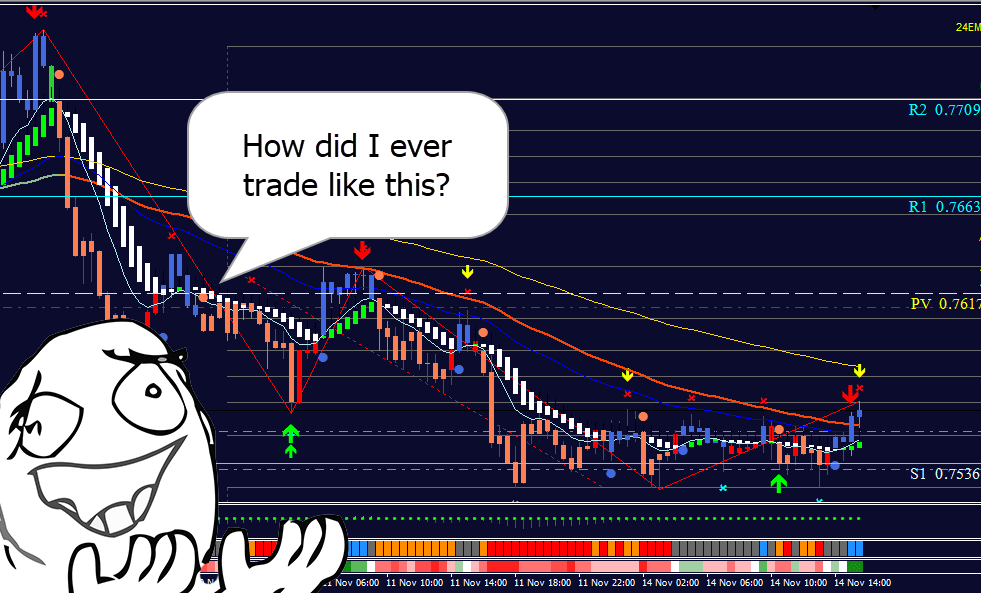

But another major reason for the move to price action is the escape from crippling anxiety and headaches from a stressful indicator heavy system…

If you’re a new trader, you might find public Forex forums a gold mine of information, and get lost in the strategies shared in all the threads for days.

While a lot of good information is shared on forums, there are a lot of strategies being pushed that really are a headache to trade, and difficult to make work.

If you’re a frustrated trader – it’s time to hit the reset button and go back to the basics…

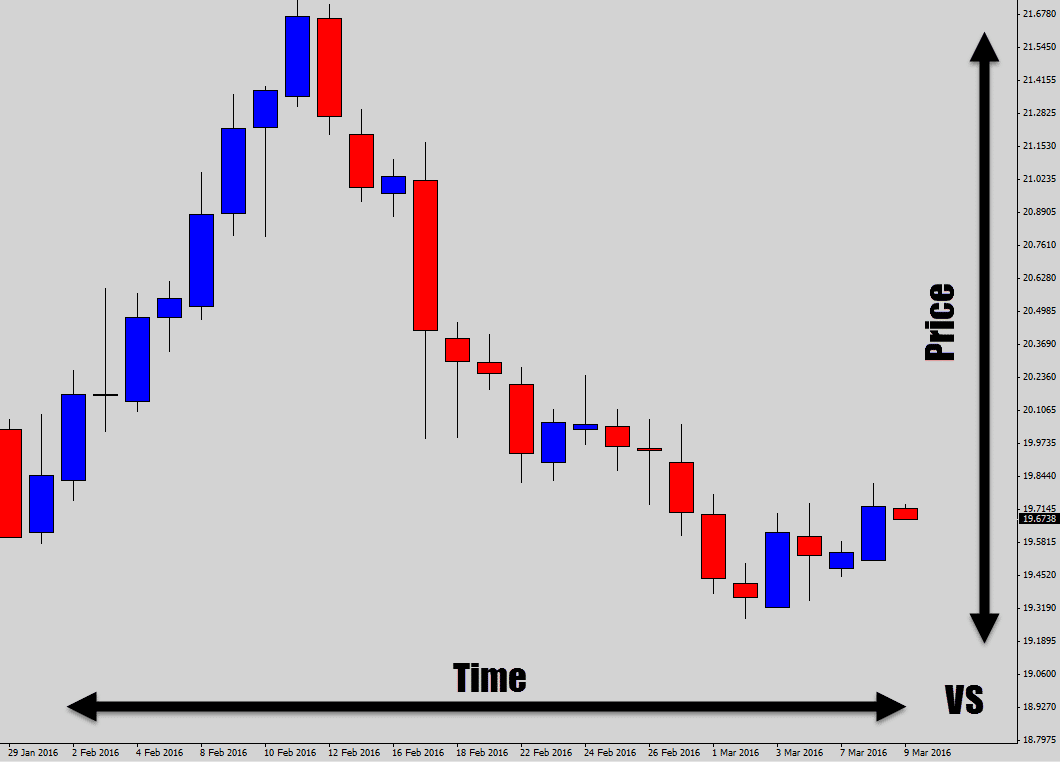

Price action is the study of price over time. This is called ‘time series data’. It doesn’t get any more raw than this.

With a nice clear chart, we can focus on the things that matter. Time and price 🙂

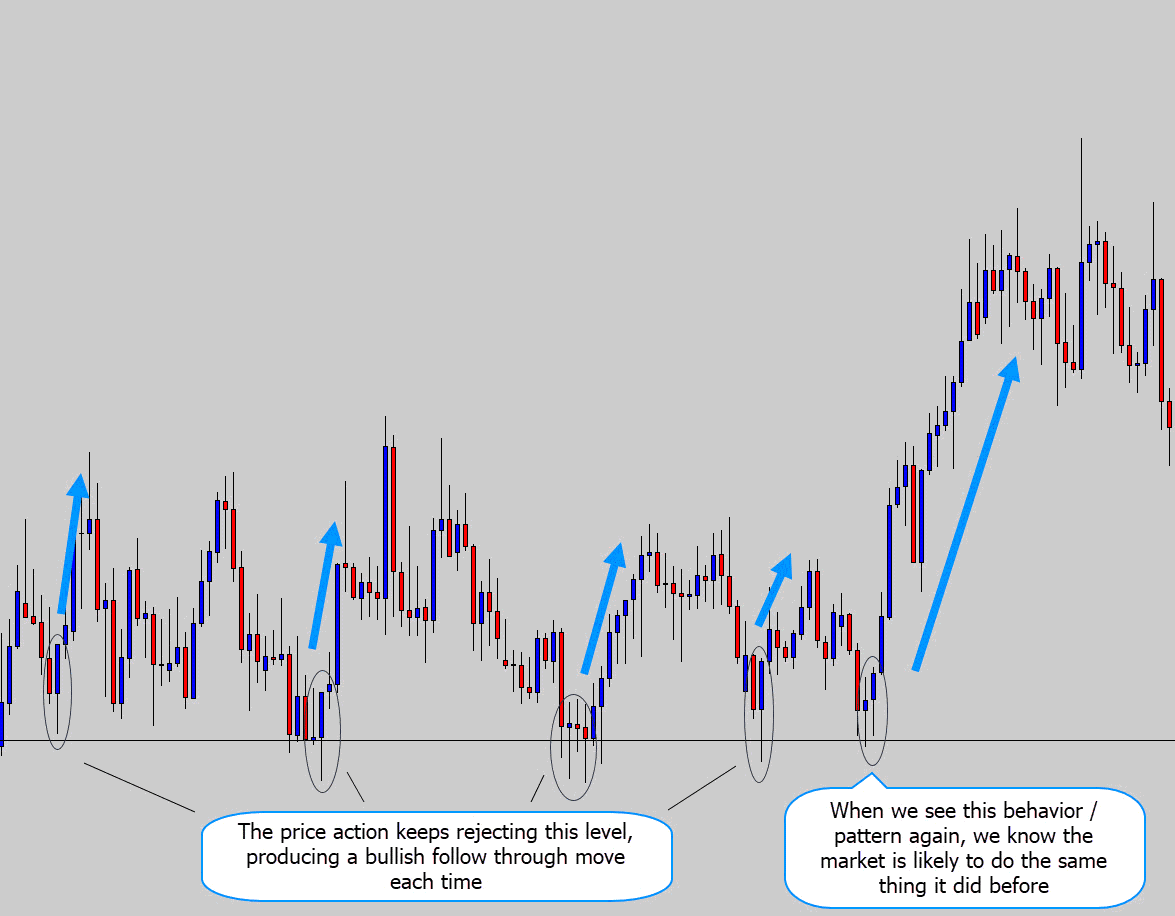

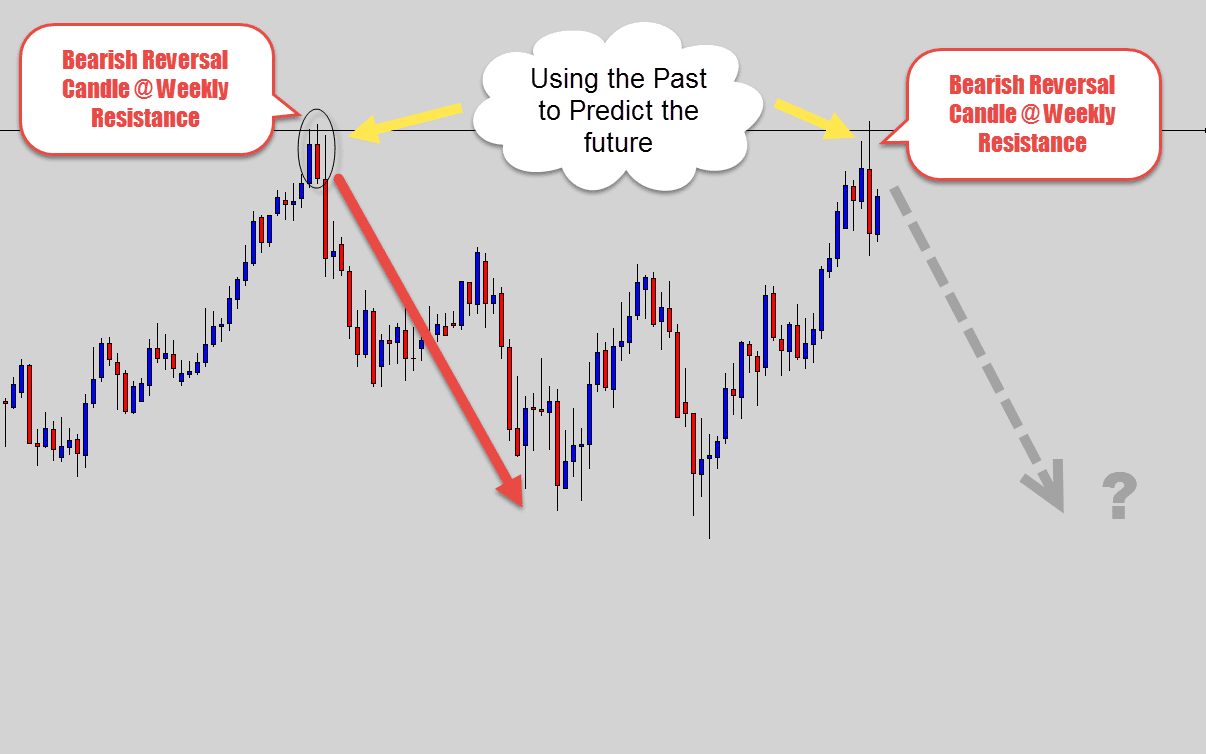

Price action encapsulates the analytical study of historical price movement and using that knowledge to find repeating patterns to help forecast future price movement.

Essentially, we look in the chart history to see what happened ‘before’ to recognize and prospect predictable, repeating patterns.

We wait for these predictable patterns to occur again in live markets, so we can forecast where the market is likely to move next – this is the basis for a price action trade ‘signal’.

Look at the price action below. We see the market continuously rejecting this support level – when bullish rejection forms off this level again, where do you think the market is likely to go?

We capitalize on this repeatable and exploitable behavior.

Because the market is driven by a crowd mentality – the same patterns keep occurring and producing the same result thanks to this crowd psychology.

Once you learn to the read the charts directly (without indicators) – you will develop the crucial skill of translating the ‘price footprint’, empowering you with the knowledge you need to transform yourself into a very confident trader.

Make the step towards increasing your understanding of price action and I promise – you will look at the market from a whole new perspective. I want you to think of reading plain charts as interpreting the ‘language’ of the market.

The charts are trying to communicate to you through the price movements, you just need to be receptive to what’s being communicated.

When you think back to your dark trading days, you will wonder how you were ever able to survive trading without the knowledge of understanding price action!

Checkpoint

How Does Price Action Trading Work?

As we discussed already – technical analysis involves observing a security’s historical patterns and placing trades that assume the patterns will repeat themselves in a similar way.

The basic assumption is that history repeats itself, because of the herd mentality of the market place.

But price action is more of a methodology rather than a term for a singular strategy. There is no ‘one way’ to trade it, in fact there are many.

Well you really start to dig in, it seems like there are endless ways to evaluate price action. I think this diversity is what draws in so much of the trading community.

Forex price action is more of a mix of art and science – a skill based system that makes it very subjective.

You could give two traders the same price action strategy, and they would both probably personalize them to their own way of evaluating the market.

But the process still remains the same. We use what information we have on the chart to establish a directional bias, and wait for signals to confirm our belief.

As a technical, or even a quantitative analyst, it’s your task to look at current price behavior and compare it with past behavior.

The comparison of what’s happening now vs. the history of price behavior can arm you with the knowledge needed to accurately forecast future price movements – this is quantitative analysis 101.

The same price action candlesticks and patterns occur repeatedly, and tend to produce the same reaction over and over again. This is exactly the type of behavior we want to exploit.

By learning these recurring patterns – we gain a statistical edge needed to become profitable over the long run!

Some price action nuances to consider are:

- The behavior of the market you’re trading

- What session the signal/event formed in

- The structure of recent price action

- If the market is at a major decision point or not

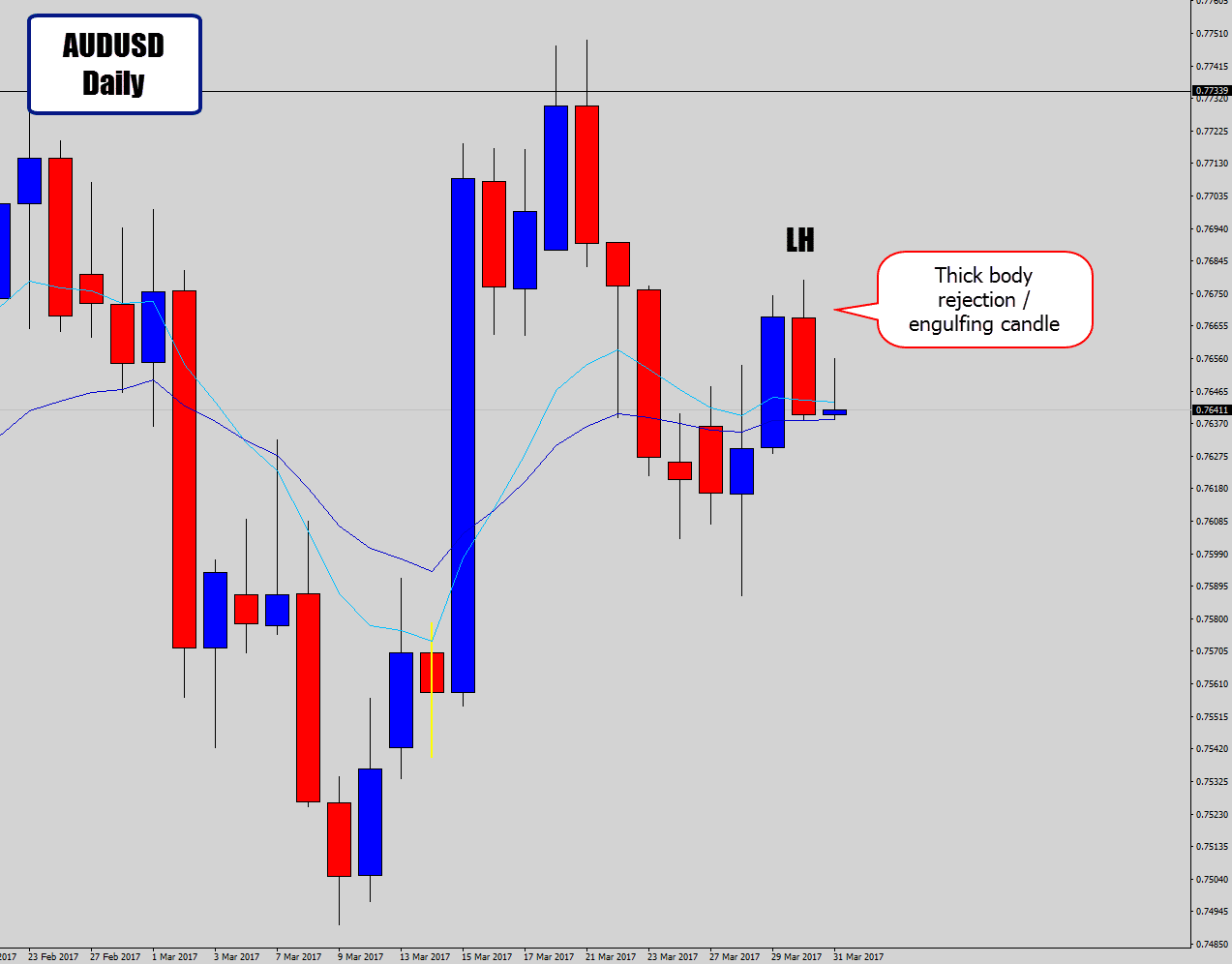

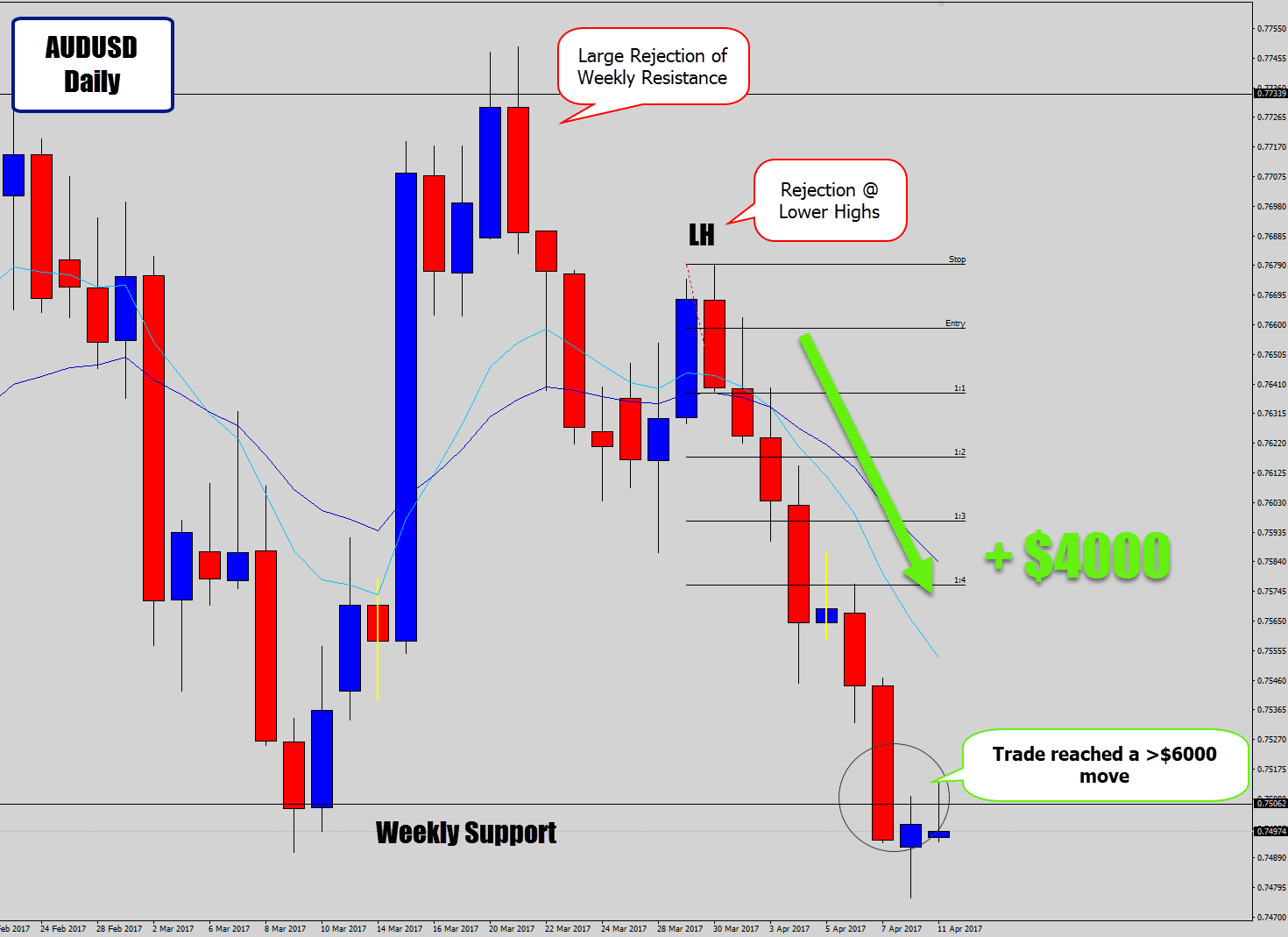

Take a look at an example trade below. We are looking at a bearish rejection candle that forms off a lower high.

A very simple sell signal – no complicated analysis necessary.

I know from my experience in the market, when we start to see weakness off lower highs after clear a bounce off a weekly resistance, the market is likely to continue with it’s downtrend…

Paying attention to historical movements vs ‘the now’ can make a life or death difference in helping you forecast future price movement.

If you want to trade price action like a boss, study the chart history, collect data. Know your signals in and out – you will be able to trade with a high degree of accuracy and confidence.

You would be surprised how many times these kind of price action events allow you the opportunity to position yourself ahead of the moves.

Checkpoint

Price Action Vs Indicators

Because we are very analytical creatures, indicators draw on our temptations.

An indicator usually visualizes one aspect of price action, or many combined together.

You would be surprised how many ways you can get data from price action, therefore we have an endless supply of indicators – extending into the thousands.

They draw on the ‘shiny new object’ syndrome – giving us a new ‘special’ way to view the market.

While my feelings are mixed these days about indicators, the truth is ‘lost’ traders tend to pile the indicators onto their charts, overloading their brain with too many inputs.

Or another common symptom is the ‘pogo stick hop’ from one indicator to the next – chasing the ‘shiny new object’, hoping the next will be the ‘one’ to bring endless riches.

That’s why I generally discourage traders from using indicators and to first become good with reading price action instead.

It is my belief that most traders fail with indicators because they don’t really understand the data that is being represented.

Most traders are looking for the ‘buy on green arrow, sell on red arrow’, no thinking required kind of tool. But most of those are usually deceptive by ‘re-painting’, or produce really low quality signals.

Whenever you’re using an indicator, you should really make an effort to understand how it’s calculating its data so you can interpret what it is meant to be telling you.

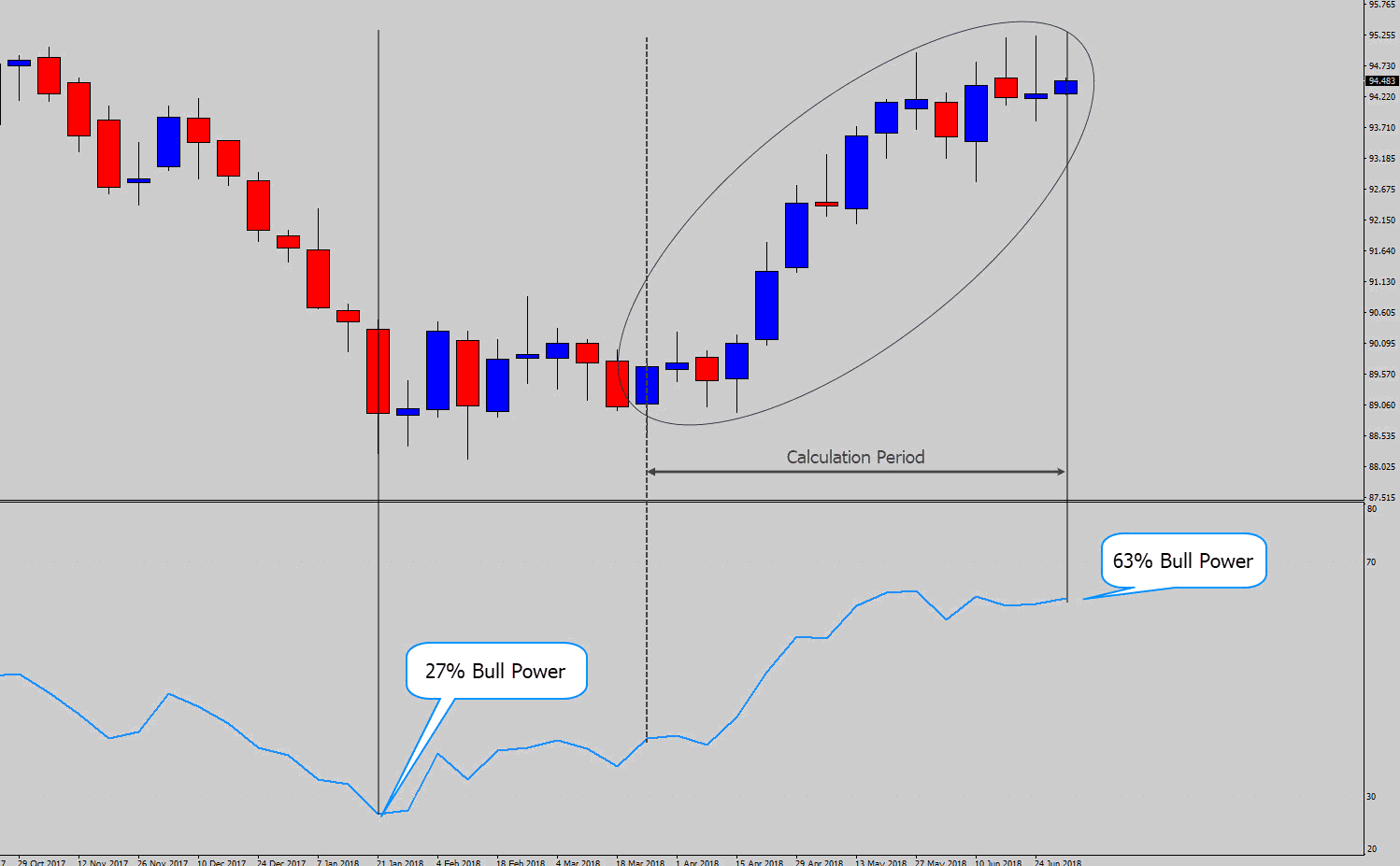

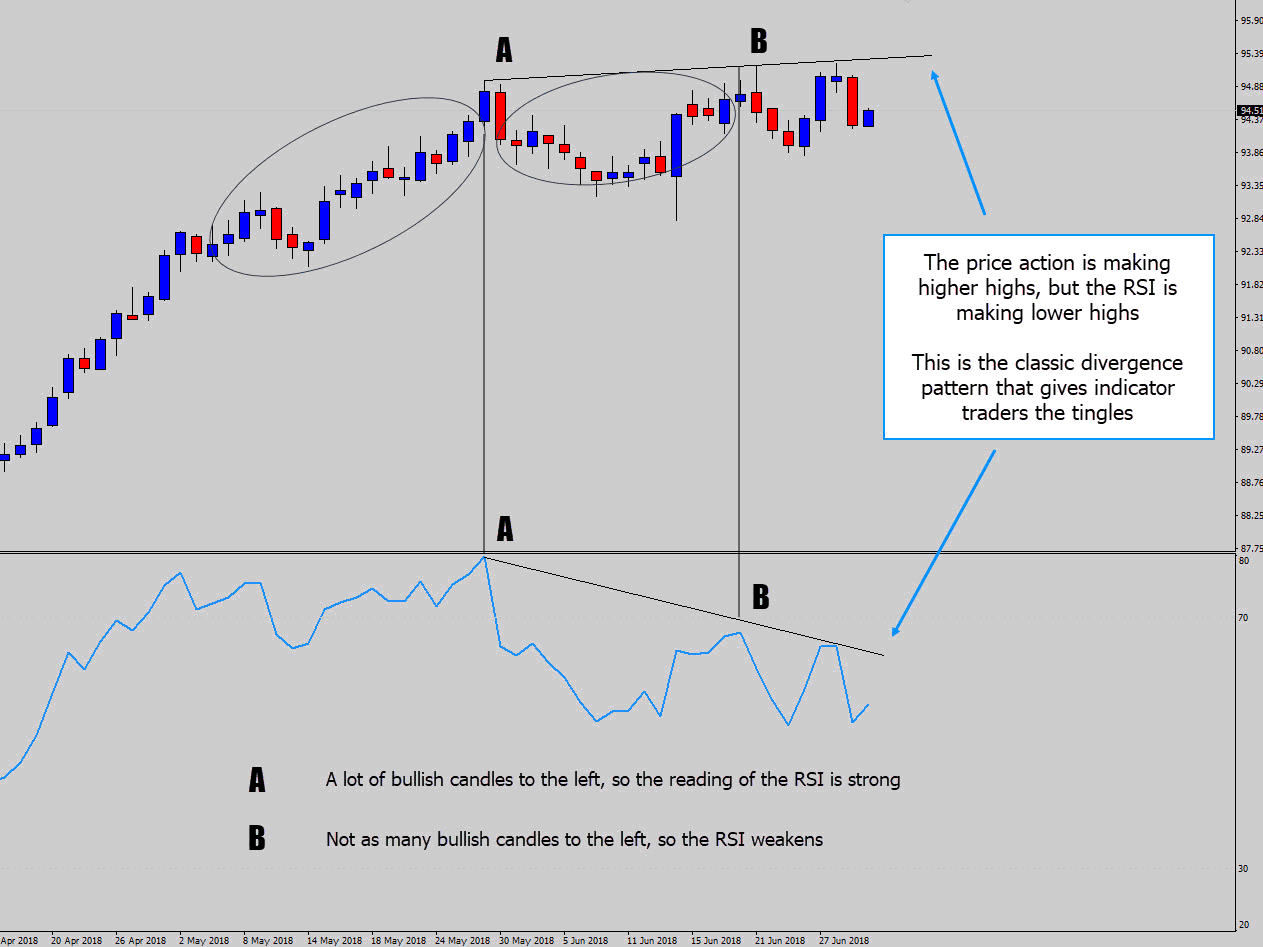

Lets look at the Relative Strength Indicator as an example. I am going to show you how to read the same information the RSI tells you, directly from the price action.

The RSI is really simple. In simplistic terms: it counts how many bullish candles, and bearish candles there were during the calculation period (how many candle’s it looks back at in history).

That number is converted to a ratio and printed as the final output. Basically a 0-100 number of a bull vs bear candle ratio.

A 100 output would mean only solid bullish candles were found in the calculation period – which is super rare.

You can see when there are more bull candles counted in the calculation period, the number will be higher.

But what about divergence? This is the part of the indicator that traders find mystic and powerful…

The divergence is occurring because the price action is still making new highs, but the RSI is reflecting less bullish candles being printed. Is this really magic?

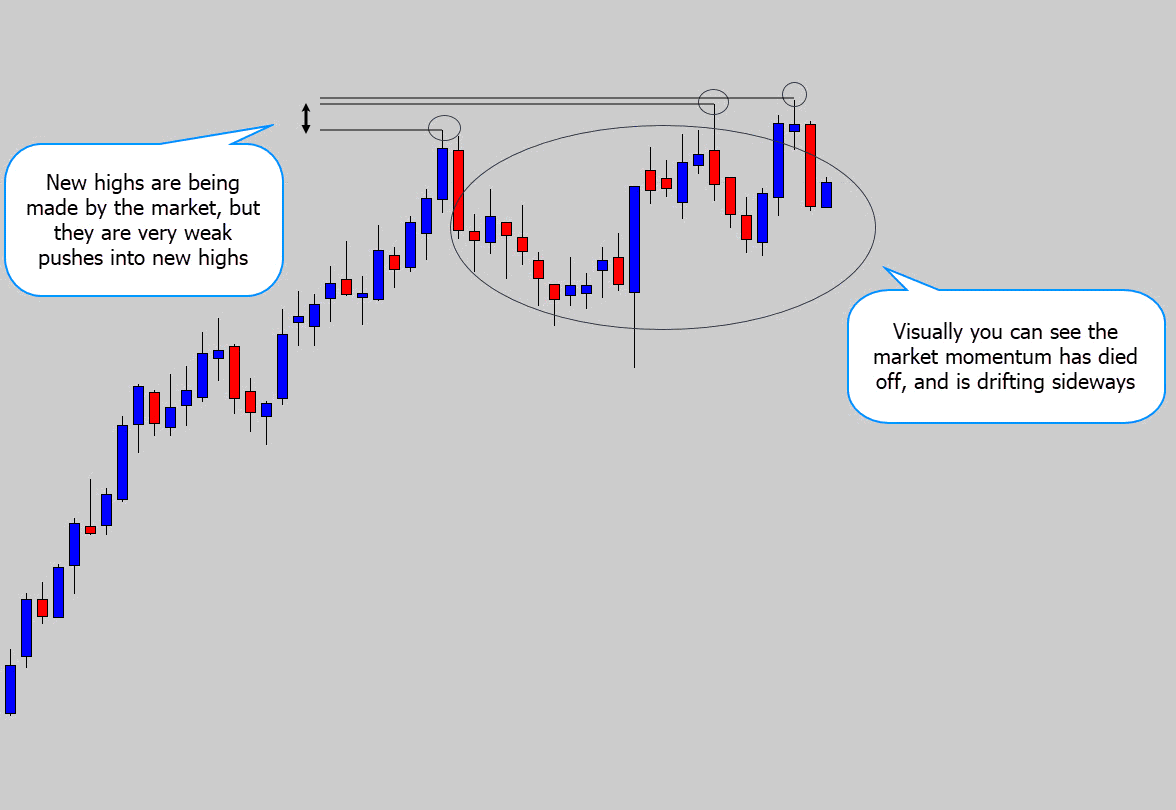

No – take a second look at the chart with the RSI out of the picture…

Although the market was officially printing new highs, they were not much higher than the previous – this is a statement of weakness from the price action.

Also, the momentum of the bullish trend has completely died off, and you can see price has now just stalled by drifting sideways – not a sign of weakness, but a sign the market has lost momentum.

When you think about this logically, it is easy to see why the divergence occurred. The RSI was weakening because of the sideways price action.

You only need to look at a plain candlestick chart and examine the swing highs/lows, and look at price momentum to spot strength and weakness in the market without using an indicator.

It’s not magic, and I really think the RSI is pretty useless in today’s markets.

I believe ditching the indicators like the RSI, and learning to read the information from the price action itself will make you a much better technical analyst.

You will also have the benefit of cleaning up your charts!

Some indicators out there may be more complex, and viable to use – especially now we move into the age of big data, and machine learning.

But most of the common indicators just give you second hand information that you can already get from looking at the chart properly yourself.

Checkpoint

Want to go Beyond The Basics of Understanding Price Action?

If you’ve made it this far, you’ve probably gotten a clearer understanding of price action trading.

You should be starting to realize by now that a price action based approach to Forex trading is a very powerful and lucrative skill to invest the time in learning.

Any trading system that has a price action based methodology as its foundation is probably going to be around for the long term too.

I hope the guide here has been a nice ‘kick starter’ into your journey.

The price action I explained here is only the tip of the iceberg.

If you’re one of those ‘hungry for knowledge’ types, you might like to move on to my tutorial which takes things to the next level: examining price action strategies further.

However, if you’re really serious about learning price action trading, and want to dedicate yourself to learning everything, check out our Forex course – in my private war room for traders (which also contains all my custom MT4/5 tools).

Don’t forget to leave your comment below, your feedback on these tutorials is important to me and gives me the positive motivation to make more tutorials like this.

Look forward to hearing from you, best of luck on your new price action journey!

kram osmond

hi i love your content. actually i started throwing my indicators in the backyard. my question is… did the weekly resistance and support is based on the previous weekly SnR? and what if the current price broke the resistance, what should be now our new resistance level? thank you sir

Adekunle Kazeem

This is awesome. Thanks

Sangu Charles John

Guy, you’re simply the best. This is one of the best article I have ever come across regarding price action. You just nailed it home. You stay blessed fella.

Simba

I really like the way you explain everything,you make me think positive even though im still loosing in my trades.but one day i will be an expert through your tutorials

Shah

Hello Dale, I always like to read your lovely articles about price action

Keep it up what you are doing!!!

said

thank you, Dale for this great article

palinda

Thank you Dale. Your articles & videos are very interesting. Please keep posting the articles.

Jeff

Again…great stuff…I appreciate your site very much….plan to get through most all of it….really think this is the way to go…..

Thanks much

Kevin Gitau Njuguna

Thank you Dale for such an amazing article. Very informative and easy too grasp. Brilliant!!!!!!

George

Absolutely great information and so true about price action!!! Well explained and in a simple yet efective manner!!

Thankyou.

rizal

Tq for posting this…good information.

Mthande

Brilliant work brother

Mamoun Ali

It is excellent

many thanks for your efforts

SANJAY SHARMA

Explained with simplicity.

Could add more value by adding more charts.

Keep up the good work

Musa Mwanshuli

you are very good. I would like to learn more from you

ujjal ray

just awsome

Craig Cassell

Thanks Dale,

I found this whole article very informative and easy to grasp.

I am new to your war room and have had 6 months of learning elsewhere, so trying to push that aside to enable me to fully understand and grasp your price action trading.

Craig

NOBAHLE MANELI

Thank you for the information shared. However, I learn better in pratical than in theory. What can you advise for a person like me?

Pavel Kokavec

Thank You Dale, great work.

Grettings from Slovakia.

Xolani

This is amazing am so will to start this.. Iwanna learn more, thank you

jessie

great stuff dale 🙂

Qalu

Thank u so much for sharing this helpfull information really the best artical i have ever seen thanks again

Md Shohrab Hossain

Very nice post bro..

Alonso Martinez

grasias por tan comprendente articulo y no solo eso abre las puertas a un nuevo orisonte que esta lleno de erroneas interpretaciones pero su modo de esplicar hase que sea mas facil de comprender gracias

Rayol

appreciate brother, you give a clear insight into PA trading.

zedi

Very Informative! Superb Article! Thanks for sharing and article hv improve my intraday techniq. thankQ

zedi

Very Informative! Super Article! Thanks for sharing and article hv improve my intraday techniq. thankQ

Rox

Hello

This is wonderfull, i wish i had seen it nefore i lost my money.

thanks for the article

satish

how to identify buy sale ZONES using RANKO CHARTS.

Are their any rules/ strategy for such zone trading using RANKO charts

mzwandile

Hi Dale I have no words except to say I am impressed and how can I get a copy of this guide …I will slowly learn the market. Thanks

Musa

Quite insightful information. Much appreciated brother.

Martin Davids

Very impressive. I learned quite a lot. Thanks Dale

Hasli

Hi Dale…. thank you for your tutorial in price action. It’s really simple and workable. Hope you can continue to share more of your knowledge to the world of traders. Thank you….thank you…thank you.

Mohd Khairul Nizam bin Rumli

very good article bro????????

Siyabonga

You are simply the BEST FOREX TRADER ALIVE. Thank you so much for all that you do.

Paulo

thanks for sharing

happy trading

be well

Carlos Fernando Dazzi

Dear Dale, I’ve learned a lot from your videos and articles. I really appreciate what you’ve done for us fellow traders.Thsnk you very much. Fernando Dazzi

David Mottram

Hi Dale,

I’ve spent the past couple of months reading everything I can on FOREX, opened up demo accounts to practice, but haven’t quite got there. And then I found your website, your articles are brilliant and seem to answer that nagging doubt in my head about how to trade FOREX. I’m seriously considering signing up for the war room membership.

Keep up the good work.

David (UK)

Fabian Drurie-Brewer

I have been analysing yours and others strategies. Yours is easier to understand, makes sense and so far has made me cash. I only lost one trade out of the four I placed but that was due to my own faulty analysis and not enough patience to ensure the set-up is correct. I will never make that mistake again! Lol. Thank you for the information and guidance.

Alden

Hello dale, just started learning how to trade for the last month and your articles are very helpful to trade without indicators. Im planning to open a real account next month but im not quite understood how to see when a sideways chart hit the support/resist going for a breakout or reversal. When the chart is going to hit a support/resist should i wait for the next candle whether its going to make a fake breakout and hop in when its going reversal? Thank you very much! Hope to get an insight from the best

Replying to: Alden

Dale WoodsAuthor

It’s not usually a good idea to trade through levels to try and catch a breakout. That is true, you are risking getting caught in a fake out, which occur a lot around main levels. I wait for the breakout candle that shows a decisive close above/below the market, so the price action clearly shows you it’s going for it.

Dahrel

Almost ready to quit trading Forex but thank God i found your video in youtube and catch my attention. I’m learning a lot from your articles and trying to apply what I’ve learned from you. Thanks a lot for sharing your talents! Keep it up and stay blessed!!!

Bernard

This is a great intro to price action trading. I enjoyed the content and hope it helps form a rock-solid trading strategy as I check on your other posts.

23Traders Tutorial

Thank you for your great post. It’s really very informative and really helpful. Please Keep posting. Thanks again.

23Traders Tutorial

Sajayan

Thank you very much Mr. Dale for this valuable informations

John Sambo

I went through your price action tutorial and made $5 with no sweat. Thank you for explaining PRICE ACTION in a simple non-technical way. I will go through the tutorials over and over again. thanks once more.

Howard

Love the way you explain price action. With understanding comes patience and discipline. Thank you Dale. Much appreciated.

jemingcrz

good info price action for trader beginner like me,gak kalu ada kot bahasa klate lagi molep,bnyk teknik hok ore buat melalui price action sajo,cth hh,lw break lebih kure cb1 break,triple inside candle lebih kure dominen cs break,jadi paham2 je laaa

Stefano

Thank you! Very helpfull

Dennis

Awesome. Thank you for what you have shared. An explanation that really helps one grasp what is going on. Yes, I will have to continue to study and get the correct mindset but very encouraging and helpful.

Rajesh

Wow, great simple reading. Is the content available as an e-book?

Tseliso Ramoeletsi

Really inightful!

Thnks n great work Dale

Pchai

Thank for good article, it is easy to understand.

DayTrader

You have inspired and helped a lot of new traders, like myself. Great work sir! Your efforts and time are greatly appreciated! Bless.

Victor

Such an intriguing insight

Rondell

Bless your soul for existing. God knows where we would all be if our tutelage was left in the hands of some of these other trainers.

Juhairi JJ

Hello Dale … Like your articale above … thanks. Need to know .. can I Copy Trade you? …

javier

thank Dale for share your knowledge with us.. Stay blessed.

jvfx

kmzahirul islam

It is very easy to understand .thank a lot .

ahmad

thanks frind on this really sporting artical

Thomas T Brown

Dale,

Thanks so much,It was presented so clearly and I learned a lot!

TB

Sikiru

Hi Dale,

This is another kind gesture from your humble self and it’s quite commendable.Thank you Dale and keep it up,but quickly want to chip in a piece of advice,try to include a snap shot of your performance on demo account using all your itemized strategies on Price Action so that we will be rest assured the strategies on P.A really work.Once again thank you.

abdul wasay khan

Hi Dale

Your article is very useful and very informative.you did a great job.thank you very much.

Generaal Goudvis

Hi Dale. You showed again….Price Action rules

Grant

Dale thank you for taking the time to write this article.

enke

my trading mind full changed from find your site. pat is great. thank you so much changing my opinion and life. best wishes for you

Travers Harris

I have started reading this article but I am a long way from finished. I signed up with IQ options as they were the cheapest with a $20 deposit and I am an old man without an income. I deposited more a bit later as I lost the $20 dollars and lost the rest of my deposits as well. So I opened a free account with IQ and used the information provided by the Forex Guy and won 7 out of 8 times., that’s an 87.5% strike rate, the best I have done. And I think why I lost the one time because I did something wrong.

I am going to really study all the information provided as it is brilliant. Thanks Dale

John Smit

Great article! Thanks for sharing your knowledge.

Dragan

Hvala Dale,pozdrav iz Srbije.

Thanks Dale,greathings from Serbia!!!

Tobias

This guide is very comprehensive and written is such a simple style that I find it very easy to understand and will be very helpful for me in the future. Thank you so much!

Paul Wett

Thanks for posting this Dale.

Ovidiu

Hi Dale,

Very good article as always!

Kind regards,

O

Eric LeBouthillier

very nice Dale !! Great work !

Norbert Harisch

Thanks a lot for this guide! Really a great service for your customers. It helps a lot to get an overview regarding price action trading. Also the chapters about Heiken Ashi and Renko are deeply interesting.

Norbert Harisch

Kwabena Boateng

Dale Woods, you are so smart and bright. You really have command on the charts. Let me ask you, did you graduate from any of the Ivy league universities?

Thank you for sharing again this priceless piece of knowledge with the rest of us.

Stay blessed.

Replying to: Kwabena Boateng

Khaliili

Super powerful EDU tips