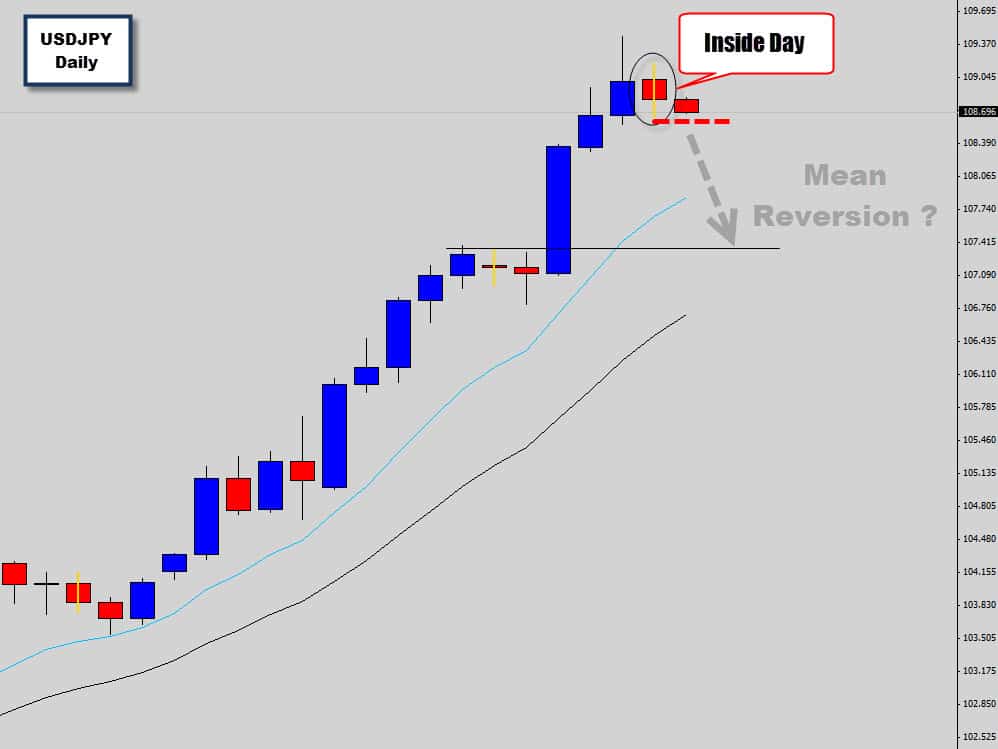

The USDJPY has rallied aggressively higher after breaking out of the long term consolidation pattern we witnessed for the first half of the year. It’s no surprise the breakout out of such a long term churning pattern has been so explosive. The bullish momentum has now pushed price to an extended point relative to its mean value and starting to look a little ‘top heavy’.

We know the market won’t move in one direction forever and know that a correction is due for this market. An Inside day formed last session as price stalled and churned at these extended prices. The Inside day closed fairly lower from the open price. A negative close to it’s body gives the setup more of a bearish feel. If price breaks below the low, we could see a counter trend mean reversion kick off.

Traders looking to get in with the bullish trend momentum should wait for a bullish setup to form closer to the mean value to avoid being wiped out in any correctional movements.