Any internet search including the word Forex will immediately serve you a plethora of popular high frequency trading systems, surrounded by those attractive money buzzwords.

These heavily marketed Forex systems are pushed in front of you through banners and annoying pop ups.

If you’ve ever had the misfortune of actually adopting one of these systems and you put your heart into it – you will already know first hand these over-hyped packages never deliver on what they promised. My condolences – we’ve all been there.

Today, I would like to introduce you to a far superior stress-free and relaxed approach to trading Forex that yields much more reward potential than those rapid paced, mentally draining trading strategies.

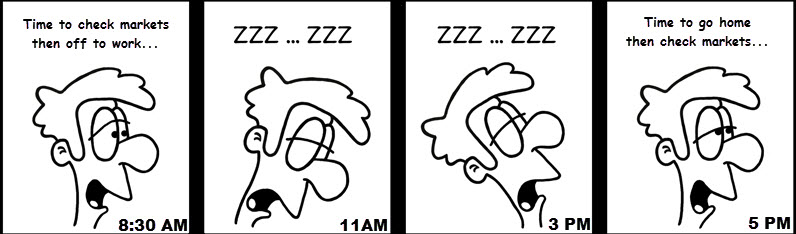

I love the “end of day” trading approach. Its great because you only have to spend a small amount of your time in front of the charts per day, and have a much better chance of achieving the results you want for less effort.

Keep your day job and still do well with your trading

Forex trading, much like any form of market speculation will always come with an element of risk. Being able to manage that risk effectively will be the difference between success and failure.

One of the biggest advantages of end of day trading is the way in which it allows traders to carry out their trading activity around a demanding day job or other various time consuming life commitments.

Whether you are: working full time or part time, studying, trying to progress with your career, or even a stay-at- home parent (maybe a combination of a few of these) – the techniques used in end of day trading will slide easily into your schedule, all without compromising your trading potential.

Most new traders have stumbled across Forex trading because they are looking for a “quick fix”.

It’s the same old story really. People are brainwashed to think Forex is the means to quickly solve all their financial problems, and when opening a new trading account they’re already dreaming of buying that private island they’ve always wanted.

If you’ve ever seen the the Matrix series, a popular quote from the first movie is “nobody ever makes the first jump” – well, this is the perfect metaphor for the markets.

It’s pretty safe to say 100% of Forex traders lose money and blow their first live trading accounts – this is nothing to be ashamed of though, I see it as part of the initiation into the Forex world. It’s where you truly start grasping the realities of Forex trading.

Many of us dream of one day being able to chuck in our day jobs, switching to full time Forex trading and relying only on our trading income to support us. Until that happens though, you will still need a steady, consistent income to pay your bills and put food on the table.

This is where end of day trading really shines, because you’re only required to interact with the markets for very short periods of time each day – I am talking as little as 15-20 minutes.

During those 20 minutes, you will be able to:

- Do a quick, but effective scan of all your favorite markets to identify high probability trading opportunities

- Place any pending orders to take advantage of retracement prices, or catch any breakouts

- Place a logical stop loss that protects you if the market moves against you, and your trade idea fails

- Adjust any levels on your chart, or trail your stop loss if that’s something you wish to do

- Perform any other chart maintenance

Checkpoint

Live your life, Don’t be a slave to the charts

I cannot stress it enough.

An unbelievably large percentage of traders with all levels of experience, even mores so the newbies – spend far too much time glued to chart, hypnotized by the rise and fall of the candlesticks.

It’s easy to understand why most traders have an addiction problem with Forex, the main reason obviously being that money is involved.

Every trader has been in a situation where they are swept up in the excitement of seeing an open trade explode into nice profits. It brings on a euphoric feeling that plays with you, and tempts you to trade more. You don’t feel like you can lose at this stage, you’re the king of the charts right now!

The difference between “chart junkies” and educated traders, is not letting the euphoric feeling of winning money influence your trading behavior and having the ability to step away and break the connection.

The “chart junkies” who can’t disconnect fall into a really bad ‘zone’ where a sickness starts to fester. Not being able to sleep properly, letting anxiety build up and thinking about the charts obsessively throughout the day.

I’ve seen troubled traders who have let the markets get to them. It’s not hard to tell something is eating away at them from inside – it impacts their social life and they sometimes become a very negative person to be around.

These guys/gals become so obsessed with every pip movement, they feel the need to constantly stare at the screen just waiting for something to happen.

I’ve been to this dark place – spending hours in front of my computer, passing off the opportunity to hang out with friends or go on dates with girls…all because I was addicted to trading.

You feel like you have a commitment to stay ready at the charts because you can’t afford to miss any trading opportunities – wasting away hours and hours of your life. It’s very unhealthy, you don’t sleep well and easily can fall into depression.

This is the main reason I switched to end of day style trading. It helped me detox this bad behavior and get back on track with trading. I’ve never looked back.

End of the day trading is sometimes called “close of play” (officially defined as the New York Stock Exchange close).

The main goal is to focus your trading efforts at a key time where you can see exactly what happened during that 24 hour Forex session. This gives you time to setup your trade orders before you go back to your busy life.

When you adopt this ‘time-friendly’ strategy, you can really minimize your risk in trading, mitigate any undesired lifestyle changes, and take positive steps towards learning how to properly spot and enter a Forex trade.

It’s hard to argue with a system that allows you to keep your day job while you learn, continue to spend time with friends and family and even not have to substitute this new venture with any hobbies or interests that you would otherwise have been doing in your spare time. It’s a hard deal to beat.

Checkpoint

Lower Your trading frequency, Be Rewarded With higher accuracy

If that’s the case, you’re probably frustrated and looking for a way to approach the markets that will reward you with better success.

The fact of the matter is that every time you open a trade, no matter what it is, you increase your risk exposure.

The problem is low time frame charts give out lots of high risk signals that can easily trap you into bad positions. Also low frequency trading systems tend to use very tight stops, so the market can stop you out if it ticks against you a couple of points.

Unfortunately traders often interpret high volumes of signals as lots of opportunities to make profit. The misconception is: more candles = more signals = more money.

You can never predict the market with 100% accuracy – which is what a lot of new traders are gunning for.

There are a lot of trading systems out there advertised to have a 85% win rate. These kind of systems generally capitalize on short term market conditions, and are considered to have a “low shelf life”.

These are “churn and burn” kind of strategies are susceptible high losses when the market behavior shifts to adapt with current events.

Traders who step back and look at the bigger picture, and contrast the daily time frame vs minute pips, have a much clearer and more accurate view on how the market is moving. This means better accuracy, lower risk and higher reward potential for each trade.

End of day trading is not about jumping into the markets with a flame thrower, torching every signal you see. It is about identifying the higher priority, “A+ signals”, and capitalizing on them with a single swift and decisive move.

Scalping and day trading is a losing battle, it will burn you out and make you very bitter with the markets. Even some traders who contact me who have found some limited success with day trading don’t want to continue with it any more due to the high levels of mental fatigue.

Trading using the daily candle closing price is a refreshing, and positive change from lower time frames – you will find better clarity, higher accuracy and just really feel like you’re trading in a mature, professional manner.

Leveraging end of day trading with positive geared risk reward money management is an effective way to reduce the required win rate to turn over consistent profit. Some models only need a 30% win rate to turn over profit in the long run.

Checkpoint

Supplementing End of day trading With New York close candles

End of day trading strategies are focused mainly on using the daily time frame and it’s easy to see why.

Every broker operating in the market has a slightly different price feed to the next. This means that their daily candles open and close at different times.

Here at ‘The Forex Guy’, we only use brokers who offer a price feed with daily which are synchronized with the New York close. This gives us the daily candle which shows the Sydney open – New York close price action.

New York close candles are considered to be the industry standard by many traders, and essential for end of day trading strategies. Most brokers are actually making the switch to a New York close price feed, because they know that’s what we want.

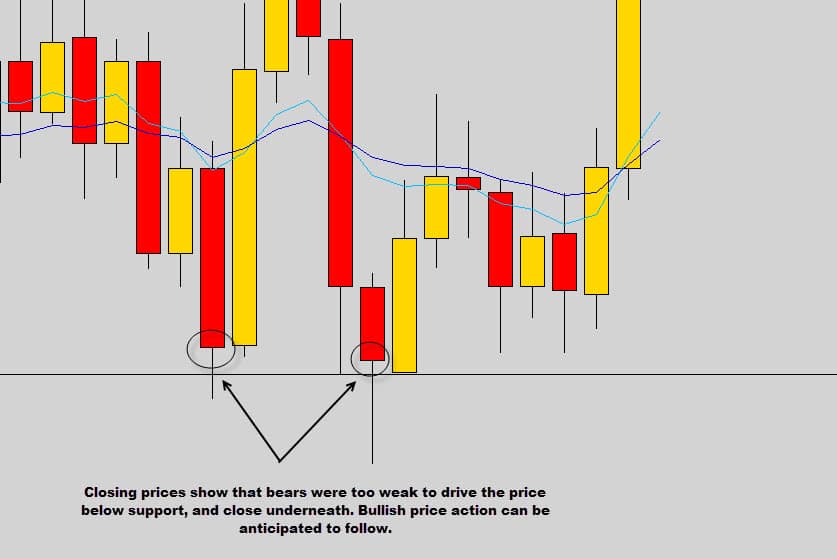

The closing price is one of the most important pieces of data on your chart. It can tell you a lot about a session, for example:

- The bullish power vs bearish power that session

- If the market was able to break through a level

- If the market was unable to break a level and caused a failed breakout

- If the market was decisive or indecisive

- Communicate the strength of a price action signal

The closing price of the rejection candle above communicates the intense bearish pressure with this signal. I call these ‘thick body’ rejection candles and they generally have a much better follow through rate.

Sometimes its just those subtle things that you overlook, like the closing price, that can give you a critical information to anticipate future price movements.

If you’re going to start using the end of day approach, make sure you tune into a New York close price feed.

Checkpoint

Taking advantage of stop and limit orders

The best way to interact with the market is by keeping your time in front of the screen to a minimum by using pending orders.

There are two types of pending orders, “stop” or “limit” orders.

The technical differences between the two are beyond the scope of this article. To keep things simple, all you need to know is – stop orders are the best option for breakouts, while limit orders are best used for catching retracement entries.

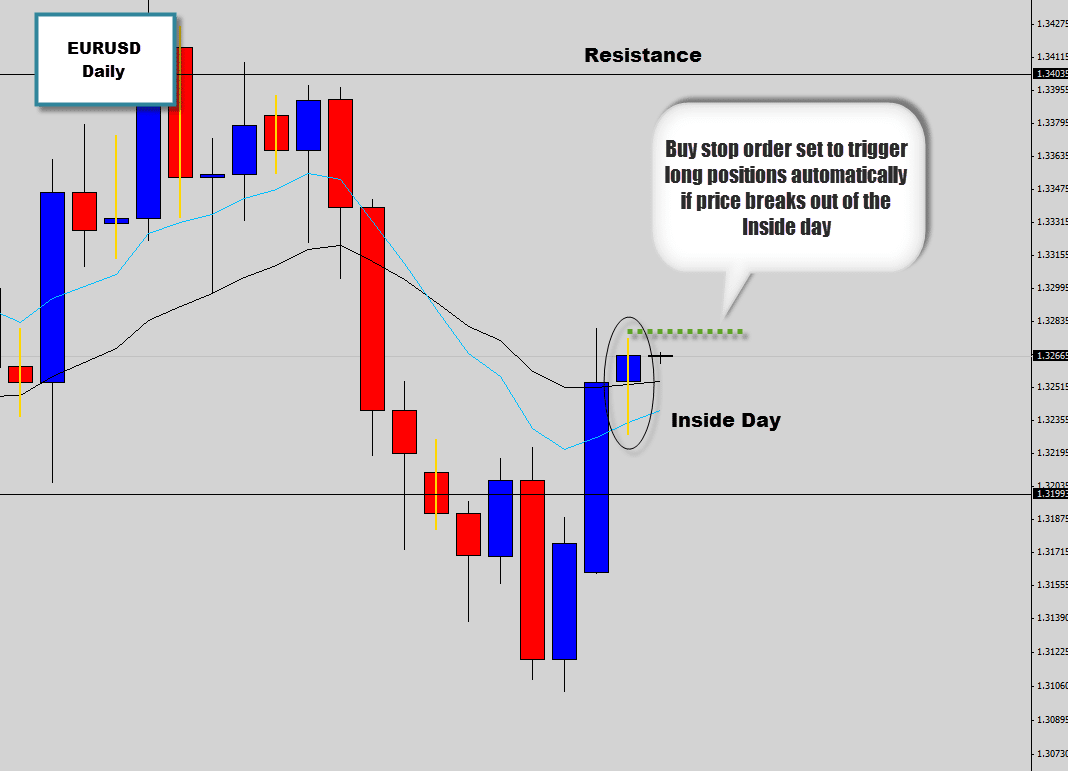

Here is an example of how we used a ‘buy stop’ order to automatically catch the breakout of this Inside Day signal.

The Inside Day is one of my favorite end of day breakout frameworks.

By implementing this kind of “set and forget” approach with a buy stop order – you don’t have to sit it in front of the screen and wait for the breakout to occur. The buy stop order will automatically trigger you in if one occurs.

This removes emotion from the equation, because you are letting the market take the reins from here on. The trade will either trigger and work out, or hit your stop loss – or not even trigger at all.

Set and forget married with end of day trading is a very powerful combination.

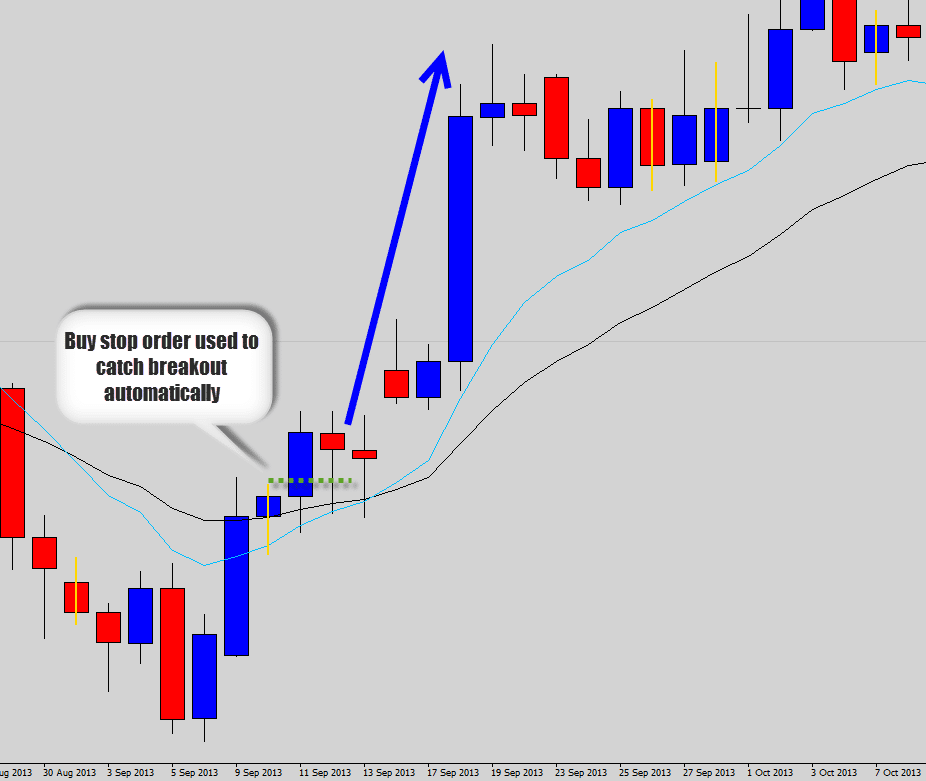

Check out what happened to the Inside day afterwards…

Checkpoint

Trade with More Free Time, Detox Your Obsessive Trading Behavior & Get better Results

As price action specialists, we love the power end of day trading brings to the table.

It’s an excellent way to uncomplicate trading by removing unnecessary data and other external variables, like yourself, from the charts. It works really well for busy people. The last thing anyone wants is to be ‘obligated’ to sit in front of the charts wasting time that you really need to spend doing other tasks.

We are firm believers in the ’20 minutes a day method’, leveraging “set, forget and collect” style management to trade at the “full time trader” level while only committing not even 2 hours per week to the charts.

Finally, you can fit Forex trading easily into your busy schedule, and build a regular routine that keeps you in a positive state of mind and above all, helps transform you into a profitable, successful trader.

If this has struck a chord with you and you want to learn more about how we apply end of day trading strategies to our price action trading, you may be interested in our War Room Traders package. Here you’ll find a wealth of information, including our price action course, where you will learn how to capitalize on low volume, low risk, but high probability trades.

If you want to learn how to combine a busy life, price action trading, set-forget-collect trading with end of day trading strategies – then the war room is definitively for you.

Regain control over your trading and your life – break free from the addiction and be a happy Forex trader.

I hope this article was insightful, please leave your feedback below – I love to hear your feedback and comments

All the best on the charts for this week’s trading.

Tom Avenell

Great article – informative and featuring my choice of trading styles. The buy stop caught my interest. I am not sure how to implement it, but I shall find out in my further quests for trading information – even though my time may be limited at 92.6 years old!

Mohomotsi

How to check sell or buy

Replying to: Mohomotsi

Shadrach Munuve

Use of liquidities and fair value gaps will help you to find a good entry.

Emmanuel

Hi Dale,

Great article.So when should that 15-20 minute scan of the markets for a good trade be,if I may ask?

Kal

Hi,

This might be a stupid question, but If I am based in the UK, should I ensure my broker’s candles are synchronised with the London open close for EOD trading? What do you suggest?

Replying to: Kal

Dale WoodsAuthor

You don’t need to do that, but you also wont find many brokers who have London open or close candles. My chart builder can do it though if you would like to explore those.

Jonty

Great article which has convinced me to turn back to my original plan of end of day trading. I now look forward to receiving your newsletter using your tools and hopefully making some money.

Thank you

Niks

Great article…and excellent learning from your site and videos…

But what if the stock goes up through the day to HIGH and comes back down near OPEN value at the end of the day, I will miss all the profit and action, since I am not looking at the market at all ? All i end up is back to my near original position. How to handle such scenario ?

kluay

good

Michael Colahan

thanks great tools

Hernando H

The day trader is interesting, but can you find the entries in 4H p 1H? , and so lower the value of the SL a little. ? Thanks for your help

Replying to: Hernando H

Dale WoodsAuthor

Yes it is possible to apply swing trading principles to lower time frames. But not as low at the 1 hour, that’s a difficult chart for swing trading newbies.

Panpha

Very realistic…..no miracles,

only probability edge!!!

Dwight

Great article. I have tried day trading (scalping) on just about every time frame. Does not work. I stumbled on to end of day trading on my own and found it to work quite well. However, before I commit to real money, I would like to find out more

Darren Blinkhorn

Excellent article this is so me while I work full time in teaching.

Can I ask what are the best currency pairs if you are an end of day trader living in UK.

Replying to: Darren Blinkhorn

Dale WoodsAuthor

All the major currencies and their crosses. You can start with a handful of the more traded ones like EURUSD, GBPUSD, USDJPY, EURJPY, GBPJPY etc. Most of the trading signals don’t actually light up until after the London session opens anyway, so you do have good opportunities in your time zone Darren.

Darren Blinkhorn

Thankyou for your reply that was very useful.

Tatiana Pantoja

Excelente work, and how can i lear more about it?

Emmanuel

Great article. Please what the periods of the moving averages you inserted in the article?

Bob Steward

Awesome

Denso Sithole

Awesome, I started forex trading and I was washed out twice, and now I still have to load my account with funds so that I can start trading again, if have had this lesson’s before I would have been a professional by now. Thanx a lot Mr forexguy, from now my eye’s are on you, I’m busy pumping myself with your lessons so that once I load my account again, be able to walk at the safe sport, not to be wiped out again for the third time. “BIG UP!!!”

sentosa masyhor

thanks mr dale.your methold very good.i must joint at your war room a litle time.i wait good time to joint or follow your web nexs .thanks for all

peter h oltersdorf

Hello Mr. Woods,

so in your opinion it is best to wait ’till the NY Close [Daily Time Frame] .so one can see the fully formed candle and NOT before ?

That makes sense

Please tell me if I am right to wait ’till NY Close !!

Thank you very much for your anticipated reply !

Prince James

Great article, its feels as it is purposed, relief stress of low frequency trading, of which I have been a victim.

Niks

excellent article….I am surely going to try this model….Thanks Dale once again..

kyle

Hi do you make trades off of a friday end of day candle going into the weekend or only monday-thursday?

Replying to: kyle

Dale WoodsAuthor

Well you can’t until the next week opens. But I use extra caution trading signals that formed at the end of the week, as Monday price action does have a higher failure rate.

Replying to: kyle

peter h oltersdorf

Kyle,

It is not a good idea to open a new position on friday except a pending order just before market Close [ 4: 50 EST ] — not much can happen in ten Min.—

Do not forget to include Stop Loss !!

Nieco Pama

Hi sir, this is a new idea for me and it helps me a lot. Thank you fir this great idea. I have a question about New York Close. We have different time here in the Philippines. What is the exact time are you saying here. As i observe in a daily time frame that it closes at 5am Philippine time. I am right?

God Bless you more and more…

mark

very informative article…keep up the good work!

Les Zerfahs

I noticed that Alpari UK has become insolvent due to the Swiss removing the Euro – Cap which has caused other brokers problems. What happens to traders accounts if that should happen? Thanks for all your very useful information. Some of the strategies sound too good to be true – are they?

Les

Replying to: Les Zerfahs

Dale WoodsAuthor

Yep they went down with the SNB ordeal. I now use Go Markets, very happy!

There setups do produce good results, but it is important to remember that there are losers too. Most traders, including myself will experience a stop out rate of around 50% or worse in poorer market conditions. Not many people will tell you that, because they want you to believe their nailing 80% of their trades, whereas in fact they probably have a high stop out rate.

The secret is to milk these setups when they do work out. On average these end of day swing trade setups can return an average of 3x-6x return on risk. This means our losses remain small and controlled, and our winners are superior and really drive the account up.

This positive risk reward profile in our money management plan is one of our key Forex survival strategies. So these setups are not too good to be true, but the simple catch is, they don’t always workout. This is just a part of Forex trading.

Rondell Garcia

Love your articles. Like your trading style, it is clean and to the point. No wasted jargon that would confuse and or discourage noobs. It has made for great training material for myself and friends, who i passed the link unto.

Thank you again Dale.

Xerkley

Any of you guys that want to improve your trading, go ahead and sign up for The Forex Guy’s War Room. It has improved my trading amazingly. I have paid for it more than 12 times over in one year. The Forex Guy did not ask me to write this. I really like the product and have gained a lot of benefit from it. Just take it slow, be patient, ask questions and you will do well.

valerie Galvin(Greenannie)

Love reading your information. I am falling into the bad habits that you talk about. I do all those things and it has got to stop. Can you direct me to some videos that are for dummies like me that slowly explain how to do all this. I read it all but it is still a mystery.

Lori

When do you typically place your trades that you get from the daily charts? The spreads get awfully large at 5:00 pm EST. Do you enter your trades at 4:30 – 4:45 pm, or wait until the daily candle closes and then place your trades later? If so, how much later? Thanks for all of the great info!

Replying to: Lori

TheForexGuyAuthor

As a general rule of thumb, I will place my end of day trade orders sometime within the first few hours of the Asia session, and breakout orders generally after London open.

Replying to: Lori

peter h oltersdorf

Lori & Forex Guy,

how about at 4: 45 ??

Noraz

Love to know more.. Any webinar to be held ? Thanks

Micaiah

I would really want to explore this and put forward a question if I have challenges. I am new to trading but want to get it right to stand on the shoulder of the giant like you. Thanks!

Nas Dean

hello again, im sorry for my uncertainty about your strategy.i know that u always stress on the daily time frame trade, but why is on the price action signal segment in your blog, you’re using the 4 HR chart? Isn’t it still considered as intra-day trading?

Replying to: Nas Dean

TheForexGuyAuthor

End of day trading is using signals from the daily chart, where you can just check the markets once per day – suiting those who have a busy life. Yes I also do swing trading on 4, 8 & 12 hour charts. I’ve developed software to watch those time frames for me and let me know if any trade opportunities surface, that way I know when to check the charts. See more about the software here: https://www.theforexguy.com/candlestick-indicator-for-mt4/

Nas Dean

If i trade on Monday, do i have to start trading on London session? coz im afraid if there might be high impact news on the weekend and i probably cannot see the impact on Sydney session as it has low volatility.

Replying to: Nas Dean

TheForexGuyAuthor

Those sort of large gaps are actually rare in the market. If you’re swing trading, then you should see the signal through as you intended when you first entered. Unless on the rare occasion you know some extremely hot event is going to occur over the weekend – but that’s also going to be a rare case.

ismail

daily chart worth risking our money

thanks

Michael

Hi,

I have a question.

There is a delta of 2 hours between close of NY trades and start of Sydney trades.

When you are saying “daily candle shows the Sydney open-New York close” the 00:00 hrs on your platform is aligned to Sydney open or actuality the time when NY is closing.

Are there 2 hrs important at all?

Great article, thanks a lot.

Replying to: Michael

Dale WoodsAuthor

Great question – we go off the NY close. Generally not much happens after the New York close – only on the off occasion the NZD will spike in volatility due to an early news release. Just so you know, I use Alpari UK as my broker.

Atif Choudhury

Great article. I loved it. If you permit, I don’t mind to post it on my own blog.