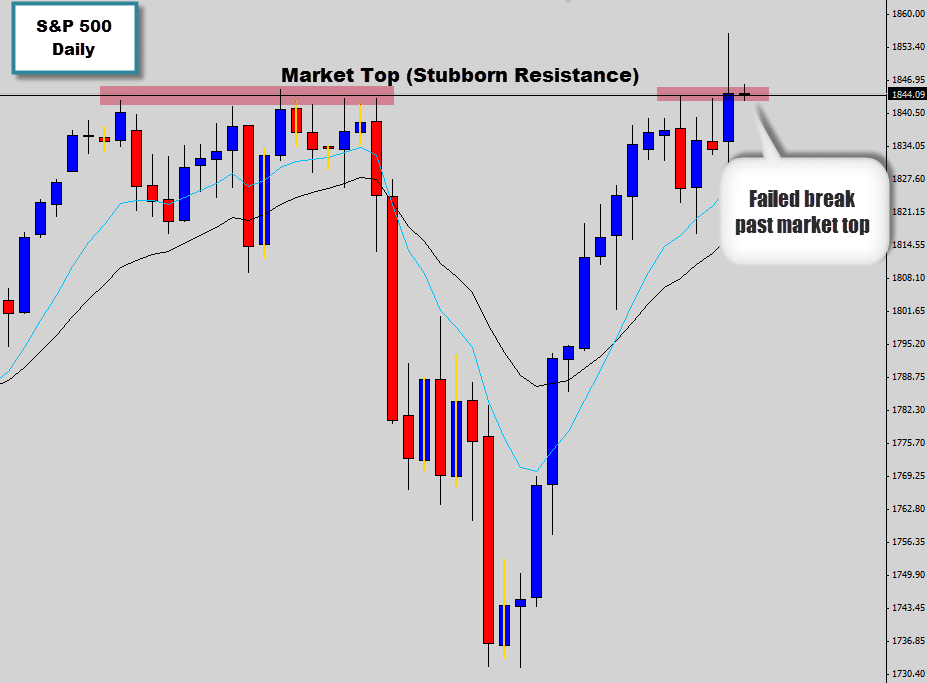

We’ve been waiting the S&P closely lately as a market ceiling as formed at all time highs. This level has been very stubborn with continuously attempts to push past it by the buyers have failed. Last session a breakout to the high side did actually occur but it was short lived.

The higher prices could not be maintained and the breakout soon collapsed back in on itself, creating a classic breakout trap. The daily candle did close back underneath the resistance level but did still have some bullish tone left in the body. A breakout trap like this is normally a very bearish signal, but it would have been nicer if the day closed lower than it’s open price.

Watching for any bearish follow through here. Aggressive traders could just short the breakout trap blindly have have stops above the breakout event high, or conservatively wait for the market to break down below the previous day lows to confirm bearish momentum.