With this kind of power you can crash the plane, or fly safely above the clouds.

Unfortunately, the thought process of most traders will lead to the plane crash. Silly, obvious mistakes knock Forex traders out of the trading game, sometimes for good.

No matter how certain you are about a situation, there is always going to be the chance your predictions are wrong.

Traders are too focused on ‘the big win’, risking way too much capital per Forex trade. Traders will neglect Forex risk management in the hope of achieving financial freedom in one swift play.

Successful traders know there are no guarantees in trading. That’s a key principle we as traders need to build our trading mindset around.

Risk management needs to be part of your overall risk management plan.

There is no need for this to be hard or complicated. There are some core ideas that will give you a better idea on how to trade safely, at higher confidence levels.

So, how much are you risking vs how much you should be risking on your Forex trades?

In this article, I am going to compare some of the common risk management strategies which are repetitively preached in the industry – talk about them in more detail, and simplify each one so you can determine which is a good fit for you.

Don’t place trades absent a stop loss

I know I sound like a broken record… but I still see traders today not using a hard stop loss and getting absolutely screwed for it.

I can’t stress enough how important it is to always set a stop loss with your initial trade order.

You just cannot manage your risk without a stop loss.

When a trader fires off a position with no hard stop, then the account is exposed with 100% risk.

Think about the off chance of a power outage or equipment failure! What if a central bank intervenes at the same time, moving the market 1000 pips against you? You’re going to suffer huge, unnecessary losses.

No Stop Loss = No Money Management

Do you know how many traders I know that lost a huge chunk of their capital when the Bank of Japan intervened?

Do yourself a favor, if you’re not placing stops it’s time to clean up your Forex risk management and start protecting yourself. Placing trades with no protective stop is one of the biggest newbie Forex trading mistakes.

Checkpoint

Dynamic Forex Risk Management

One of the most popular Forex risk management models, promoted heavily in the Forex community, is the ‘2% rule’.

Before a trade is placed, you calculate your position size with your stop loss sizing to risk 2% of your available capital.

The idea behind this system is to limit losses in periods of draw down, and to gradually increase your risk as your account grows.

It works like this; if you’re in the middle of a Forex losing streak, your account will be obviously be in the negative. Therefore when you risk 2% of your remaining available capital, you will be risking less money than your first initial trade.

The further into draw down you go, the less you risk per trade.

This is effective at slowing down capital disintegration when the markets are not responding well to your system. Sounds good so far, right?.

The only problem with this model is you must work harder to regain your losses.

When using a risk/reward money management system, where you aim for 3x what you earn, your profits won’t be as good as they would have been before the losing streak.

Let me elaborate with an example…

Let’s say you start with a $5000 account. You lose a couple of trades and you’re down $1000. The account is now sitting at $4000.

@ 2% risk, you would now be risking $80, instead of the $100 risk taken @ $5000

If you use a 1:3 risk/reward ratio, your trade profits will be $240 instead of $300, making it a little tougher to recoup losses.

Have a look at the chart below. It shows the further you go into draw down the harder it is to recoup your losses.

| Drawdown Percentage | Percentage Needed to Get Back to Break Even Water Mark Level |

| 25% | 33% |

| 50% | 100% |

| 75% | 400% |

| 90% | 1000% |

The math basically states, if you lose 50% of your trading capital, you need to achieve a 100% increase in capital to get you back to the break even watermark.

When the numbers are put forward to you like that, it can be a bit distressing.

Dynamic Forex risk management works against you when you’re in the negative, but with you when you’re in the positive.

Checkpoint

Linear Forex Risk Management

The fixed risk model is a very straight forward, simplified approach to Forex risk management.

You select a fixed amount you’re comfortable with risking per trade, and you continue to risk this amount on each trade regardless if your account is in a profit or loss.

As the name suggests, the fixed risk model is more linear in nature.

You don’t have to work harder to recoup from losses. When combined with the 1:3 risk/reward rule – you can keep ahead, even if most of your trades are losses.

If you risk $200 per trade, then you are aiming for a $600 return. That means if you lose 3 trades in a row (-$600) you only need 1 winner to get you back to break even ($200 x 1:3 risk reward = +$600).

So, essentially you only need to win 25% of your trades to stay at break even. The higher you aim with your reward ratio, the less trades you need to win to stay ahead.

This approach may not be for everyone, especially for more conservative traders. The linear risk model doesn’t slow down during periods of draw down, or benefit from an account in the positive.

Checkpoint

My Approach to Forex Risk Management

One is designed to limit risk in draw down, and step up the game when the account is doing well. The other has a more linear approach and doesn’t adjust trade risk based on the account status – but can recover from losses easier.

Personally I like to mix a little from the two together.

To determine my trade risk, I will use an initial % calculation from the dynamic money management model.

Not necessarily 2%, but maybe 3 or 4%. It really comes down to how much you’re comfortable risking, and how confident you are with your trading.

Once I calculate an initial trade risk from the dynamic money management model, I plug that figure into the linear model. So for an example; with a $5000 account I might decide to initially risk 3%, which would be $150.

I then switch over to the linear money management model and risk $150 per trade regardless if the account is up or down.

If the account suffers 10 losses in a row, you can then recalculate the risk setting using the dynamic model, and then plug that back into the linear model.

So 10 losses would be -$1500, which leaves the account with $3500.

3% of $3500 is $105.

Therefore $105 will be my new trade risk.

The same applies to account gains. If you reach say a 25% account gain, do the same adjustments.

+25% x $5000 = $6250.

The new trade risk will be 0.03 x $6250 = $187.50

By using a hybrid approach to Forex risk management, you can get the best of both worlds.

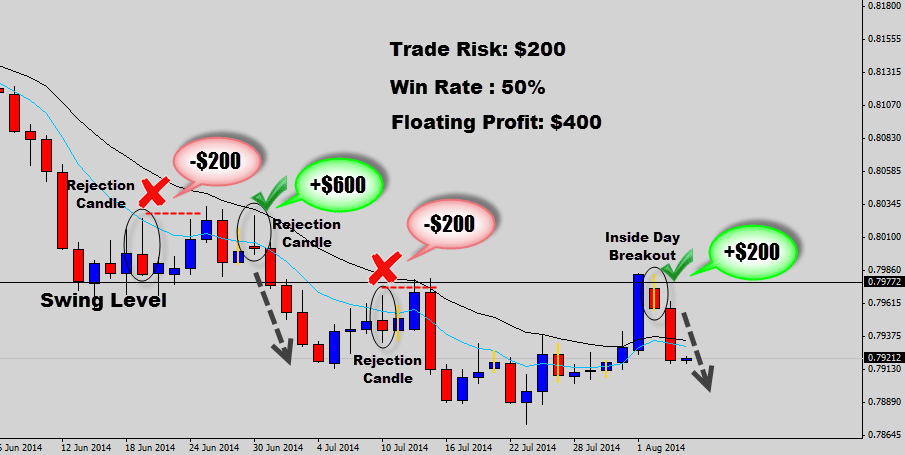

Take a look at the EURGBP chart below…

If you took every single decent price action signal on this chart with a risk of $200 on each trade; you would have suffered two losses, achieved one full 1:3 return, and have an open trade which is currently floating at 1:1, but looks like it’s well on the way to hitting 1:3.

If the open trade hits its target, then a floating profit of +$800 will be achieved.

This is a classic example of how you can make money, even with 50% failure rate – All the magic is in the money management.

Checkpoint

Conclusion

At the end of the day, you as the trader should only risk what you’re comfortable with.

As long as you think with probabilities and have a plan to protect yourself, you’re already one step ahead of many other Forex traders.

If you place a trade, break into a sweat and are having trouble getting to sleep at night, you’re risking too much. Before you place a trade, make sure the trade setup is high quality and you’re consistent with your Forex risk management plan.

Defining your Forex trade’s risk is only a small part of a good solid money management plan.

We offer some very powerful money management systems in our War Room. All our money management systems are positively geared, meaning they are designed to return more than your risk.

If you would like to learn more about our money management plans, or any of our price action strategies, please stop by and check out the War Room Trader Membership.

Some War Room traders have stated that the money management systems we teach alone have been a huge step forward in their Forex trading.

Cheers to your trading success.

[socialpoll id=”2214302″]

Sylvester Madxen

This is very much awesome,the point discussed here is very helpful for all traders ,if any traders follow this he will get successes .. Thanks!

Olumide Adewebi

Great Stuff B

True

Traders are too focused on ‘the big win’, risking way too much capital per Forex trade. Traders will neglect Forex risk management in the hope of achieving financial freedom in one swift play.

Alex

Good article, need some details how do I know when to switch between approaches. Comes from confidence???

Lazlo

Thanks for this bro…

I knew that consistency in should lead to good results even in bad conditions.

Lakes

Nice one! I learned from that shot.