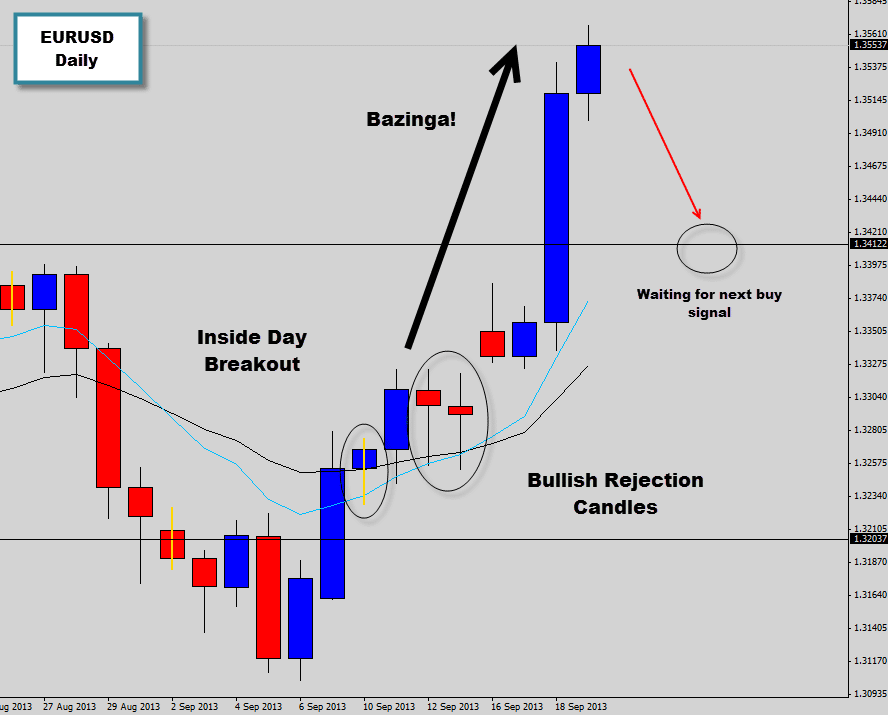

We are revisiting the EURUSD chart today to debrief on a trade setup we’ve been discussing in the last few weeks. We’ve been posting about our bullish bias on the EURUSD daily chart and have pointed out a few bullish price action indicators which gave us the early warning sign that the market wanted to move higher.

The first sign was the Inside Day breakout earlier on in the trend’s development, then the consecutive bullish Rejection Candles that followed suit. The market continued to respect the mean value as dynamic support which is another plus for the bulls and then finally last session the market exploded higher.

You only really need simples cues like these in the market to help you anticipate future market direction, and by using our price action trading techniques you can grab awesome entry prices with nice tight stops that deliver lazy returns on investment. This one of the key benefits of trading price action with the higher time frames, you don’t really need to do much. With minimal amounts of effort on your behalf and the market takes over from there.

Now a key resistance level has been breached and the bulls have established a dominant presence here, we will be looking for market corrections back to the resistance level breakout area and price action confirmations that the level will maintain itself as support. This is going to be a hot spot for long signals to develop on the chart.

Previous discussion on this trade setup

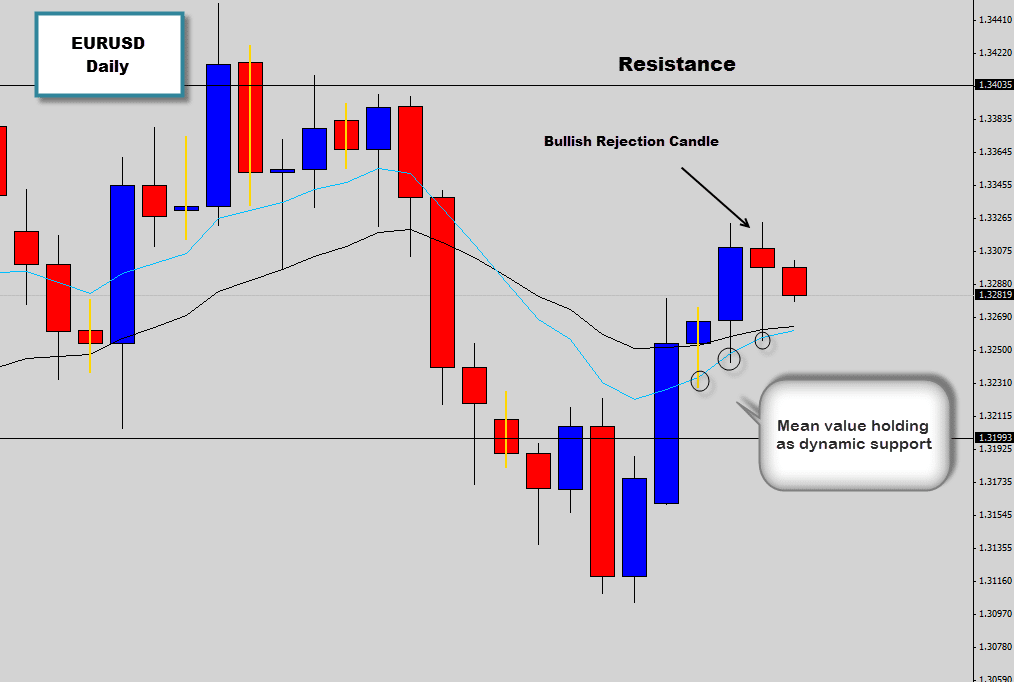

We’ve been watching and discussing the recent upward momentum that has been building on the EURUSD market after last weeks NFP excitement. After the initial surge upwards price has been slowly grinding itself further upwards which created an Inside Day signal, which has now been triggered via price breaking the Inside Day high. The trade hasn’t made much progress, but the mean value has been acting as strong dynamic support most of the week, which is a good sign for the bulls.

A Bullish Rejection Candle has formed last session, the long lower tail protruding from the lower end of the body suggests that the market was not interested in holding lower prices and found support around the mean value. The market is now retracing down the the candle which is a perfect opportunity for retracement entries.

If this signal plays ball and rolls out we could see the next upward stretch into higher prices to test the next major resistance level.

Previous Discussion

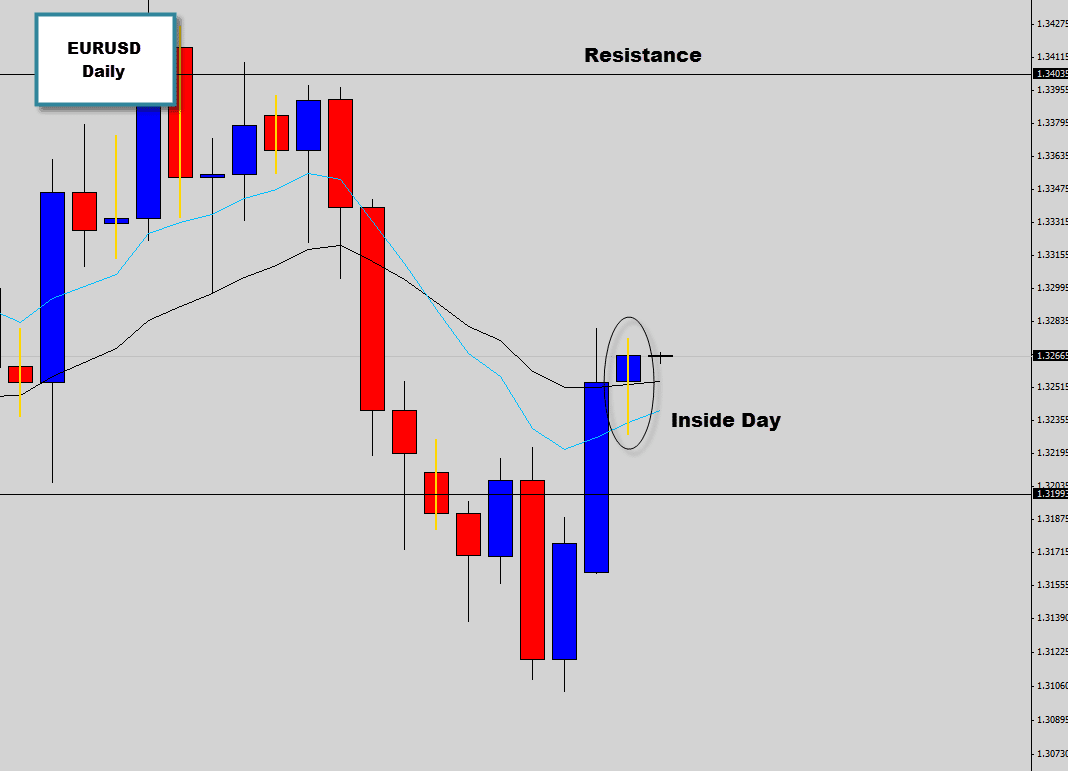

EURUSD reacted strongly and surged upwards off last week’s NFP figures, last session the momentum did give pause and manifested an Inside day consolidation pattern as a direct result.

The Inside day did close higher and has a lower tail, suggesting lower prices during that Forex trading session were not favored in the market, communicating to us price action traders that we could see a bullish continuation breakout here.

We are just going off the recent bullish momentum alone, most markets are still grinding sideways, and we are scraping the bottom of the barrel for quality setups these days, with all the uncertain vide the market has right now.