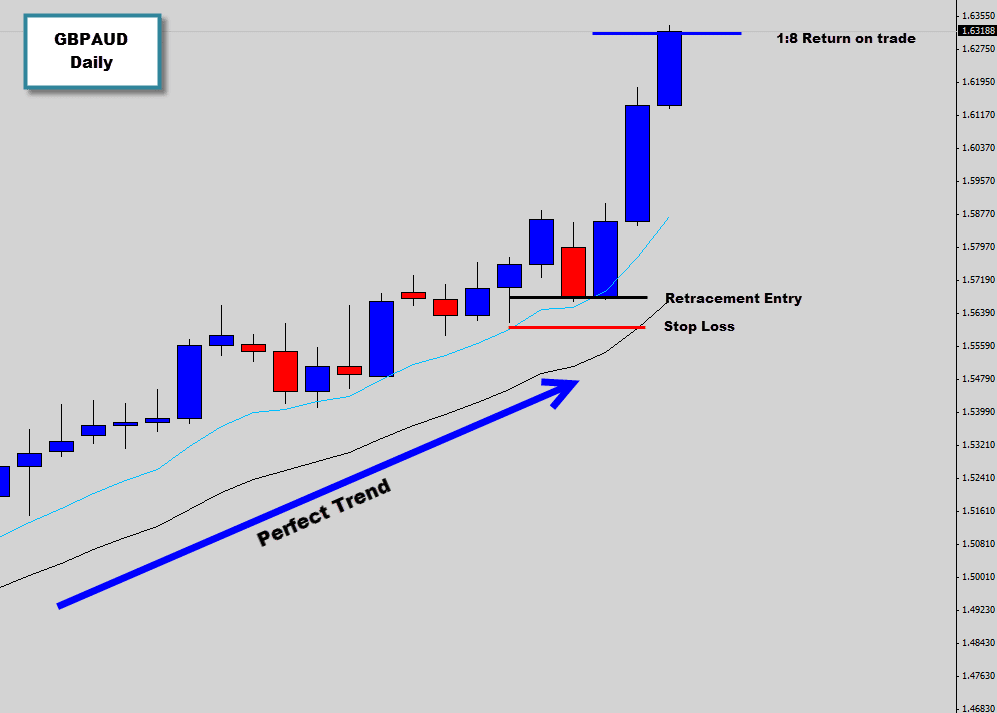

Remeber the GBPAUD price action signal we spoke about last week?, well we are back to see what happened to this trade. As expected it turned out really well, this trade setup formed in perfect trend conditions and was strong in form.

We described this Bullish Rejection Candle signal as a ‘textbook perfect’ trade and got the highest score on our War Room Signal Assistant.

We got our retracement entry opportunity, but we had to wait for the second day for price to hit it. The retracement entry technique nailed us an excellent price, tightened our stop loss right up which allowed us to grab a massive 1:8 risk/reward return on this trade, that’s 800% ROI!

That means if you risked $200 on this setup you would have just pocketed $1600, not a bad pay day for 10 minutes worth of work! That’s the way we like it here at DnB, trading less, aiming high and making more!

Previous Discussion on this Trade Setup

We are looking at a perfect trend on the GBPAUD today. The price looks very stable and buoyant here just floating on top of the mean value. The volatility is only focused in one direction which is perfect, the EMA’s are smooth out and facing towards that 2 o’clock angle, perfect conditions for price action signals to form.

Last session we got a nice bullish rejection candle form, not only did this one form in a perfect trend environment, it’s rejecting a swing level within the trend. The higher close on the signal candle was nice, what can I say it’s a textbook perfect signal.

We will be targeting retracement entries from the Price Action Protocol to really milk this trend for what it’s worth, setups like this will usually generate generous returns especially when you nail the entry price.

We are fairly confident this setup will play out nicely