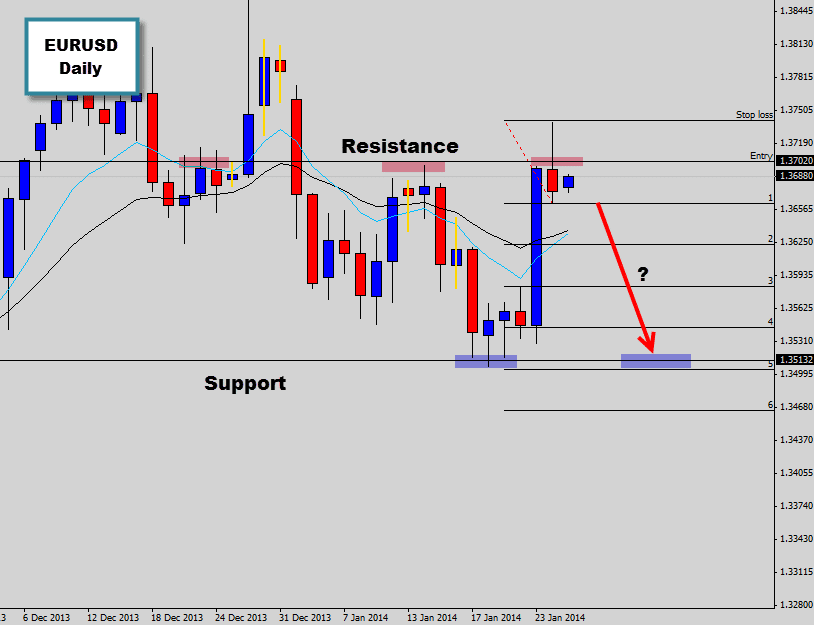

Today we’re honing in on the EURUSD daily chart where a nice bearish rejection candle setup has gotten our attention. The market has just rallied up aggressively just after hitting some fresh lows. The bullish power candle was produced from a very high impact news release fulled movement.

The move pushed EURUSD into the previous swing high, where the move terminated and the market printed a rejection candle. The rejection candle communicates to us that the market did initially try push passed the previous swing high, but failed. The bearish denied any higher moves higher and the daily candle closed lower than it’s open price – as a rejection candle.

This looks like the start of a ranging market now, so as a classic range play we can aim to target the other extreme of the range boundary, in this case the range support level for target prices. It looks like we may get a retracement entry opportunity as in the time of writing this post, the market is producing the classic asia session retracement movement.

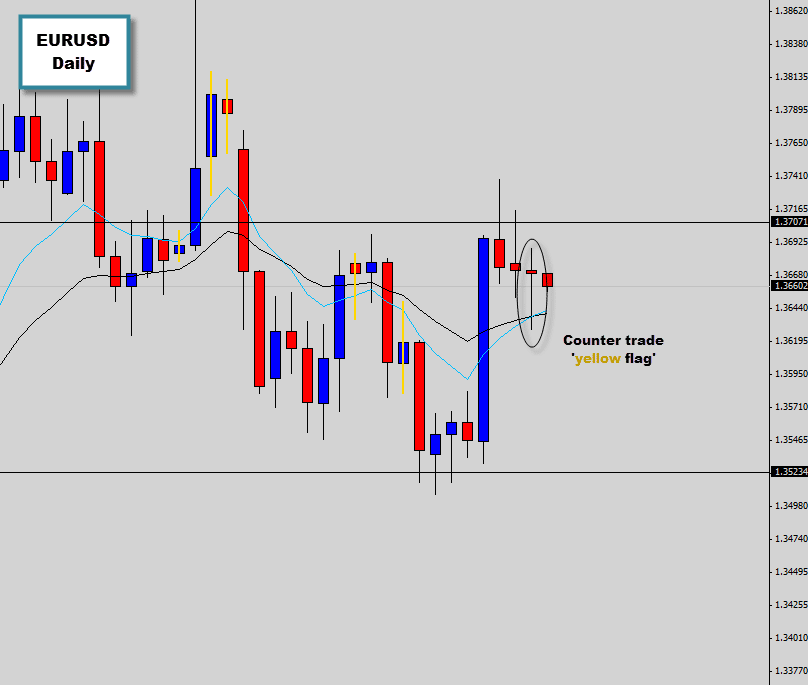

A Yellow Flag has been raised

The eurusd short signal was discussed this week in the market commentary. The setup has unfolded nicely triggering the 50% entry and showing good bearish price follow through.

Last session a bullish rejection candle formed. Although it’s not an A++ setup itself, it still poses a moderate threat to the short setup and I would call this a ‘yellow flag’ warning. Under these conditions you can move your stop to break even, close the trade in a small gain or simply just follow through with the set and forget mentality and don’t tamper with the trade at all.

EURUSD is really non-directional at the moment, there is no real trend to ride so some caution is needed

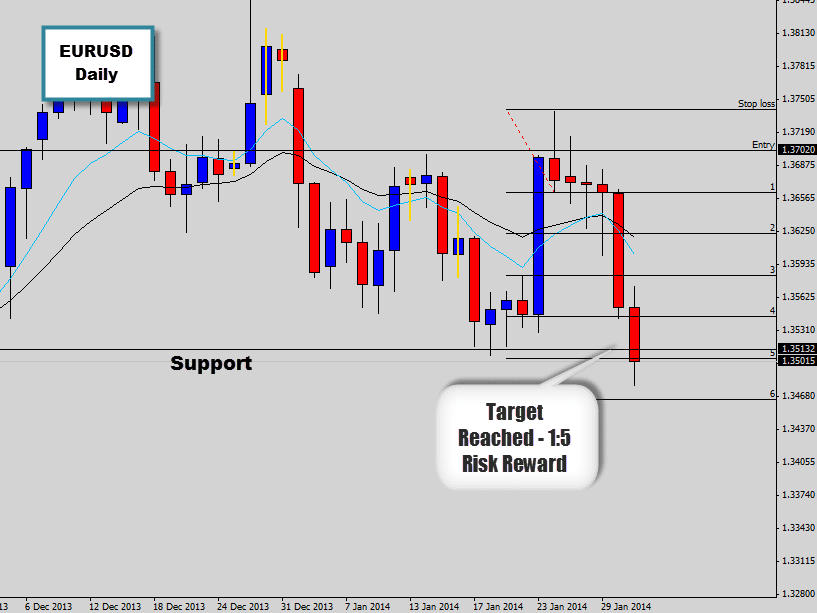

Trade hits target

After hitting a few bumpy days, those who persevered with patience and discipline would have been nicely rewarded. The price action trade setup did eventually hit target as price weakened into the range bottom. This has returned a very healty 1:5 return on investment. To put that in perspective, for those who use consistent risk/reward money management, this trade would have mitigated 5 previous losses.

This is a classic example of how the set and forget approach can really be a gem if you tend to freak out at the first sign of trouble. At times this trade didn’t look like it was going to work out and would have cause a lot of traders to intervene emotionally, and regret it later.

Psychology makes up probably 80% of your trading success, and failures. You are your biggest obstacle when it comes to this industry. Even with a good strategy like price action trading, if you’re head isn’t in the right place no strategy can save you.

inderjeet

Wowww really discipline is most most most important

Mario

I love this! ✊????????????????????