The sad truth is that there are a lot of potato strategies getting cooked up in bedrooms, and passed around on forums, branded the holy grail.

Everyone’s time is precious! There is nothing worse than wasting a lot of your time on a trading system that leads you down the wrong rabbit hole.

Time is a commodity that is non-refundable.

Don’t get me wrong – there is some golden information out there, but you need to have a bit of industry experience under your belt to be able to ‘filter’ what’s worth investing energy into.

The crazy amount of foreign exchange information that poor in when you do a google search can be an overwhelming, and dilute your ability to find reliable trading strategies to get you going.

You might already be trading Forex, but looking for simpler Forex trading strategies to supplement your current regime.

In this tutorial, I am going to share 3 strategies with you which are:

- Forex Trading Indicator free, only need clean price charts

- Require no ‘extra’ tools, just your charting software

- Have a simple & effective price action approach

- Reveal straight-froward, uncomplicated trade signals you can spot easily

When Forex strategies have these kinds of properties, they are easy to stick with for the long run (like a well designed diet).

Let’s put things into gear, and begin…

Forex Trading Strategies Using ‘Indecision Doji’ Candles As Breakout Trading Setups

This is one of the most overlooked and underestimated Forex trading strategies!

There are many definitions for a Doji candle – you can probably find over 10 variants! I am going to stick with the generic definition here, which I think works best.

The ‘indecision’ Doji‘ is the one I trade – it’s a very simple to understand signal, and extremely easy to spot on the charts too.

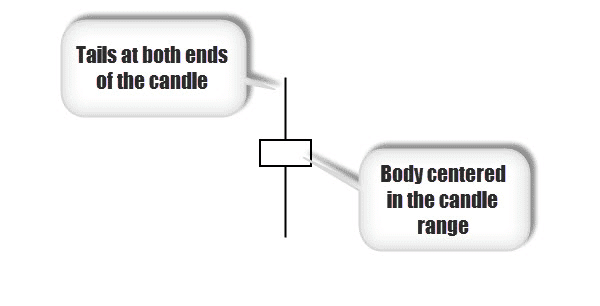

An indecision Doji candle has a small centered body, with wicks protruding out both ends of the body.

As the title suggests, this candlestick pattern represents indecision. The market is communicating to you that it tried to move higher, and it tried to move lower, but ultimately closed off back around the opening price.

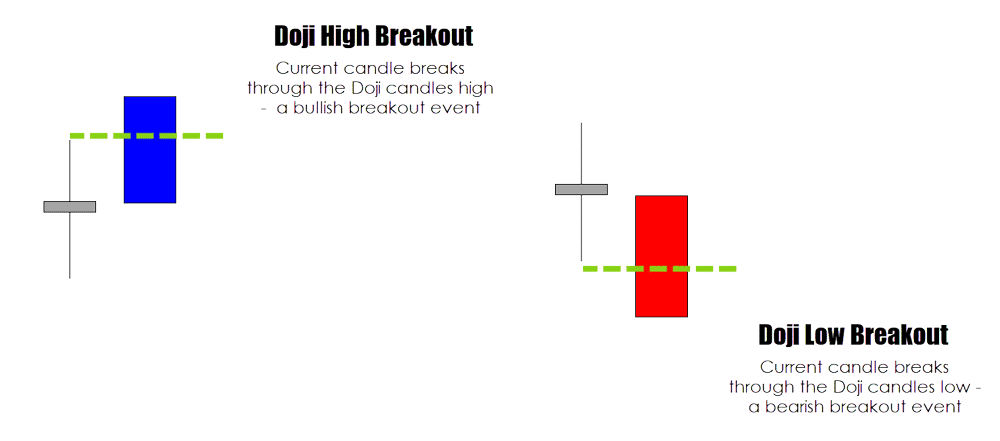

The idea is to catch the breakout of the indecision. In general, we aim to catch bullish runs as price breaks the high, or bearish moves as the market breaks the low of the Doji.

Above: The basic way to trade these is to wait for a breakout from the ‘indecision’ the candle represents. We do this by catching price as it breaks above (buy), or below the candle range (sell).

There are also some more advanced tactics where we wait for a break of one end of the Doji, but only take action if it fakes out, reverses, and breaks the other end instead.

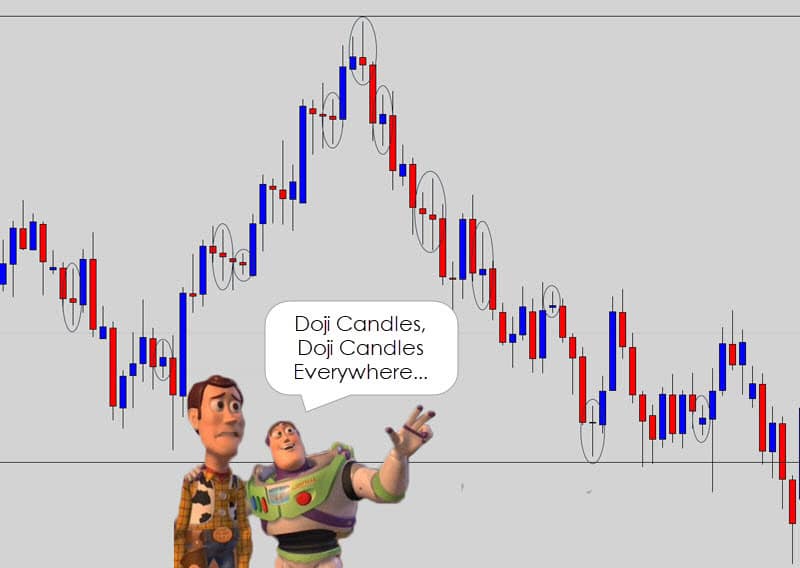

Doji candles print very frequently, and can be seen across a few time frames. Very easy also to spot with your eye!

Above: Yep, Doji candles form often, across all time frames.

One important thing to remember is that the more ‘data’ that you have packed into a candlestick pattern, the more reliable it will be.

Meaning: A Doji on the Daily time frame has magnitudes more value than a Doji on the 5 minute time frame – which is true for any price action Forex trading strategy.

In my crazy price action Forex tips article – I talk about how traders screw themselves over constantly by trading candlestick signals in isolation and give away my approach to a candlestick signal trading strategy decision.

So, the first lesson is: don’t trade every single Doji you see!

What is the difference between a good and a bad Doji signal?

We want to target them at points on the chart which have high technical value. Locations where you know the market has a ‘decision’ to make.

Looking for key locations like:

- Proven support and resistance levels

- Swing levels within a trend

- Trend line structures

- Any point on the chart your technical analysis tells you the market should ‘break or bounce’

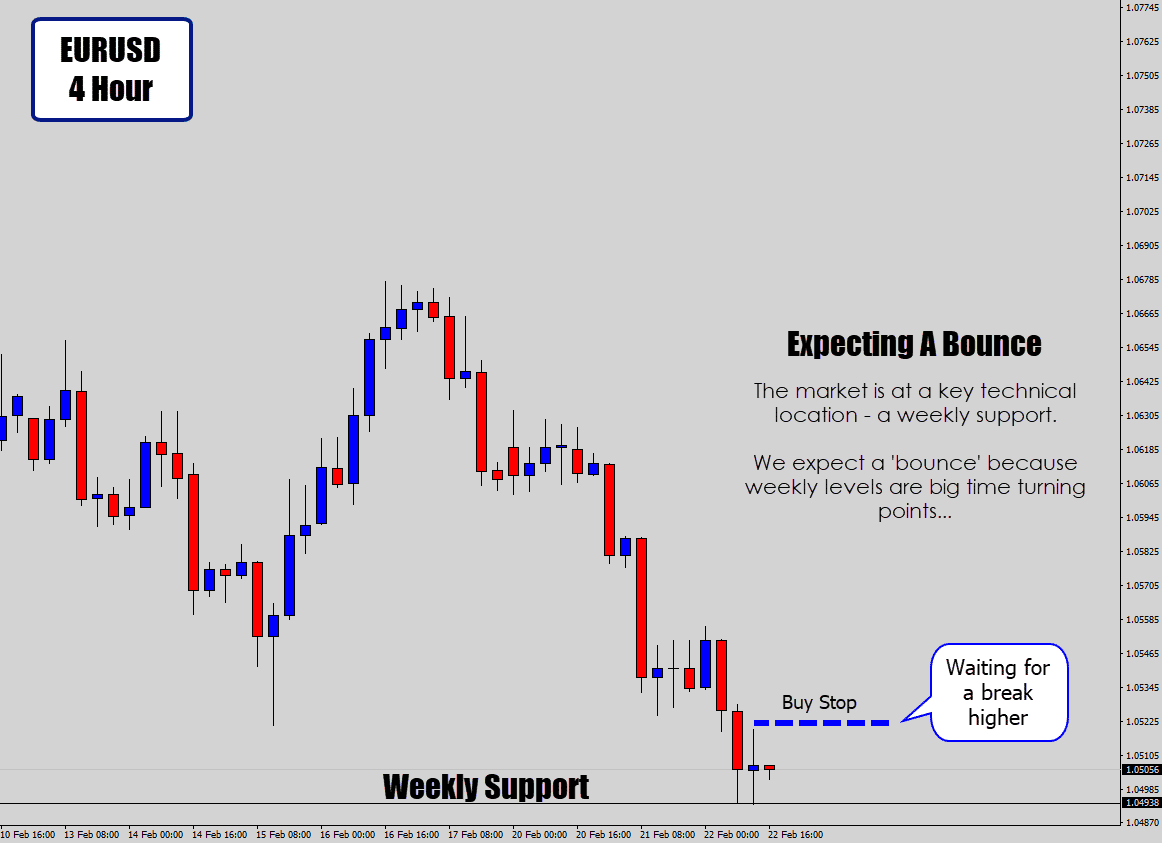

Check out this Doji setup below…

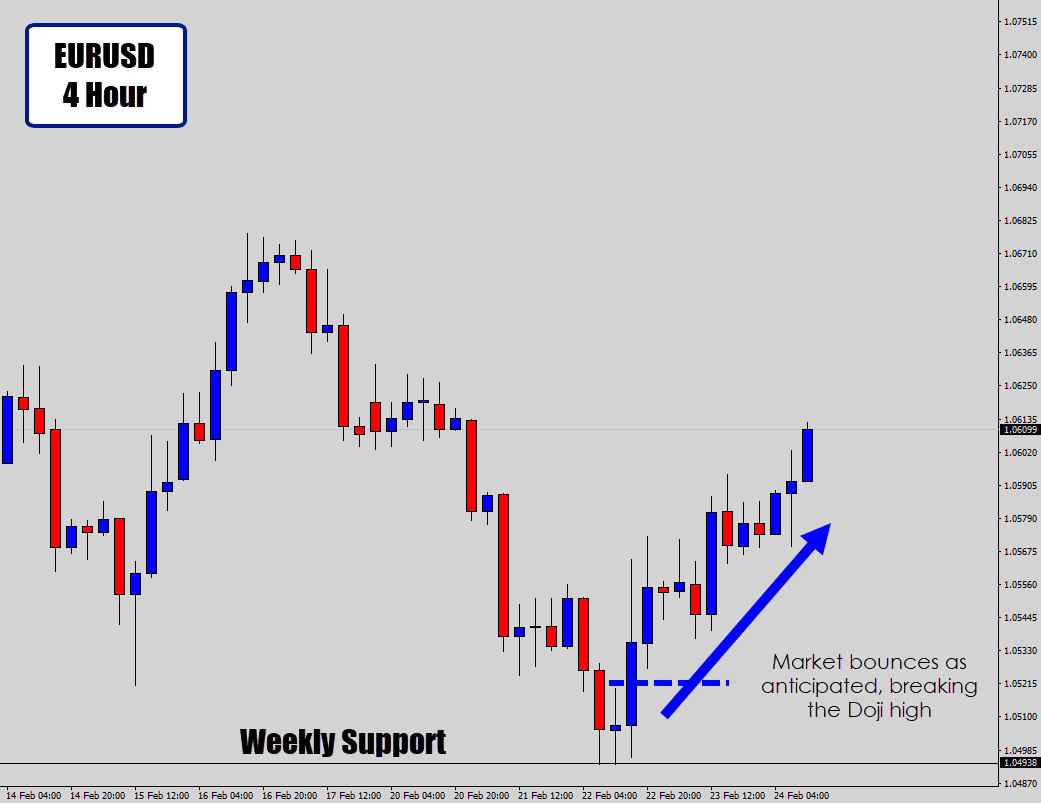

Above: The indecision signal formed on a weekly support level – where we highly anticipate a ‘bounce’.

With that logic in mind – we only look for bullish breakouts

Above: As expected, a ‘bounce’ occurred off the major level, and price broke above the indecision high – kicking in our bullish trade order.

It’s all about using your technical analysis to find key areas where you know the price action has a ‘break or bounce’ decision to make. Wait for an Indecision Doji to form, then trade the expected outcome (usually bounces).

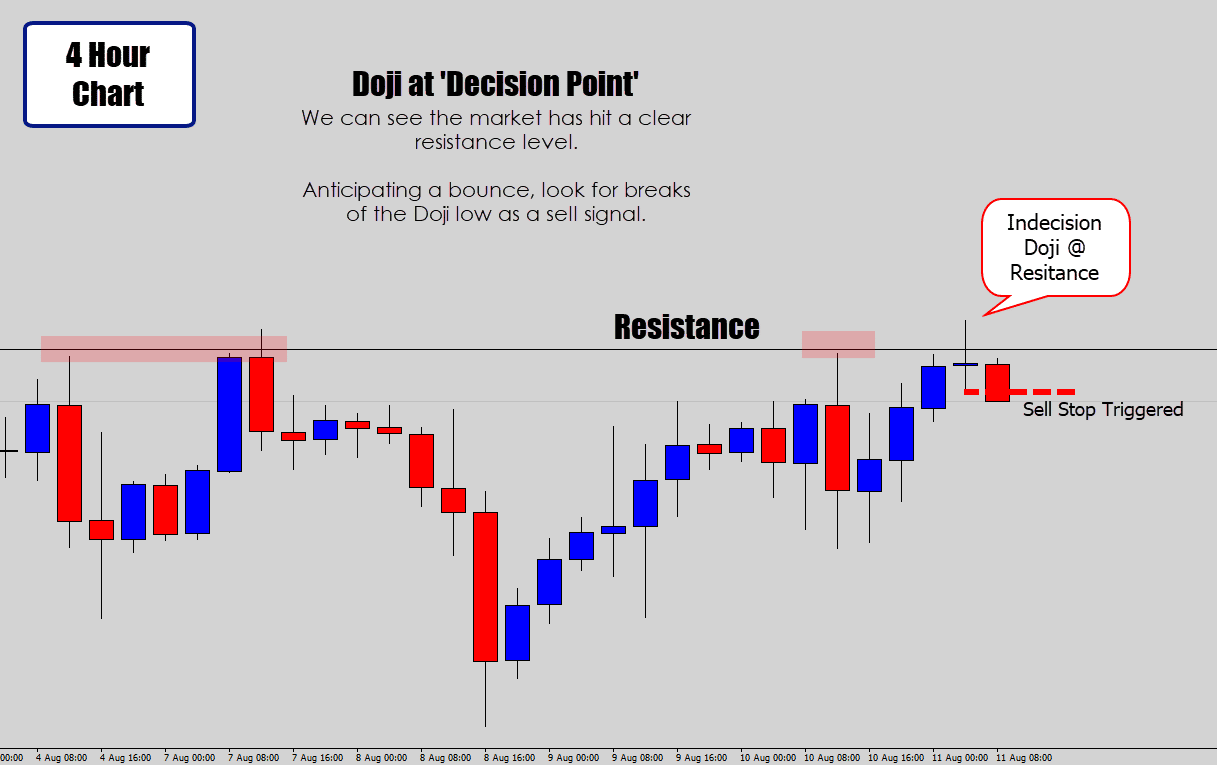

Above: With simple technical analysis – we easily spot a clear resistance level on the chart.

An indecision Doji candlestick pattern forms, so we look for bearish follow through off resistance (trading the bounce), and use the break of the Doji low as a trade trigger.

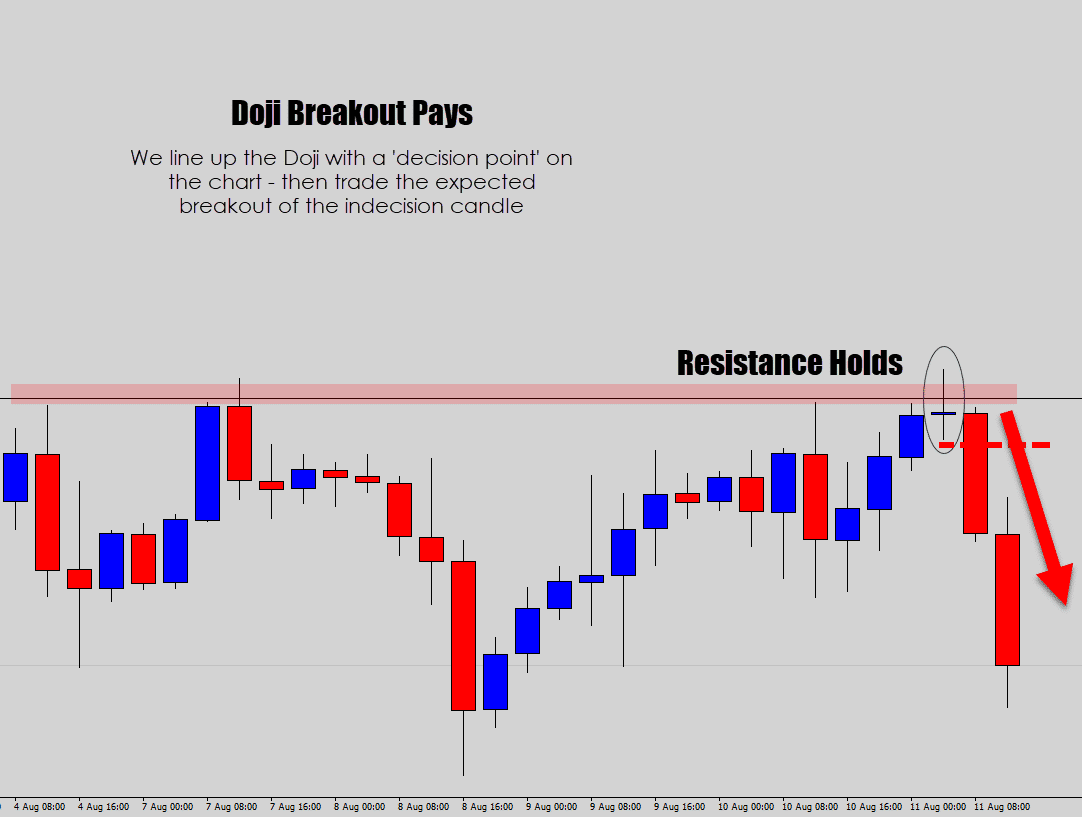

Above: The market follows through with the indecision breakout, and explodes downwards.

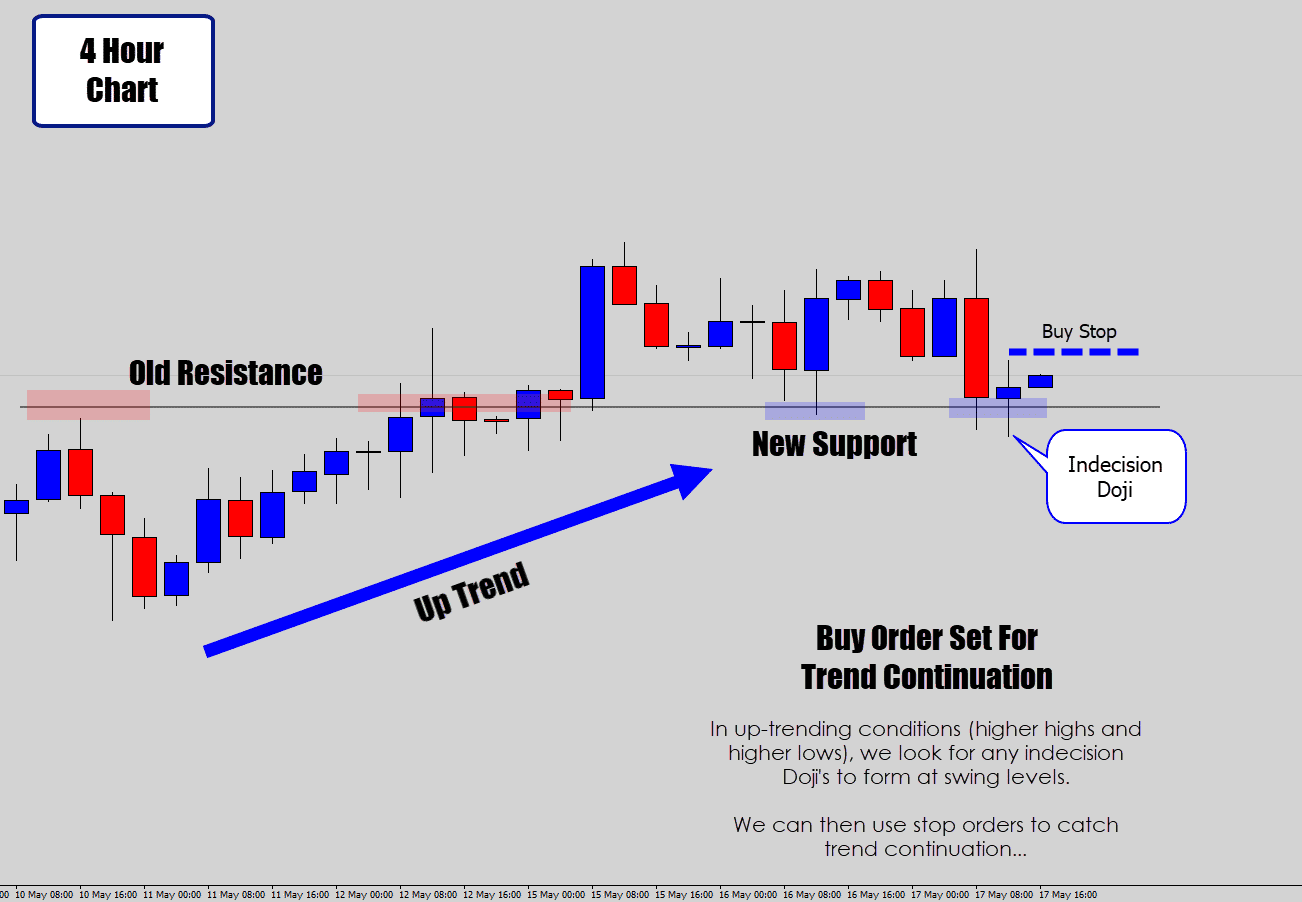

We can also use them in trending conditions to catch trend continuation.

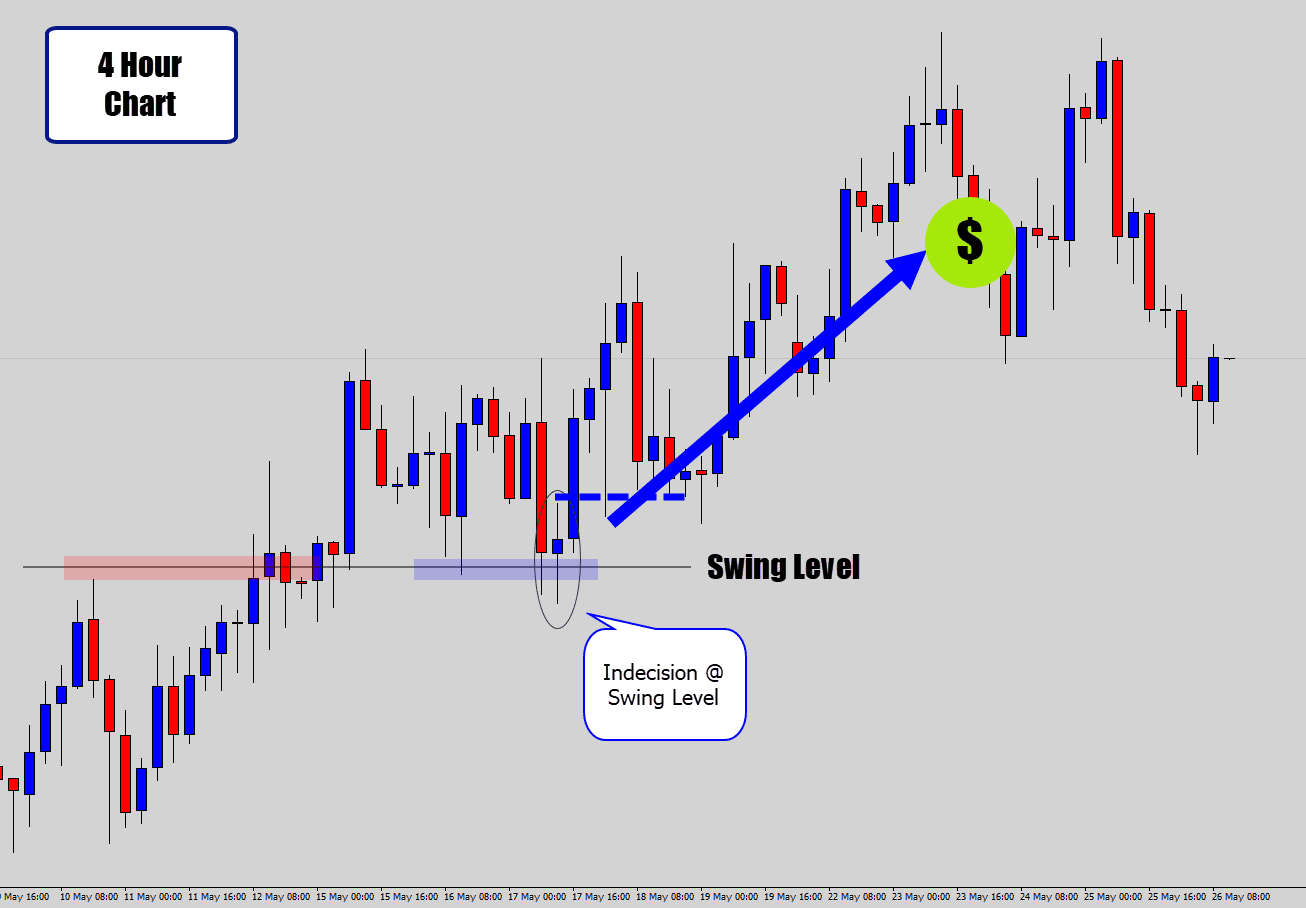

The best place to target Dojis in a trend is at swing levels (old support turned new resistance, or reverse of that).

Above: In a trending environment – look for indecision Dojis that form at swing levels. Target breaks in the direction of the trend.

Above: A nice result after trend momentum picked up via the swing point, broke the Doji high to trigger the trade, and continued to trend higher for days.

It is as simple as it is critical, that you perform good technical analysis first – then you can line up your Doji breakout idea to see if it fits.

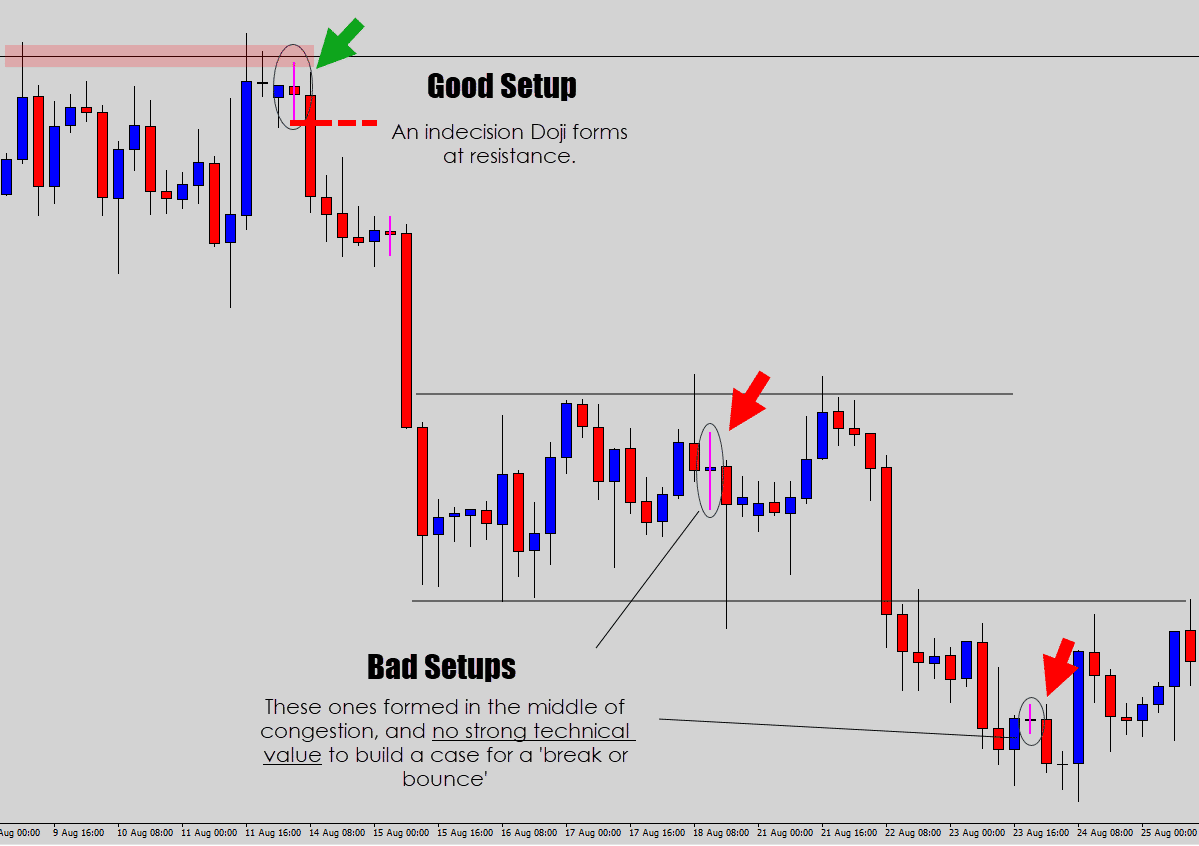

Above: A glance at what separates a good indecision breakout opportunity from a bad one.

Remember, Dojis form very regularly – it’s your job to use your basic technical analysis to filter the bad from the good.

If you don’t have good chart reading skills, and can’t pick up the basic structure or context of the market – you might run into frequent trouble trying to trade these candlestick patterns…

When you apply this Forex strategy – just remember you will see a lot of Dojis printed, but only a small selection of them will be good trading opportunities.

Checkpoint

Some key points to remember

- Do your technical analysis first before you consider the Doji as a trade opportunity. In most cases, simple price action analysis will rule it out as a viable trade

- Match them up with important technical points on the chart, where you know the market has an important decision to make – then plan to trade the ‘break or bounce’ via the Doji breakout

- Don’t be tempted to trade Dojis on low time frames – the less data in the candlestick, the less reliable the pattern.

The Flag Pattern – A Trend Continuation Strategy

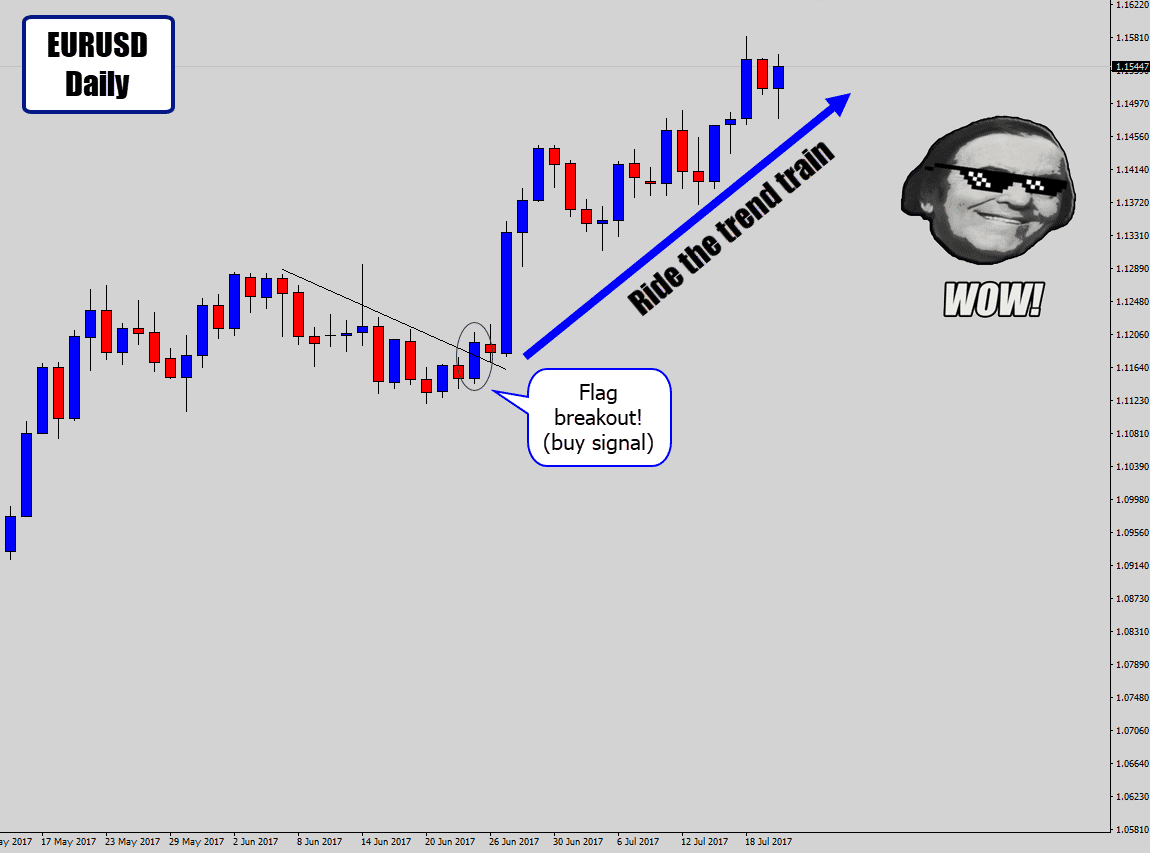

In my opinion, flag breakouts are one of, if not the best Forex trading strategy for trending markets.

Because of the simple nature – flag breakouts are another overlooked gem, usually because Forex traders are always chasing the more complicated methodologies!

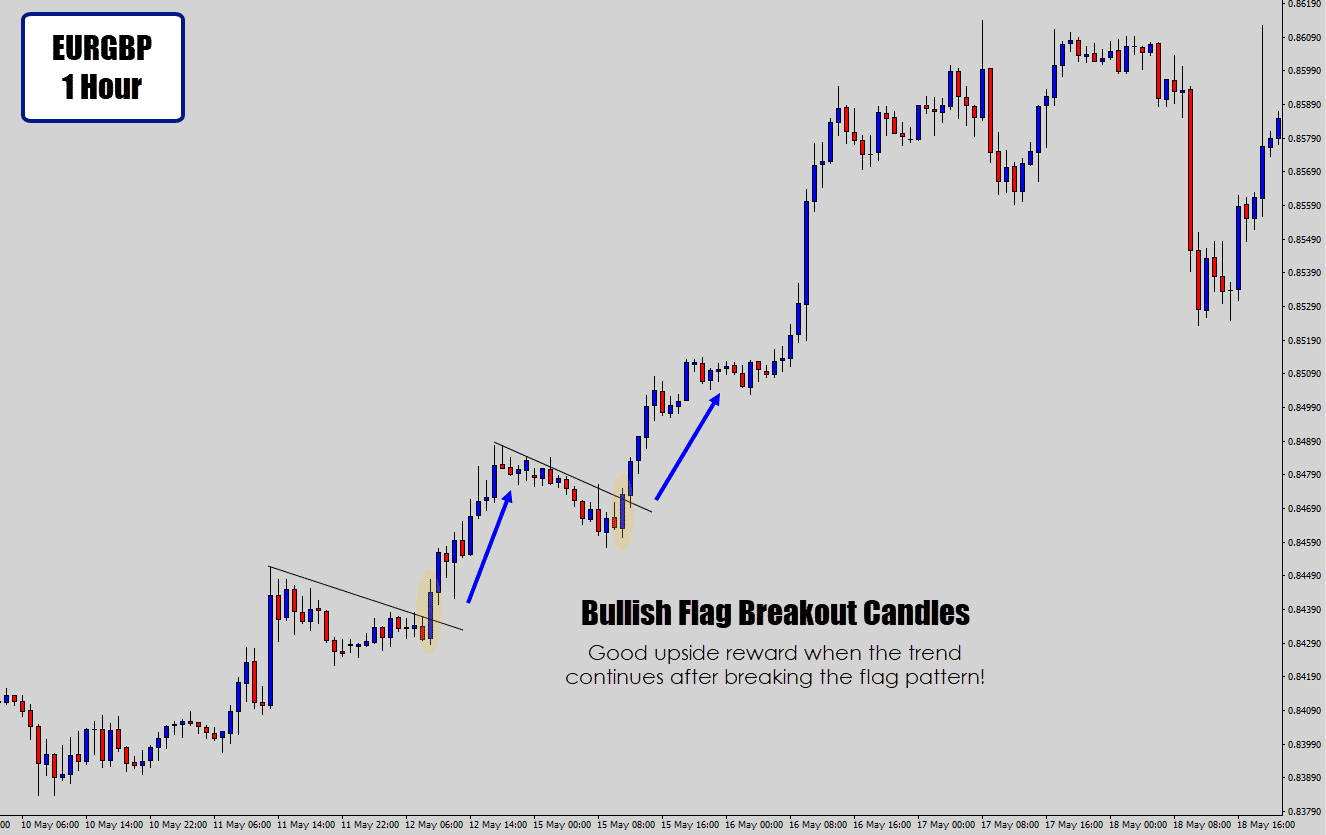

Like always, flag breaks work well on higher time frames – but I’ve even seen them work well on charts like 1 hour time frame!

Here is my ‘to the point’ breakdown of what flag patterns are, and how I trade them:

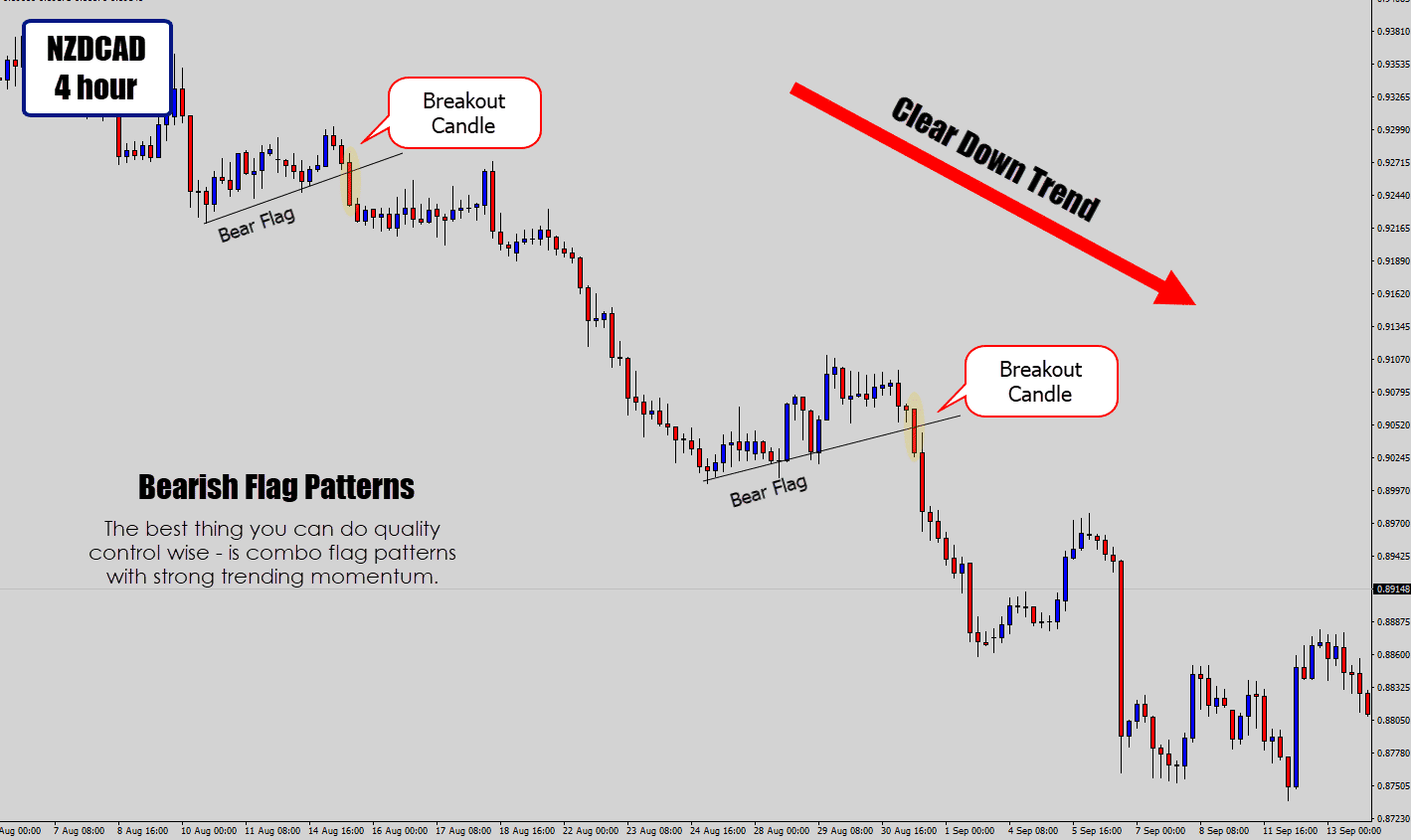

- A trending structure must be in place.

- A counter sloped, trend line develops against the existing dominant trend (the flag line)

- The flag line breaks in the direction of the trend

- Trade the ‘breakout candle’

Let’s look at an example.

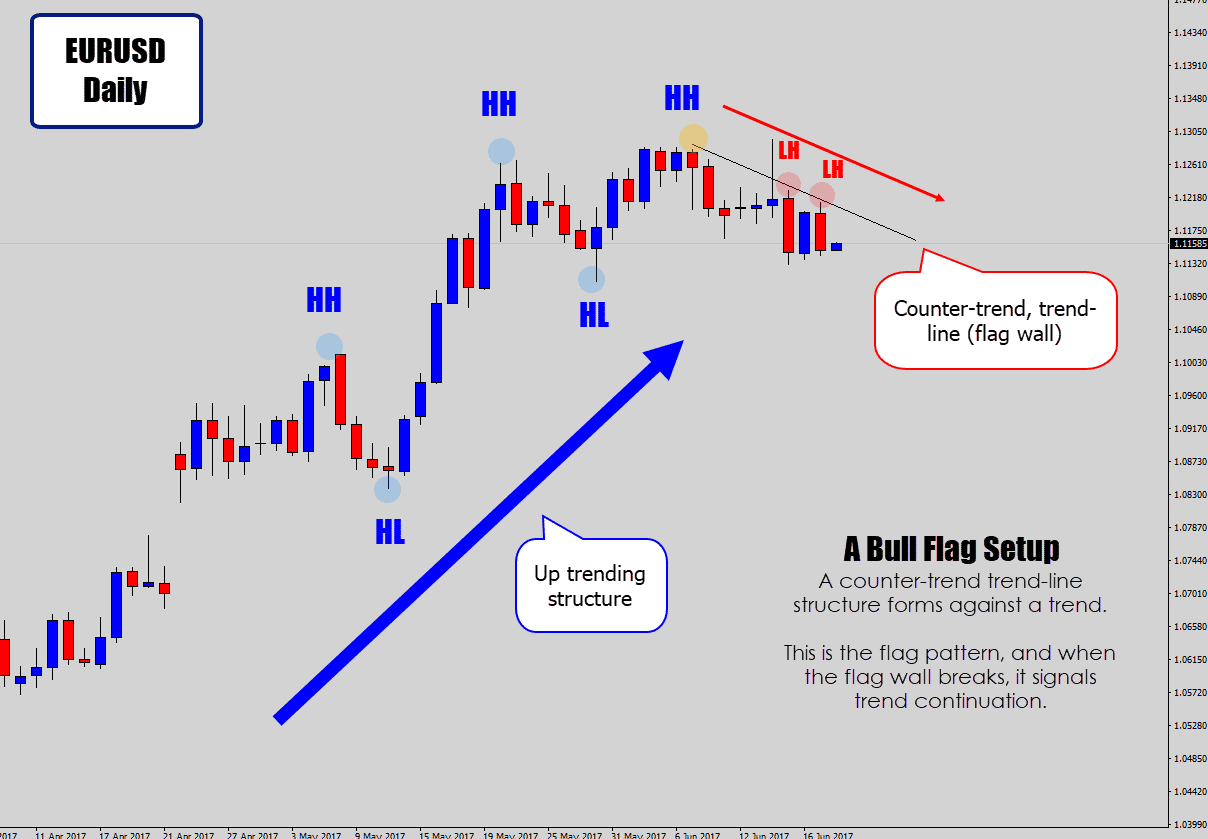

Above: This is my text-book scenario for a bullish flag breakout. A strong trend in place, then shorter frequency lower highs develop against the trend – creating a counter-trend, trend-line.

We’re now waiting for the flag line to break, which signals trend continuation.

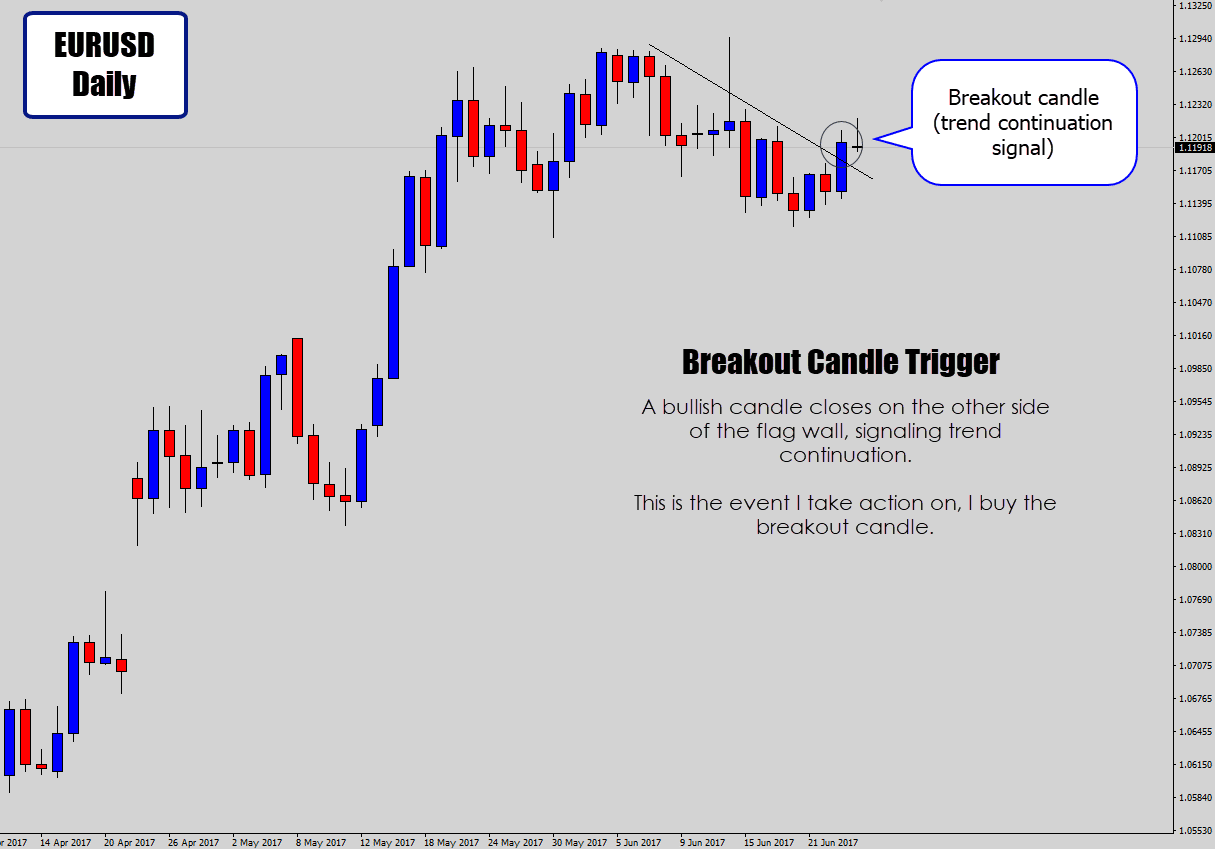

Above: A breakout signal! A bullish candle closes above the flag structure. We’re looking for a convincing close here, not a candle with a large upper wick.

Once we have the breakout candle, that’s our cue to get long. There are a few different entry, stop loss, and money management combination you can apply here.

I can’t cover them all here, I’ve dedicated a few modules to these subjects in our War Room Forex course.

The basic way is to buy/sell the breakout candle event (after it closes), and place a stop loss below the breakout candle.

If the breakout candle is really large, then other strategies need to be deployed to tighten the stop.

Above: The follow through move after a breakout candle busted the flag structure.

Hopefully you can see the value in this as a trend continuation strategy.

When the market is trending, these flags are actually forming all the time, right under your nose. If you haven’t been looking for them, then you’ve probably been overlooking many opportunities.

If you’re into the lower time frames (like 1 hour), open up your charts and check out what you’ve been missing…

Above: Even on a 1 hour chart, flag structures are actually worth looking out for.

You can see above during a strong trend, even the 1 hour chart produced the goods. The 1 hour chart is normally a difficult chart to apply swing trading strategies to, but flag breaks within trends just work so nicely.

Above: The power of catching flag breakouts within a trending environment. They key is to make sure the broader market is trending before you consider looking for flag trade opportunities.

You do see flags form within consolidation or in ranging cycles, but they just don’t offer the reliability, or reward potential. That’s why I only use them as a trend continuation trading strategy.

Checkpoint

The Rejection Candlestick Reversal Trading Strategy

The rejection candle is one of my most utilized candlestick pattern signals.

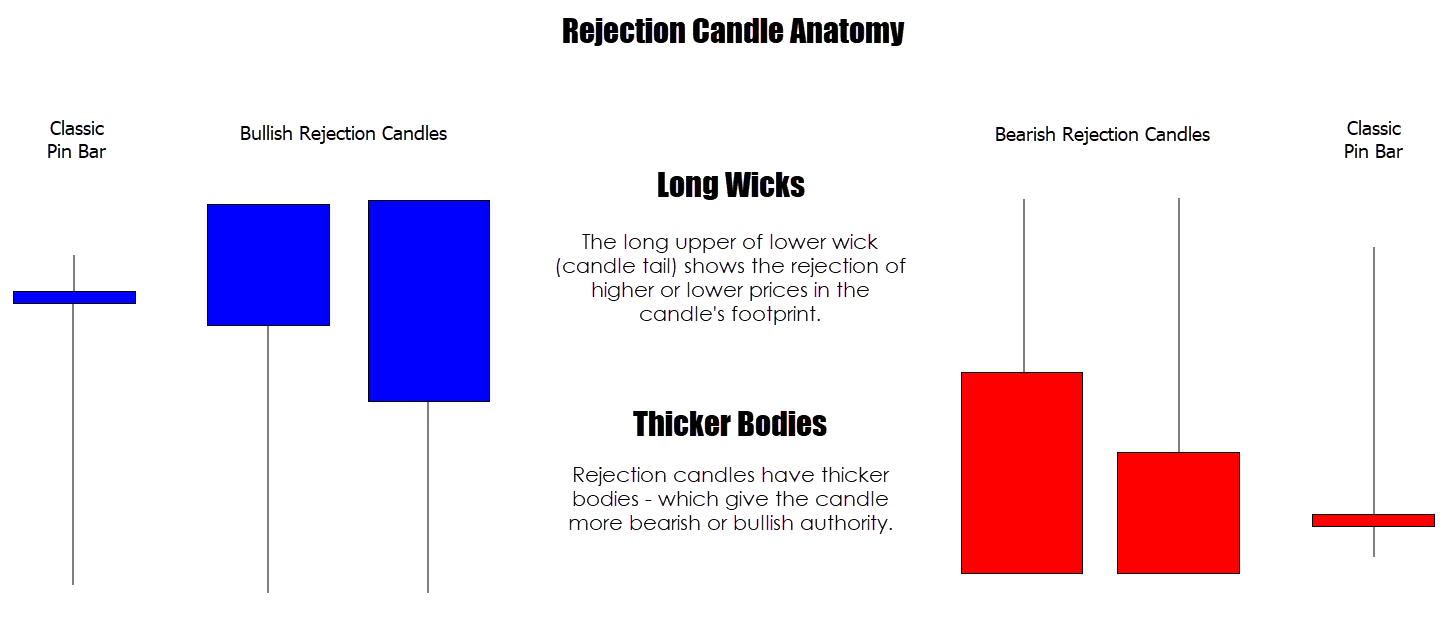

The anatomy and concept is similar to the classic ‘Pin Bar’ – which is the most engaged topic of interest in all the price action discussions, and communities online.

Rejection candles are a candlestick pattern that communicates denial of higher or lower prices. The market tries to move to an area, but it ‘rejected’ by the market.

This denial leaves a very distinct feature in the anatomy of the candlestick – a long lower or upper wick.

The better quality rejection candles pack thicker candle bodies (closing in the direction of the rejection).

Above: Simple anatomy diagram, comparing the classic pin bar to the more authoritative rejection candle pattern that I use.

Rejection candles have a thicker body. The ‘bounce’ from the rejection causes the closing price to be higher or lower than the open price.

The thicker body demonstrates more strength and authority as a reversal signal in the rejection candle anatomy.

What’s the #1 quality factor for rejection candles?

I am going to stay something stupidly simple here – the key is to match them up with technical areas on your chart, where you expect price to reverse.

Such a simple concept that many traders don’t use! Most Forex traders out there will trade any and every rejection candle (or pin bar), that pops up on their chart.

I like to target these guys at:

- Weekly support or resistance, the major turning points (counter-trend opportunities)

- Swing points within a trend (trend continuation opportunities)

- Range tops and bottoms

- Very over extended prices (mean reversion opportunities)

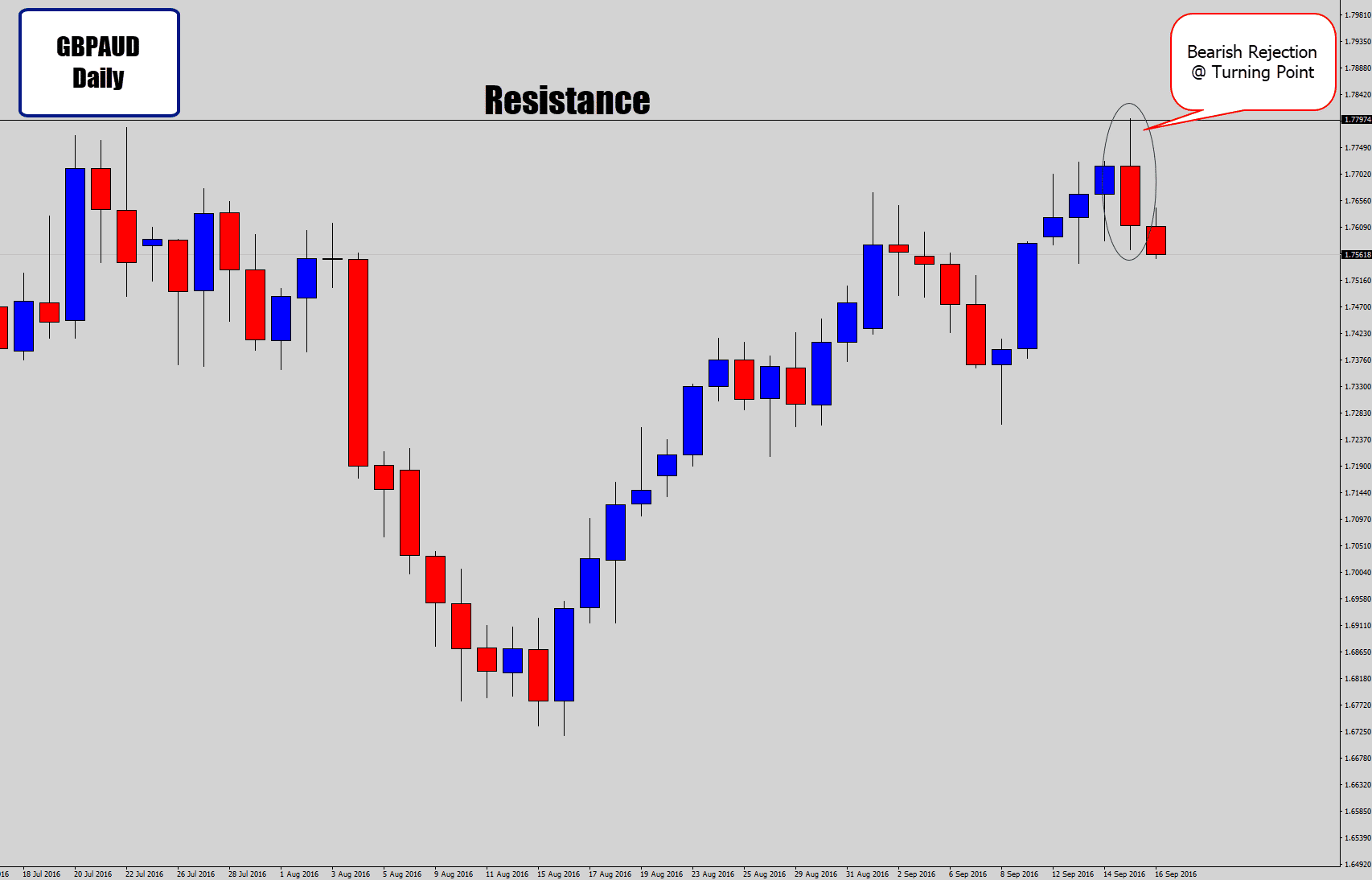

Check out the bearish rejection setup below…

Above: A nice bearish rejection candle forming at a resistance level. Remember, rejection candles are a reversal signal – and strong resistance levels are an expected turning point. The signal matches the context!

Above: A very nice follow through move to the down side, after the bearish rejection sell signal printed.

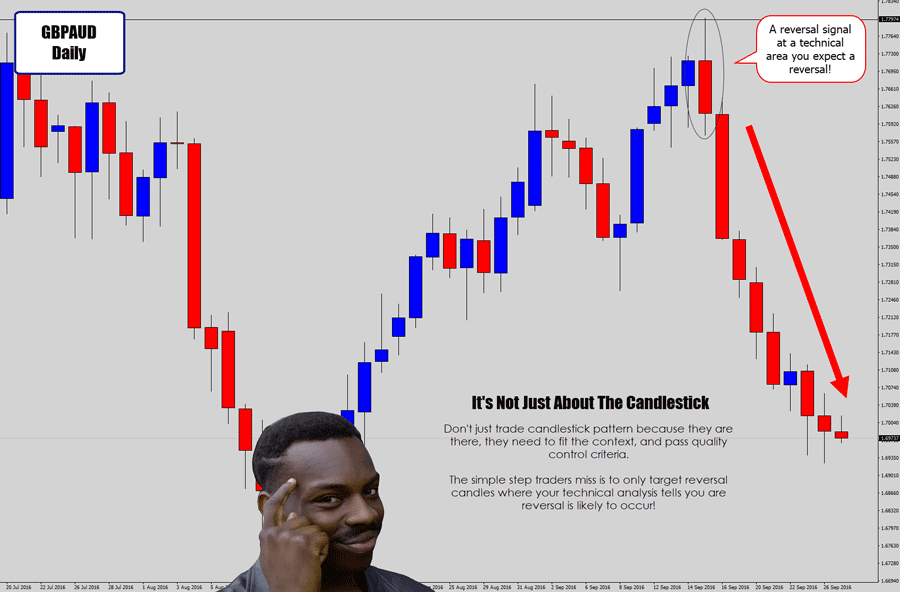

Don’t fall into the trap of ‘trading every candlestick pattern’, just because they’re there. Get into the habit of doing technical analysis first, then build that analysis to the candlestick trade idea, for synergy and quality control.

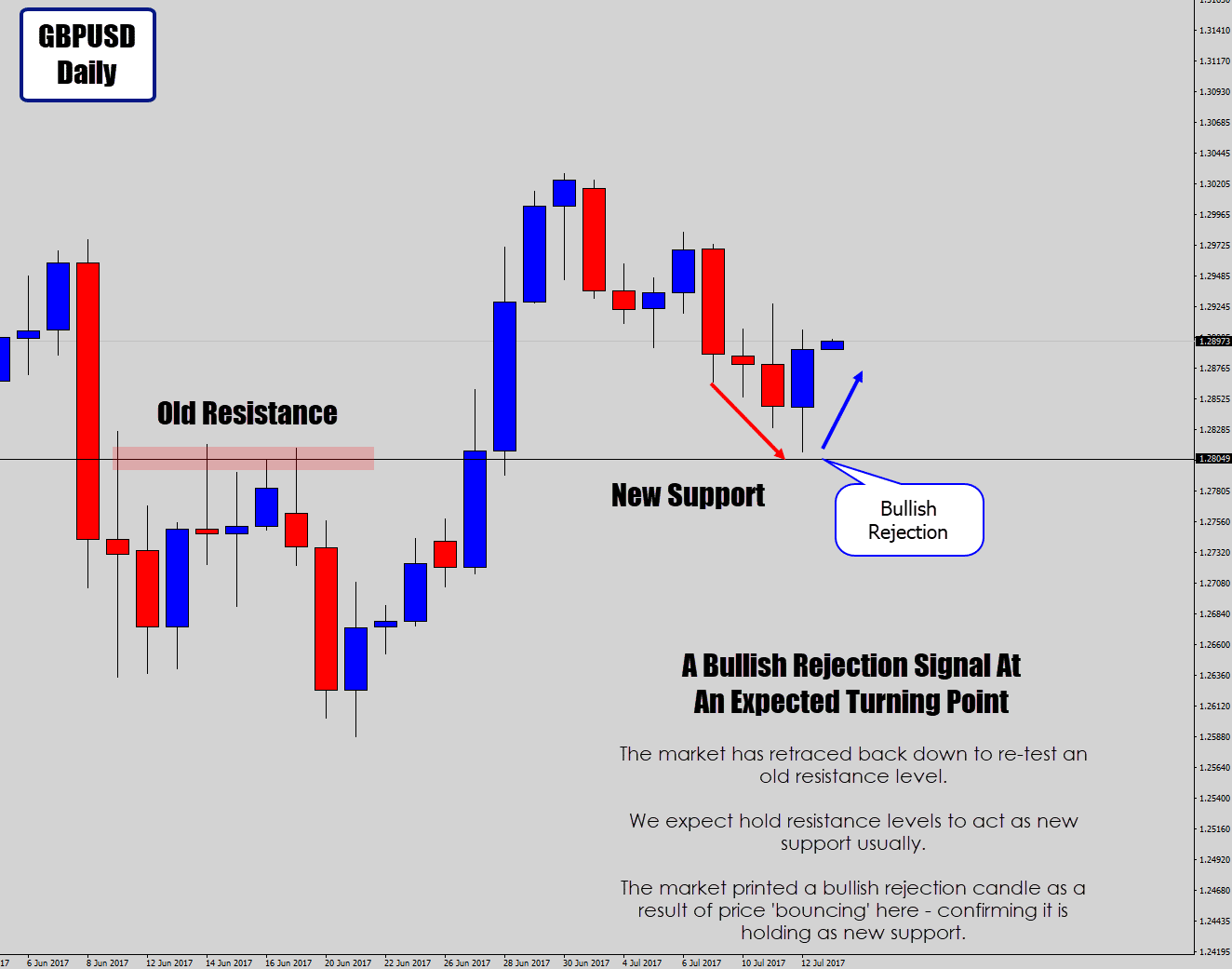

Above: Simple technical analysis tells us this level is likely to cause the market to bounce, as old resistance holds as new support.

The bullish rejection is printed as a result of a bounce (at least the beginnings of one) – therefor it fits well with our technical analysis, and has a lot of synergy with what’s going with the chart.

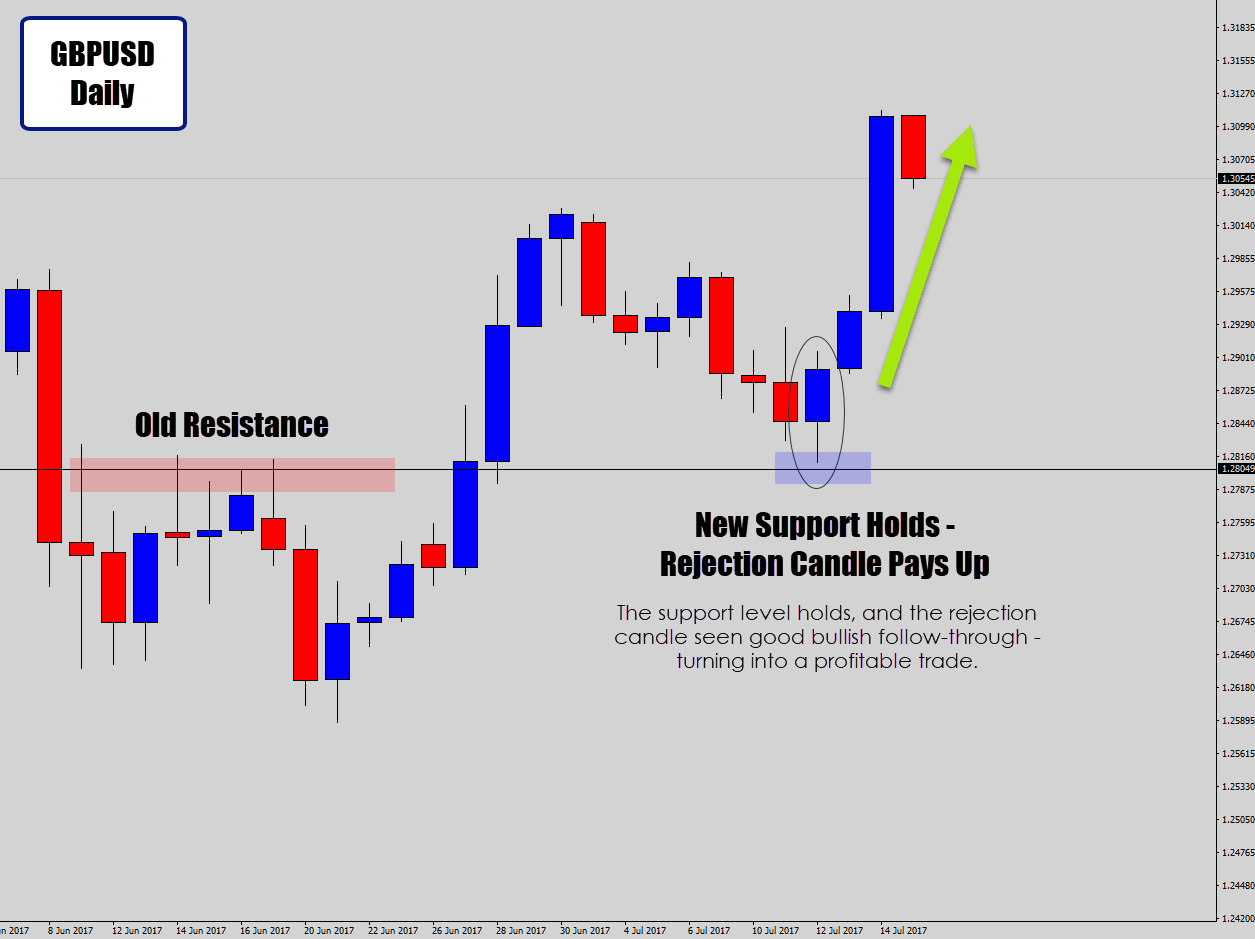

Above: The technical analysis and the rejection signal both play out as expected, and become a profitable trade idea.

It’s just as simple as lining up the rejection candle (a reversal signal), which those likely reversal points on your chart.

Try to avoid trading rejection candles when there is a lot of congestion to the left.

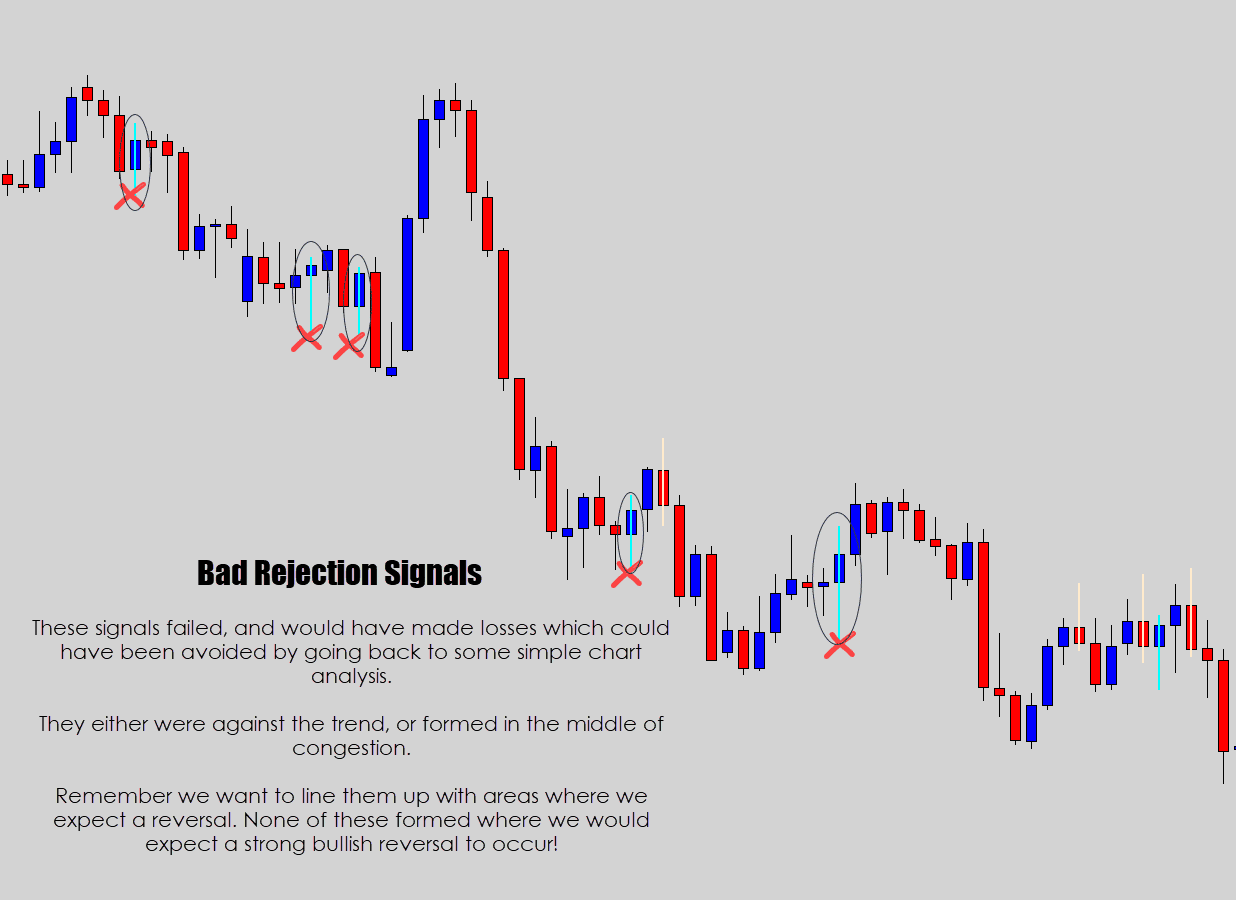

Above: An example of not lining up technical analysis, context, or reversal points with your rejection candle signals.

These are dud signals because they hardly met any of the analytical quality control points we’ve talked about in this tutorial.

If you see heavy congestion to the left, and the rejection candle formed in the middle of it all – then that’s a red flag.

Also if you plan to go against the trend (which can be profitable), you better line up strong rejection candles with major reversal points (tip: get these from weekly time frame)

When you look back through your charts to evaluate these signals, take note: you will find them everywhere!

Be careful of confirmation bias – which means you only ‘see’ the profitable signals located at the tops and bottoms of moves in history, but you over look the signals in-between, which are the ones you would have likely been screwed over ‘in the trading moment’.

Rejection candles & pin bars are a fairly straight forward signal, but they are not the holy grail ATM machine that prints out everlasting money (which is how I’ve seen them promoted). They are only lucrative when combined with good technical, and price action analysis.

Checkpoint

Forex Traders – Make These Forex Trading Strategies Work For You

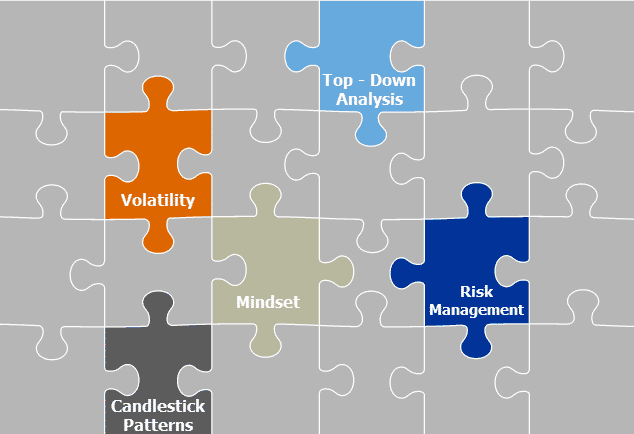

The most successful Forex trading strategies need to go beyond the charts. We need strong money management and a solid mindset to complete the recipe for long term survivability in the markets.

Obviously there are risk management techniques that need to be coupled to the strategies you’ve just be shown here. There are ‘risk mitigation’ strategies that I have modeled, and some other aggressive strategies.

But for simplicity sake: my goal is to always make sure that winners pay up way more than my losses – at least 3x more in fact. This positive risk reward ratio is the key to keeping your head above water, and eventually turning a profit over many trades!

There is a saying among experienced Forex traders: “Forex is simple, but it is not easy!”

What we’ve discussed here today is the simple technical side of trading, however, the true mastery comes from a trader’s mind-set, and is what makes him/her a winner in the end. That’s the insanely difficult part no one talks about.

To make these strategies work for you, you’re going to need to be disciplined, focused, and consistent with what you do in the markets. I recommend reading “Trading in the Zone” by Mark Douglas.

That book will give you a real good kick up the culo, and start to dramatically change how you think about your trading.

Did the strategies in this tutorial spark your passion? If so, feel free to look through my other Forex tutorials and videos here – there is a lot of helpful information for free on the site for you.

If you want to really get involved with how I trade, learn all my strategies, secrets, or even get a hold of my custom metatrader software (which does some crazy stuff) – then you’re welcome to check out my private War Room program for Traders.

It contains everything under the one membership to keep things simple – just the way I like my Forex.

So, these are my ‘getting started’ Forex trading strategies that work in today’s markets – which should be especially helpful to newbies.

I truly hope you got some value from this tutorial, and are ready to dig into your trading and try some of this stuff out.

If you liked the content, don’t forget to leave me your comment below.

Best of luck on the charts 🙂

Venkat Salluri

Sir Amazing Article, you brought, it gave lot of knowledge on Forex, thank you Very much 🙏🙏🙏💐💐💐👍😊

Swervie

Good, I’m a professional Trader since I started reading and mastering your articles, please drop more articles.

Thank you so much ❤️

Chris

Great job. I can see you a sound knowledge of the subject matter.

Yudi

Awesome article, I hope you continue more share article

Ashik

It’s just awesome. To the point discussion. Now I am full confident.

Patrick sambwe

TRYING IT

Uzzal Kumar Baidya

The forex guy tools always is good. very helpful post. I always read article in this website.

Edgar

Excellent article brother. The way you set it up is just excellent. I enjoyed reading it. Thank you for your time and effort as well as the value you provide to each and everyone of us. We appreciate you. ????

Tonderai Peter

I wish I had come across your articles before wasting money paying fake Gurus.Thank you sir.May God bless you and your family.This is good stuff.

Yeronimo

I really got something to practice. Thanks

mohamed dahir

really i liked it, thank you sir for the posting

Zahid Hossain

Just excellent ????.

dharambir

very good & transparents

William

Really really appreciate the help.

I’m actually getting a hang of this so seeing it all properly elaborated really did a lot for me. Thank You Dale

Kevin

Indecision Doji is interesting, It was my first time reading this strategy, you can also try to use fxleaders with this strategy too then tell everyone about your experience ok?

ediv

great classic tutorial,no fluffs but straight to the points.

TRILL_4X

I see a lot of Weekly Support/Resistance lvls, and Daily Lvls, but I don’t see how you ‘pick’ them. Support and Resistance can be and are completely ‘subjective’ person to person. How do you choose your level locations? And are there ‘set rules’ in your choice of location?

Replying to: TRILL_4X

Dale WoodsAuthor

A simple tip, mark important levels from the weekly chart, there the “main” levels that you actually need to draw. The swing level you can spot with your eye, no need to mess up your chart drawing all swing levels.

ally

I enjoy the lesson its so nice pen the mind… thanks a lot

Bart

And of course do this 3 strategies with a forex signal provider that will fit for beginner like FxLeaders that can be used by a new trader.

Tapos Chandra

Very nice.

Vitaly

Hi, Dale

Thanks for this article, it is really good.

As an experienced trader, do you mind to recommend a good fx broker, who doesn’t do scam, stop hunting etc? Thanks very much.

Askar

Thank you for this wonderful tool

Frantz K Prevalon

Great Read, I’ve read this multiple times. Thanks.

Angel komane

I also want to join trading

Blue Trading

Thank you sharing this wonderful collection of winning strategies and i hope they are gonna thrive. I will give them a shot definitely with small investment and will leave my feedback if they work or not.

Regards

Jaba Forex Training

Great! Thanks for sharing the 3 best Forex trading strategies for beginners. Keep posting.

Heru

Most powerful article and very useful, good combined with technical analysis and price action…..and I really love it

Thanks a lot

Newbie

John Neil

I’m a newby but have attended and paid big sums for forex courses over the years in Australia mostly teaching to trade short intraday timeframes. You are so right it’s a fast way to draining your account. I’m passionate about forex and PA seems to appeal to me. There is so much out there everyone searching for the perfect system that’s going to make them squllions. I’ve just read Trading in the Zone what a revelation you are so correct it’s your mindset you need to work ion. How do I sign up to receive your education

Thanks

John Neil

Newcastle BSW

denis mwabu

when reading your content it was the best feeling have ever had when studying forex staff great man this was perfect

Kelvin Abu

Great content i really enjoyed it

Alceu Pimentel

in the past i download your inside bar indicator but i have a glitch in my computer and it dissapear at all. can you send me your indicator back for me? i would appreciate this.

Nahid Akter Khan

nice article, easy to understand, thank you. 🙂

Huy

Sincere thanks for the article for a simple strategy but I think it’s great.

aslam

thanks mate for all the valuable information simply great

AKIM

This has really opened my eyes to how easy trading should be.thank you for this great content man.swing trading is the way to go.

arveeseck

wonderful sinple trading strategy which works best for longer timeframes many thanks

james moore

article was very clear and understanding

Emmanuel Geffie

Thanks a lot for your generosity.

Michele

Very good

CXFX

Great article, as others have already said. Thanks for taking the effort.

I have a question left. With “The ‘Indecision Doji’ Candle Breakout Trading Strategy”, do you recommend that the the low/high of the Doji will be broken in the next candle? Or can it be the 2nd or 3rd as well. If feels like the moment is over by then, though the breakout can still happen of course.

What do you recommend?

Replying to: CXFX

Dale WoodsAuthor

The idea is to take the break of the Doji

Flynn

Loved your write up regarding how to properly trade these. Found it very helpful.

Antonio

Hi Dale

These are the kind of analysis that I love to see.

You are the kind of guy I would like to follow.

Unfortunately even with so many good explanations it is dificult to find either time or discipline to put in practise.

I have seen so many traders that can understand but fail at the time they need to apply all the rules and principles.

I have seen some of your other videos and I have liked them.

Do you provide paid forex signals?

Regards

Antonio

Anthony

May God bless you a thousand times. After reading this articles my view about my trade changed totally. Going to work with this doji.

Amos

First of all, this site is gold! especially for a newbie like me still trading demo accounts. Continue the good work. I also noticed the flag formations are on an Elliot wave. holy crap! i am learning!!

Mike

Nice posting, thank you. A timely reminder!

Tsokolo Mokoaleli

I have really enjoyed reading your material,they are very helpful and like the way you explain concept and your graphical examples are really helpful. Please continue with the good work that you are doing.

Regards,

Tsokolo

Genevieve

Great advice thanks will try these. What platform do you suggest is the best to use. Thanks

Mitchell

Hi Dale excellent article! good brain food as you pointed out in your article. Looking forward to becoming a part of your war room very very soon.

David O'Connor

As a teacher, I love to see clear, simple explanations, backed up by logic and examples and with consolidation points to revise. Really impressive, thanks a lot!

Kelvin Gan

Hi, Thank you for sharing good information. I’m a beginner in forex trading less than a year . Hope to hear more information and guidance for you .

Siphamandla

Thank you so much very insightful and easy to read and understand I can’t believe such info is available for free. I’ve paid so many self proclaimed forex gurus to assist me yet they info was not helpful at all. Thank you so much God bless

Johann Schonfeldt

Hi there Dale

Thanx for the Valuable Info on these 3 Trading Strategies.

My Goal for this Week coming is to Scout for Flag patterns on the 4 hour Time Frame and Use Indecision Doji’s as Entry Points.

Have a Blessed Week

Johann

Utham Ramnarine

Love your tips and to the point-ability….

Second day live with 120usd deposit.

Definitely going to post more updates

Blessed love ????????

jeanphi

Good morning.

Nice article ! thank you

You are provider signal? thank you

Michaelforex

hi Dale. Nice article, I like the way you use the median values to help in price action strategies. Can i also use the alligator (5,8,13 smoothed MAs applied to median price) in substitution to mean values (10 and 20 ema). I await your reply on this suggestion. Thank you

RoooooOoon

I enjoy reading your articles sir, its so awesome and newbie friendly. 🙂 So easy to understand not like other articles out there in google. I bookmarked now your website, i will always read your post if im not busy at work. 🙂

Amyrul daniel

Great article and been watch your video on youtube. Very useful and simple for beginner like me. And how do i get the trade tools like you use on mt4. Thanks from Malaysia

Amyrul daniel

Been seeing your video on youtube recently. Really great content and simple. I am a beginner trader. I just invest 100 dollar for begin trade. After sees your video i can make a little profit consistently. But more to learn on risk reward and so on. And how do i get to have the trade tools like you use on mt4. Thanks to you from Malaysia

Johann

Thanks Dale !!

I’m sure this is what I’ve needed to get my trading back up to par!

I do like you’re work and the simplicity of the strategies.

With the war room package, you said about the trade alerts to your phone , does your computer at home have to be on for you to get the alert setups on your phone during the day?

Thanks again

Johann

Replying to: Johann

Dale WoodsAuthor

Yes the battle station needs to be monitoring the market always.

Jeremy Dugdale

Excellent. Started trading on daily charts forex and shares using moving averages only. Charts look good but stop loss a lot higher due to swings. Your trading is something I’d like to explore. Im going to do this full time in 3 weeks time to see if I can make a modest living from Trading. If not it’s back to work.

Any suggestions?

Fxraj

Amazing strategies so easily learned from simple and to the point language. These form the basis of newbies forex crutch.

mandla

nice article educative

Per Paterson

I like this very nice and structured presentations with nice non-messy charts to look at with good text. Nice to be reminded of doji, flags and rejection candles. Very valuable information about pin bars not working well in correction areas. Like your work very much and the simplicity behind it, not easy to do.

Indika

Very good One.

Thanks.

Indika

vasilika

hello. thank you for this lesson. It was so helpful for me. Thanks a lot

Wasim

Very good article……..

great work.

Jun Hiano

What best technical analysis can be used for the three strategies you presented?

Roy Peters

The doji section is an eye opener. I’ll definitely look into trading dojis at key levels in the market. Thanks.

sentosa masyhor

thanks MR DALE.easy strategy but not easy for me

Wayne Wardman

Thank you Dale, a very good presentation

Wayne

muhammad ashraf

hi,

thanks my brother for best tips GOD bless you and your sweet family

Nathi

Thank you for sharing such information, you just gave me what I needed. I hope I’m going to do better now in my trades.

andywallington

Excellent article Dale!

Have been working my way through your course over the last few months and this is a great summary of some of your key points.

Walter Basile

Thank you very much Dale, I alredy practiced with the doji 🙂

The other two are amazing too.

A question, do you sometimes use the Ichimoku? I like to have a look to that on the daily.

Replying to: Walter Basile

Dale WoodsAuthor

No need to use Ichimoku – it is just a play on support/resistance. Really just previous price levels shifted forward.

Paul

Very informative and well explained will be looking for these setups on my charts.

You do explain things in a very simplistic way that makes it easy for a new forex trader to understand.

Well done Dale.

Joel Pinto

Hi, Dale

Great post. I was already missing content from you. It’s been a while. I am now trading on the daily chart doing price action and swing trading. It is coming out nicely and much more peaceful than lower time frames which were driving me nuts.

Thanks for the nutritious input. Always welcome.

Souheil

Hello,

Very informative and to the point.

Thank you

Souheil

enke

tnx for your article and lesson. you change my mind from 2015. i am happy for found your site. thank you sir.

Rich

Simple and easy to understand. I’m still studying with a demo account and will put these strategies to the test. Have lots to learn and have followed your blog religiously. Keep the articles coming, please!

Theo

Dale,

Many thanks for this very simple but mind blowing tutorial. It is amazing how much sense things make in trading when it is written down and can be easily read or glanced at either daily or weekly.

Regards.

Theo

Roger

Excellent!!!!! You gave me the missing part of the puzzle which was right in front me and i ciuldnt see it. Cheers mate

tabbrat

Merci très instructif

good article very informative Thank you

Paul Cole

This is a great and an eye opening article I went back on some history on my charts and they all showed up. Thanks Dale I enjoy all your articles

Joubert Petrus Lesibo

Thanks very much I can see the light. I am sure your building my confidence after a big disappointment

Duncan

HI Dale, Three great strategies, some I was previously aware of, however appreciate the additional detail you go into regarding the use of quality control and getting your levels of support and resistance correct and then using those to trade from and in turn identify the difference between a good setup and a potentially bad one. Cheers Duncan

Joubert Petrus Lesibo

Thanks very much I started picking some pieces that make sense to. Hopefully I will start trading with purpose

Waldemar

Good staff, did you back tested or traded them on regular basis and could you shear expected results ? Thanks.

mounir

Helpful

thank you

but i guess in video it will be better

vickie

I know this article is targeted at beginners, but I think it’s a great reminder for experienced traders as well, who sometimes forget the basics when they are focusing on more complicated strategies. Thanks! Great refresher!

Tim

I enjoy reading your articles, but could you mare them print friendly so I can take them with me, for when I’m not connected to a computer?

Thank you.

Gabriel Braidotti

Awesome, easy to understand, article! Great starting point to those who want to start understanding graphs and mentality! Wish I had an article like this when I 1st started studying and trading.

Replying to: Gabriel Braidotti

Dale WoodsAuthor

Thanks mate – sometimes its nice for experiences trader to have a refresher on basic strategies.

Steve

Great article, thanks for posting! 🙂

I’ll be checking these out on my charts, for sure.

Cheers, Steve

Replying to: Steve

Dale WoodsAuthor

enjoy Steve!