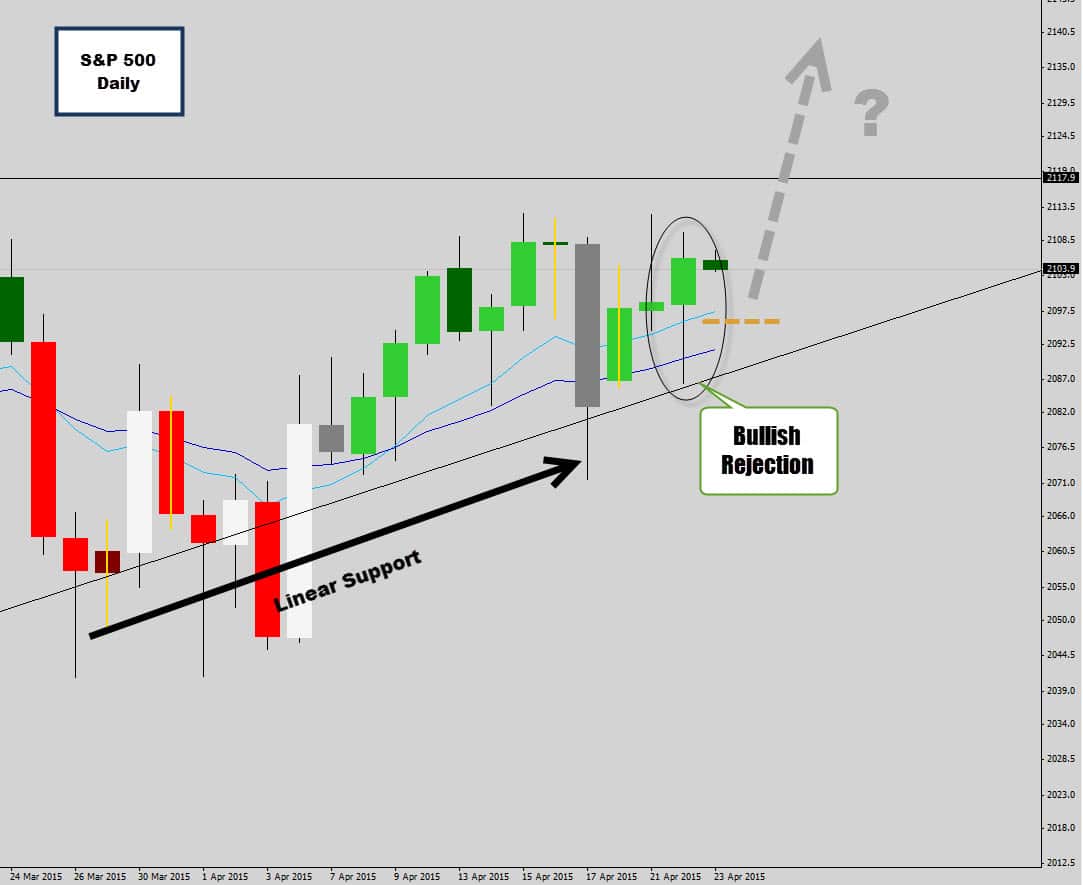

Looking over at the big US stock index today – the S&P

I am eyeballing this bullish rejection candle that demonstrates price is respecting the rising trend line on the daily chart. I don’t use trend lines very often, I personally think they are overused by many, and traders easily turn their charts into something that looks like a star chart.

This trend line is very dominant on the daily chart and if you zoom out you will see what I mean. Price is clearly using the trend line as linear support which is squeezing price into an overhead resistance level – creating a price wedge.

Generally these ‘wedge breakout’ lead to violent breakouts and sometimes a setup like this occurs which can help you get in ahead of the move. I am not saying that the market is guaranteed to breakout higher here – just that we’ve got a strong bullish rejection candle denying moves into lower prices, and holding at the trend line support.

If we do see this signal play out and push price through that resistive containment line, we could potentially looking at a nice move up for the S&P.

Hopefully we can get a retracement entry here on this signal this session to help tighten up stop loss spreads and increase reward potential.