Welcome back traders, I trust you all had a great holiday period 🙂

We’ve seen the market come back alive after the break – and we’re starting off 2015 with a BANG. Lots of crazy stuff going on – giving us price action traders the volatility we need to gain returns. A refreshing outlook compared to the horrible first 1/2 of 2014’s sluggish markets.

Let’s have a look what’s been happening on the charts from a technical standpoint…

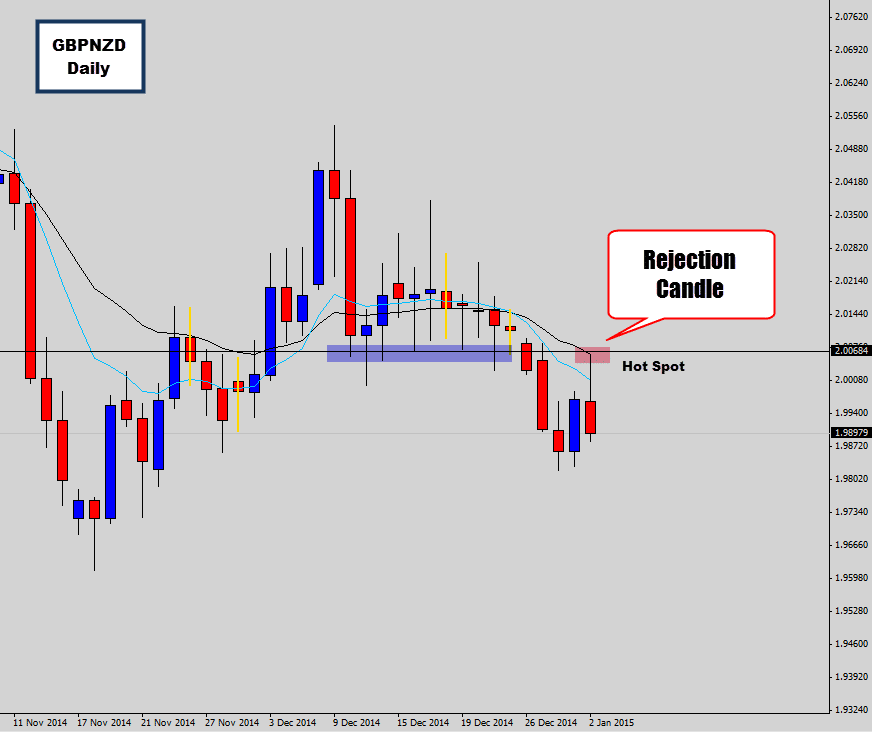

GBPNZD SWING TRADE

A bearish rejection candle formed after the market broke down through a stubborn support level, then retested it from the other end. These kind of ‘breakout and re-test’ type of trades are very high quality setups, and can produce nice extended moves. You’re catching the breakout of consolidation at a really good price.

The bearish rejection candle here actually has a heavy close on the body – closing much lower than the open price. This is also a nice bearish feat for these candlestick reversal signals.

The setup almost retraced back up into it’s highs – which is where a lot of weaker traders would ‘freak out’ and close their position out of fear. Using our set, forget and collect money management models, you would have nailed some great returns here. The retracement entry was also available for this bearish rejection candle setup – which increased the reward output of this trade significantly.

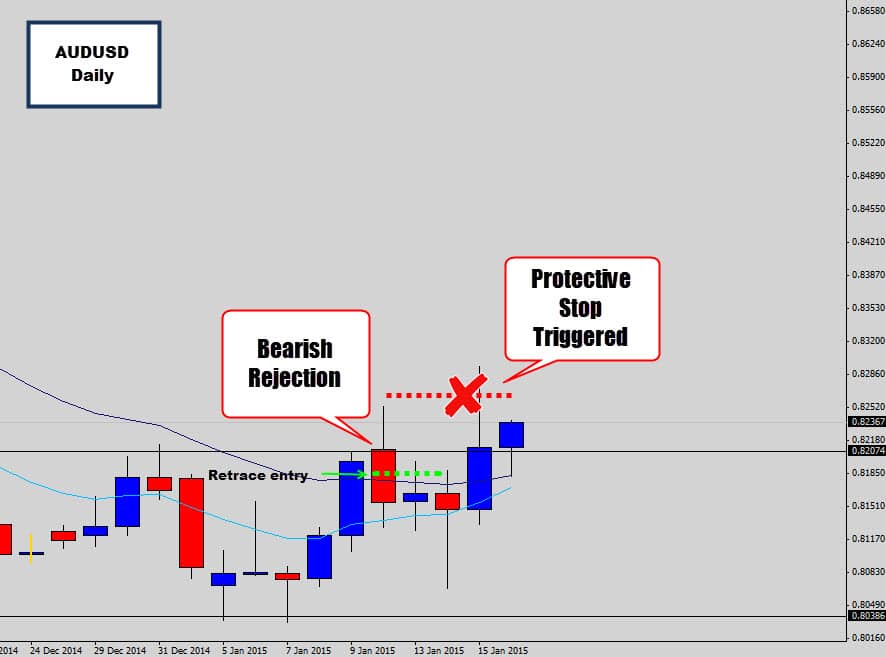

AUDUSD ASIA SESSION FAKEOUT

Another setup that looked very promising was an Asia session breakout trap that occurred on the AUDUSD daily chart this week. These Asia ‘fake outs’ are generally a good early warning sign of what is to come.

Generally they have great follow through – and if caught early can offer a huge return.

This particular Asia session breakout trap formed at a proved resistance level for this pair adding value to the bearish trade idea. To reinforce the position, the daily candle closed as a solid bearish rejection candle which could be traded with end of day Forex strategies.

Unfortunately, despite how good this setup was looking – it didn’t end up hitting our target.

Some traders may be shocked that I am writing about losing positions, but Forex trading is not about winning all the time – it’s about becoming an expert risk manager. There is no need to shy away from a losing trade.

As a ‘risk manager’, I did the right thing by using a stop loss – which a lot of traders don’t.

Some War Room traders actually broke even here by either moving their stop loss after the counter trade bullish rejection candle raised a red flag, or used our split money management system from the War Room’s Price Action Protocol Forex trading course.

The bottom line is, your job as a Forex trader is not to win 100% of the time, it’s to manage risk the best you can 100% of the time. When you don’t manage risk – you fail.

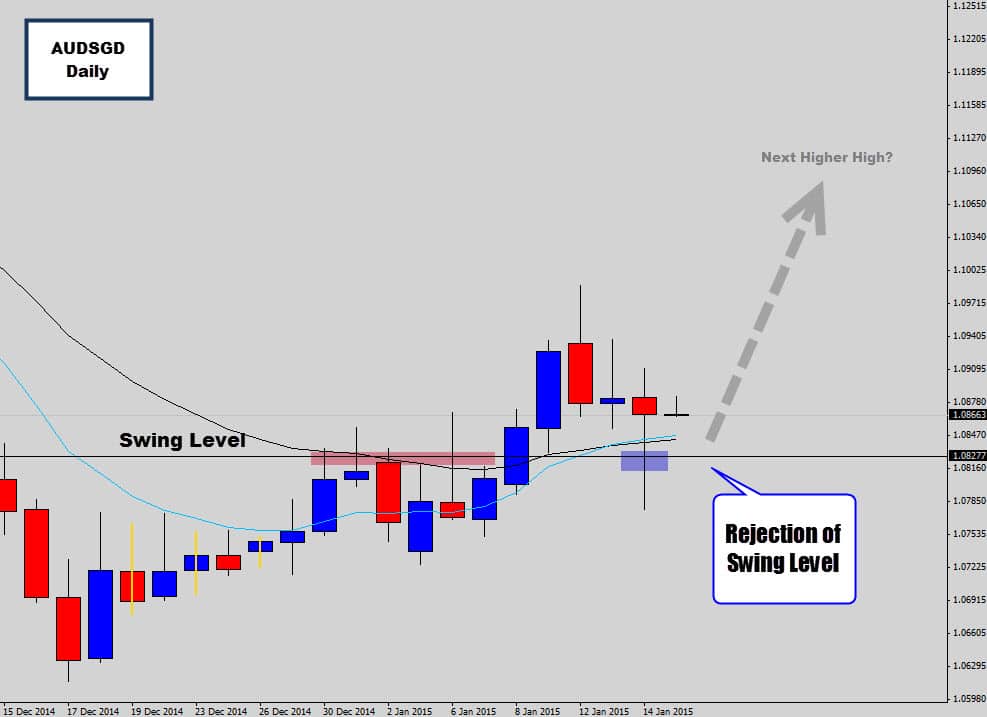

AUDSGD Bullish Rejection Signal

The strength in the Australian Dollar has helped the Australian / Singapore Dollar cross pair push into new highs.

This market is recovering for a recent downtrend, and is now producing the classic higher high, higher low pattern of an emerging uptrend. After a retracement from recent higher, price tested an old resistance level where it held has new support – creating a swing level.

This are the ideal ‘hot spots’ to enter into moving markets like this, and because this pair has just started to transition higher – it could be a good chance to change the developing trend early.

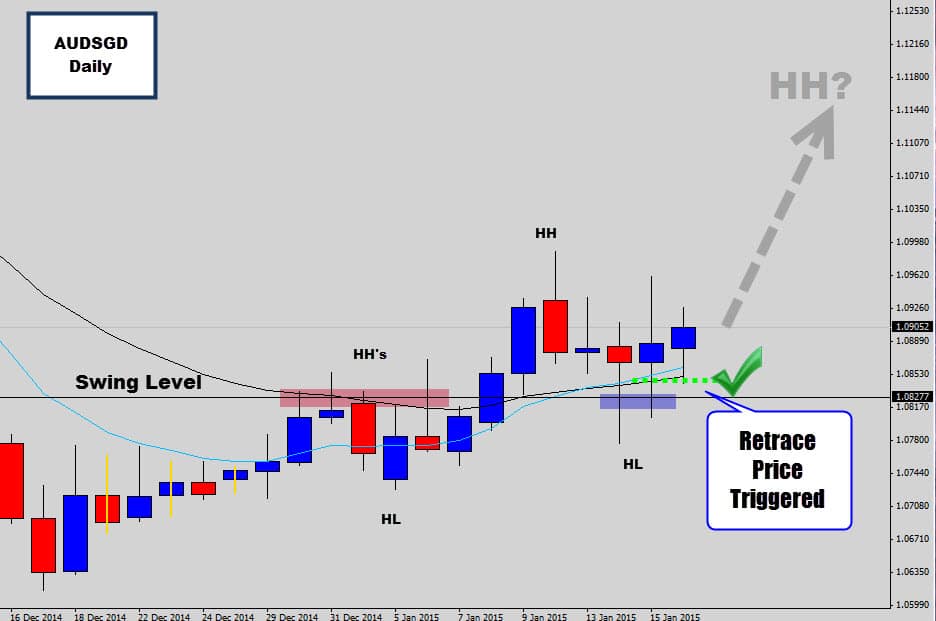

This trade is still in it’s early days, but is responding well. The retracement entry for this trade was triggered – tightening the stop loss spread and increased the reward potential here at the same time.

This trade survived the recent volatility that rippled through the market from the recent SNB action, and we’re getting positive closes on those daily candles as price maintains itself on the bullish side of the mean value.

Like I said still early days here, but looking good so far.

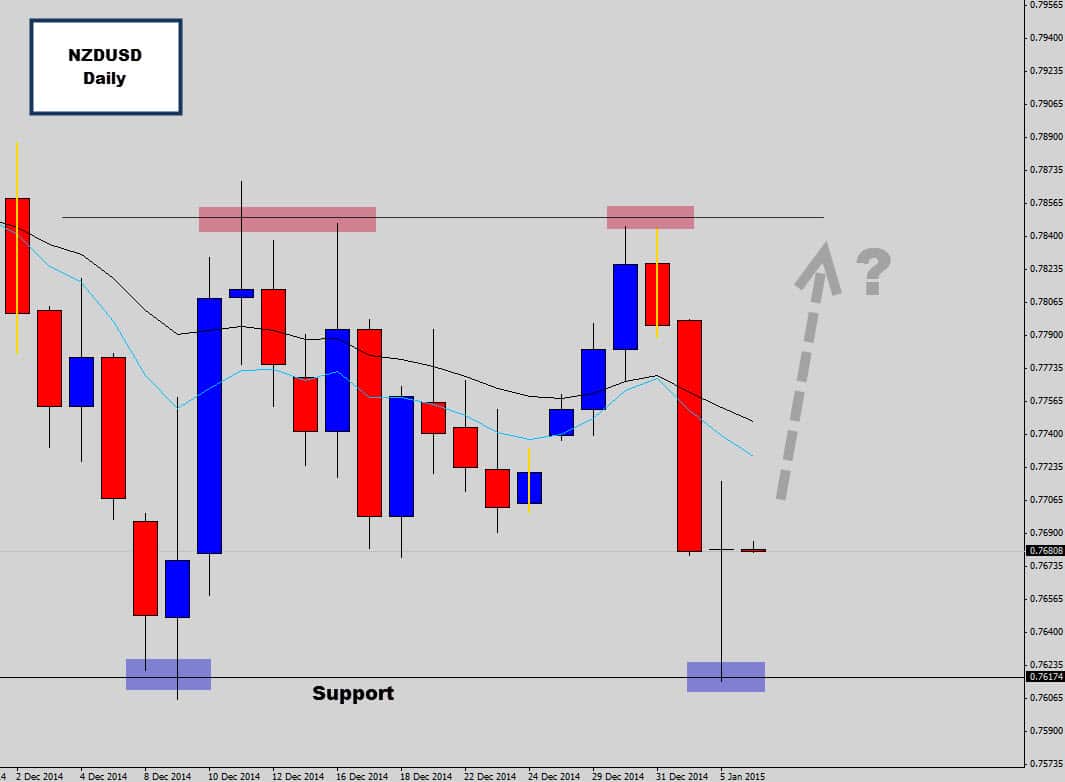

NZDUSD RANGE SUPPORT TRADE

A long tailed bullish rejection candle formed at the NZDUSD tested it’s range support. This pair has been trapped in daily range bound cycle for a few months now and has just been oscillating between the two boundaries.

Range trades can get a little noisy, as the market is technically in a form on consolidation. One trick is to look how price behaved last time it tested the range level on it’s previous cycle. We can see here there was a nice clean bounce when the support level was tested last time…

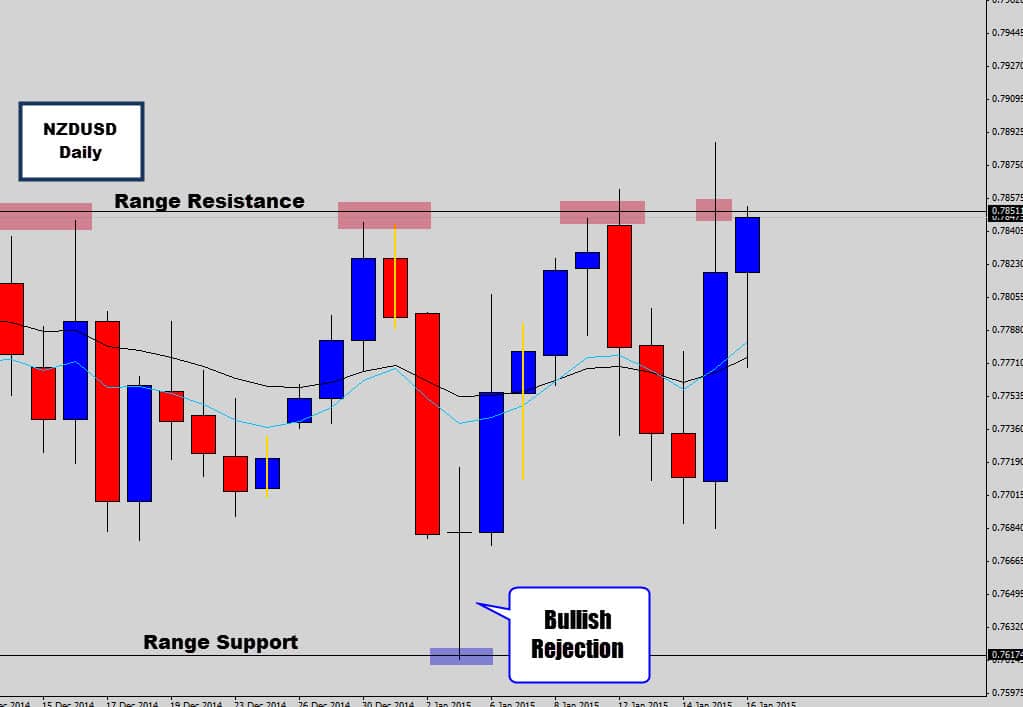

This trade did work out nicely and produced that clean ‘bounce’ we were anticipating off this level

Price inflated higher out of the bullish rejection signal and powered on upwards to the range top. Here we go another bearish reaction, but price quickly recovered and is looking to test that range top again.

This trade was spoken about in the War Room, and it is generally recommended to target the opposite side of the range for potential trade targets – which this trade did quite quickly.

THE SNB PULLS THE PLUG

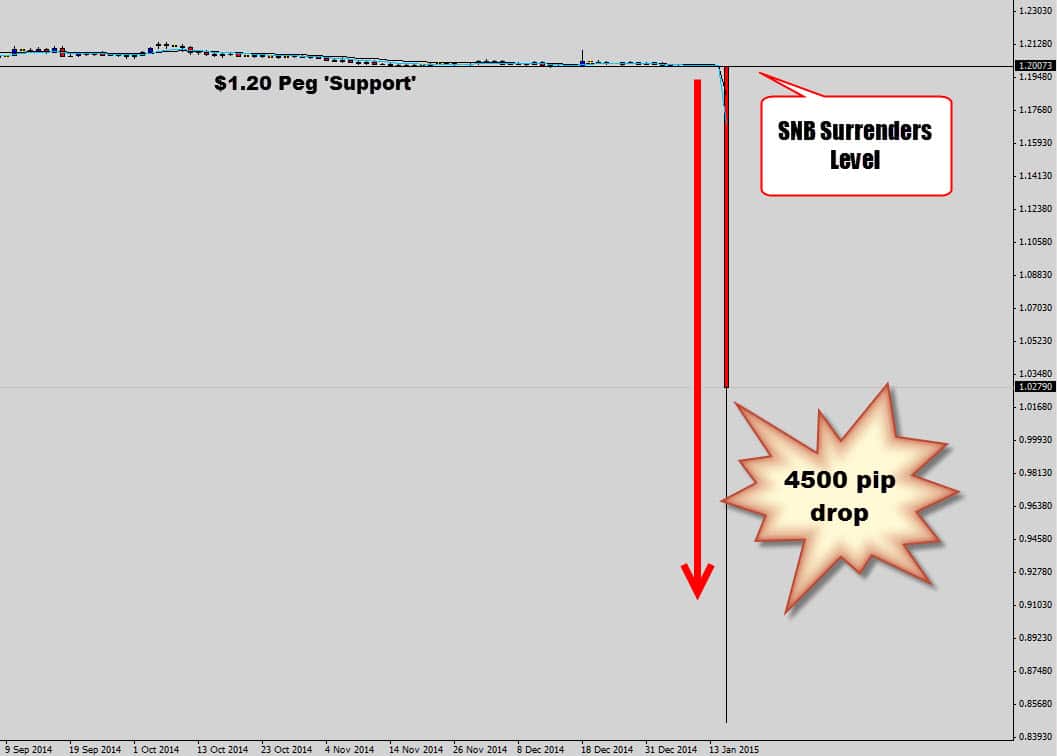

The SNB have been holding a peg on their currency against the EURO – locking in the EURCHF exchange rate above $1.20.

Last session, surprisingly, they put down their arms and removed their peg. This caused one of the biggest moves I’ve ever seen in the market and will be one for the history books. The pair almost instantly dropped 4500 pips!

There are reports coming in of brokers being bankrupted from this move and clients losing a lot of money because their stops could not be filled at the set price.

Courtesy of Forex Trader Scotch (The Fundamental Guy):

http://blog.excelmarkets.com/2015/01/critical-open-positions-must-be-closed.html

http://www.zerohedge.com/news/2015-01-15/2-fx-brokers-suffer-significant-losses-after-snb-surprise-breach-regulatory-capital-

Brokers will probably remember this as another ‘Black Monday’ and we will probably see a lot of brokers drop off the radar. This is why it is important to pick a broker who is well established and has access to multiple liquidity channels.

I recommend Alpari UK – they are a very well established broker and didn’t crack under the pressure from this event. I have War Room Traders set up with Alpari UK who actually had CHF trades open – their stop loss was filled at the correct price.

**UPDATE: It appears I spoke to early about Alpari UK – Although they have been my trusted broker for over 6 years and never done anything wrong by me… it appears they also have been hit with their ‘no debit balance policy’. I guess I can’t recommend them at this stage as they too have also claimed insolvency after this event…

http://www.alpari.com/company-news/posts/2015/january/important-announcement/

If you would like to learn more about the strategies and concepts we’ve spoken about in today’s post – feel free to check out our War Room Trader Membership. It includes a lot of educational material, including a Forex course that covered all the Forex trading strategies we talk about on the blog, and all the money management systems and tools that marry beautifully with price action trading.

Until next time, best of luck on the charts for 2015!

Kevin Thorne

I don’t understand why Alpari UK is recommended here. I use this broker and as from today they are insolvent due to this huge move yesterday!

Replying to: Kevin Thorne

Dale WoodsAuthor

Hi Kevin, the article has been updated. I didn’t know about Alpari UK’s insolvency claim until after I wrote this. I did have War Room Traders report their CHF stop loss’ were filled at the right price. I guess Alpari had other accounts which they could fill stop losses for. This is sad news as these guys have been good to me, and are a great broker.

waqas

That really nice stuff u share it