This powerful Outside Bar Price Action is one of my favorite signals taught in the Price Action Protocol. Large power signals like this in established trends are the high probability, low risk trading opportunities we patiently wait for. We talked about the Outside Bar signal last week, which has now pushed prices into higher territory, leaving Price Action Traders in a floating profit.

Previous Post

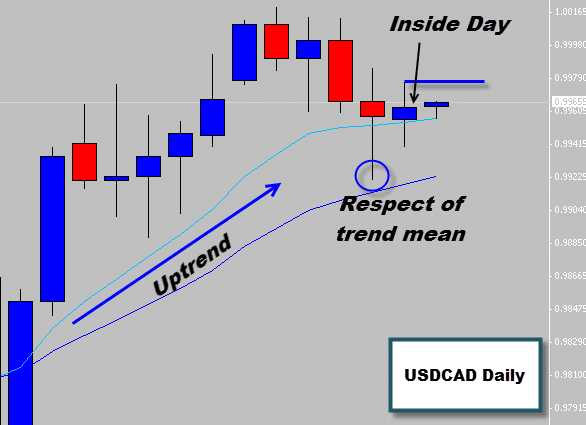

There has been some interesting Forex Price Action on the USDCAD market since we last spoke about it earlier this week. We did mention that a break of the Inside Bar formation’s highs could see a further extension upward in this established uptrend. Before moving upwards price made a large flase move down below the trend mean, trapping a lot bears before launching back up to create a bullish Outside Bar signal, which further enforces a long bias. Now price has broken the outside and previous Inside bar trade triggering long positions. If you would like to know more on how to trade these Price Action Signals, please see the Price Action Protocol.

Previous Post

While shooting over the charts today, I’ve spotted a potential long signal on the USDCAD market. While this market can be erratic at times due to the high correlation with crude oil, it’s currently in a steady uptrend at the moment and ticks all the boxes for ideal trading conditions as per the Price Action Protocol. At the end of trading last week, the USDCAD marked sold off into the trend mean value when buyers took advantage of the market weakness and pushed the price back up with the over all trend. As the market churned away last session, the Daily candle closed as an Inside bar. If we see price break the highs we could see another leg of this trend continue, USDCAD is usually most active in the New York Session, so caution to any false breakouts that may occur too early and trap traders into bad positions.