Crude oil has been recovering after a major downtrend caused it to lose over 50% of it’s value.

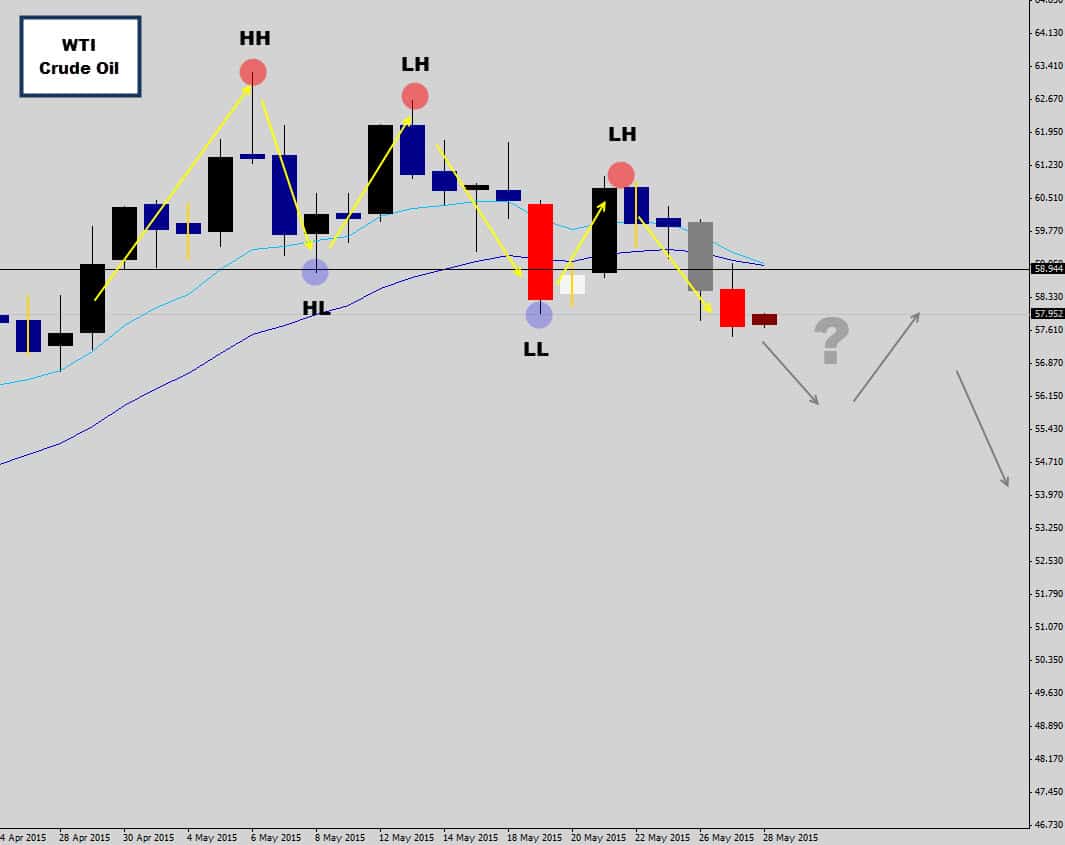

It’s only natural that we see a bullish correction after a 6 month push down. We recently discussed a swing trade setup on the level marked in the chart above -but it failed and we can see bearish activity starting to becoming more dominant now.

The charts has gone from swinging to higher highs now to lower lows – the classic footprint of a bearish trend.

Now price is closing and trading under the swing level, and last session dropped a thick bodied bearish rejection candle which could see much lower prices develop.

Generally I like to see breakouts occur during the New York session for oil – as that’s when the serious money comes online with the Chicago mercantile exchange.