During our years of involvement with Forex trading we have come across many other fellow traders that we have become acquainted with or just simply observed from a distance among various trading communities.

Some of these traders evolved into profitable full time traders, others unfortunately became another bad statistic. This article is going to tell the Forex horror stories of those traders who didn’t make it. We can reflect on their mistakes and make sure we don’t repeat them.

These are true stories, so to respect the privacy of these people we will replace each trader with the appropriate Mr Men personalities.

Mr Greedy

Mr Greedy was set for life, his business was doing well and things couldn’t be better. But Mr Greedy wanted more than his fair share, so he started looking for other ways to make even more money. Mr Greedy discovered Forex trading and discovered the sky was limit when it came to potential income. Because Mr Greedy was already a successful businessman, he was very overconfident in his ability to take on the markets and generate wealth beyond his wildest dreams.

Mr Greedy invested heavily in the markets and quickly discovered that he wasn’t really getting the returns he was initially expecting. So Mr Greedy invested more money and traded more aggressively and started to notice his money disappearing even faster. Mr Greedy was not used to this kind of failure and in his frustration poured even more of his money into the markets and pursued even more aggressive trading tactics.

Then POOF! Mr Greedy lost all his invested money, but he wasn’t finished yet. Mr Greedy sold off what was left of his businesses, got loans from the bank and went ‘all in’. With everything now on the line Mr Greedy was an emotional time bomb, his third attempt at making money from the Forex market bankrupted him.

Mr Greedy is now a shelf packer at the local supermarket struggling to pay off his over bearing debts.

The lesson: Mr Greedy thought he could apply what he had learned in the real world into the Forex market place, this is far from true. As we often point out, the lessons you learn from your everyday life don’t work well in the markets. Things like ‘the harder I work the more I will make’.

Mr Greedy’s bad and greedy approach towards the market destroyed him quickly. To make things worse, when things were not working out, Mr Greedy started to revenge trade in an attempt to recoup his loses plus some change which only accelerated his journey to bankruptcy.

It’s often said that some of the biggest losers in the market are successful businessmen, doctors, dentists, engineers etc because they think their success in life will automatically fall over into the markets. Just because you were successful in other areas, doesn’t mean you will be when it comes to Forex trading. The Forex markets are on a completely different level, it’s a level playing ground for everybody.

Mr Perfect

Most of the time his Forex preachings were erratic and seemed to change from day to day, however his Mr Perfect personality managed to get him quite the following in the chat room and the associated forum. Mr Perfect was so supercharged by his new trader god status that he decided to open up a public thread with a title implying that he would turn $100 into 1 million dollars in a 1 year time frame. In this thread he was going to take newbie traders by the hand and show them each trade he made and explain his reasons for doing so.

Mr Perfect started delivering on his promise and posted trades that he took, but no one could seem to make sense of his explanations as they were rich with Forex babble and saturated with Jargon. Not to mention his reasons for taking trades seemed to be inconsistent and his money management made no sense. Despite the confusion and inconsistency, Mr Perfect was slowly making some returns and the attention on the thread continued to expand. The popularity and attention Mr Perfect was getting drove him to take the next step.

Mr Perfect opened a managed trading account, where traders could invest money in his trading ability. A trade copying tool was used so any trades Mr Perfect took would be duplicated on his fans real trading account. He was promoting the best forex signals so traders jumped at the offer.

Mr Perfect’s managed trading account got a lot of attention and he got quite a few investors that come on board.

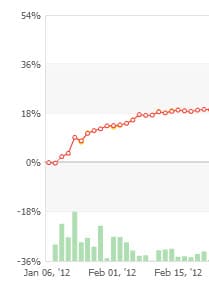

The chart to the left shows Mr Perfects trading performance when he first started.

Not too bad, 18% in just over a month. His followers were impressed and started to sign up around mid-February. Mr Perfect continued to flood the chat room and forums with his confusing market preachings.

But that didn’t bother anybody as he was delivering on his promise and demonstrated he could make them money.

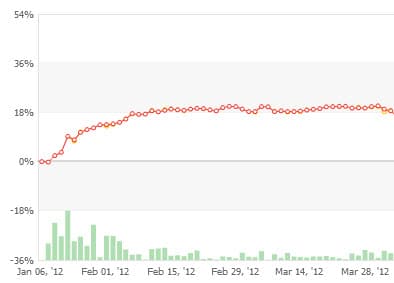

Mr Perfect’s performance flat lined and people were starting to raise eyebrows.

Not only was he not making any money for his followers, he was losing them money with spread costs. Mr Perfect was a ‘scalper’ which means he opened lots and lots of trades at a time to achieve only small gains.

There were no serious losses yet so most of his followers continued use his service. Mr Perfect was still confident as ever and continued to preach his stuff in the chat room and forums while we watched him closely.

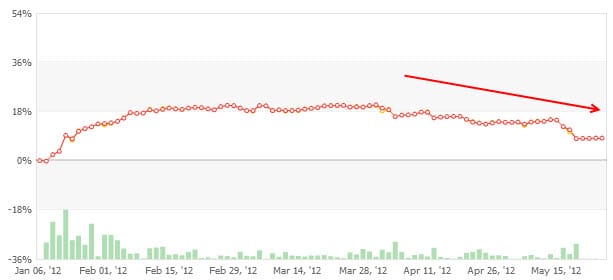

Finally Mr Perfect crumbled under the pressure. He increased the amount of trades opened at one time, and like a cancer, he slowly killed his followers accounts…

As the majority of people jumped on board his managed trade service around mid-February he never managed to make them any money. Mr Perfect was at one stage opening 30 trades per day which didn’t really turn out too well. The spread costs were destroying the live trader’s accounts but leaving Mr Perfects stats hardly affected, as much as he was using a demo account to send his signals.

Mr Perfect went from Hero to Zero very quickly, his thread was soon filled with negative comments and he was no longer welcome in the chat room. Mr Perfect lost a lot of people’s money and walked away from the whole venture a nobody.

The lesson: Mr Perfect thought he knew everything about the markets and that all of his technical analyses were flawless. Mr Perfect had a lot of confidence in his ability as a trader when in fact he was actually relatively new to Forex trading and didn’t really have as good of an understanding as he made out.

The phrase ‘A little bit of knowledge is a dangerous thing’ fits well with Mr Perfect, as he taught himself a few simple concepts and converted them into an over complicated, confusing format that he used to draw in people’s attention.

Mr Perfect was an attention seeker not a professional trader, he had bad money management and there was no consistency in his trading strategy. We were just counting down the days when it was all going to fall apart on him. We were actually surprised how long he lasted.

The real failure lied in Mr Perfects ‘high frequency trading strategies’ and the bad money management that come with it. Mr Perfect was only aiming for 3-5 pips profits, but risked 20-50 pips to do so. This is called negative risk/reward money management and is a sure fire way to burn yourself up in the market. It was just unfortunate that he took a lot of other unsuspecting traders with him.

We think Mr Perfect would probably make a good car salesman and should keep away from Forex trading.

Mr Gullible

We often tried to engage in intellectually stimulating conversation regarding Forex topics with Mr Gullible but could never maintain that level of conversation. Mr Gullible would often change the topic towards some scalping or day trading system that he just discovered and was getting heavily involved in.

Mr Gullible eventually kicked off his trading career by attempting to trade news releases on the economic calendar. We knew news trading was dangerous, volatile and causes unpredictable movements in the markets, so it wasn’t a surprise that Mr Gullible didn’t have much success with his news trading.

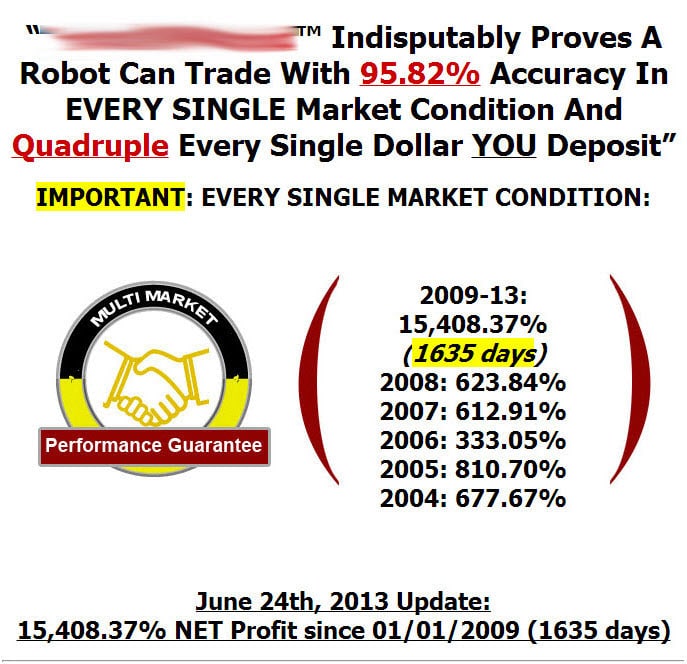

Mr Gullible eventually stumbled across a popular Forex trading robot’s website and was completely drawn in by the sales page…

WOW Mr gullible said to everyone in the chat room. 95% win rate, what could possible go wrong, look at all those claims, I mean they even give you a guarantee! So Mr Gullible purchased the Trading Robot and integrated it into his trading platform.

Remember Mr Gullible in this story is actually representing a small group of traders, 3 to be precise. All 3 traders pooled their life savings together and gave the Forex trading robot full control of their hard earned money. Uh Oh! The trading robot wasn’t performing as the sales page said it would. Instead of cutting their losses, one of the Mr Gullibles opened up the internal programming of the trading robot and ‘tweaked’ the settings more to his liking. What he had actually did was change a few random settings and really amped up the risk the trading robot would apply to the markets.

In about 3 days most of their pooled life savings were destroyed, the robot had made extremely bad trading decisions and actually never once turned a profit. Only one of the Mr Gullibles was able to walk away with some of his capital, but it was church change compared to what he initially invested.

Mr Gullible 1 was forced to sell used cars with his father, Mr Gullible 2 used money he couldn’t afford to lose and stranded himself in Egypt during some bad times and Mr Gullible 3 walked away with his tail between his legs.

The Lesson: There are so many Forex scams out there, for every 9 Forex scams or crappy products; you will probably find 1 good trading system. This kind of saturation makes it hard to find a good Forex Trading Course to get you set on the right direction with your trading.

Automated Forex trading robots don’t work. Usually they are designed around the current market conditions. This gives them a low shelf life, as market conditions are constantly in a state of change, and with each shift in market dynamics, the trading robot’s performance instantly crumbles.

Even if someone developed a consistently profitable trading robot, it would not be sold on the internet for $200. It would be hidden away in a safe while the creator reaps the rewards.

Forex robot sales pages deploy the best marketers that really know how to get inside your head and target those ‘get rich quick’ emotions of yours. Don’t be a Mr Gullible and fall for these marketing tricks. There is only one way you are going to become profitable in the market and that’s if you follow a simple trading system that can clearly give you the edge in your trading.

Mr Lazy

Well we regretted that decision quickly, we expected Mr Lazy to play the role of a keen student but instead he turned out to be an annoying parasite. My Lazy had no intention of learning price action trading for himself, he just wanted to bludge off our experience and be a fly on the wall when we were talking about what trades we were planning to take.

We soon caught on to what was happening when we noticed Mr Lazy was not receptive to the knowledge we were providing him and tried to gently cut him loose. The unfortunate thing for us is he had our private email and Skype details. Sigh!

Every couple of hours Mr Lazy was hounding us for trading signals, even at the most inappropriate times. We had our fingers on the short trigger for EURUSD when some vital Greek elections were taking place. The Greek elections were broadcasted in Greek. Scotch is from Canada and had to be quick on the Google translator to try keep up with what was going on in the live election feed. During the entire process Mr Lazy was bombarding Scotch with messages every 5 minutes asking him if he should go short yet.

Out of frustration we eventually gave him the cold shoulder until he got the message. We later discovered that Mr Lazy found someone else to annoy, and was receiving signals from his work college who had come up with a ‘miracle RSI crossover strategy on the 15 min chart’.

This was our ticket out and we finally got rid of him.

The Lesson: Don’t be a Mr Lazy and try and leech off other peoples trading decisions or seek out Forex signals. Firstly these traders could be the worst traders in the world and you are blindly following them, holding their hands as they walk you right off the cliff.

Forex trading is a personal journey that you should take as an individual. You are responsible for your own trading decisions, get the proper education and become a confident trader so you don’t have to rely on other traders to make your trading decisions for you. If you are looking for a simple but powerful price action trading course, then you stop by our Price Action Protocol page for more information.

Mr Rush

However, as the name implies Mr Rush was trying to become an expert too quickly and wasn’t displaying much patience. Mr Rush wanted to take all the right steps to become a professional trader, but he wanted to have completed those steps yesterday. Mr Rush was trying to run before he even knew how to walk.

Eventually Mr Rush’s impatience consumed him. Mr Rush started taking every single pin bar formation on the 1 hour chart, across a variety of markets. At times Mr Rush would had about five intra day trades open while continuing to look for more potential trades to open. Mr Rush’s impatience had driven him to the shorter time frames and caused him to start over trading. He even started off by making a trading blog where he would record the steps of his trading journey, from a nobody into a millionaire.

His over trading and lack of experience washed him out of the markets, his blog went dead and we never seen him again.

The Lesson: Don’t just throw yourself in the deep end; take the time to learn a solid trading strategy like our Price Action Protocol. Understand it, master it, test your skills on demo and keep your cool. Over trading raises a red flag that you don’t have control of your emotions and is an early warning sign to your impending failure. Realize that the trading is no different to learning any other profession; you need to go through the learning stages before you’re put in the hot seat.

Apprentice chefs don’t just take a 1 week training course and all of a sudden become the next Gordon Ramsay. No, it takes time and it’s no different to any trading system that you apply yourself to. The market requires patience, keep your cool don’t be a Mr Rush.

Mr Messy

We have Mr Messy to thank for most of our laughs. Oh, he wasn’t trying to be funny, he was actually serious 100% of the time, but he had a completely distorted view of trading, which we found extremely entertaining. Mr Messy would often post up his opinions, trades and charts regularly. Let me share with you two snapshots containing Mr Messy’s analysis that he shared with us.

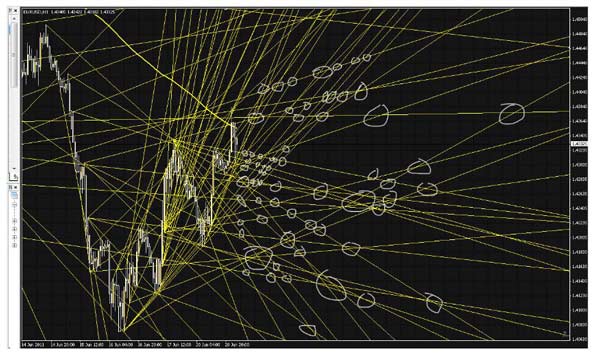

Below is some trend line analysis on a 1 hour chart of the EURUSD…

To actually make sense of this chart you needed his ‘master chart’ which had color coded levels that were key to unlocking what he referred to as the ‘trend line holy grail’. We weren’t privy to the color coded master chart.

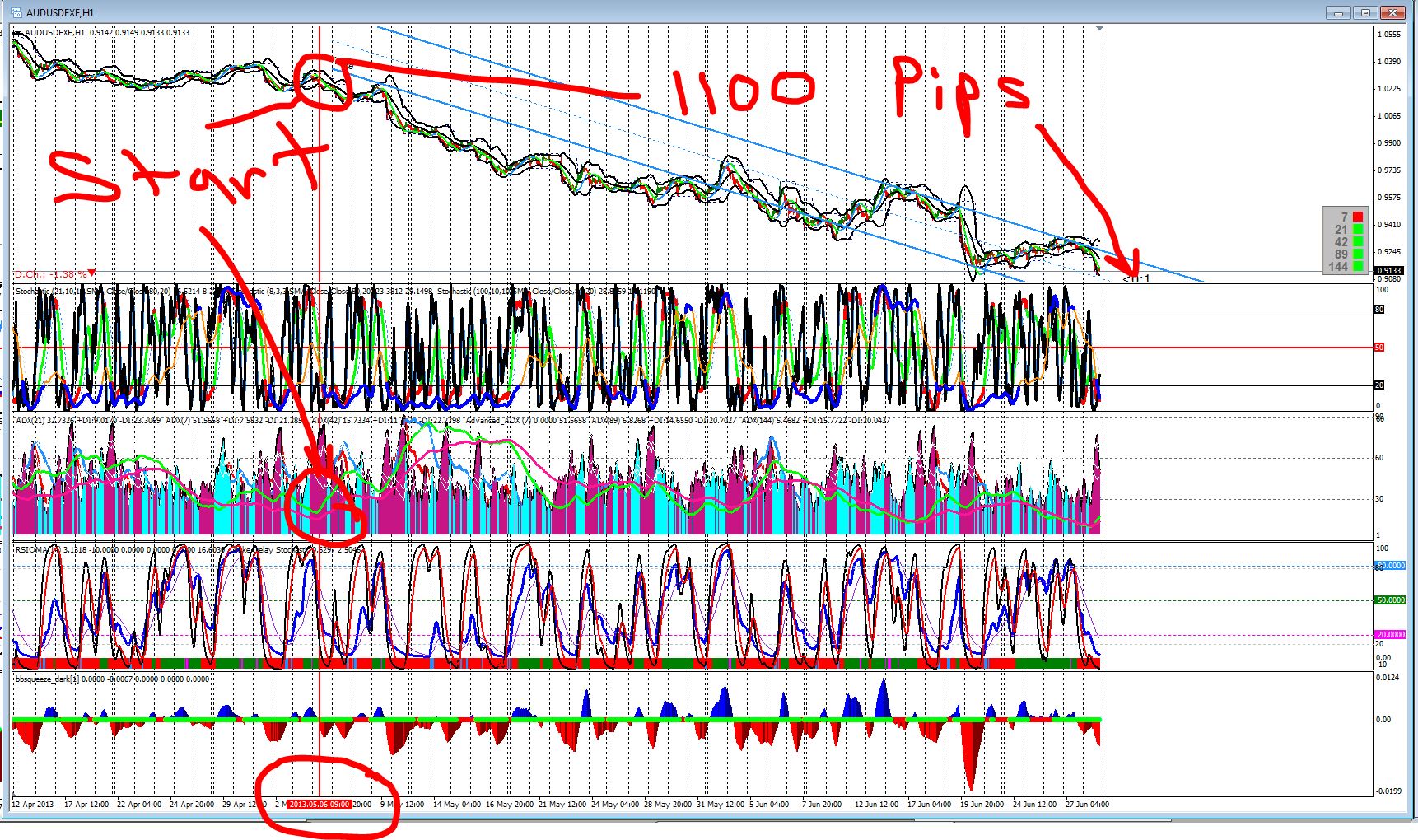

Here is another typical chart from Mr Messy.

Yep, you can see why we’ve used Mr Messy to represent the guy in this story. Mr Messy was one of those traders who combined about 50 different trading strategies into one chart and tried to execute them all at the same time. Not only that, but he tried to factor in market sentiment and economic news releases into the mix as well.

Mr Messy would deploy all sorts of exotic Forex indicators that he found from all the dark corners of the internet, he left no stone unturned. Mr Messy also used martingale money management, which basically means every time the market moved against him, he would open up a new trade against the momentum, trying to anticipate a bottom or top in the market.

One day he presented a screen shot of his open trades, he had been buying all the way down a bearish trend and managed to accumulate a total of 50 open trades against the market momentum. Mr Messy… is a mess and made trading way too complicated for himself.

The Lesson: Trading is not meant to be complicated. We have found great success in simple Price Action strategies and by keeping our charts clear of confusing indicators. It’s not hard to figure out why Mr Messy failed, his trading methods were a combination of bad strategies mashed together that made up one super bad trading strategy.

Forex Horror Stories conclusion

In this article we’ve shared real life stories of traders who didn’t make the right choices when it came to their trading career. This hand full of real life examples would no doubt be consistent with many other failed traders’ stories. Many would have made the exact same silly emotional choices that destroyed their trading future.

It really is common sense, these traders surely would have known subconsciously they were not getting anywhere with their current approach and were digging themselves into failure. Don’t make the same mistakes these guys did, keep trading simple, keep your emotions in check and follow a simple trading plan.

This is why we are so passionate about Price Action trading. It’s simple, powerful and stress free. Price action trading really brings out the clarity of the market. You will be able to read charts like you never have before if you make the switch to price action.

If you want to learn more, we offer an advanced price action course for anyone who is serious and passionate about learning price action trading. If you would like to learn more about our price action trading course and War Room members only area, stop by our War Room information Page for more details.

Cheers to your trading success.

Mnqobi

Hilarious 😀 let me be sadistic here and say I’m glad I’m not the only one who’s done some crazy things out of emotions trading forex. Thanks for such an eye opening read.

Manik

Very Innovative for reviewing all type of trader. It will help find our self and will help to discover our types for further research about our trading psychology to get us well trained. Thanks for the post. Knowing our self mind is much m,roe important starting trading….And this post has its all……….

Zoran

Thanks Dale, for the very plastic description of different trader types.

I would suggest a similar article with positive types described. Like Mr. Patient, Mrs. Confident, Mr. Not-Interfering-With-Open-Trades and similar. Think it will give the readers chance to identify with positive examples.

Thanks again, cheers

Replying to: Zoran

Dale WoodsAuthor

Great idea!

Replying to: Zoran

Roy Peters

agreed, the positive stories of traders!

Bijan

Thank you dale for sharing this topic.

This is one of the best topic so far I have ever read.

Those people are all within every one of us. We all after something easy and quick. We should learn we need to look at the market like a totally different business. You would only be successful if you put your foot on very solid ground , knowing where you are going , taking the appropriate tools and advice with you. And be patient enough to take those steps.

By the way thanks again and keep up with a good work

Brou Exson

I CAN see myself on some of the type. Thanks you for bring this attitudes out. I do beeline we must really learn from them. Thnx the forex guy

Nigel Price

Hahaha – this is one of the best reads I’ve had in a long time! I think there is a little bit of all of those Mr Men characters inside all of us – they reflect human nature a lot of the time.

The key of course is to be able to recognise when they are taking over and becoming a harmful influence on your trading. Easier said than done though – it tends to be a full time job for me!

Thanks again, thoroughly enjoyed that 🙂