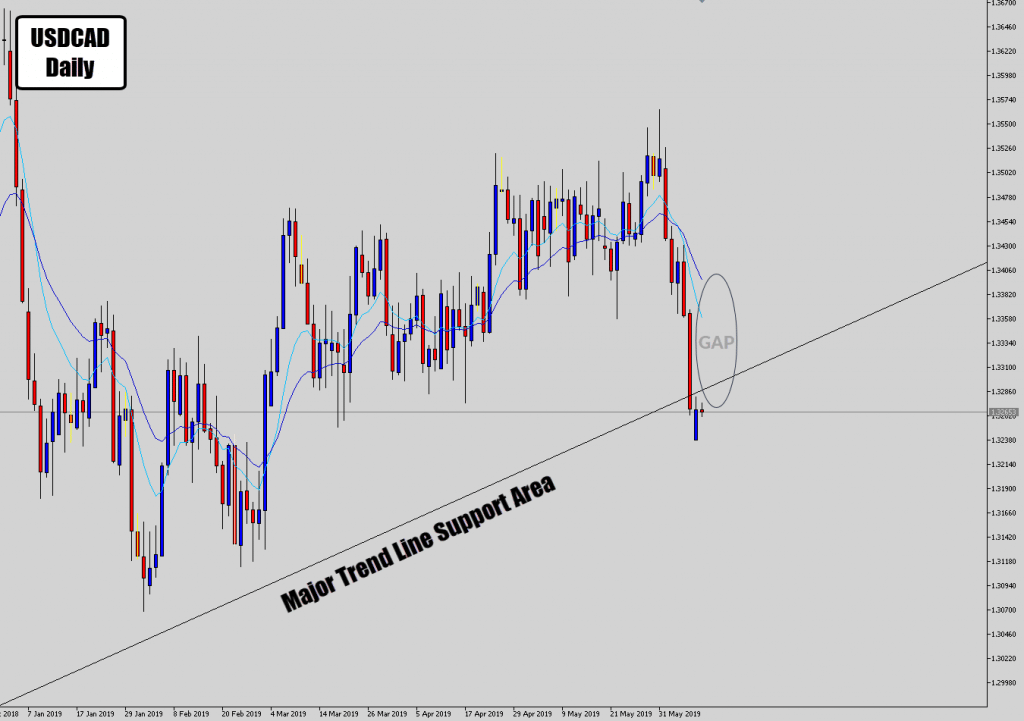

One of the strategies we use in the War Room is a mean reversion setup – which is what is happening right now on the USDCAD.

Visually, the price moves a lot faster than the mean value can move and “gaps” away from it. These gaps are the tell tale signs of a pending reversion.

We’re looking at a gap between mean and price, but also some testing of a major tend line.

This major trend line structure is not visible unless you scale out to the weekly chart and see the long term macro at play here.

So we have two catalysts for a reversal, the mean gap and the major turning point.

Breaks past this bullish candle high will like turn into a quick push back up towards the mean to “fill the gap”

Best of luck traders.

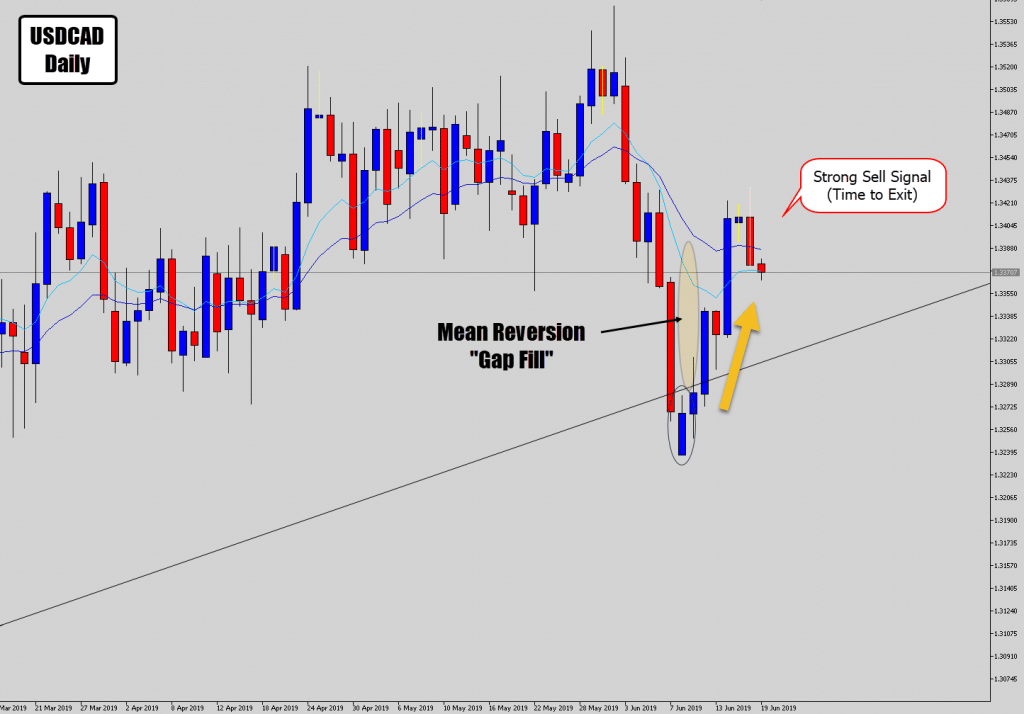

Price Pushes High and Mean Reversion Explodes

This is what a good mean reversion trade does, just gets going and makes that rapid correction move.

One price broke higher past the signal candle, the next few days were very strong to the upside.

Now it’s probably time to think about getting out of this one, as we have strong evidence the market wants to sell off again.

The last bearish outside day yesterday coming off the resistance is communicating the market is very weak here and likely to drop in the coming days.

Most price action traders are likely to exit the long and go in for the short now.

But that’s the mean reversion trade idea over, with shining success.

Hope you made some coin here – if you want to learn more about mean reversions, check the War Room for traders which is set up for traders who want to master price action trading.

Until next time, best of luck on the charts.