Focusing on the gbpusd today, during the last Forex session the GBP demonstrated bullish price action across all its paired markets.

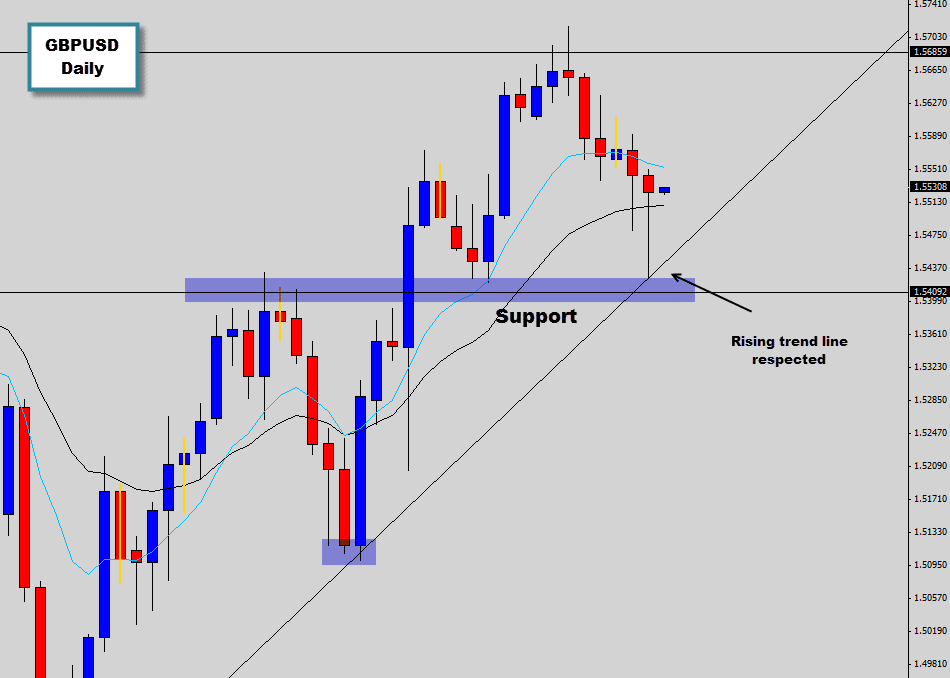

You can see here there is a rising channel that the GBPUSD has been climbing up in. Last session the bottom of the channel was tested and did hold as the lower boundary linear support. There is also a horizontal level acting as support intersecting with the trend line building more value into to this trade signal.

Retracement entries are always favored with reversal signals so we can tighten up our stop as much as we can. Need to watch that overhead resistance at the 1.57 area, traders could even look to set this as a potential target.

What happened next…

The bullish trade signal we discussed about 2 weeks ago on the GBPUSD has developed into a nice returning trade. The market has been really tough to trade lately with all the uncertainty circulating around the fed QE tapering and the tense situation in Syria which has caused the market to fall into consolidation across the board.

Thankfully the GBP has maintained some bullish direction and driving this trade setup into some nice profit.

This was an easy 1:3 trade and is now actually floating around the 1:5 return ratio target level, it would probably be in traders best interests to start thinking about taking profits now, we don’t want to be greedy forex traders and lose the potential returns.

Lots of traders will be struggling in bad market conditions like this and would have taken a few hits, but when targeting high reward trade setups like this one, you can wipe out much of your losses very quickly, this trade could have made up for 5 previous losses in the market if your money management is consistent.

This bullish rejection candle was a simple and obvious trade setup and didn’t require much effort from the traders end, just a simple fire and forget price action trade setup.