There are various strategies that the panel has integrated, ranging from placing stops via a candle stick, market volatility size or even just by inputting it yourself. Let’s walk through each strategy and their options available with them, and I will explain in more detail.

Common Features & Options

Before we get into the actual strategies, I would just like to talk about some things the panel does which will remain consistent between the built-in strategies. Firstly, you must remember when you’re shorting the market that your exit is at the ask price. So your stop will be triggered when the ask price touches it.

This means we have to factor in market spread to the stop loss – but no action is required from you, because the panel does this automatically.

If you see your stop is placed a few points higher than you expected it to be, that’s most likely because the panel accommodated the spread for you. The second common feature is the ability to add on extra number of pips to whatever the panel calculates the stop price to be.

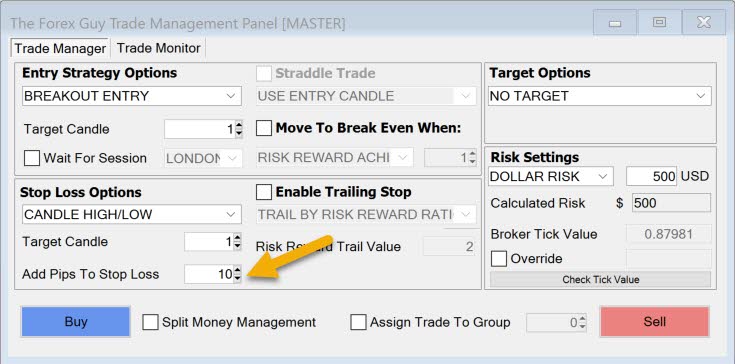

Above I have asked the panel to add 10 pips onto my stop loss. It will first calculate the stop loss price based on what strategy you select, then after it has the strategy’s stop level, it will add your requested amount onto that to get the final stop level.

The extra pips and market spread will be included in the risk calculations to make sure you don’t risk more than intended.

Using A Candle High or Low

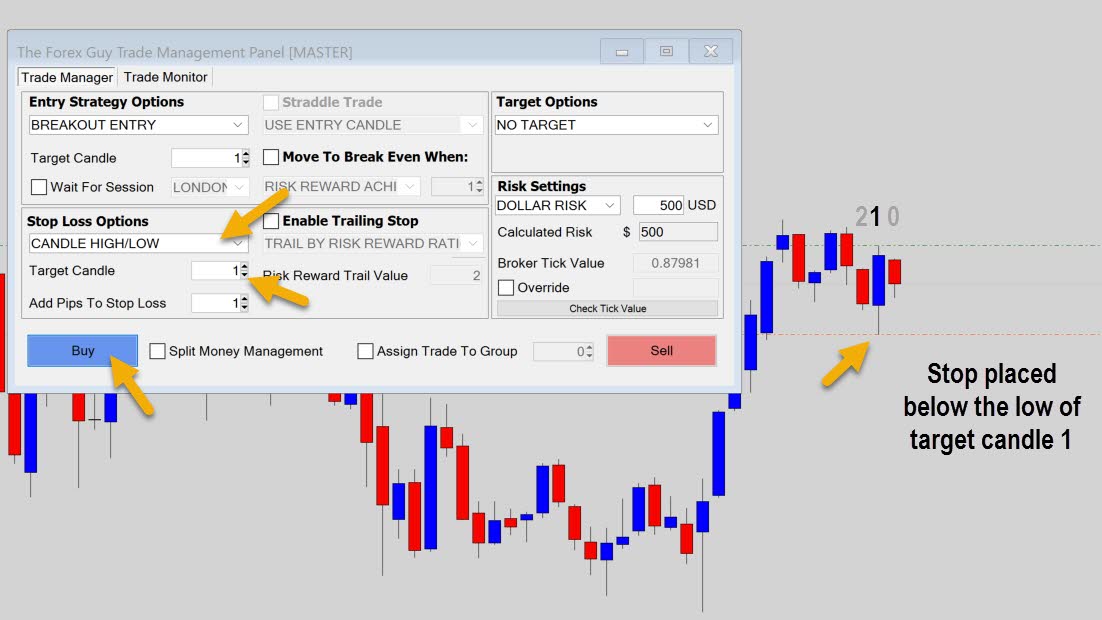

One of the most common approaches for stop placements is to use a candlestick’s high or low price. In order for the panel to understand which candle you want to place the stop on, we use the target candle selector.

Remember the candles are ordered backwards, current candle starting at 0, previous candle is 1 and so on…

- Press buy and the stop loss will be placed below the target candle low

- Press sell and the stop loss will be placed above the candle high plus have the spread added to it.

The panel was asked above to set a stop loss at the previous candle’s low.

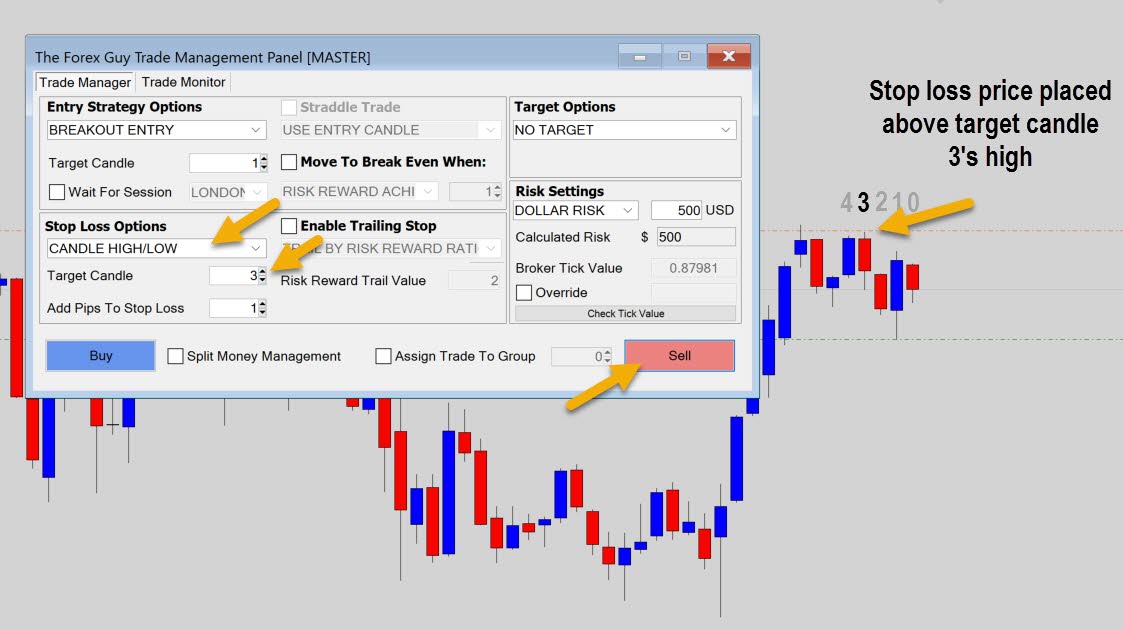

The example above shows a sell trade set up with the stop loss targeted at candle 3’s high price. Because it is a sell order, the spread has automatically been added into the stop loss.

You can change the target candle for various reasons, one might be to get your stop above the previous swing high or low, kind of like what I’ve done in the example above. Just make sure you double check your target candle input before you fire off the order.

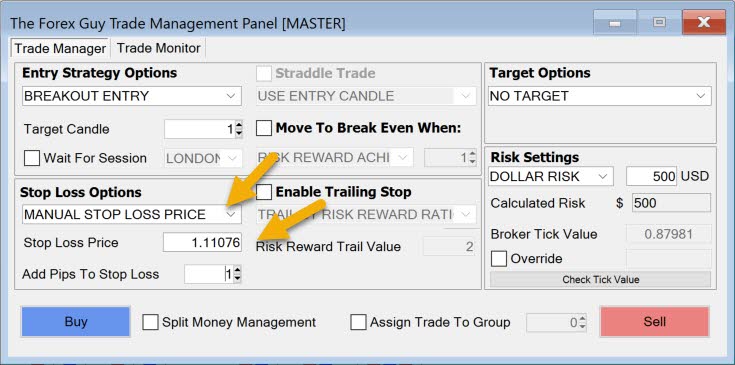

Manual Stop Loss

If you need to place your stop loss at a customized price, you can do it with the manual input. This is straight forward enough – put your desired stop loss price in the input box, to be passed into the trade order processor.

Note: The panel will not factor in spread to a manual stop loss price, but it will honor the add pips to stop loss input.

The final stop loss will be calculated by grabbing your input price, and then factoring in the add pips to sl input – this final stop price will be the one used in the trade order, and the risk calculations.

Volatility Stop Loss

This is a really cool feature added into the panel during the last stages of development. It is a dynamic stop loss size that is based off of current market volatility.

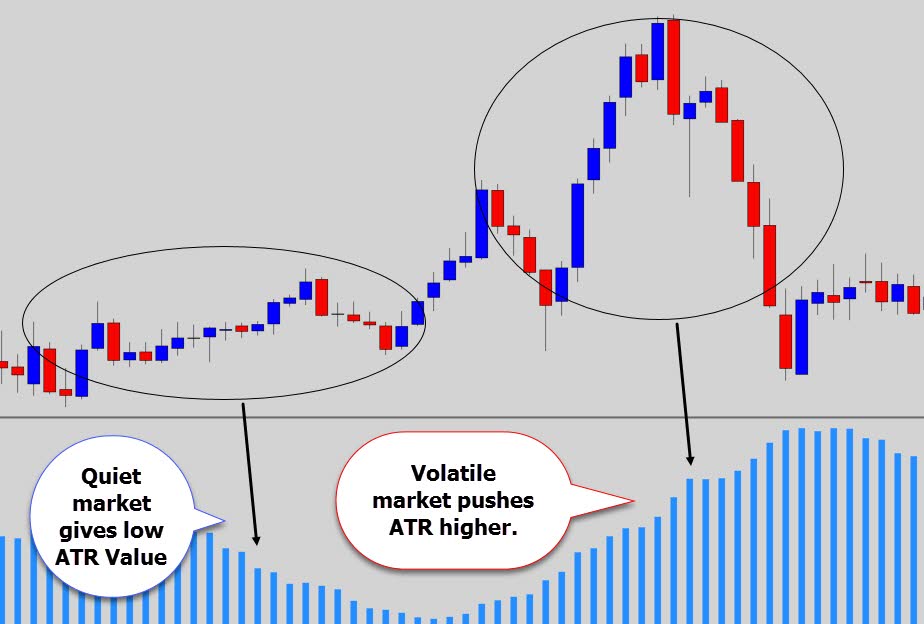

We are using the Average True Range (ATR) data as a measurement of market volatility. When the is market volatility high, the ATR will be higher, and when the market is quiet, the ATR will be much lower.

The logic here is to have a larger stop loss for more volatile markets, and a smaller stop loss size for markets that are not doing much.

In the example above I set the panel to place a simple volatility stop.

The panel will read the last confirmed ATR reading, which is on the previous candle. We can see the previous candle had an ATR reading of about 95 pips, and the panel did set the stop appropriately.

We also have access to a multiplier input, so we can do multiples of the ATR reading. Check out the example below.

Same chart, but this time our stop loss size has doubled because we asked the panel to do a 2x multiplier of the ATR reading. Any number is accepted here but might start to become impracticable passed 3x or 4x.

So that’s basically the volatility stop loss explained, just keep in mind it’s going to change in size depending on market conditions.

Once you’ve set the stop loss though, the stop loss will not be modified with new ATR readings – only when you press the buy or sell button, in that moment, the ATR reading is taken and used for the stop loss size.

The panel also has a volatility based trailing stop which we will cover later on.

Common Errors

If your order doesn’t go through, you will either be prompted with an error message, or an error notification that may be printed in the experts tab down the bottom of Metatrader – so make sure you check those.

Here are some common errors that you may run into.

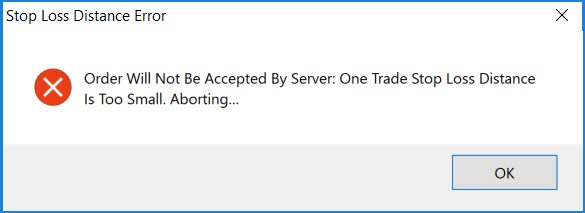

Too Close To Market Price

This error message box will pop up when you have a stop loss price that is too close to the entry price.

Metatrader has an internal limit for a minimum stop loss size. If this distance is not met, the panel will throw this error to avoid a server error.

This minimum limit will change from broker to broker.

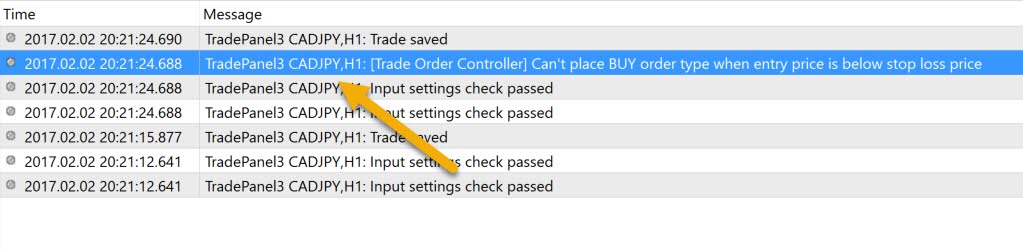

Stop loss Is On The Wrong Side of the Entry Price

If your stop loss is on the wrong side of your entry price, an error message will appear in the experts tab. This can easily happen if you have the wrong target candle selected for your stop loss, or entry strategy.

If you get this error, double check your configuration on the panel.

Final Notes

There are probably more things now than you realized are needed to be considered for a simple stop loss placement – like spreads and internal limits set by your broker.

The panel has been designed to accommodate all these nuances as much as possible so you don’t have to worry about them, allowing you to place trades fast and hassle free. Set your trade up, press buy or sell and all the work is taken care of for you.

In the next part of the tutorial, we’re going to take a look at the trailing stop loss functionality.