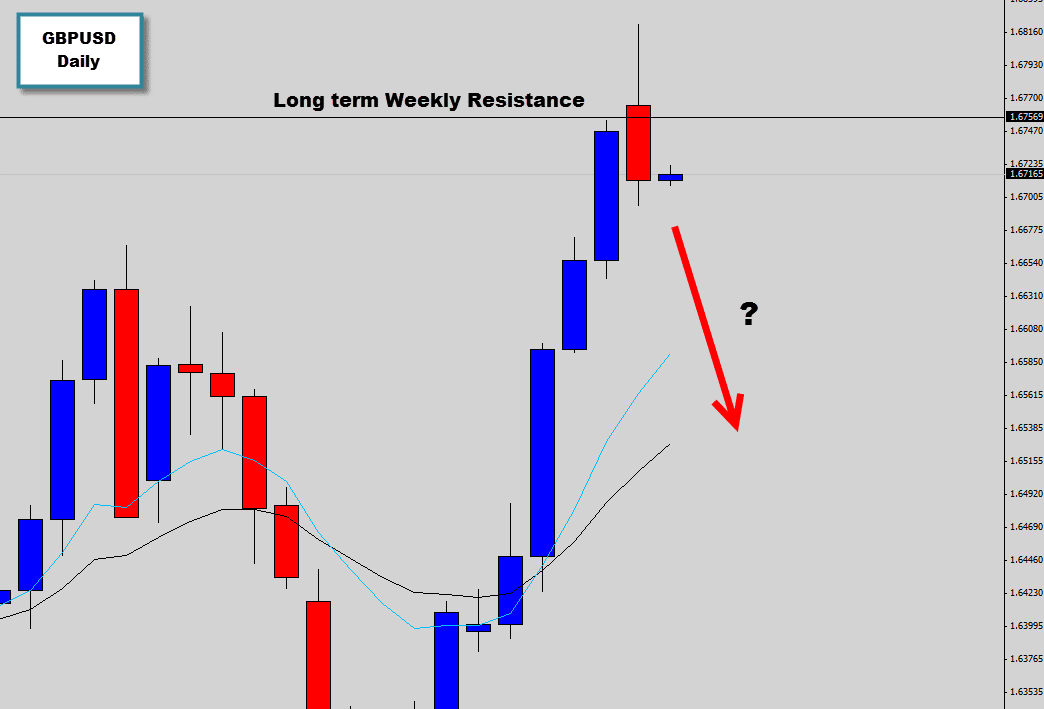

In this week’s War Room market commentary we talked about the situation on the GBPUSD at the end of last week’s Friday close of trading. The market closed right on a weekly resistance level at extended prices from it’s mean value. We did mention traders could watch for false breakouts of this level and strong bearish signals to consider counter trend positions.

Last session, the market did try to move past the weekly resistance level, but the higher prices were denied. The rejection of the resistance level continued well into the New York session where the day closed much lower than the open price.

The weekly resistance level has been the ‘roof’ of the market since 2009 and is a proven turning point for the GBPUSD. In terms of countertrend setups this one pretty much has all the boxes ticked for us in the War Room. We are expected much lower prices to develop off the back of this rejection candle signal.