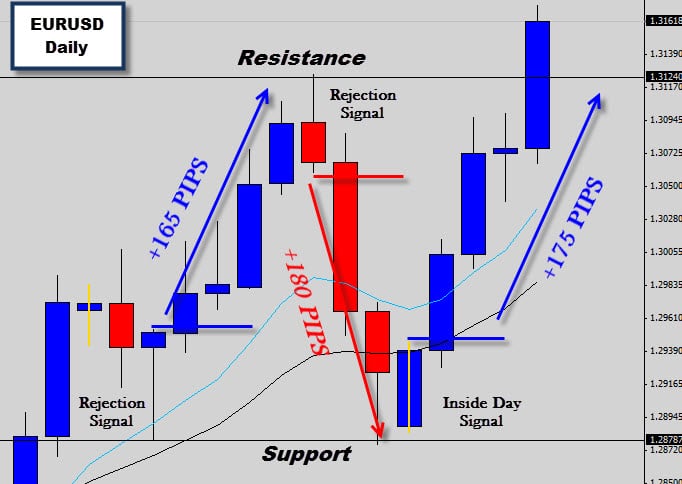

Christmas has come early for all the Price Action traders out there who have been following the EURUSD market! We have recently been discussing EURUSD Price Action activity in our recent posts, so lets follow up and see how traders could of benefited from these type of price movements.

The first signal we spoke about was the rejection candle that formed with trending movement on top of a key support level, on the Daily chart. Price broke the signal high and moved +165 pips in the signal direction where the rally hit the wall when price reacted with next major resistance level on the chart. This produced a Bearish Rejection signal, which if Price Action traders took the break of the low could of earned themselves another +180pips.

We then spoke about the Inside Day signal that formed back at the original key support level, this indicated price churning away, possibly from money exchanging hands as the bigger players in the market changed positions. Once the Inside day high was breached, long trades were triggered for price action traders and for those who set target at the next key resistance level, would have earn an easy +175pips, all for about 15 mins work.

If you would like to know more on how you can take advantage of the Forex market using simple Price Action signals such as the ones shown above, check out the Price Action Protocol.

Previous Post :

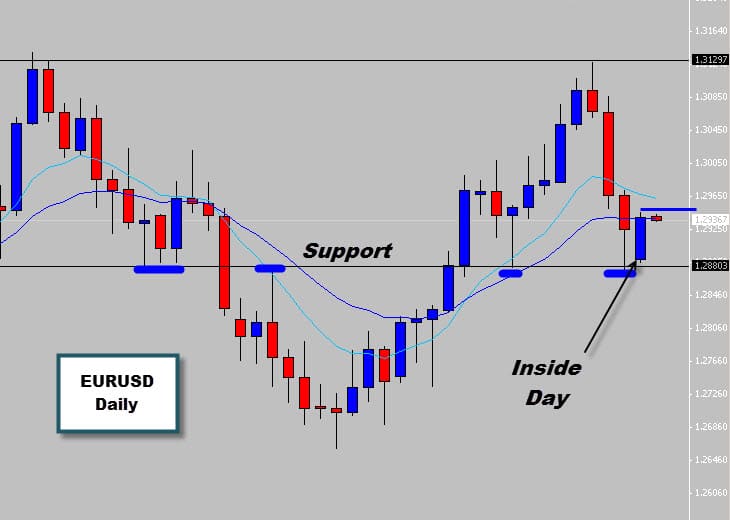

EURUSD has been a pretty active market as of late, so we’ve been keeping a close watch on it. At the end of the last trading week price sold of and tested the support level marked on the chart. This week’s Forex Price Action started off by consolidating above the support level to create and Inside day signal with a strong bullish close by the end of the session.

Using the Price Action Protocol entry methods, we are looking for a break of the Inside day high to trigger long trades, but not too early in the session to avoid false Asian Breakouts.