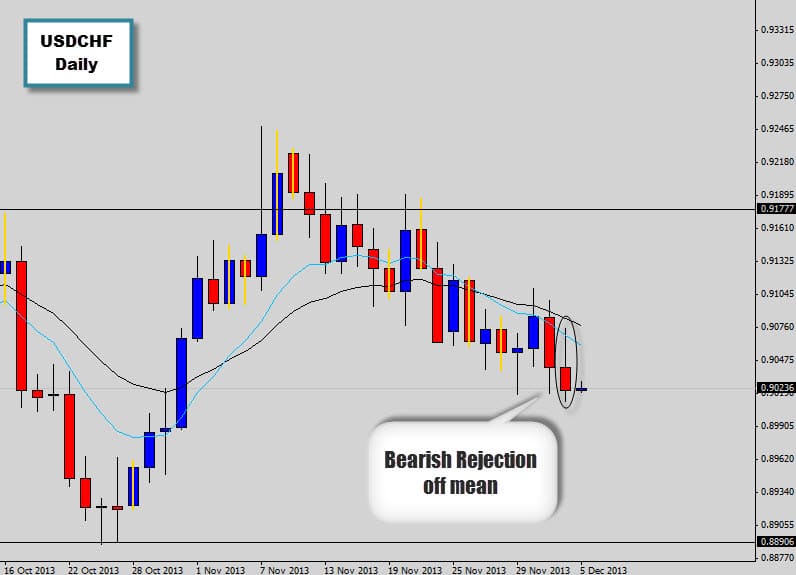

At the end of the New York close, the market closed as a bearish rejection candle because a bullish move higher into the mean value that session was denied. The candle closed much lower than it’s opening price emphasizing more weight to it’s bearish nature.

We are looking for retracement entries during this session to take advantage of better entry prices of this setup as we are anticipating further downward movement here. The market will most likely continue to sell off and test the weekly support below. Because this trend seems to have a ‘grinding’ nature due to lack of volatility, the trade may take a while to hit the desired target.

USDCHF Trade Update

Last week we looked over a bearish trade opportunity when a bearish rejection candle formed in a down trending environment. The trade did give us a retracement trade opportunity and really picked up bearish momentum from there. We’ve seen an aggressive sell off into that weekly support level we were targeting where the trade was liquidated.

I am just checking the charts around the London open time, which I often do to see what happened during the Asian trading session. I’ve noticed now that the USDCHF has reached an important turning point. The weekly support level being tested is where the market previously found a bottom.

Now the Asia session breakout to the low side is now being rejected as buyers step in as we build closer to the busier London trading session. Price is also located at an extended point from its mean value, so there is a good chance of mean reversion trade opportunity.

This is the beginnings of a breakout trap & reverse setup, I am anticipating the bulls to fire up here but I’ll be waiting for a break of the previous day’s high before we consider any long positions.

Thandazani

I have always been wondering that during the the trend if the bearish rejection can form what action to take…. now I know that what to do. What is also my concern is, the bearish rejection candle it high is not higher than the high of the previous candle, can I also consider making a trade even in such situation?

Replying to: Thandazani

Dale WoodsAuthor

That normally would be a great quality control sign, but in this case I felt that the signal was still good quality even though it was just shy of forming at a swing high.

You could have still used the previous swing high as a stop loss point.