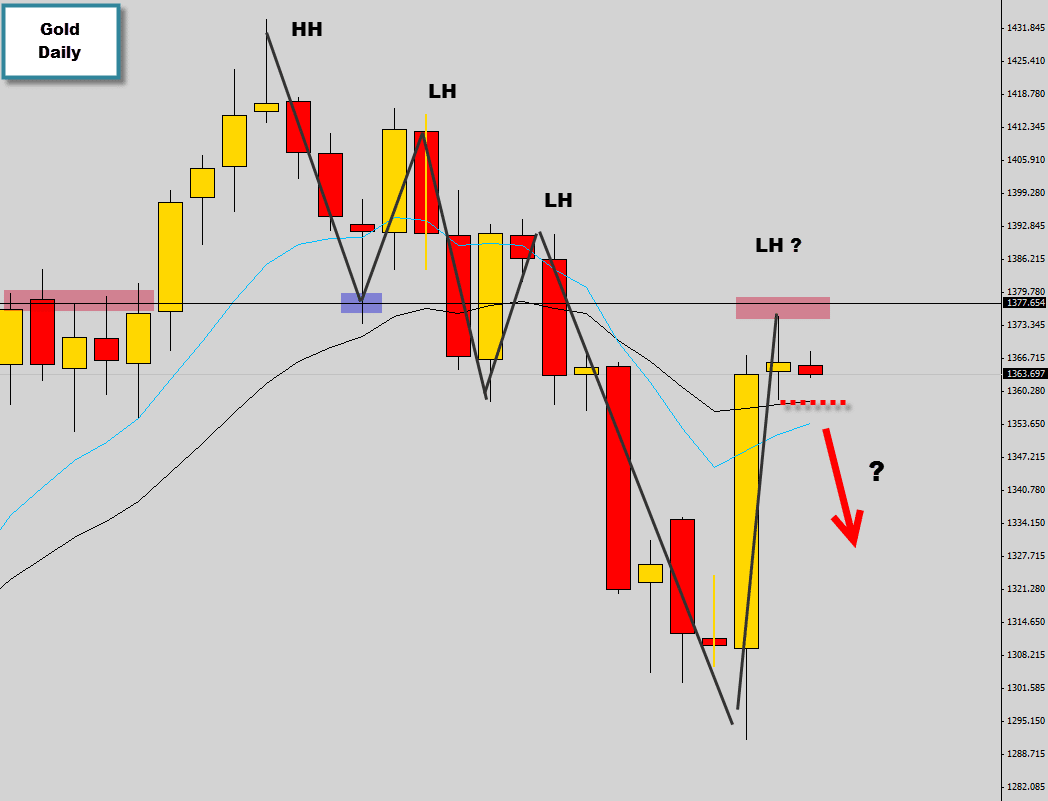

During the last few weeks gold has been stepping downward creating lower highs and lower lows, we have been following the footsteps of Gold in our ‘chart of the day’ and ‘weekly commentary’ section inside the War Room and would like to consolidate all the posts and share with you here.

After the aggressive movements from most of the charts this week, we are waiting patiently for the market to correct back to important S/R levels and the mean value before jumping in on any signals.

Just looking at the price action from gold last session, after the aggressive move back to the mean, gold stalled and produced an indecision/bearish rejection candle price action setup.

The market did stall at a daily resistance level, and does currently look like a lower high swing in the market here. If the low of the indecision candle is breached we could possibly see continuation in the downtrend. Remember gold is most active during the new york session so breakout entries should be timed before the New York open generally.

The only issue here is the large bullish power candle, but we believe this to be just be news inflated movement that can’t sustain its momentum. If the resistance level holds here and price breaks the low of the signal candle, we will probably see the weakness in Gold continue into lower lows.

After a successful trade Gold dropped us another signal

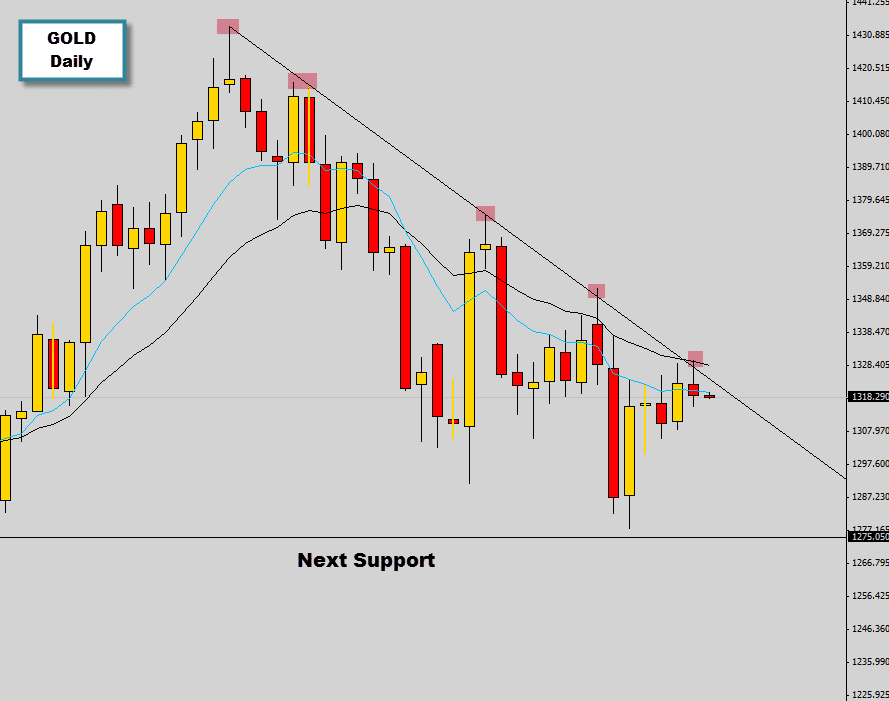

Gold is testing that falling trendline we’ve been watching closely, this trendline has already produced multiple bearish signals which have seen bearish price action follow through. This falling trendline is an obvious consistent turning point here on the daily chart and should have our attention when price tests it.

A small bearish signal has formed when the market retested the trendline last session. This area also lines up with the trend mean value dynamic resistance. Because this market has messy swing highs and lows, the trend is not really considered as stable as we would like it to be, but has demonstrated excellent responsiveness from the other price action signals that have developed.

A safe approach would be to take breaks of the low after the New York session opens, since gold becomes most active then.

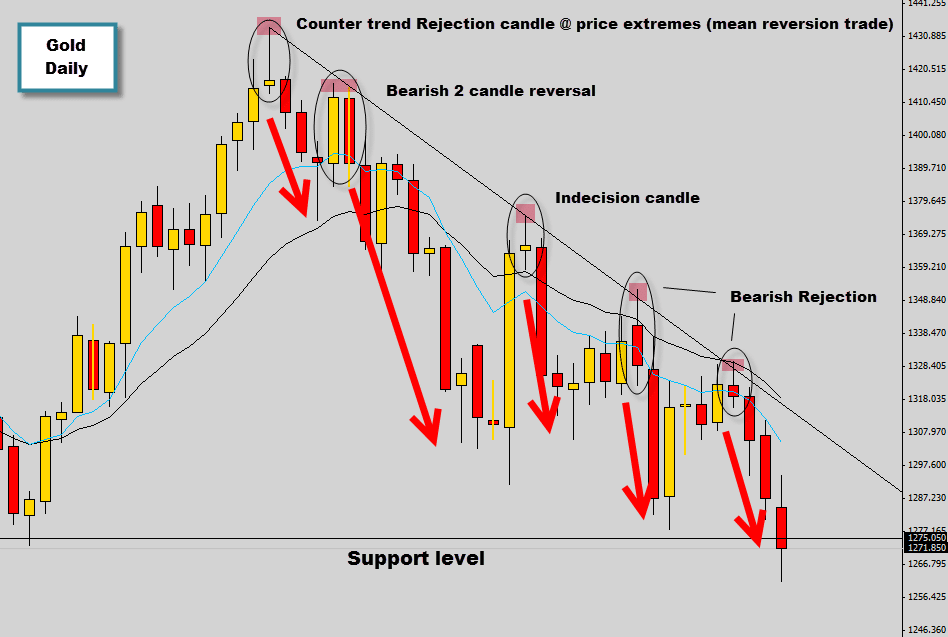

After the dust settles we walk away with another successful trade under our belts, happy to be a gold bear this month

On average the market has been relatively flat and there haven’t been many good moves to capitalize on, but Gold however has been a really good money maker for us in the War Room during last months worth of trading.

Both of the bearish price action trades discussed in the previous posts unfolded nicely and returned more than 3x return on risk. Every price action signal that developed when price reacted with the falling trend line has seen an excellent bearish response.

Most War Room members have taken profit on the most recent bearish rejection candle trade as the market dived into a support level. Now the market seems pretty wedged between the support level and the falling trend line. So, if the market does retest the trend line again and drop another bearish price action signal, there might not be enough room to set our normal 1:3 risk/reward target.

We are really looking for the support level or the trendline to break before considering any more trades here. Gold will most likely break the trendline and head into higher prices as an overall correction to the larger downward movement, but anything can happen so we play it candle by candle.

If price action trading like this interests you and you would like learn how to trade effectively with the various candlestick signals that we use, check out our War Room lifetime membership information page and consider joining us on the front line of the battle for currency.