Wow! The NZD has been dropping faster than a falling grand piano this week – providing some good volatility for traders to work with.

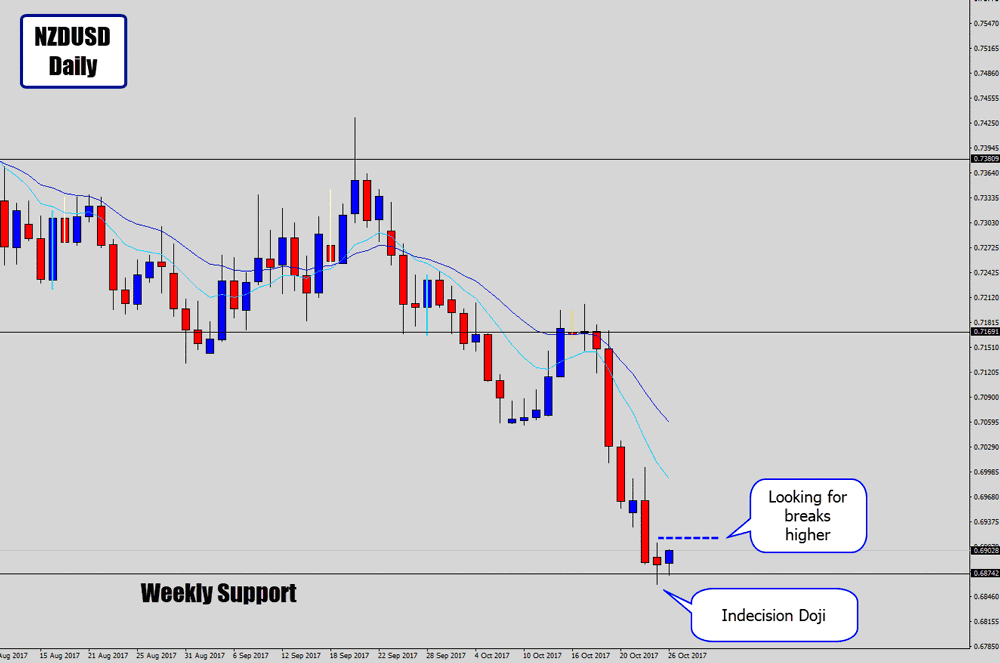

Now the NZDUSD as dropped to it’s next major weekly support level, where in the recent past, has seen some really strong bullish rallies aggressively launch from.

The market seems primed enough here, for at the very least, a bullish correction – but we may see another strong rally if recent history repeats.

There is also a gap in the mean, which is a strong catalyst for a reversal move, not to mention the weekly support is quite a big deal.

Last session printed an ‘indecision doji’ candlestick pattern, which can be used as a ‘framework’ for breakout trades.

Indecision price action around major technical levels is a good recipe for these type of breakout trade setups.

Looking for the market to break through the doji high, and communicate the market is looking to make a push higher.

Best of luck on the charts 🙂

Tim van Niekerk

I dont have a closed doji on my chart and Im using NY close charts

Deric

If the trade (price above the high of the doji) does not get triggered on the next day, will you still hold it? Thanks.

AmbiHill

I know the trade setup didn’t work out however, I want to know how many pips do add to the high of the of breakout candlesticks? Thank you for making out time for us your followers .

Replying to: AmbiHill

Dale WoodsAuthor

What do you mean it didn’t work?… it hasn’t even triggered yet?

Yusif

Thank you!

Yusif

Thanks for the insight 🙂 So how would you play it? Conservative or aggressive? Will you take the break of the doji or wait for a retest of the break and move away? And what made you make yur decision either way…..Thank you for your precious time.

Replying to: Yusif

Dale WoodsAuthor

I am simply looking to catch breakouts of the doji high.