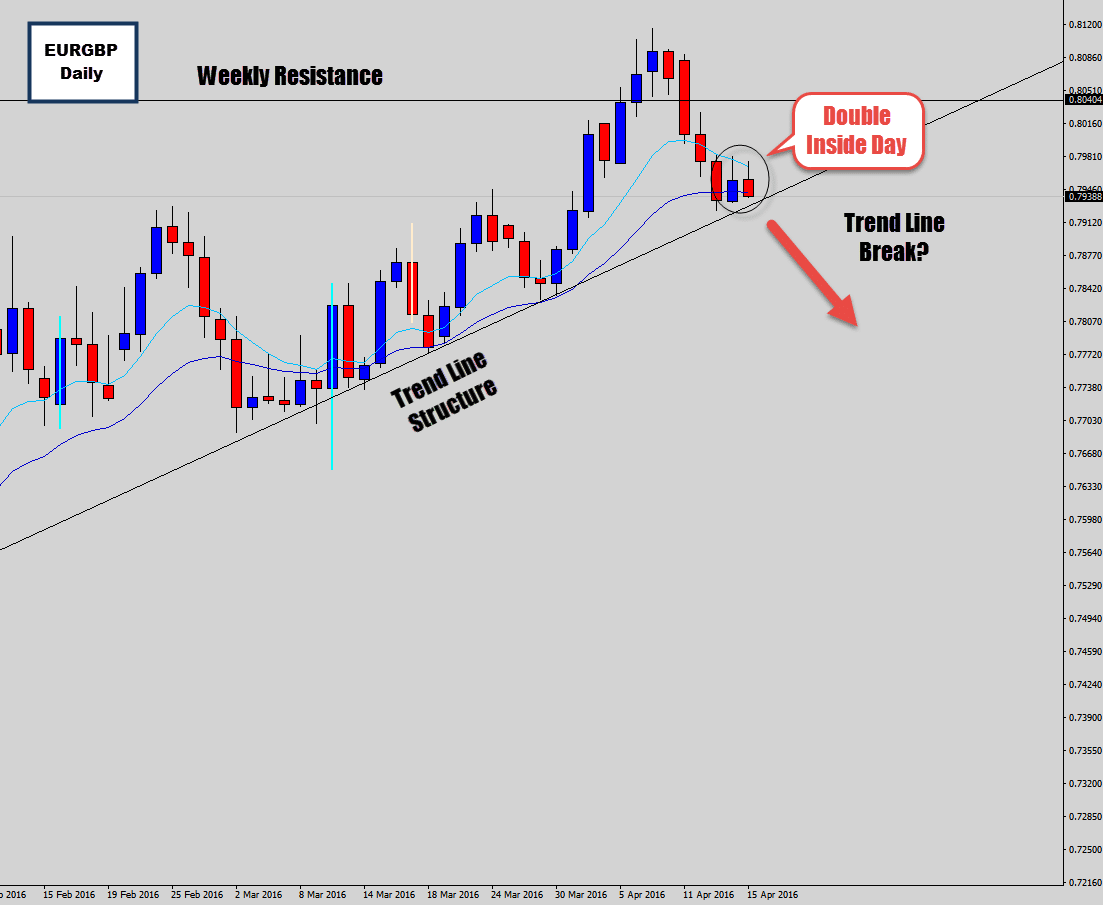

EURGBP has been on a nice bull run the last few months, creating a 10,000 pip rally from it’s lows on the weekly chart.

Recently the bulls have been using a trend line structure as a linear support level where all the counter trend corrections have been terminating.

Price has met with a strong weekly level, where sellers entered the market aggressively. The weekly candle close with a serious looking bearish body.

On the daily chart, we can see the sell off from the weekly level pressed price back into the trend line. Residual buyers were obviously waiting here – as a result ‘soaking’ up the bearish price action.

Price has reached a major decision point where many buyers and sellers are going to come into conflict – creating an indecision period where price goes nowhere until the victor is decided. Bulls vs Bears.

This kind of price action has created a double inside day setup, where the candle ranges cascade inside one another.

This setup is a breakout catalyst, generally the victors of the indecision period will cause the market to breakout of either the double inside day setup high or low.

I am gunning for a break to the low side, because the bulls have already made their ‘move’, and are probably a little exhausted at the moment.

Trends don’t last for ever, and we’ve seen some serious weakness come into the market right at a major weekly turning point.

Looking for a break of the double inside day low – if we get the low side breakout, it will be a very bearish event, and will most likely be the catalyst for a serious breakout.

A word of caution for Monday, be vigilant about Asia session breakouts – they are notoriously deceptive. I think I will wait until the London open to assess whether this trade setup still looks viable.

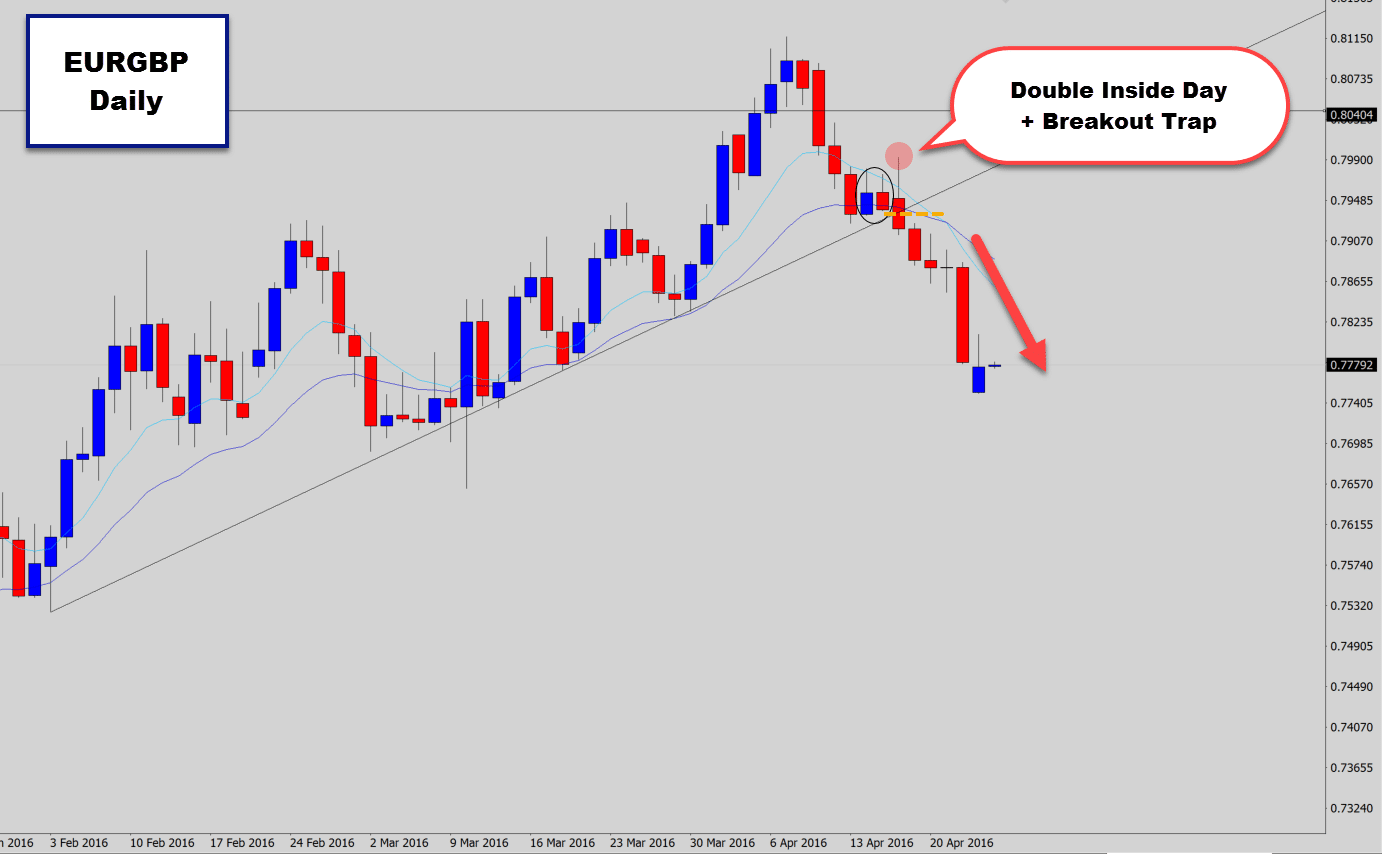

Breakout Trap First, Then The Breakout Move!

This setup worked out an anticipated, but actually we got some more bearish confirmation before the breakout move occurred.

A breakout trap occurred when the market tried to break higher above the double inside days – that move failed, collapsed on itself and the market dropped out the bottom, breaking the trend line and the double inside day setup.

This triggered our short positions and we’ve only got heavy bearish price action since. A couple of war room traders have already gotten nice returns hitting that 3x & 4x risk reward target for the trade. I’ve decided to exit here after the market gaped down after the weekend, as this usually encourages retracements.

Now the market is at lower lows, we are going to look to re-short after retracements when the market drops fresh reversal signals via lower highs.

I will have the battle station tuned in here to get alerts on any potential setups.

If you would like to learn more about this type of breakout trading, or get your hands on the battle station algorithm – checkout the war room information page here to find out more.

Best of luck on the charts this week guys.

ALi

Nice trading sir????

Lucas

Hello. i do have a question. Lot size = [($ wanted to risk / stop loss in point) / 1.4128]

question: how can i get 1.4128 ?

Thanks

Replying to: Lucas

Dale WoodsAuthor

It’s the tick value – the exchange rate between your account currency and the base currency of the current pair you’re trading. The number is generated by my Battle Station tool.

Lucas

Thanks dale. to make myself clear, currently my account is in USD. hence, the tick value would be 0.88 (USD EUR exchange rate) instead of 1.4128 as compare to above. Please correct me if i wrong. 🙂

ritik

Sir your article is so good and easy to understand,because of you i able to understand it easy.please share your views in commodities *gold.copper crude etc.

Thanks

$@h!l

yaa.. i was too looking for the same setup…a break below mother bar can give a opportunity to short…