Hey Forex traders,

The end of the year is in sight.

It is this time of the year where we reflect on the years trading and set positive new year goals for our 2015 trading year.

The first half of 2014 was generally tough markets – lots of price churning with no trends.

This made it very hard to turn a profit and really demonstrated the importance of Forex money management.

Most of the market indecision flowing from uncertainty about the majority of central banks ‘next play’.

By mid 2014 central banks and the fed, put their cards on the table giving the markets some clear direction. In today’s post – I just wanted to round-up some of the major trades we’ve been talking about in the War Room, and the front blog posts here.

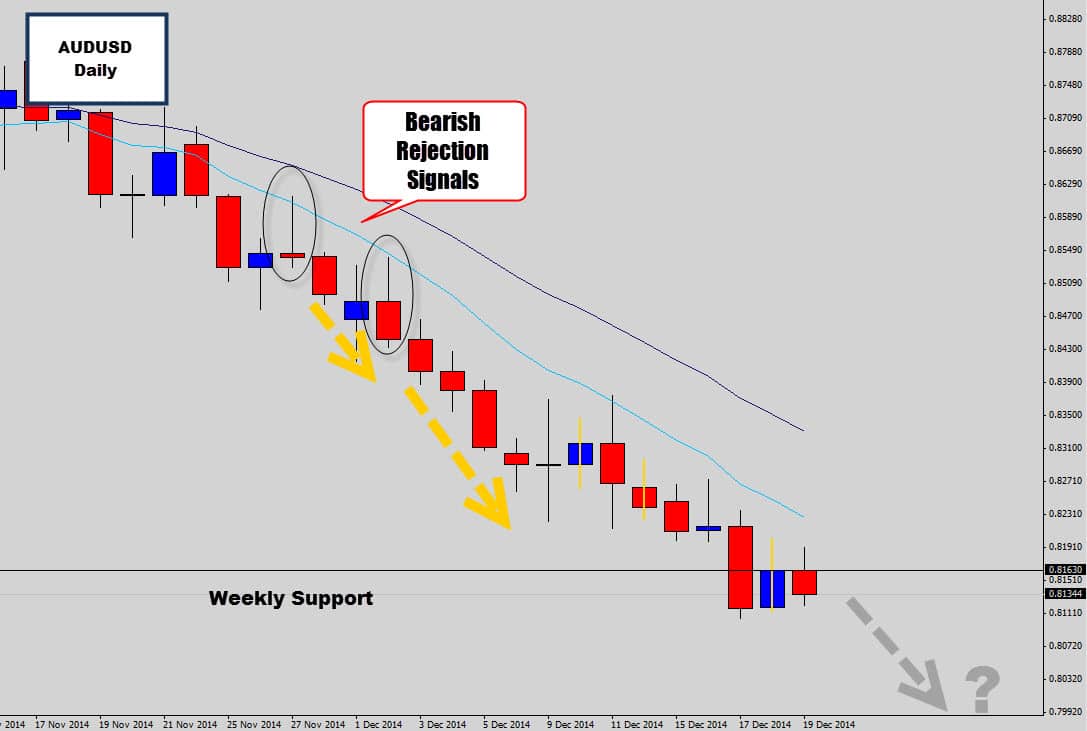

AUDUSD Bearish Trend Trades

The AUDUSD has been a really big mover during the last half of 2014 – this bearish trend has produced a number of shorting opportunities of price action swing traders.

The most recent trade setups we looked over were these bearish rejection candles that formed off the mean value.

See how the mean value is nicely angled down here – demonstrating good momentum.

I’ve got a level marked on the chart which doesn’t make much sense from a daily chart perspective – it’s actually a strong weekly support level.

Now the weekly support was taken out by the bearish pressure – the market continued it’s free fall down.

The bearish rejection candles that formed off the trend mean had a body on them where the close was lower than the open price – visa ve, a bearish body. This gives a nice plus to the overall trade edge when looking to short.

The bearish trades worked out nicely as the overall selling pressure continued to push the Aussie Dollar into lower prices.

Unfortunately, these signals didn’t offer a retracement entry price, but even with a breakout entry – were still able to give good return on investment.

The AUDUSD has reached the next weekly support level – giving no signs of trend exhastion. In fact, the level is being cut through like a knife through water.

If price holds under this weekly level, we could see much more lower prices yet out of the AUDUSD for 2015.

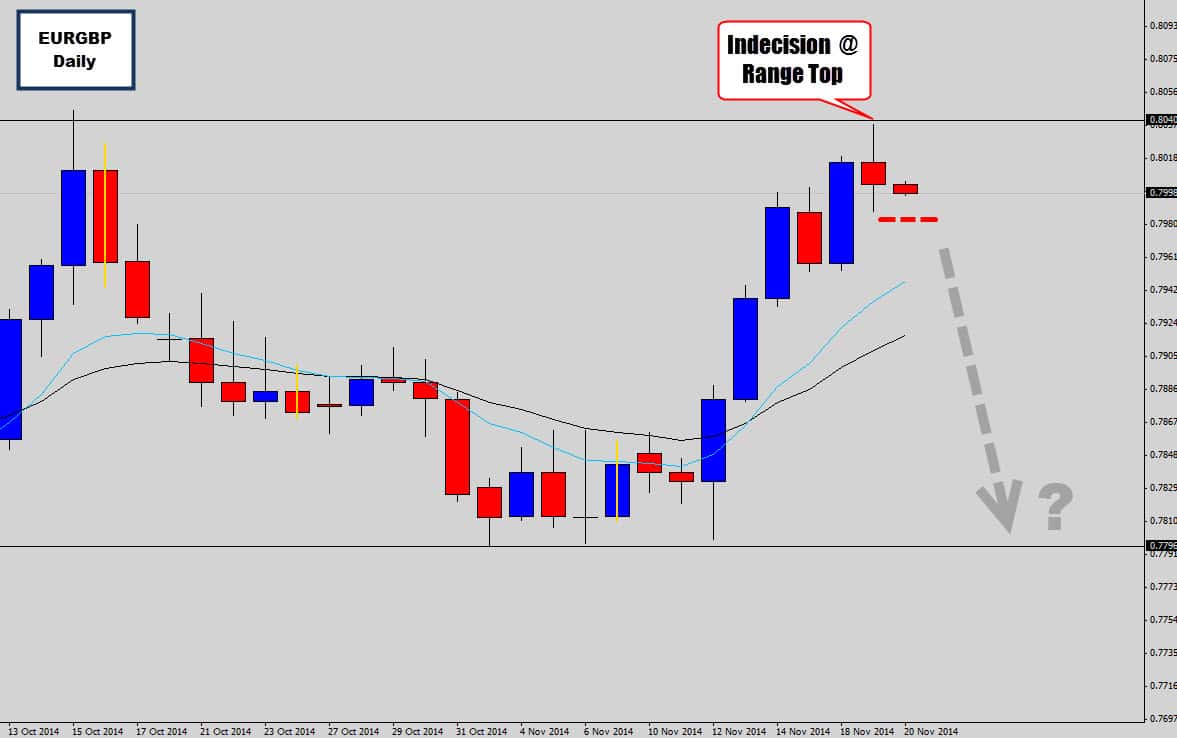

EURGBP Range Trades

In our previous post we talked about a EURGBP range trade opportunity.

An Indecision ‘Doji’ candle formed at a proven resistance level on the EURGBP daily chart – which has been trapped in range-bound conditions.

The body on this candle also closed in the negative, which is good to see when looking to get short on a market.

The trigger here for a bearish trade is when the market breaks out of the Indecision Candle low – confirming bearish momentum. Because this is a range-bound market, we can look to target the range bottom for potential profit targets.

Let’s see how this trade played out…

This trade ended up being a bit of a journey and was held for over a month. This is where your discipline is really tested.

Price did break below the Indecision Candle, triggering that Doji breakout – but didn’t reach the desired target price before falling into a heavy grinding pattern.

This is where not looking at your charts and just letting your trade ‘do it’s thing’ can be really beneficial. It’s very hard to resist the temptation to heavily monitor, or ‘micro manage’ your position – but the best results are usually achieve when you have a ‘hands off’ approach.

This trade I took personally and did actually see it nearly hit 1:3 risk/reward – only to shoot back up and push my trade back into the negative. I though this trade was done for.

Thankfully I resisted the urge to close it and let it play out. The rally higher ended up being severely rejected – creating a long tailed bearish rejection candle (a second sell signal).

This was reassuring to see, and prices did end up being pushed back lower after the rejection candle formed.

I decided to take profits on thursday’s close – the bearish power candle.

Watch the range support now for any strong bullish signals to play another range cycle.

Moral of this story is – sometimes you get nice clean moves that drive trades into 1:6 profits in one or two session, then you get these trades who put your through the pip grinder and give you that nail biting anxiety. Just remember to use proper risk management and try remove yourself from the charts if you feel like you’re losing emotional control.

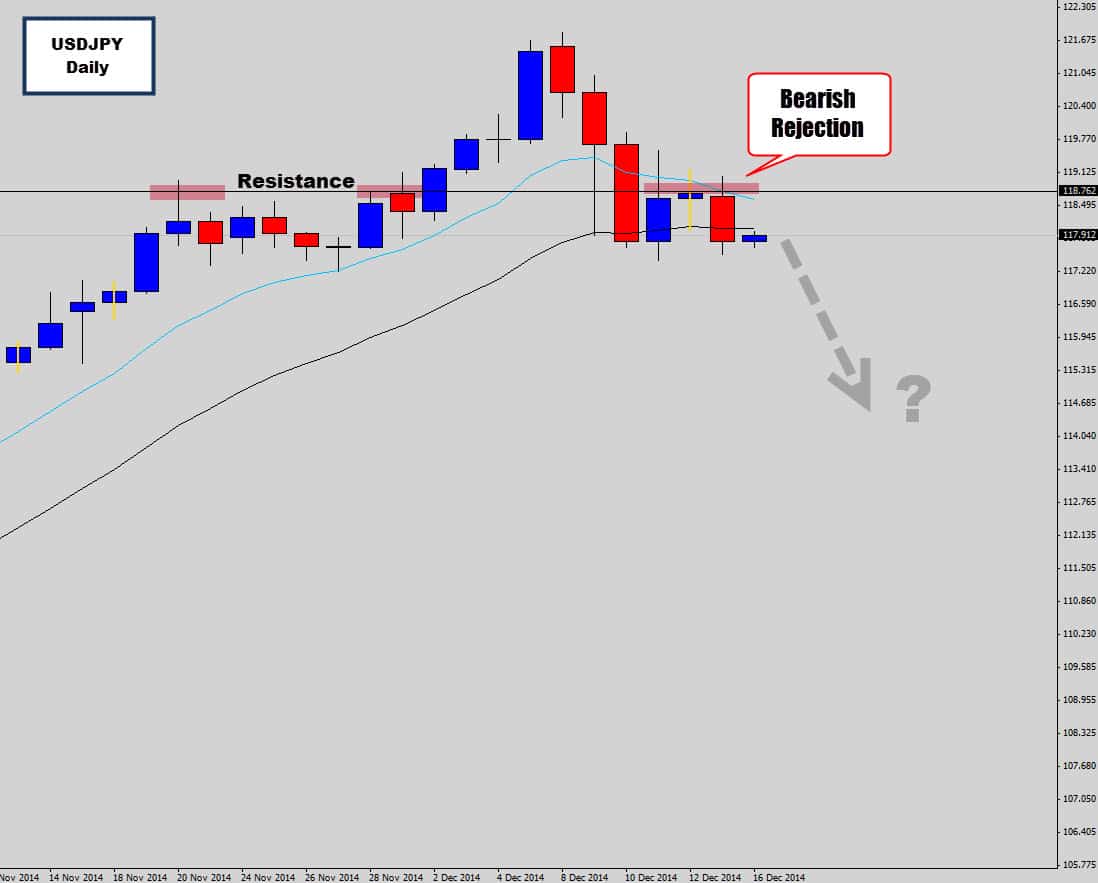

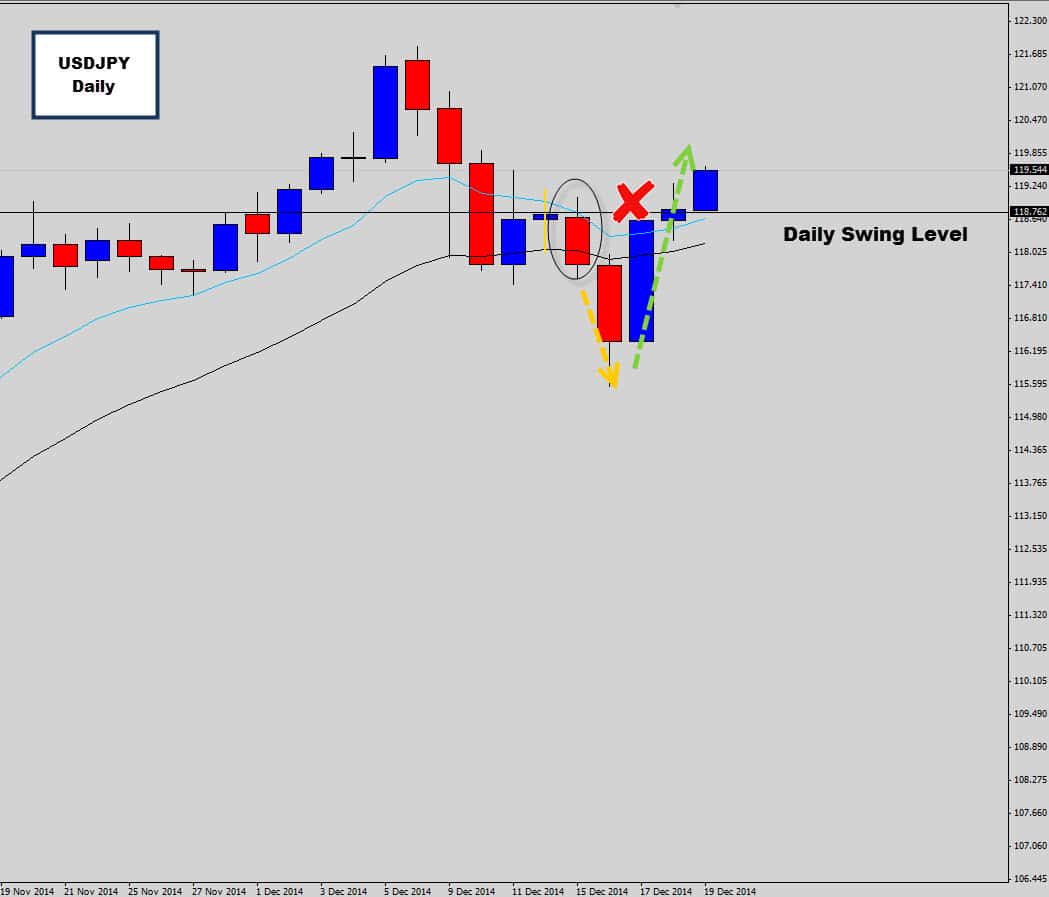

USDJPY Bias Change Swing Trade

Another bearish price action setup that we’ve talked about is a ‘thick bodied’ bearish rejection candle on the USDJPY.

On the daily chart, the USDJPY failed to hold above the mean value, and an important swing level. The bears pushed price lower changing all the dynamics here into the negative.

A bearish rejection candle formed when the swing level that was recently broken from above – held as new resistance and contained price from moving here.

This communicated the possibility of further bearish movement and the potential for a medium term bearish trend to develop.

There was some initial bearish follow through from the bearish price action setup. But, the market recovered very quickly and shifted gears quickly.

The bullish moment kicked back in and snapped prices back up higher above the level.

We all know Forex trading has a compulsory losing element to it – so there is no need to shy behind losing trades. This trade was a loser, but the reasons for the trade setup were sound.

A lot of traders will try to find excuses to take a trade – sometimes you have to reverse the way you think and think of reasons not to enter the trade.

Now the USDJPY has powered its uptrend back up – Will be looking for long signals to develop inline withe moment continuing into 2015.

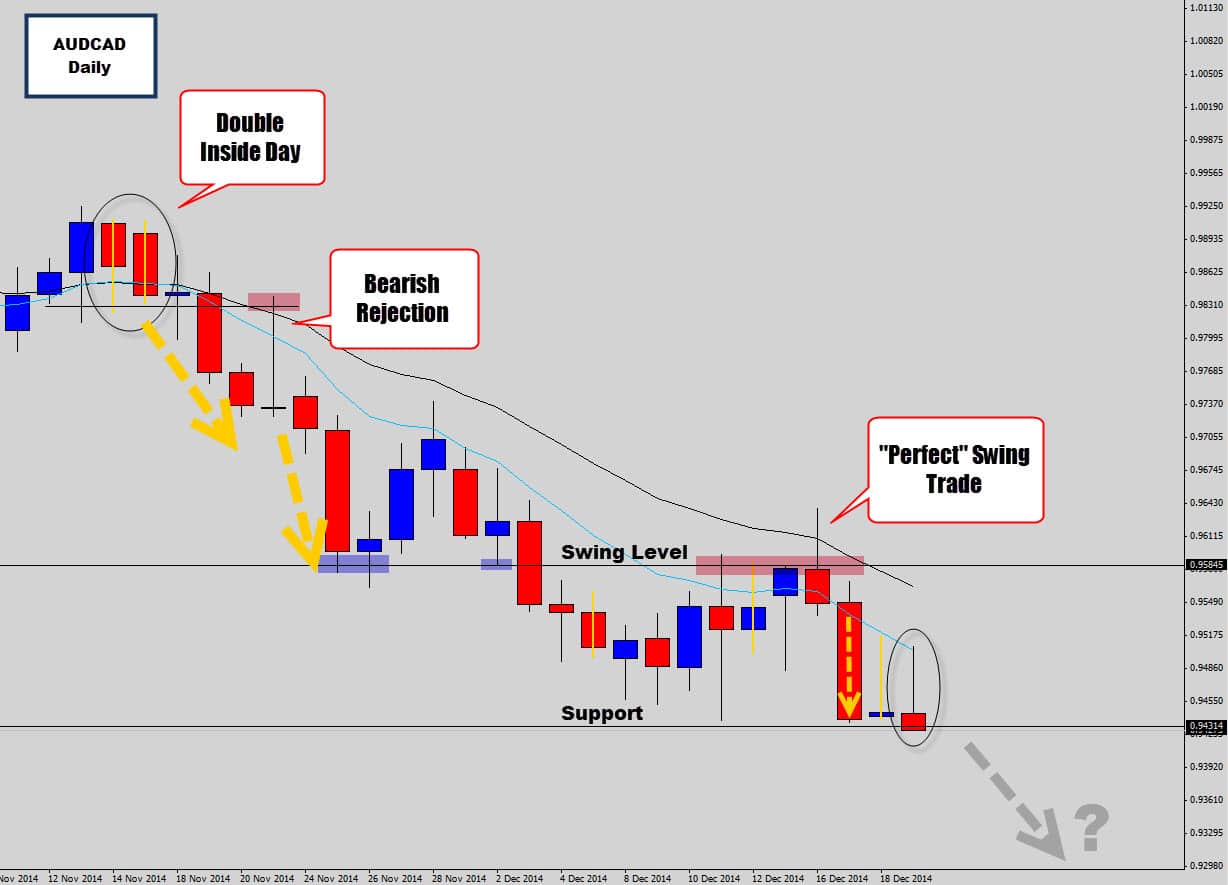

AUDCAD Swing Trade From Hot Spot

The AUDCAD is one of the most recent trades that was discussed in our war room commentary.

A bearish rejection candle – with a negative close, was printed at a bearish hot spot on the daily chart.

Hot spots are areas on the price chart where multiple variables line up together to support the trade – in this case it was a swing level + the mean value.

In our commentary, we explained this is basically a ‘text-book perfect’ swing trade setup and it’s hard not to find any reasons not to trade this opportunity.

The AUDCAD has actually produced a lot of good bearish trading opportunities – thanks to the Australian Dollar weakness.

Firstly we had a double Inside Day consolidation breakout setup – a very powerful breakout catalyst.

You can see the overall bearish move that was generated out of the double Inside Day break in the last two months – with bearish movement still continuing today.

There were a few other price action setups that aligned with the downward movement along the way.

Next there was a bearish rejection candle off the mean value, and a swing level. This trade seen nice bearish follow through to the next support level.

Next is the ‘text-book perfect’ swing trade that we just looked over.

We can see this price action signal produced some good bearish follow through into a weekly support level.

It doesn’t look like the show is over, with the week closing heavily on support. If the Australian Dollar weakness continues into 2015 – we could definitely see this market push into new lows.

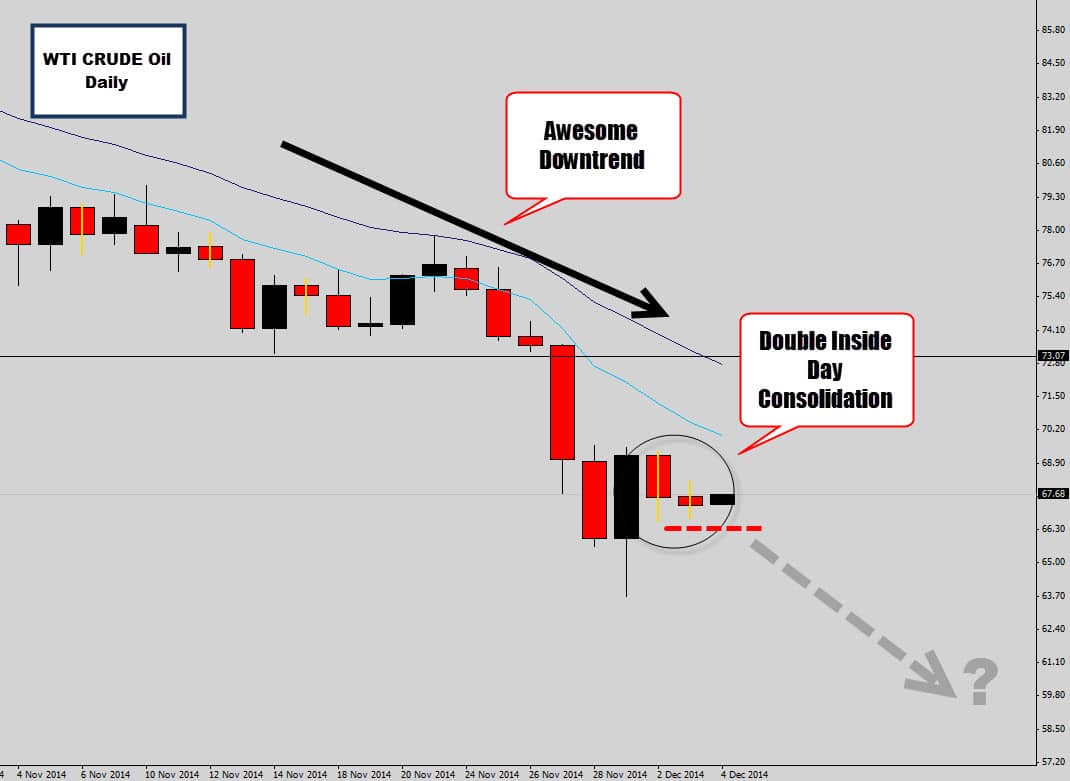

Crude Oil Goes into Freefall

One of the biggest movers of 2014 is crude oil surprisingly…

Which is good for everyone – because we are now starting to see drops in fuel prices!

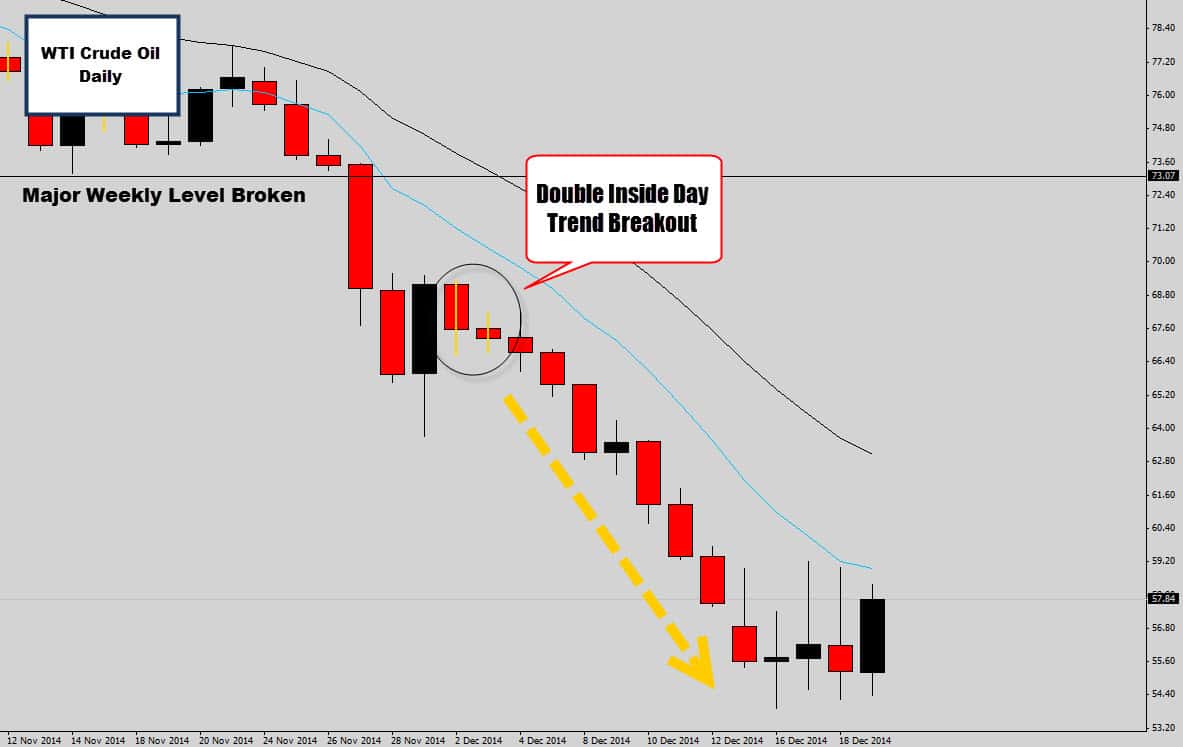

The monster downtrend produced some good bearish price action signals like this double Inside Day consolidation pattern…

I speak about double Inside Day setups a lot – and emphasise the explosive breakouts they can produce.

I am an idiot, because I backed down out of this trade – intimidated by the extreme volatility of crude oil.

Remember how I said sometimes you need to think reasons ‘not to take the trade’, well I was hoping to see more of a retracement as I didn’t want to short as the market was a little extended from the mean.

But I should have known from experience – once crude oil gets going, it gets going 😛

Wowie, this double inside breakout caused crude oil to drop more than 10c a barrel!

This is the raw power of double Inside Day breakouts I was telling you about – now I am kicking myself for not pulling the trigger on this one, but I wanted to share it in today’s post.

The bearish momentum seems to have come to a halt and found some support this week. My broker doesn’t actually have enough historical data for this market to find any historical lows.

So essentially this chart is in uncharted territory now.

If you check out the weekly chart, this market is extremely overextended from it’s mean – so that is a warning sign a corrective movement is due.

We will probably see this market recover some losses before any moves lower occur.

My congratulations to those War Room Traders who caught this move.

Learning How to Trade Price Action

Inside out Forex traders War Room membership are – is one of the most comprehensive price action Forex courses available online.

It covers all the setups, entry, exits, stop placements and also contains some of the most powerful money management plans you will come across.

So if you’re an aspiring trader, want to clean up your trading and find clarity in the market – check out the War Room members for Forex Traders.

I wish you all a Merry Christmas, and the best for the New Year.

I hope 2015 is a very lucrative year for you and wish you all the best on the charts!

jeff yap

as i know , there is no 100% price action ea , price action trading is set and forget trading system ,every morning used some time to analysis the market and set ur order than go to do other thing ,this so call set and forget method

Matthew

I would like to have an EA that trades this for me. I don’t have the patience or stamina to sit in front of my PC and watch the charts always.

Please consider producing an EA that you can sell – I’m sure it would be a best-seller!

Marvelpips

TFG, You promised right from the beginning of this forum (last year)to make it unique and you have not failed me. Thank you so much