The news about the Scottish independance has been ‘the’ hot topic amongst Forex traders this week causing heavily volatility on the GBP markets. As most of you know, I don’t follow the news or fundamentals too heavily. One of the benefits of price action trading is letting the charts communicate how the market ‘feels’ about these kind of events. I am not sure what the outcome was yet for the vote of independence, but we can see the market reacted very negatively towards the results and produced a variety of strong price action sell signals across the GBP pairs.

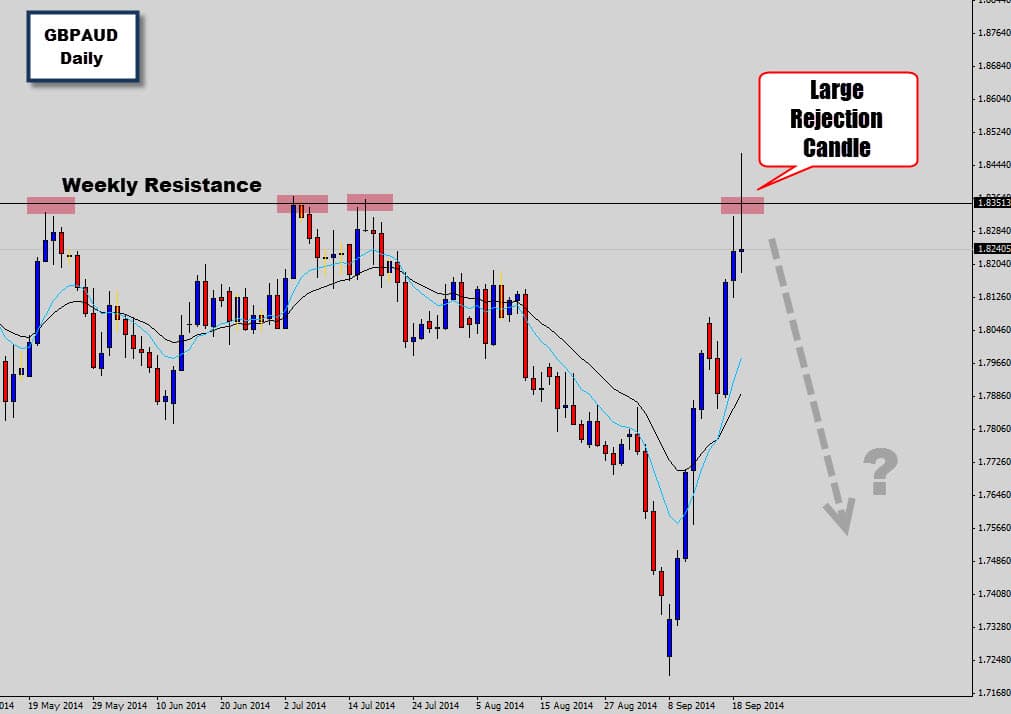

The price action setup that catches my attention this week is the one on the GBPAUD cross pair (the one on GBPNZD is also a beauty). I like the GBPAUD setup mostly because of the well defined weekly resistance level the market has clearly rejected. At the close of last weeks trading, the daily candled formed a long wick bearish rejection candle. The fact that the rejection is so large, clearly communicating higher prices are a ‘no go’ for this market, and the fact there is a major weekly turning point right here, I believe we’ve got ourselves a nice high probability sell signal here to look forward to for this week’s trading.

The action plan for this bad boy is to try take advantage of any bullish retracements up the reversal signal’s range. If we don’t get the retracement price, we can deploy more aggressive breakout type orders using ‘sell-sops’. The ideal entry is the 50% retracement or previous high retracement, with a stop loss placed well above the high.

Javed

Awesome way of looking at price action charts. Its a great help to me. Thanks