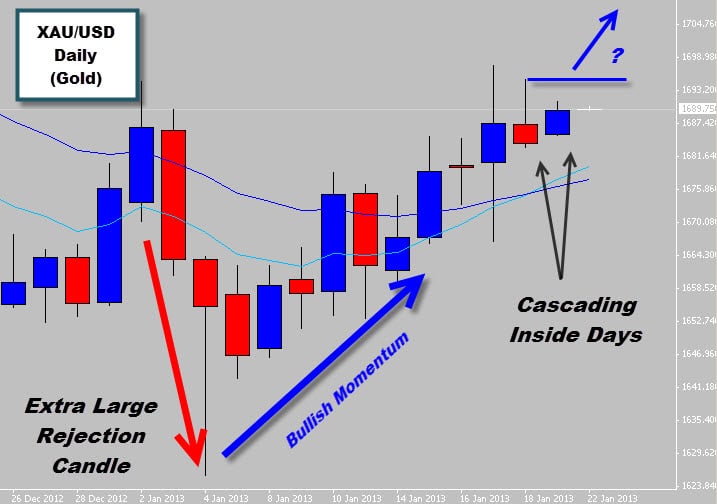

The bulls have started to pick up the pace on the gold market with our dynamic mean value now acting as support (bullish bias), after the market sprung higher off the back the large Bullish Rejection candle that formed recently.

When the gold price transferred over to the bullish side of the mean value area the daily candle closed as an indecision candle. The next two daily candles closed as inside days. This sort of indecision churning/consolidating price action can be the precursor for a powerful breakout.

Since we’ve established a bullish bias on this market, we only really want to trade bullish breakouts, if price does break out higher here, we could see a trend develop into much higher prices.

When the gold price transferred over to the bullish side of the mean value area the daily candle closed as an indecision candle. The next two daily candles closed as inside days. This sort of indecision churning/consolidating price action can be the precursor for a powerful breakout.

Since we’ve established a bullish bias on this market, we only really want to trade bullish breakouts, if price does break out higher here, we could see a trend develop into much higher prices.