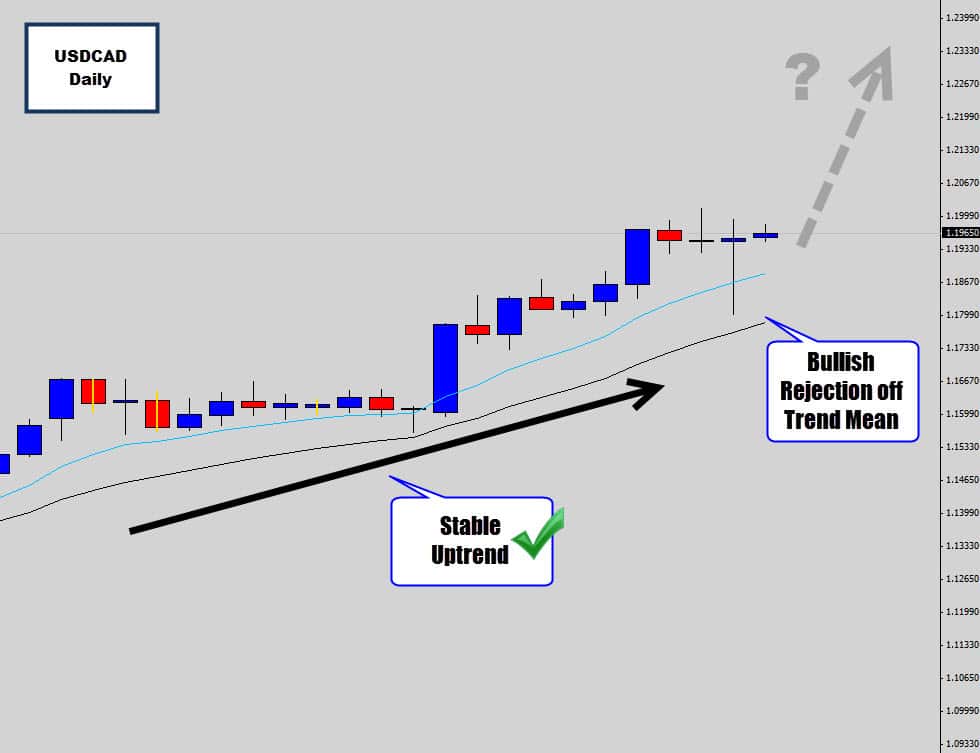

Recently we covered a bullish price action trade that formed within a stable uptrend on the USDCAD daily chart. You can see how stable this trend is just by observing how the EMAs, which map out the mean value for us, are nice and smooth, and angled upwards nicely.

The mean value has been acting has nice dynamic support and has been a key turning point for counter trend retracement within this trend – which is a good sign also of trend stability.

A large bullish rejection candle formed when a counter trend move terminated at the mean value, as the mean held as dynamic support. This is a very good sign the trend is still intact and higher prices are very likely to develop from this setup.

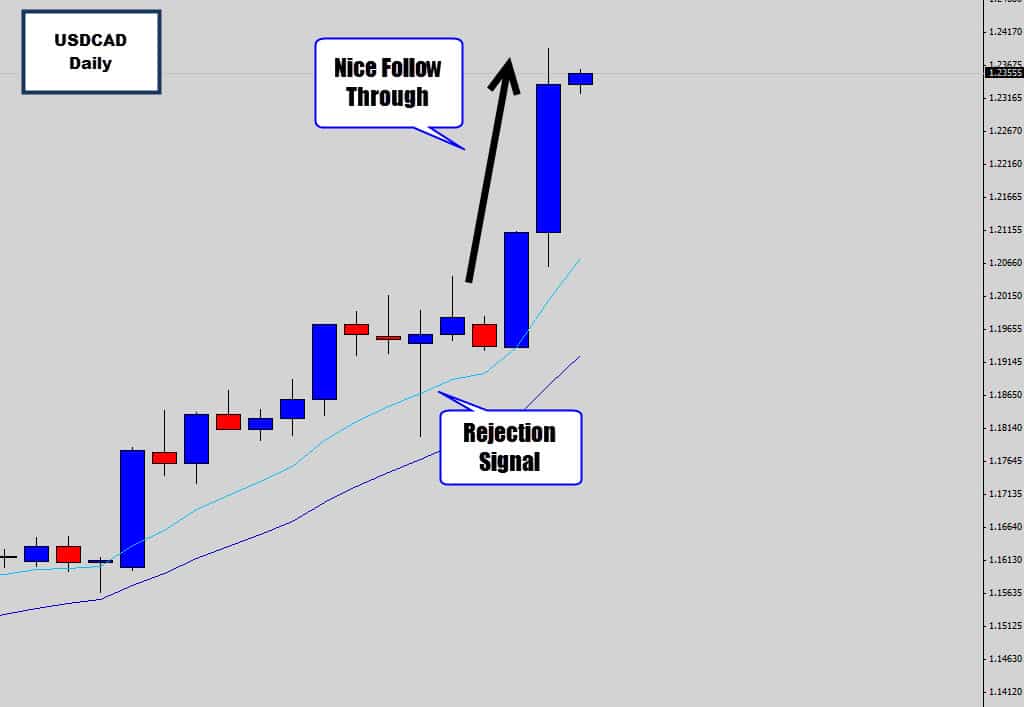

USDCAD Rejection Candle Pushes Market Higher

As foretasted the rejection candle off the mean value was a nice catalyst to drive prices higher and extend this trend into new highs. War Room Traders already reporting in some nice returns here.

Anyone still in this trade might want to consider taking profits as the market is now overextended from the mean – we could soon see a mean reversion move as the market corrects back down. It’s important to always go with the flow when you’ve got mammoth trends like this one, this market would be chewing up anyone attempting to sell.

Now we’re just waiting to see if another buy signal forms when the market returns to the mean, and see if it holds as dynamic support again.

If you’re interested in extending your knowledge about trading Forex, reading charts without indicators to forecast price moves like this one – then feel free to stop in to our War Room information page and check out if being a War Room Trader would be a good fit for you.

Best of luck on the charts!