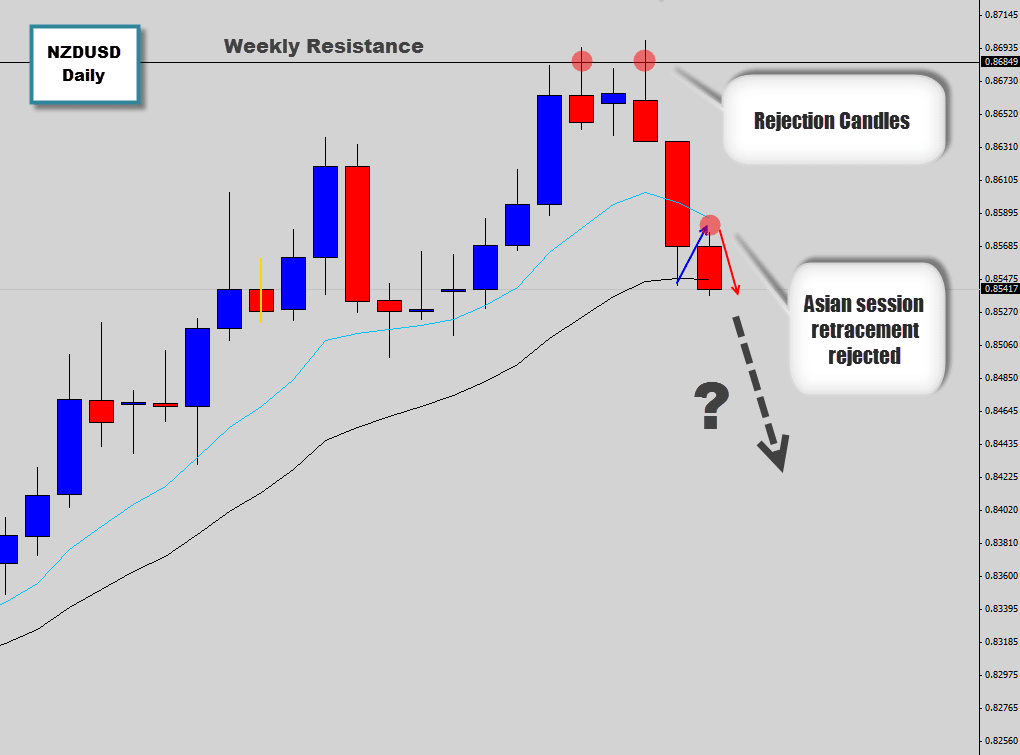

The NZDUSD rallied straight into a weekly resistance level last week, which has contained prices on 3 consecutive tests (visible on the weekly chart). The most recent re-test of the market top, seen the daily candle produced two bearish rejection candle price action trade setups, which have now ripened into profit.

Last session the bulls were shaken out, and price finally dropping lower. The sell off was quite aggressive, coming straight down from the open price of the day, and closing near the day lows. We’re now moving into London trading hours, and we can see the current daily candle has demonstrated that an asian session retracement has been rejected.

Statistically, when we see this type of asia session rejection after a “power day“, it’s typical to see further extensions of the overall movement. Price has already breached the low of the previous bear day and looking to move onto the bearish side of the mean value. Once price breaches the 20 ema, there is so much open space for the market to fall into. Traders who aren’t in the move can wait for further bearish price action setups to develop, if the downward movement develops into a full blown bearish trend.