The market has been fairly uneventful with the US debt ceiling issue smothering the marketing with uncertainty and indecision. Now there has been some progress made and it seems like risk appetite is in full swing with analysts calling this the big ‘hope rally’.

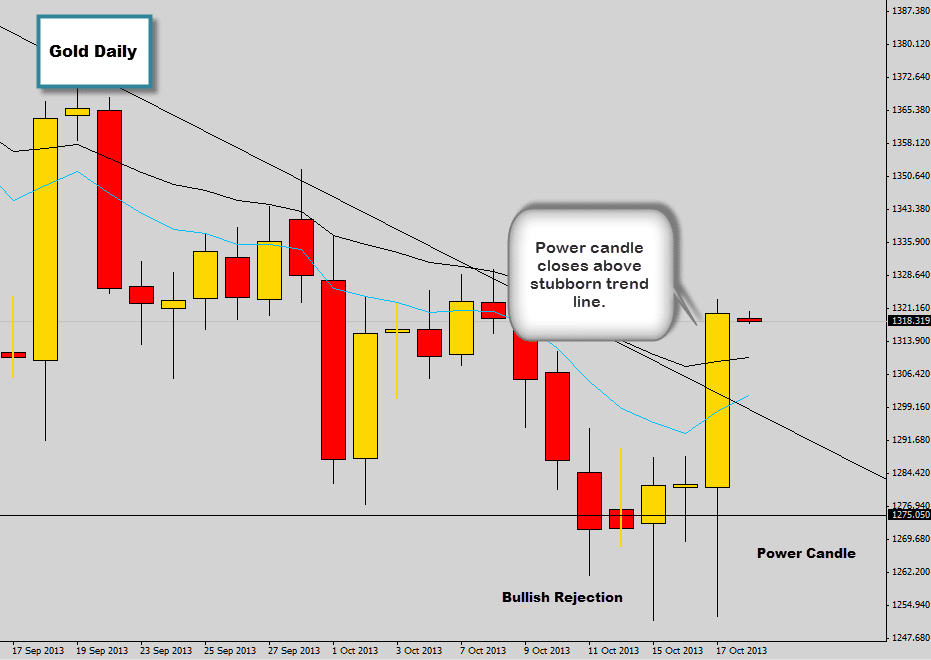

One big mover was the gold market. Gold has been respecting a falling trend line which developed some very profitable bearish price action signals that we capitalized on in the war room. Now gold has closed in on a support level which did hold strong. A large bullish rejection candle formed which did promote further bullish price movements in the following trading days.

The last candle closed as a bullish power candle, which is a very aggressive and decisive candlestick signal. If the power candle trade plays out correctly we could see much higher prices into the next trading week or two. We are looking for a break of the power candle high to consider long positions.