- The Anatomy of Renko Candles

- Comparing Renko to Regular Candlesticks

- The Art of Non-Time Based Charting

- How do Renko Candles Form?

- How to Get Renko Charts on MT4?

Today, I would like to introduce you to a very unique type of charting format, an ‘out of the box’ idea – so simple, you would probably say to yourself, “now why didn’t I think about that?”

The concept was brought to us by the Japanese – no surprise there. You probably already know the Japanese invented the candlestick chart. However, they also invented many other type of awesome charting formats – including Renko candles.

Seriously, where would we be today without their historical contributions to financial analysis? Doumo arigatou gozaimasu guys.

Renko is derived from the Japanese word “Renga” – which translates to “brick”. You will soon discover the name is very fitting.

What I love about this chart format, is that it’s simple in nature, and most of you will know that keeping trading as simple as possible is one of the best trading philosophies to adopt. For this reason I’ve been a big fan, following Renko charts casually for the last 5 or so years.

In this lesson, I would like to introduce you to Renko candles, explain how they work, and show you how Renko price action can be a very powerful way of looking at the markets.

The Anatomy of a Renko Candle

There are a few different flavors of Renko candles out there, today I am going to focus on the original versions.

Most scripts, or charting platforms that do offer the Renko format, will generate Renko Bricks only. The brick section of the Renko anatomy is basically the body – offering only two points of data, the open and close price.

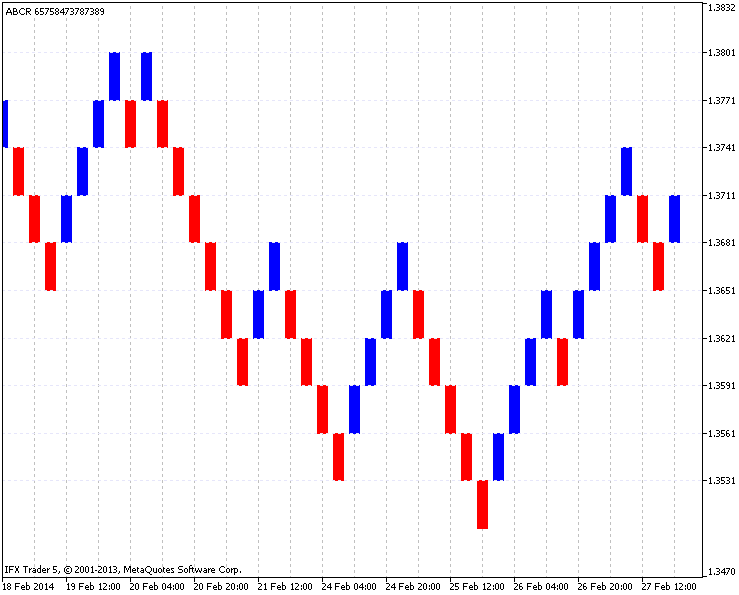

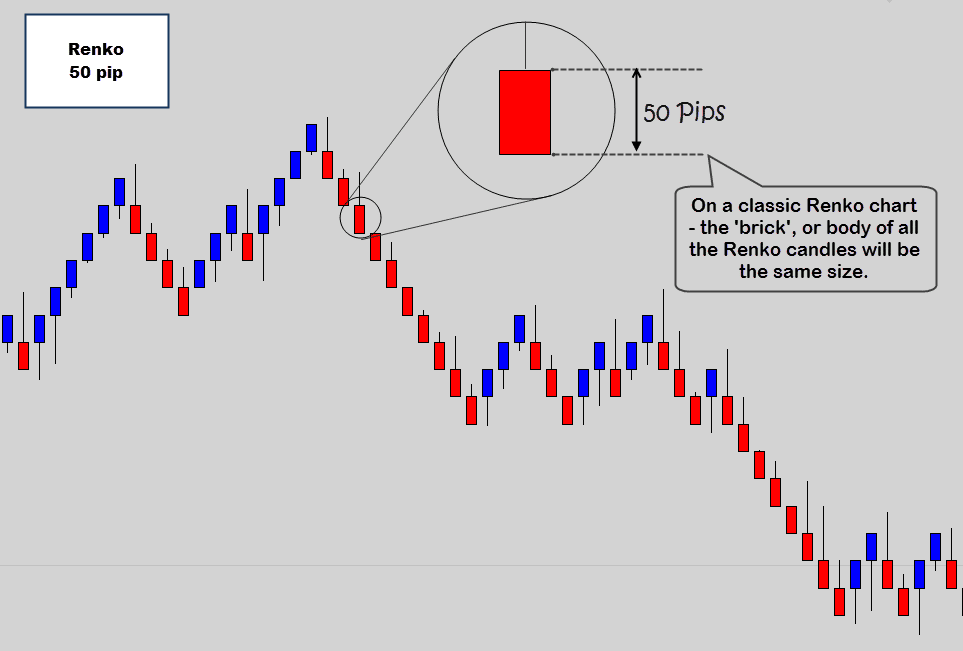

Here is an example of a Renko ‘brick only’ chart that is generated by an MT5 script.

Renko bricks do look nice and clean, and at first glace look like the holy grail.

A lot of traders will tell you that Renko bricks are the best, because they cut through all the market noise – which is somewhat true, but deceptive at the same time. You’re missing out on 50% of the information – almost ‘flying blind’ having no true indication of where price has been.

For this reason, I much prefer Renko candlesticks.

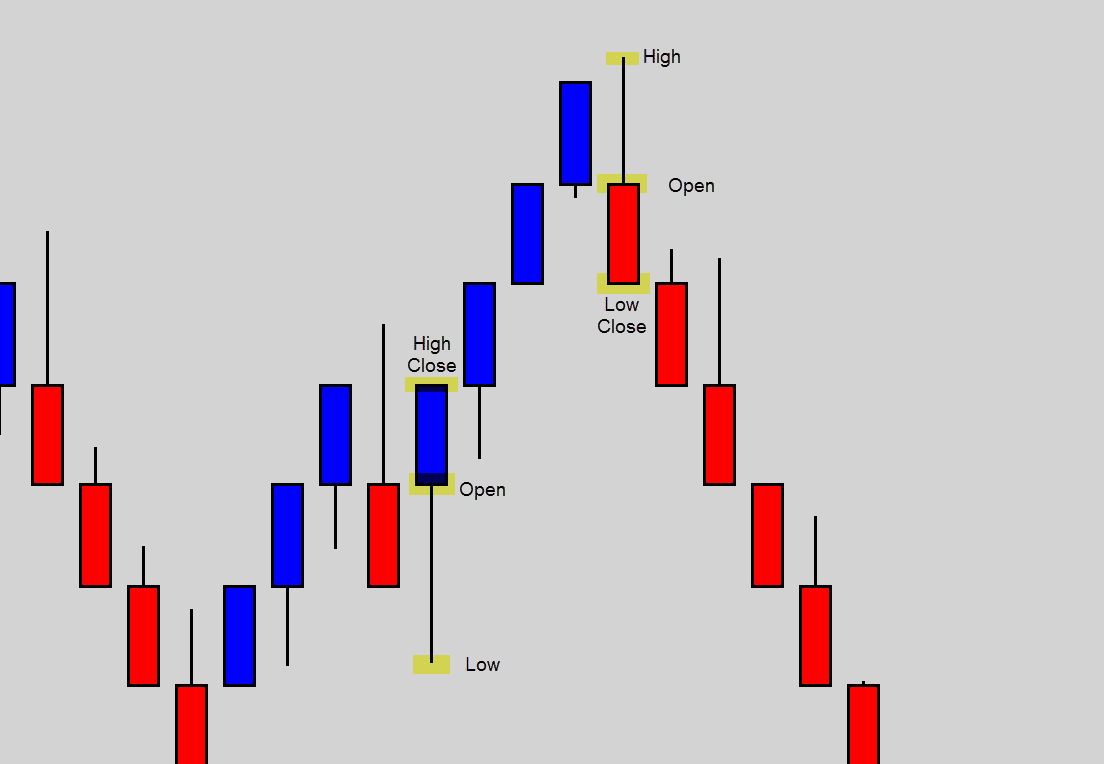

The candlestick versions are identical to normal candlesticks in regards to their anatomy – both provide an open, close, high, and low price.

Therefore no information is hidden away, Renko candles give you a true representation of the price action. That’s excellent, because us traders want to know the ‘complete picture’ – not half the story.

Due to the nature of the candlestick version, 2 data points will always meet. When you see a bearish brick, the close price will be the same as the low price. For a bullish brick, the close price will be the same as the high price.

Checkpoint

Comparing Renko to Regular Candlesticks

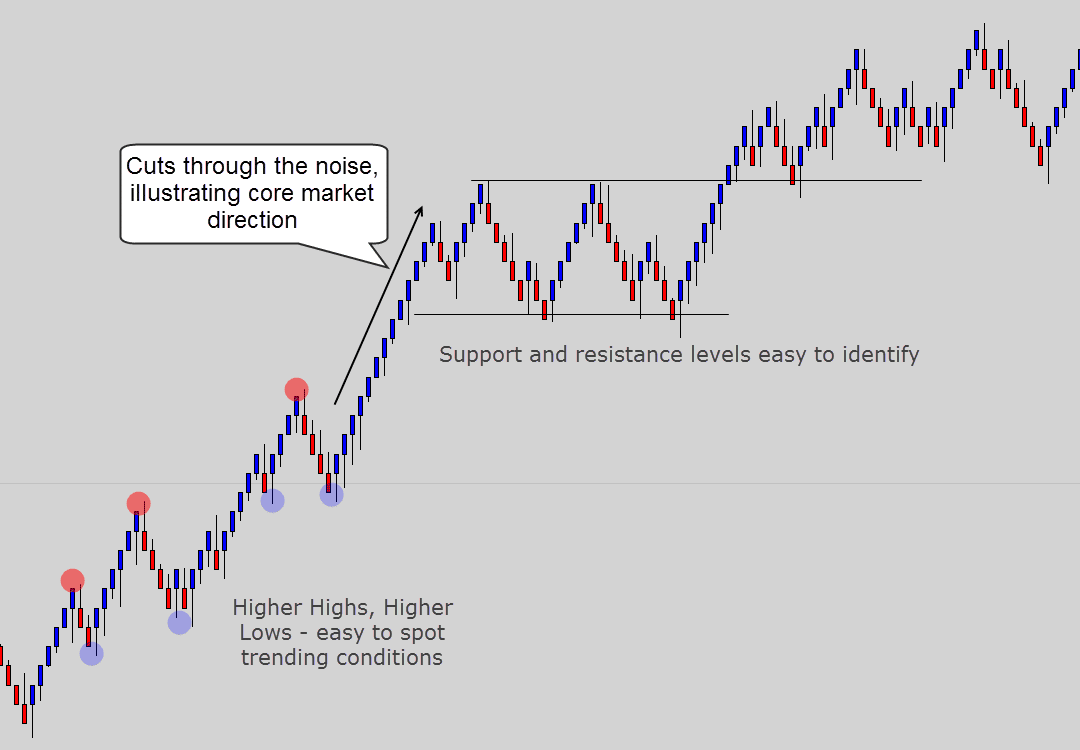

More and more investors are equipping their arsenals with these ‘timeless’ charts.

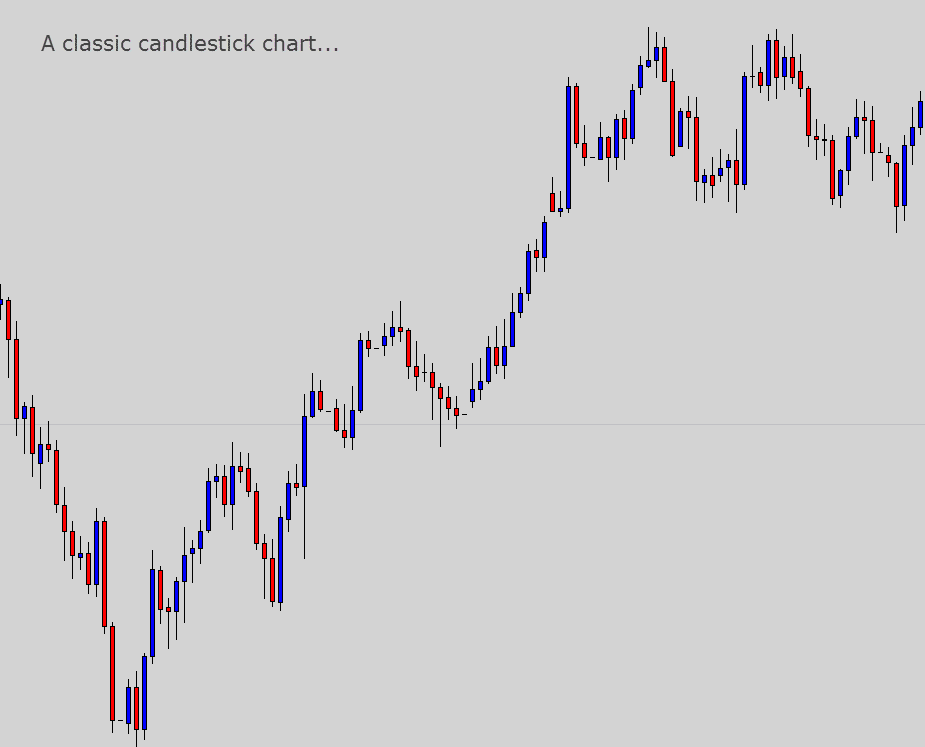

Traders are attracted to their ability to filter out market noise, and provide a better representation of the overall market structure. In other words, they are easier on the eye and it makes chart reading much more pleasant.

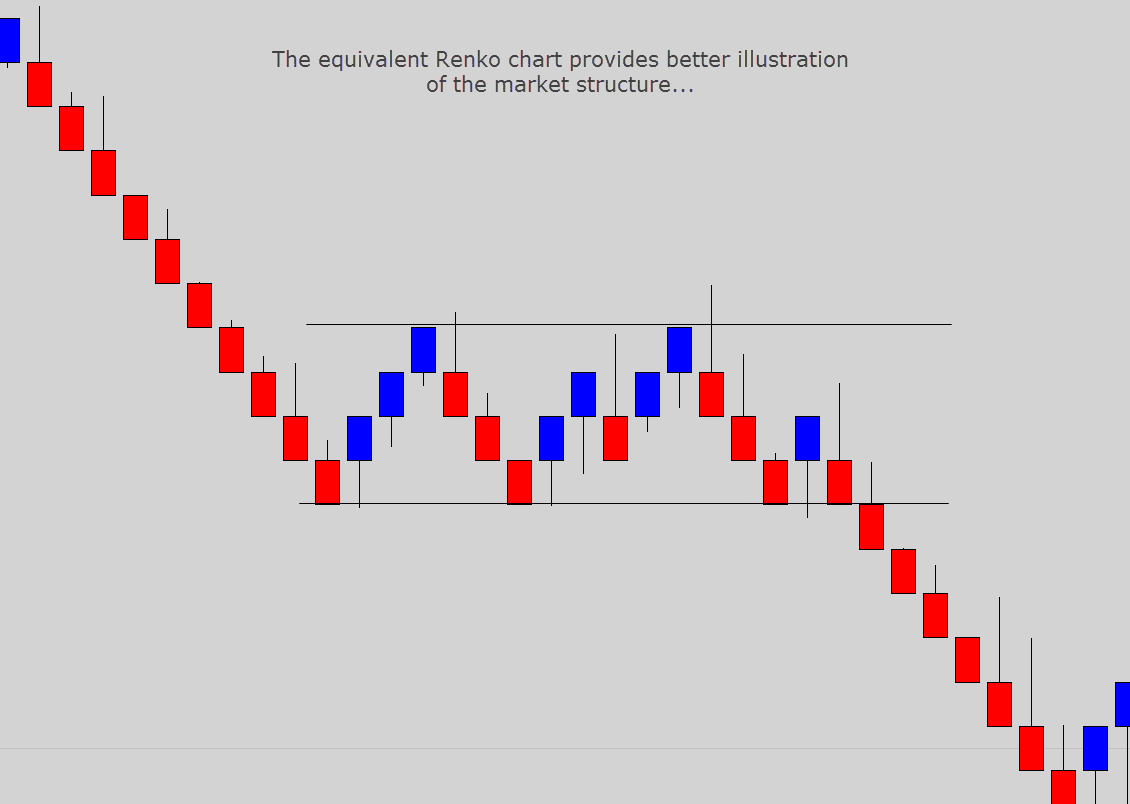

This type of ‘no time limit’ price action makes it is very easy to spot: trends, ranges, and the classic market patterns – like the double top or bottom. Traders also find it a much easier way to identify support and resistance levels, because turning points on the chart are illustrated more sharply.

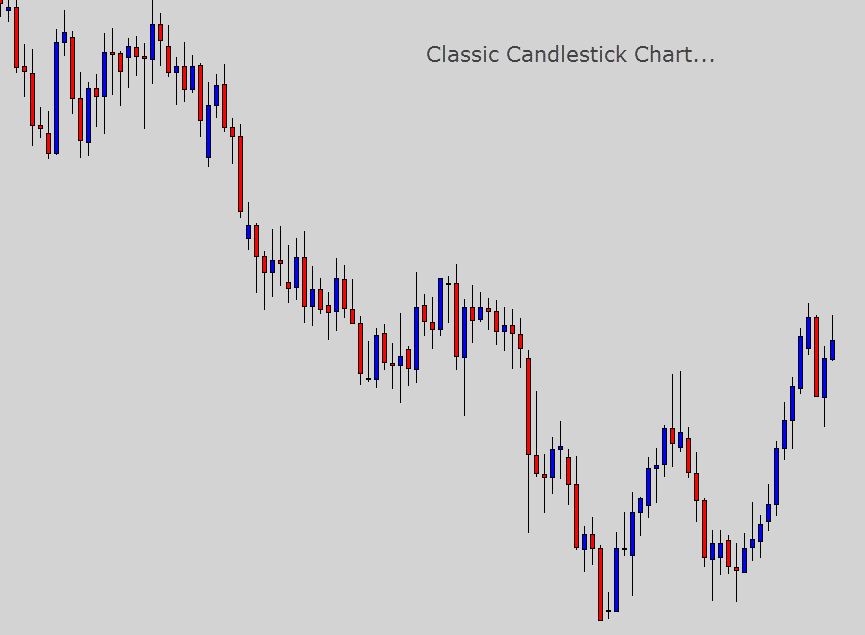

When comparing the two charts, it’s clear that the Renko charts offer a much more aesthetically pleasing way to gauge market conditions.

Check out the comparison of the two charts below…

Checkpoint

Welcome to Non-time Based Charting

We’re conditioned to perform technical analysis with candles that open and close at predetermined time intervals, like the daily,12 hour, 8 hour, and 4 hour charts, for example.

Have you ever wondered would happen if you removed that time based rule? That’s exactly how you create a Renko chart.

Renko is a derivative of a special charting format known as ‘range candles’ – where time is not taken into consideration for the candle closing condition. Instead, they use movement-based rules, therefore only respond to changes in price movement exclusively.

If the market goes nowhere, then no new ‘bricks’ are created. If it takes 2 weeks for the market to breakout and move, it will literally take 2 weeks before you see a new brick develop on the chart.

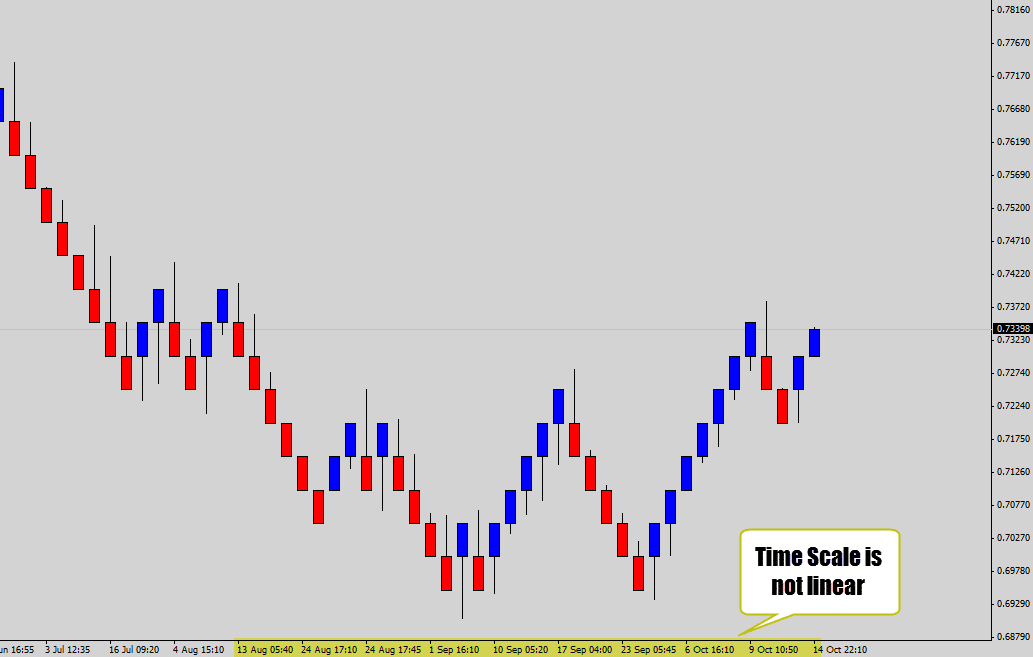

Even though ‘time’ is taken out of the equation, a time-axis will still be present at the bottom of your charts – however, it is no longer on a linear scale – the time x-axis exists now purely for reference only.

On candlestick charts, we choose what time frame we would like to view the market from. With Renko charts – we have control of the ‘brick size’ instead – which is normally set in pips.

The brick sizing will alter the way the Renko chart appears in a similar way that changing time frames does.

Smaller bricks, like 10 pips, can be compared to the short term time frames such as the 15 min – whereas larger brick sizes, like the 50 pip Renko chart, can be compared to something like the daily chart.

The larger the brick size, the smoother the chart will look. Smaller sizes will make the chart appear ‘noisy’. I personally like the 50 pip setting.

If I selected a brick size of 50 pips, then each Renko brick’s body must equal 50 pips precisely.

Because we’re using 50 pip brick sizing in the example chart above, every single Renko brick that forms will equal 50 pips – no exception.

Checkpoint

How Does a New Renko Candle Form?

One of the most important things you need to with the Renko format is exactly how a new brick forms, and what can happen in the meantime.

Allow me to elaborate…

On a normal chart, you select what time frame you wish to view the market from. On a Renko chart, you input the brick size you would like the Renko bodies to have. The script, or software you’re using to make Renko charts will provide this option.

I am going to continue using my favorite brick size of 50 pips as an example.

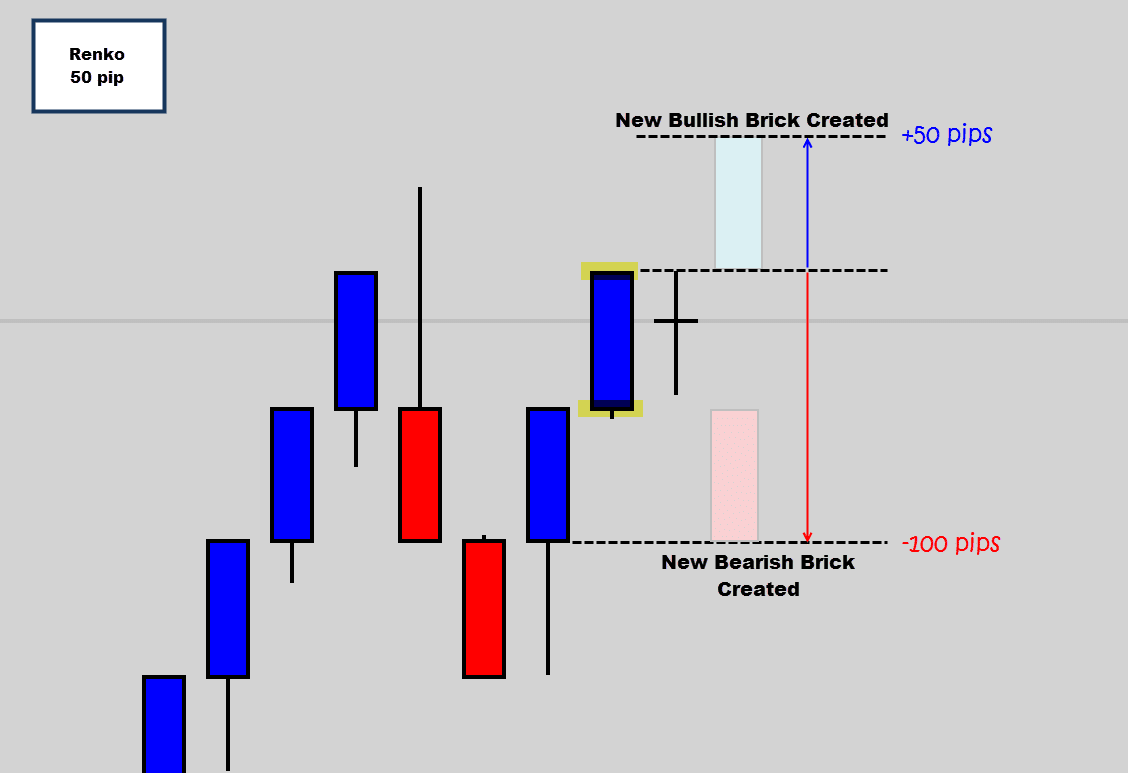

Observe the illustration below…

The diagram above will show the conditions required for a new brick to form.

Because the previous Renko brick was bullish, the market only needs to move another 50 pips higher to create the next bullish brick.

To get an opposite to brick form, the market must travel much further. Price needs to move down 50 pips below the previous brick low – meaning it first must travel through it’s own 50 pip range. Therefore, price needs to move the distance of two Renko candle bodies to establish a direction change.

This is what most people don’t realize, and why it’s important to have Renko candles instead of just Renko bricks alone.

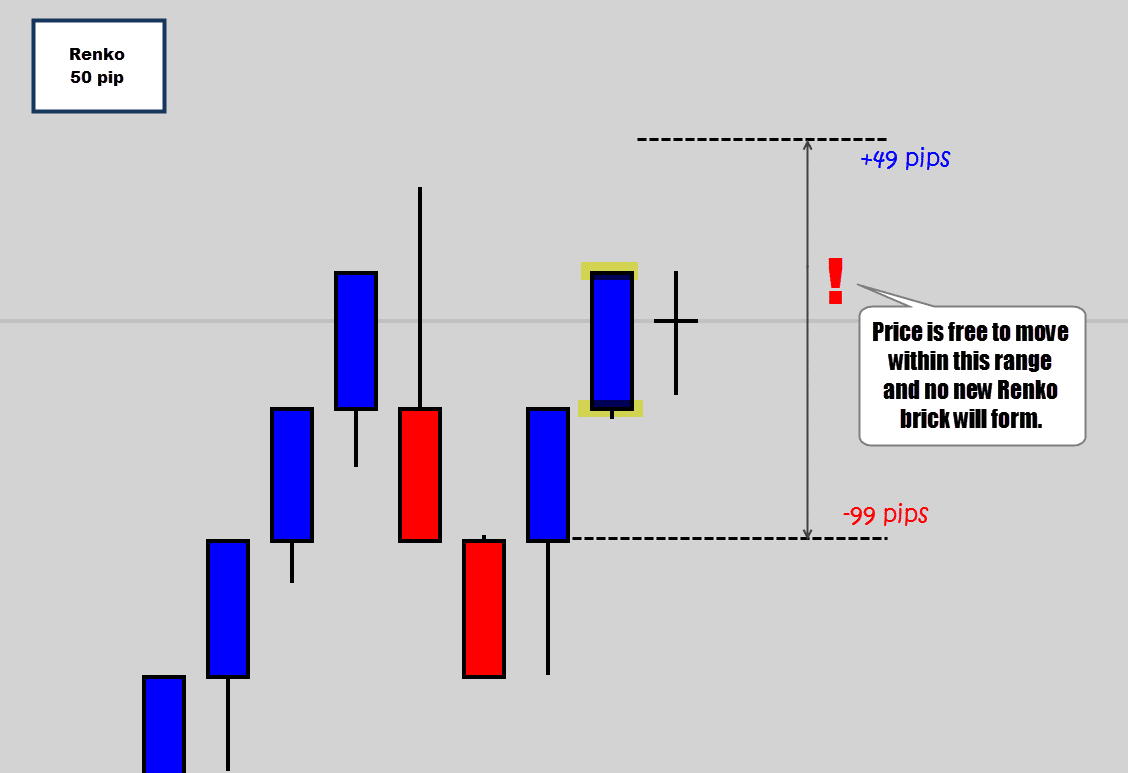

In the chart above, I’ve highlighted the full range where price is free to travel before any new Renko brick is created. This is very important information to know if you’re going to be trading these charts.

Continuing with the example shown above: A trader may choose to place their stop loss below the low of the previous Renko low, thinking that’s a safe, logical place for a bullish trade’s stop order – whereas price could move through the stop, trigger it, and then move back up high enough to create a new bullish brick.

This is how a Renko chart could deceive some traders if they don’t fully understand how they work. The trader would be stopped out, and still see a bullish brick form – even though he was long. Again, this is why the Renko candlesticks are much better – the trader would see the lower tail, and know price moved down before coming back up to create the next bullish candle.

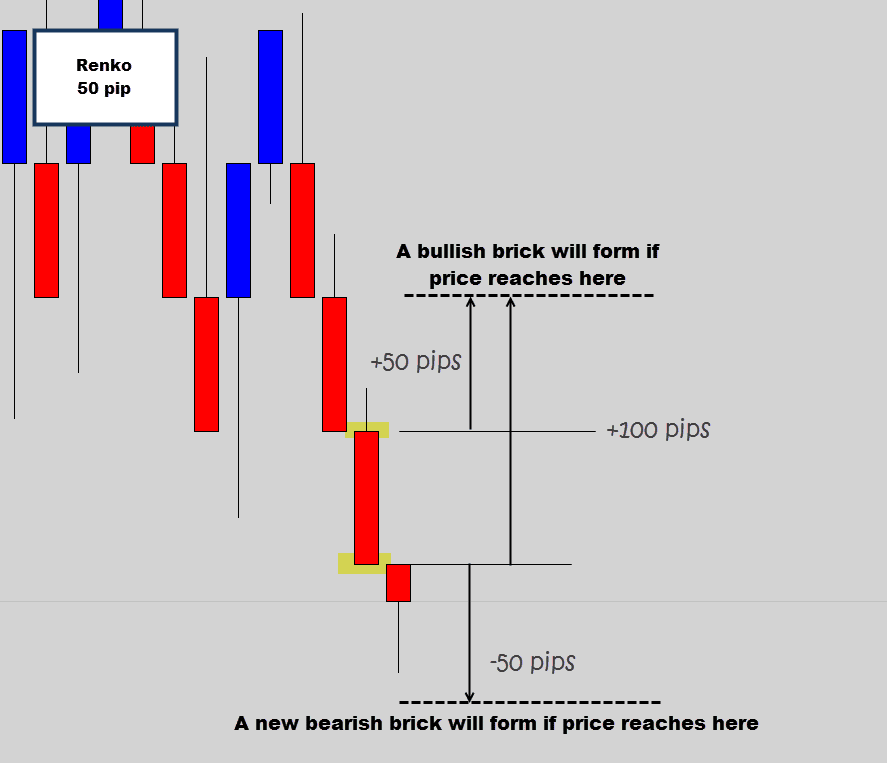

The opposite conditions are true for the reversal scenario shown in the chart below.

Now remember, no new bricks will appear until price actually touches one of those dashed lines. Take 1 pip off the top, and add one pip from the bottom barriers, and we’ve got a 148 pip range here for the market to move around in before we get any new bricks.

Notice in the example above, price has moved down to almost touch the next brick creation level – but is starting to rally back higher.

This chart could move up another 80 pips and, then fall back down to touch the new bearish brick level. That sort of price movement would leave an upper wick on the Renko candle, and would communicate extra information to the trader, who would have otherwise missed out if they were just using plain brick only charts.

Checkpoint

How to Get Renko Charts on MT4?

Most traders use MT4, it’s considered the industry standard for Forex charting for many reasons. Unfortunately, it doesn’t support Renko candles ‘out of the box’.

Programmers can make scripts and the like which can provide work around solutions to get these unique candles on your MT4, and in fact there are many of them out there.

The problem with most of the free ones floating around forums, is they can be annoying, and messy to use. Most of these free scripts will clone a candlestick chart into a Renko chart – but the catch is you must keep the candlestick chart version open, with the program running to emulate live Renko charts.

This leads to a lot of chart clutter, a lot of unnecessary resources used, and a very cluttered work space.

If you would like to try a free version – there is one here. You will see what I mean regarding how messy it can be manage all the charts you generate.

One or two is fine, but if you need say 10 Renko charts – it means in total you will end up with 20 charts open to make that happen.

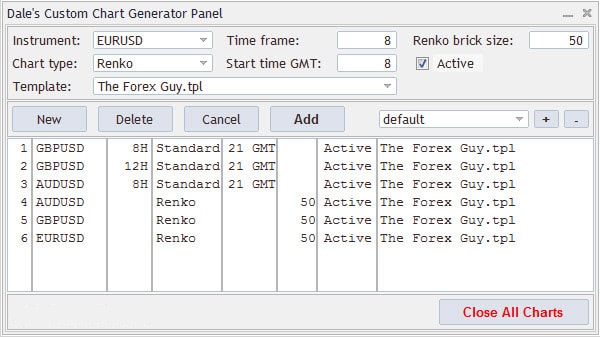

If your serious about using this format, I have designed a panel system that allows you to generate, and maintain all your Renko charts from one location.

From here, you can make as many custom charts are you like – and can even create custom candlestick charts in the same space. The panel keeps all the generated charts ‘live’, and they are compatible to use with any MT4 indicator, or robot.

To learn more about it – you can check out my MT4 custom chart generator panel information page.

I hope you walk away from this tutorial now with a full understanding on how Renko charts work, why they are becoming popular, and maybe a keen interest to give them a try.

Leave me a comment below if you’re using these charts, or if you would like to see more content regarding Renko candles on the site. Look forward to reading them.

Talk soon, and best of luck on the charts this week 🙂

Raja

I have a question. How come historical bars are getting changed? I know in 5 mins timeframe within 5 mins, the bars can be repainted, which got created in that 5 mins based on the price. It can have 5 bars or 10 bars within 5 mins (based on price movement in that 5 mins). But I can see in 5 mins timeframe Renko, 9.15 AM a bar got created in around 10.30 AM I can see the bar which got created by 9.15 AM got modified. How is that possible?

protrader

one question. suppose i have 5 minutes candle chart. i am using 10pips renko. can you please tell me

what happense if candle price goes up 11 pips but 5 minute candle still not closed. eventually 5 minute candle closes at 9 pips rise will the renko chart wait for close of candle ? or brick will be created because the price has touched 11 pips?

wong

Hi Forex Guy,

Does Renko Chart show gap that correspond to candlestick price chart especially if the price gap is larger than the renko brick size?

Replying to: wong

Dale WoodsAuthor

It depends on the renko engine if gaps are shown or not.

Fred

please give an example of how to construct a Renko chart- could you please give figures to illustrate, (the closing prices of a stock on a daily basis) and the construction of the brick based on those prices

as I am unclear on one or two points

For example is the calculation from the close of the previous day or is it from the close of the day when the last brick was constructed

Thanks in anticipation

Fred

Rajesh

Renko charts working in M2 charts only. But I want work at different time frame. How.. Please help me

Replying to: Rajesh

Dale WoodsAuthor

With my chart builder? Or someone else’s tool?

Mark

Very clearly explained and it helped to sort out the “mystery” of the long tails that trail beyond the selected brick size. Excellent site by the way Dale.

Sreedhar Vedula

Awesome explanation! I’ve read many articles on Renko and this article is the winner.

Peter

Does renko operate on M1 and M2 timeframes or charts only or even on H4,D1 or H1 charts I can still rely on it??

Replying to: Peter

Dale WoodsAuthor

You mean where does it get the data from to build renko charts? Yes 1 min data is the best.

GIRISHCHANDRA PAREKH

I wants to subscribe robot develop by u

The Golden Bear

Nice explanation. The next step is to add volume to the brinks and understand the price/volume relationships, now that creates something very specail with sweet trade set ups. Try it with the Weiss Wave for even better results.

michael f

Thanks for the clear tution on Renko tactics

michael.

Russell

Hi Dale

I’ve been looking at Renko charts for a while now. I like the way they show some clarity to price movement. However the EAs that create them have a few problems that I can see.

1. They print impossibly long wicks on some candles

2. They imply gaping on some bricks or don’t show the wick at all. ie on say a down brick and the next brick being an up brick, there is no wick between the close of the down brick and the open of the up brick. You can see this on a couple of the charts in this article.

3. Most EAs need an M1 chart open, as you have said, which gives limited history data to look back at and they can only create Renko charts when markets are open because they require a stream of tick data. I have a version that uses H1 data which gives a much greater history and it can create charts when markets are closed. A big advantage when you want to much around a bit on the weekend.

4. Support and resistance are not so easy to determine. There are many swings which could be interpreted as S & R but which ones are signifficant. I think that should be determined from a daily or 4Hr chart maybe depending on the strategy.

I have been experimenting with 10 and 20 pip bricks and indicators such as sma, Ichimoku averages, envelopes and bands of different sorts and a few oscillators such as MACD. I have also manipulated the indicator settings where possible to see if I can come up with a strategy that works. Well I have had some success, however you have to be in the right place at the right time to get the desired entry because not being time based that’s impossible to predict and usually happens during London or New York sessions. zzzzzzzzzzzzzzzz.

End of day trading may work. So might larger sized bricks say 50 pip but I don’t think I could stand a 149 pip move against me.

So I think that an auto trading robot is the go. Let me know when you have developed one and I’ll be in like Flynn.

Regards Russell

Replying to: Russell

Dale WoodsAuthor

A few points I agree, some I don’t

Transam

I have used renko before but never was able to trade hem too well. the renko candlesticks are what would of helped emencly, another problem was the double up of charts and constant need to refresh them ,they became too much of a hassle, plus I was using 10 pip candles …You seem to have created a better way and I cant wait to load them up again, I really do like em ,, Thanx Dale

Yemi

Nice article. Its Like looking at the market from a new set of eyes.

Hans

Thank you for the Renko information… I hop[e to learn a lot more from you – I have traded for many years and always worked off Fib and other stop streets such as R&S levels – Walked away and stayed away for many years (mainly ill health) Now 80 years old and very Healthy (thank God) I like using the price – not some repainting TA indicator – I have been playing around with HA but this, whilst cutting out the clutter to some extent is nowhere near what a true price based system can do.

I would very much like to use the Renko charts – if need be I’ll walk away from MQL 4 – I understand fully how the Renko works, but like the candle as opposed to the brick.

Please advice me

Thank you

Kind regards

Dean

Thanks, Dale. A good intro and I needed that. I am now curious to see how you can assess and manage risk on a Renko chart.

Marcio

Excellent content! How to add Renko Candles to a MT5 Chart?

Rafael

Hi Dale. First of all thank you for providing valuable information on your website. I’ve been following your blog for almost a year and has been very helpful everything you post.

Although I had read something very superficially some time ago about the Renko candles, it was not until I read this article that I started really interested in the subject and I found very interesting this form of graphs. I started as the reference interest came from you. I would also like you can continue rising more information about Renko candles.

I would also like you to ask a concern that I have with these graphs. Not being considered the time for closing a candle (ex: candles set in 50 pips), as knowing when the bars are formed as it is very difficult to be in front of the screen all day to take operations. You still considering the NY close to analyze Renko charts and take trades at that time? I hope I made my point.

Thank you

Replying to: Rafael

TheForexGuyAuthor

Thanks for the questions Rafael.

NY close & Renko candles is like comparing apples and oranges – you can’t think this way. Remember, Renko candles are non-time orientated based candles, which means New York close price feeds become irrelevant. These candles will only form after x amount of price movement regardless of what time your daily candle closes.

You make a good point about not knowing when a new Renko candle will form. This is where we have to leverage the development side of MT4 – I am planning to upgrade my Price Action Battle Station tool to be compatible with Renko charts. That way we can get alerts via email, or on our smart phones when a new Renko candle does form.

dean

Thanks for that. I’m starting to get it, but clearly I could use a little help. Am I mis-reading the examples given? It appears that there are doji candles on the Renko chart examples to demonstrate how far price would have to move to form a new brick. How can that be? Are dojis even possible on a Renko chart?

Replying to: dean

TheForexGuyAuthor

no they’re not – you’re looking at the active candle which has not closed yet.

jassowal

I like these bricks to easily detect any chart pattern. Thanks for the panel dale. ..SUKHPAL SINGH

Taufiq

Thank you.

I’ve never seen Renko chart well described before your explanation today. Super!

It change my mind on how to trade but please follow the posting with your Renko strategies.

Best wishes.

Xerkley

This looks fantastic. I’m excited to give it a try.

Olumuyiwa

i want to know more about the Renko candle formation to make a good trading profit