If you’re a price action trader who a trader who uses technical analysis, then there is a good chance you’re looking at candlestick patterns.

Certain candlestick formations do give off early warning clues to the future movement of price, especially when aligned with other factors on the chart.

Technical traders analyze the outcome of specific candlestick patterns that occurred in the past, and look for repeating occurrences that give the same results time over time.

There are some very popular candlestick patterns used in the markets today, which are hunted down vigorously by traders – because they are known to produce certain outcomes that we can capitalize on, like price reversals or breakouts.

My Battle Station tool acts as a powerful candlestick recognition indicator for MT4.

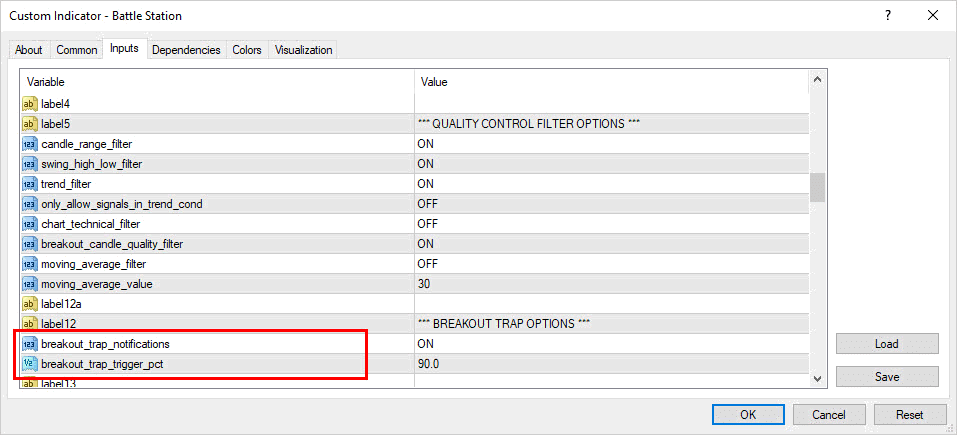

It has the ability to detect popular candlestick pattern formations, and perform various quality control checks – aiding in the filtering of poor quality signals.

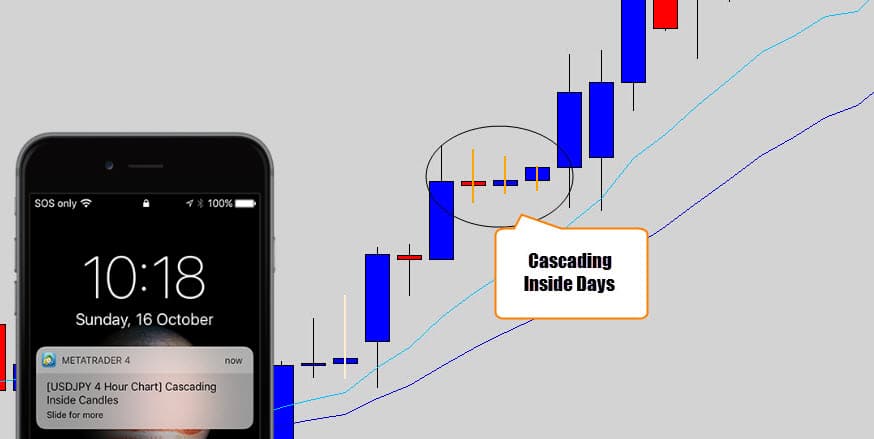

The advantage here is the Battle station can monitor the market tick-by-tick, and as soon as a high quality candlestick pattern is detected, you will be notified about it either by:

- Notification on your iPhone/Android device

- Email Alert

- Internal MT4 Alert

In this guide, I will walk you through my Battle Station’s candlestick recognition capabilities, and how it can benefit you in your trading.

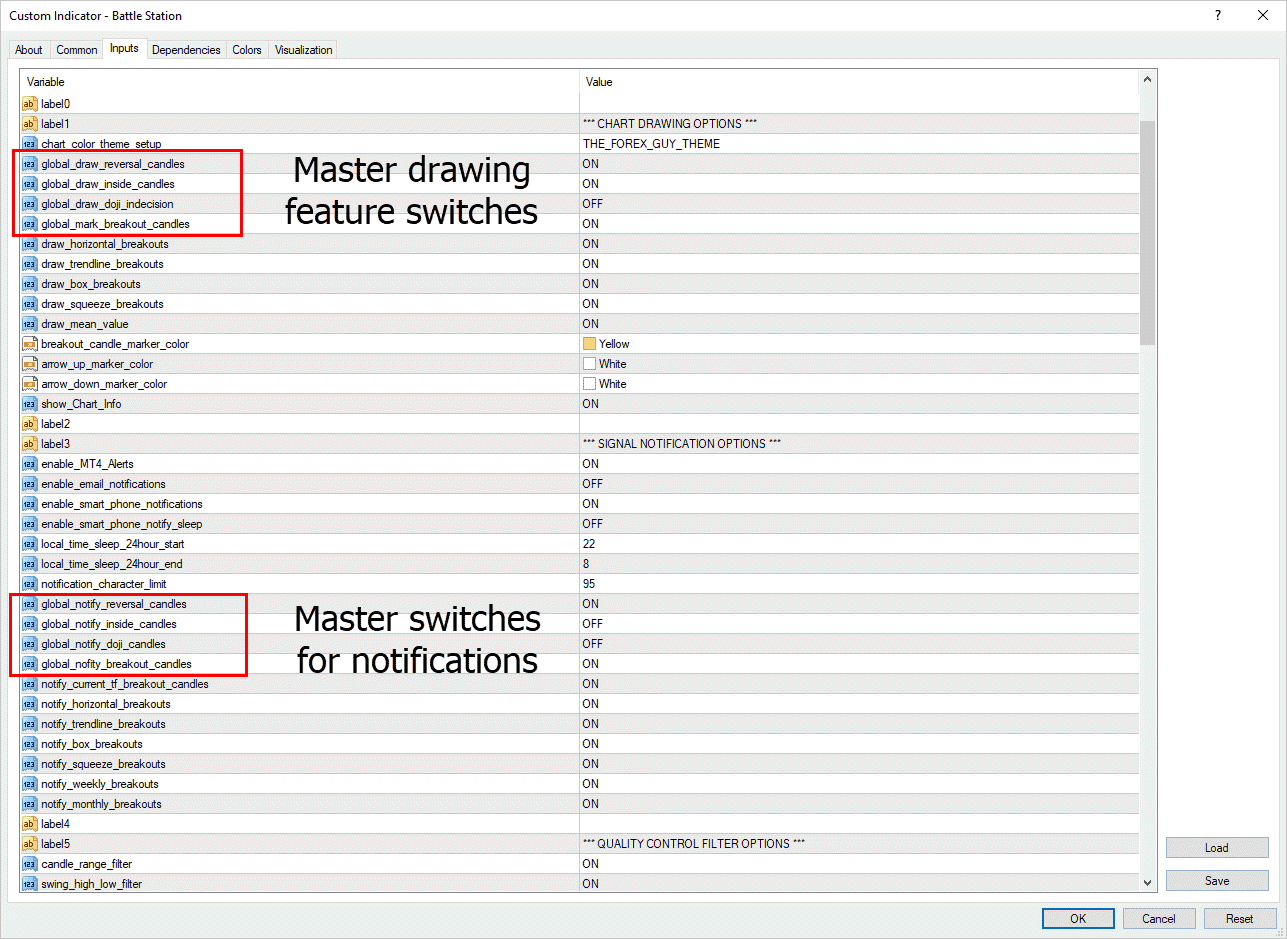

Master Switches

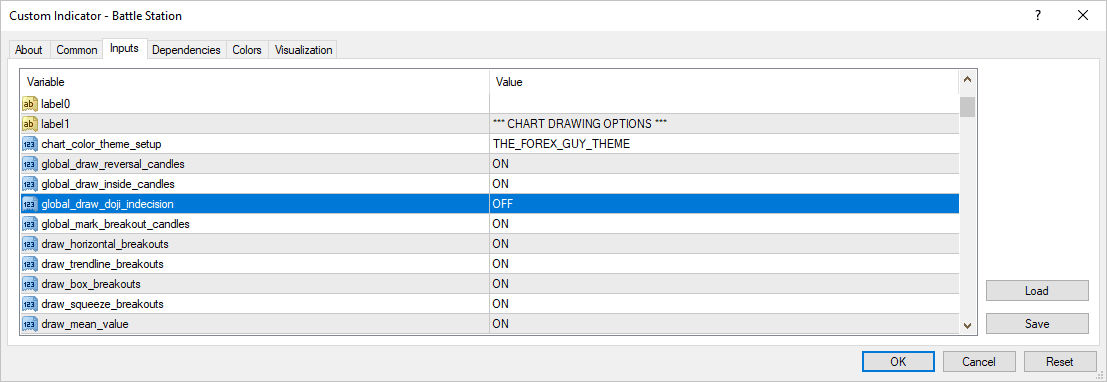

I have provided two ‘master’ switches for drawing reversal signals, and notifications sent regarding new reversal signals found.

If you turn off any of the master switches, it doesn’t matter what settings you have further down the list – it is like unplugging the power cord from the wall. If the master switches are not on, the features they control will be disabled, period.

A master switch is a quick way for a trader to quickly turn off a feature without having to go through all the individualized options.

There are set of master switches for:

- Reversal Candle Patterns

- Inside Candles

- Doji Candles

- Breakout Events

For each group, there are separate master switches for the drawing module, and the notification module

For example: The inside candle notification master switch is turned off by default on passive 4 hour, and 1 hour scanning, to avoid excessive notifications about inside candles forming frequently on your charts.

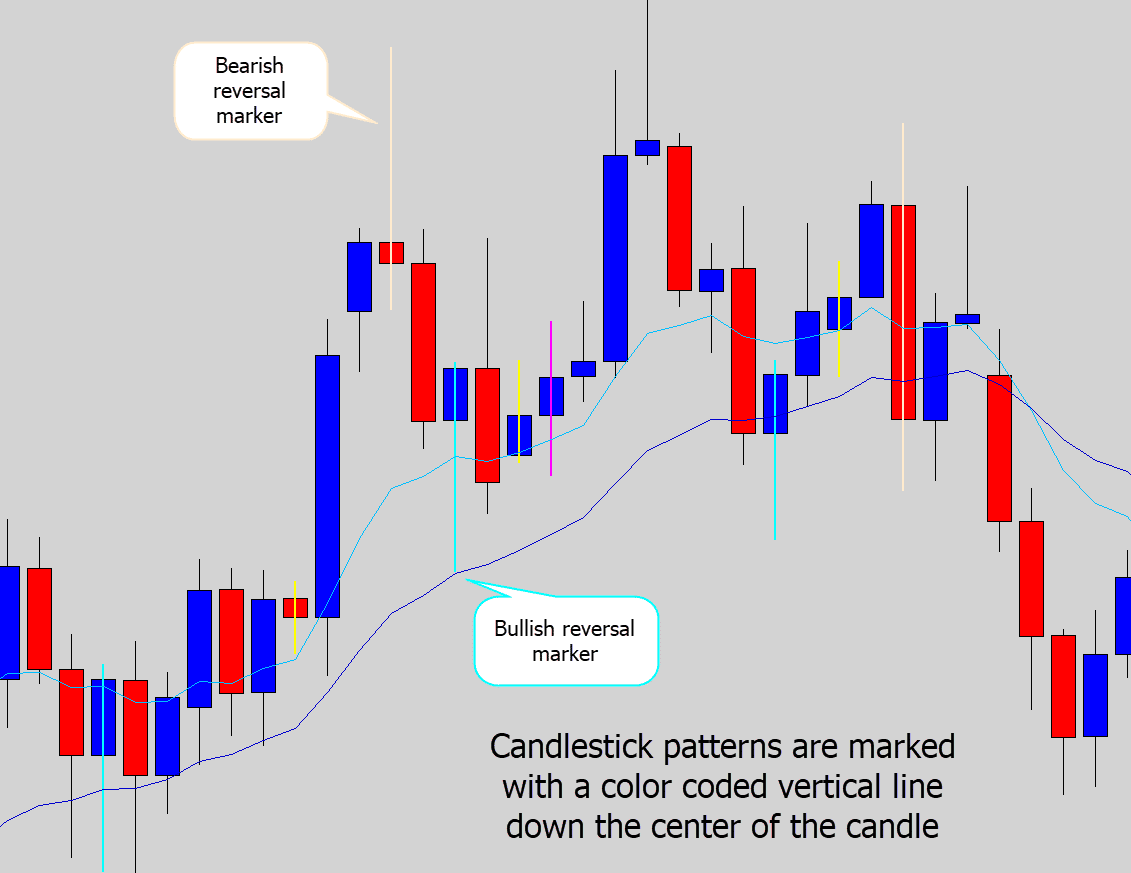

Candlestick Pattern Drawing Options

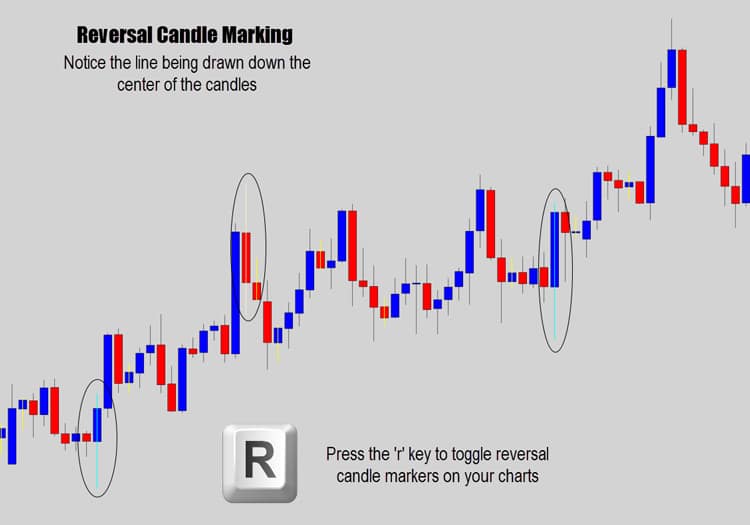

The Battle Station will mark any detected candlestick pattern (you told it to), on the chart by drawing a color coded vertical line down the center of the candle range.

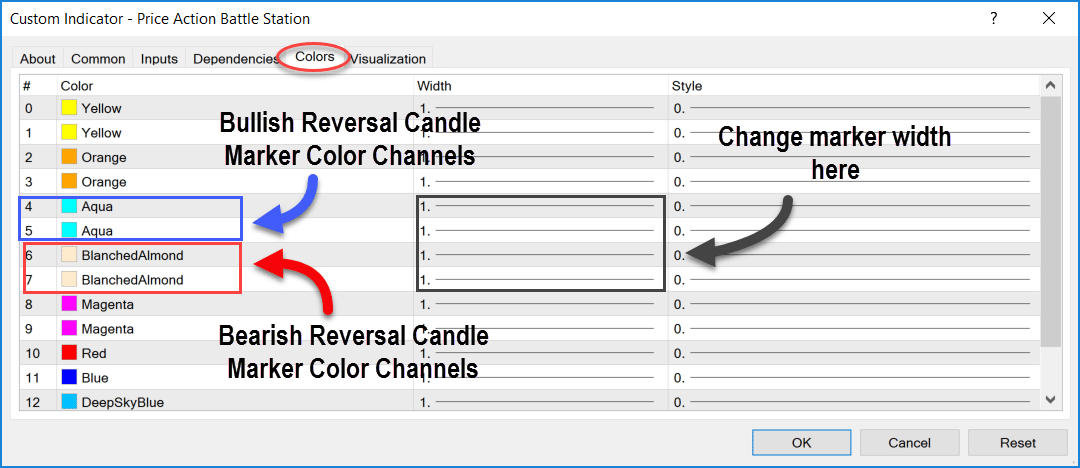

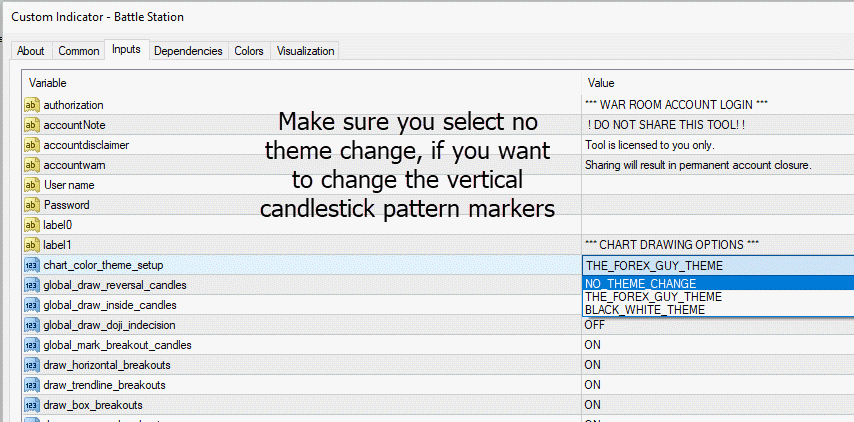

If you would like to change the color of the candle markers – go to Battle Station’s indicator settings (ctrl+i), and select the color tab.

The color channels operate in pairs, so just make sure set each pair with matching settings.

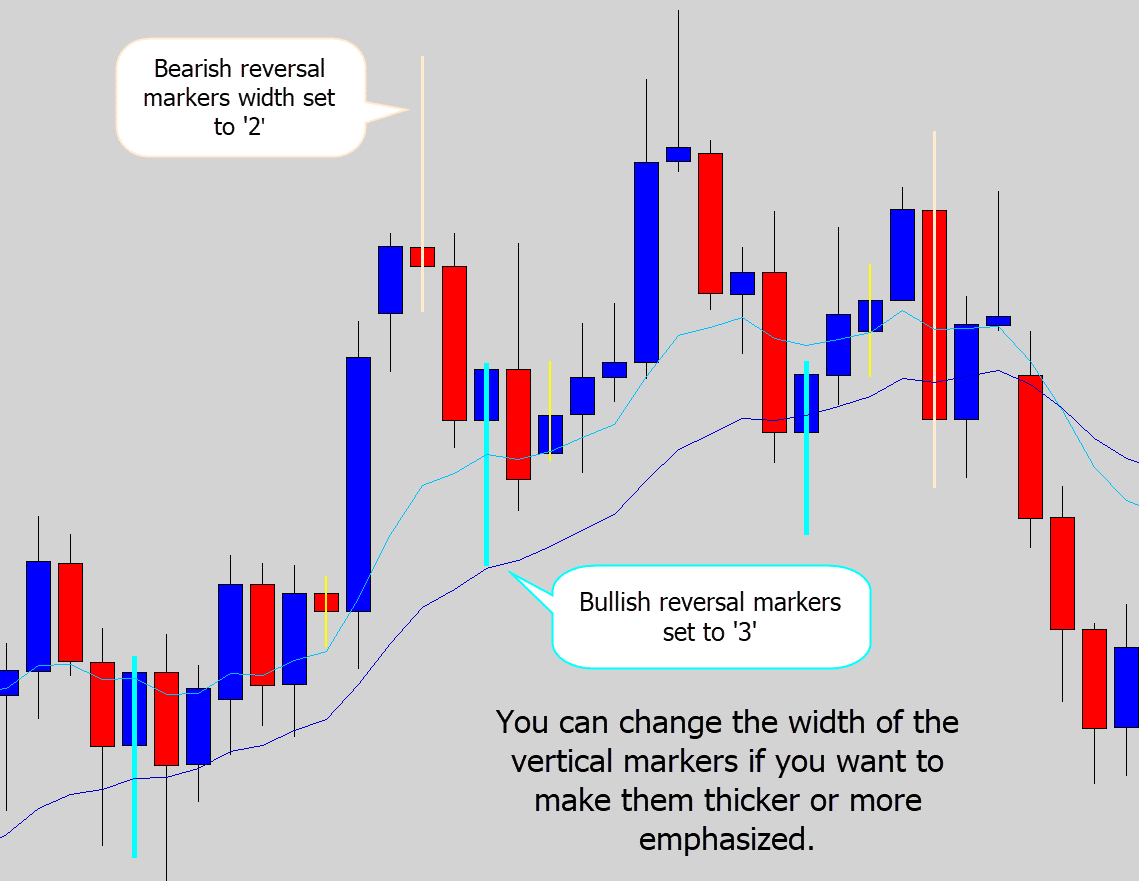

You can also change the width in the adjacent column to the color setting, making the candlestick marker draw thicker if you so desire…

Above: Change the width number to get a more emphasized vertical candlestick pattern marker

Critical Information - Please Read

Candlestick Reversal Signals Options

Probably the most chased after class of candlestick pattern are the reversal group, for good reason.

Catching a nice candlestick reversal signal that has value and context within the recent price action can be very lucrative.

The Battle Station can detect the following reversal signals:

- Classic Pin Bar

- Rejection Candle

- Engulfing Candle

- Outside Candle

- Bullish Piercing (added by request, turned off by default)

- Dark Cloud Cover (added by request, turned off by default)

These are the most popular set of candlestick signals used by price action traders in today’s market – including us traders in the War Room.

As per most features of the battle station, there is a set of options for the chart drawing, and a set of options for the notification system.

Reversal candle markers can be toggled by pressing ‘r’ on the keyboard while the chart is selected and in focus.

Pin Bar & Rejection Candles

These guys are the hot items of the price action trading community today.

Price action traders are usually waiting for the next pin bar signal to appear on their charts.

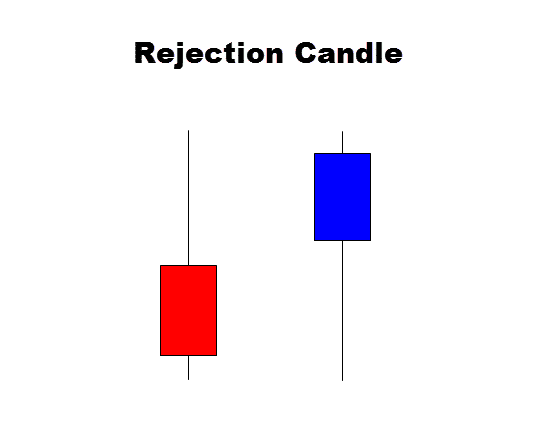

I often get asked by trader’s what the difference between a Pin Bar and a Rejection Candlestick pattern is?

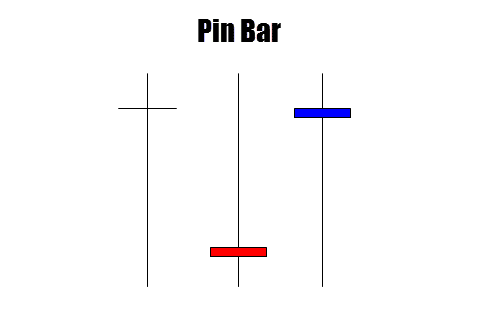

Think of it like this – a pin bar is a weaker version of a Rejection candle. The pin bar has a small body, and resembles that pin shape.

A rejection candle has a much more stronger anatomy – usually packing a thicker body, and simply have more bullish or bearish presence on the chart as an authority reversal signal.

[block]

- Long upper or lower wick

- Small wick at opposite end

- Very narrow ranged body

- Body is located at one end of the candle range

[/block]

[block]

- Long upper or lower wick to display rejection of higher or lower prices

- Little to no wick protruding from candle close price

- A thick bearish or bullish body

- Candle closes in direction of the reversal, eg bullish rejection has bullish body, bearish rejection has bearish body

- Bullish body located at top portion of candle range, or bearish body located a bottom portion of candle range.

- Larger in range than the surrounding candles

[/block]

Notice how the rejection has a thicker body. Rejection candles usually are larger in range as well.

In my experience rejection candles are a stronger signal, and have a better chance of producing a reversal.

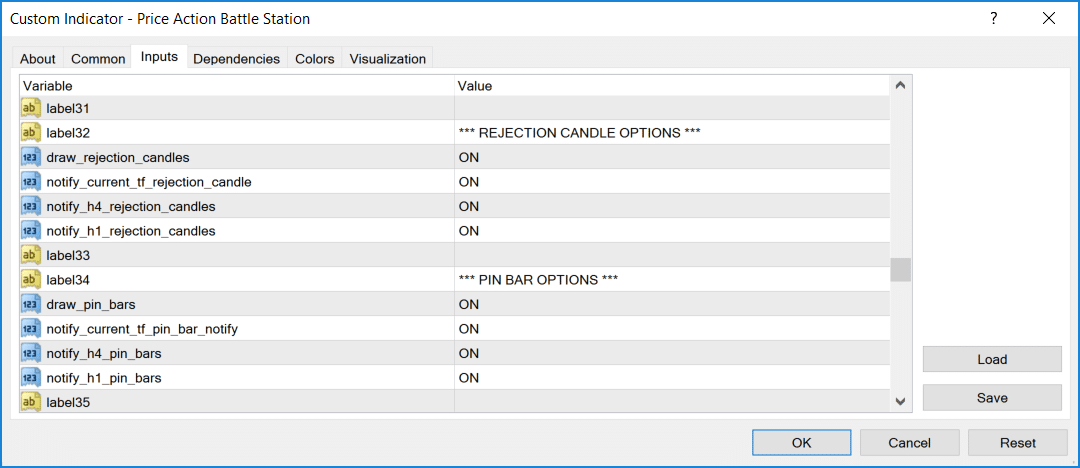

The Battle Station can detect both of these patterns on the chart and send you notifications when it finds them.

Here are the options that directly effect pin bars and rejection candles

They are pretty self explanatory. You can individually toggle drawing and notifications options. There are some passive time frame candle scanning options. More on that later in the guide.

Remember: Pin Bars, and Rejection candles are effected by the global_draw_reversal_candles, and the global_notify_reversal_candles

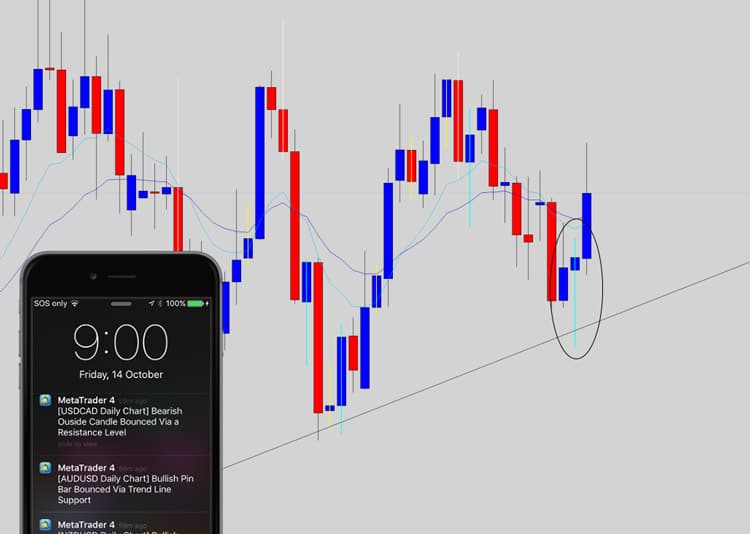

Below are some example alerts I captured…

The above two screen shots show the Battle Station picking up Pin Bar and Rejection Candle signals, and pushing them to my old iPhone.

Traders report back these are very informative and really convenient alerts – which I agree with from my own experiences.

Engulfing & Outside Candles

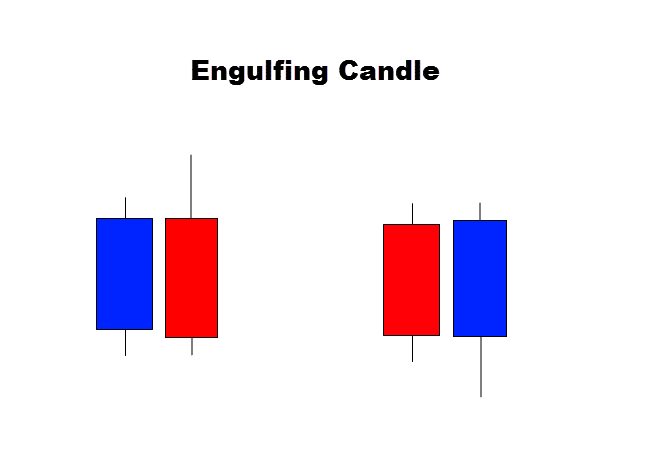

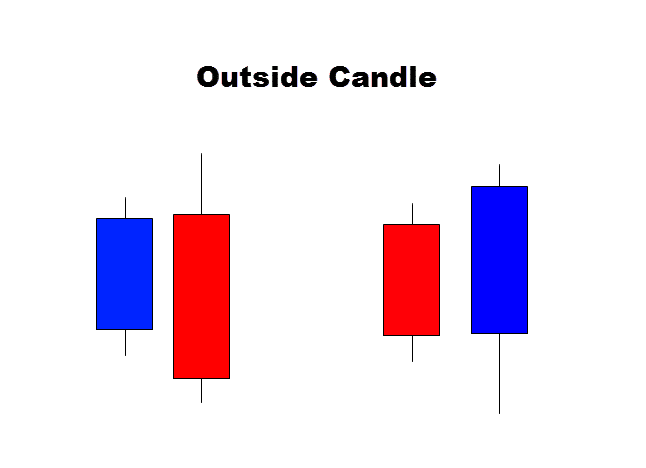

Another question that I get all the time is: “What is the difference between Engulfing Candles vs Outside Candles”?

This one can be tricky to answer, because the answer to this is heavily opinionated – there is no text book definition we can follow, they are loosely described in the industry.

Therefore everyone has a different opinion on what an engulfing candle should be, and what an outside should be.

However, we don’t have the luxury to be be loose with our description when programming things like a candlestick pattern recognition algorithm, you need to be very specific when to tell the code what to look for.

I believe I have nailed down the best definitions between the two signals.

[block]

- An engulfing candle is a two candle setup

- Must have a higher high (if bearish) or lower low (if bullish) than previous candle

- Close price must be close within the top ~15% (bullish) or bottom ~15% (bearish) of the previous candle’s range.

- Little to no wick out of the closing price end of the candle body

[/block]

[block]

- An outside candle is a two candle setup

- Must have a higher high and lower low price than previous candle

- Close price must be outside previous candle’s range

- Little to no wick out of the closing price end of the candle body

[/block]

Notice the difference between the two? It’s very subtle.

The Engulfing candle first breaks the high or low of the previous candle, then shoots back in the opposite direction. It then almost closes outside the other end of the previous candles range, but doesn’t quite make it.

It ‘engulfs’ the previous candles range, but does not completely close outside it.

For the Outside candle however, it initially forms under the same conditions, but it must close outside the previous candles range.

In my options this makes the engulfing candle a weaker version of the Outside candle signal.

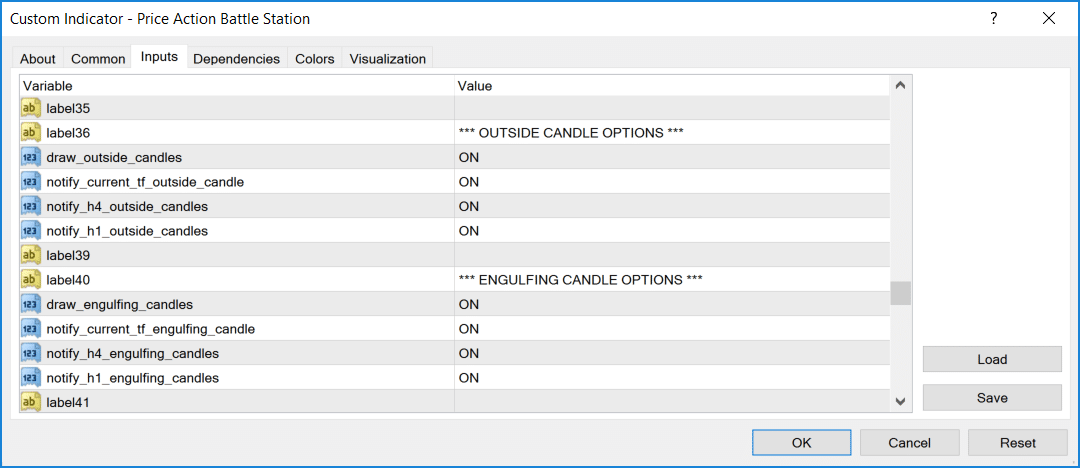

Here are the options that will effect engulfing and outside candles individually.

Above is an example of the Battle Station pushing an alert about an outside candle that was detected.

Below is an example engulfing candle alert. I just upgraded to the OS10 on the old iPhone 5s at this time, so it has a different UI look.

Breakout Catalyst Candlestick Patterns

These are a group of what I would call ‘neutral’ candlestick patterns which don’t signal a direction in their anatomy.

They form when the market takes pause, and grinds in a tight range. These kind of price action patterns can lead to strong breakouts, which is why they are respected as breakout catalysts.

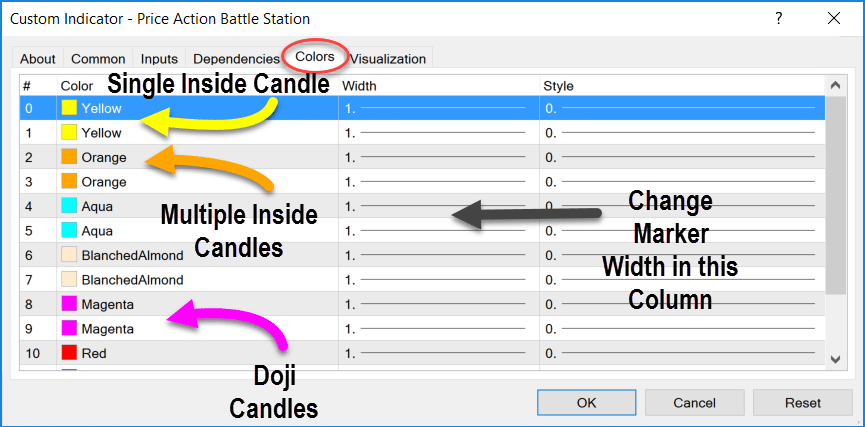

The two main breakout catalysts the Battle Station is tuned for are:

- Inside Candles (single and multi-chained)

- Indecision Dojis

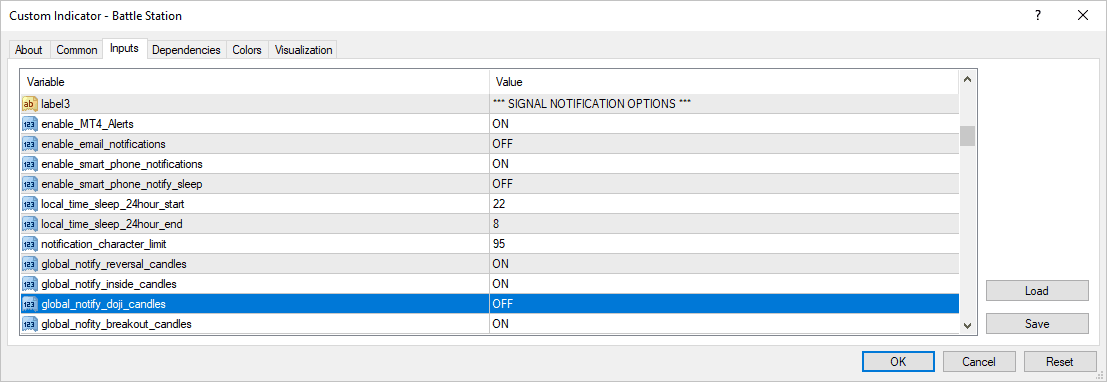

These type of candles form A LOT!

That’s why their notifications are disabled by default – to prevent Battle Station ‘message spam’

If you really need alerts from these signals, feel free to turn them on in the options.

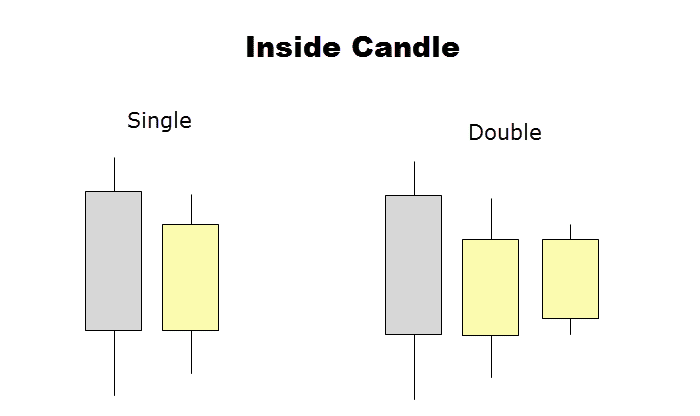

The Inside Candle(s)

The inside candle is a very common price action entity. It is probably the most common candlestick pattern that forms on your charts – hence why notifications are off by default.

Inside candles need a lot of technical context, and value built into them as a trade idea. Usually best traded from major decision points on the chart, like major support/resistance, or at swing points within a trend.

Here is the criteria for Inside Candles:

[block]

- Candle high and low price must be within the previous candle’s high and low price range

- Chained inside candles can form, they must follow the same rules. If a double inside candle forms, the last inside candle must be within the proceeding inside candles high & low price range.

- Generally inside candles that form after an extremely large proceeding candle are discounted. Inside candles work better when they are small in range.

[/block]

Very simple to understand – to qualify for an inside candle, the candle range must completely be within the previous candle’s range.

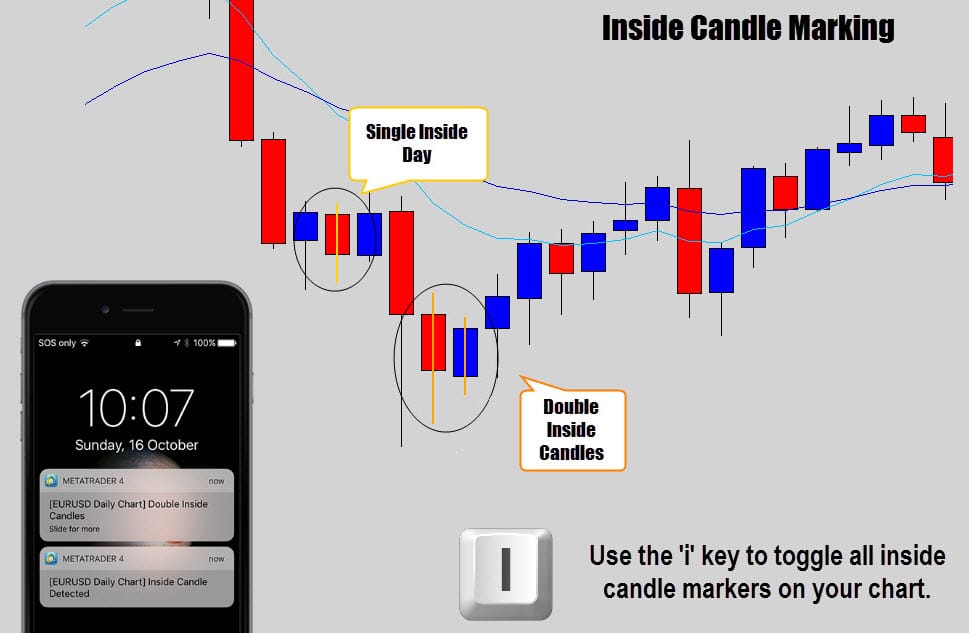

It’s also possible to get multiple inside candles in a row.

The battle station will provide detailed information about single, double, and multi inside candle patterns.

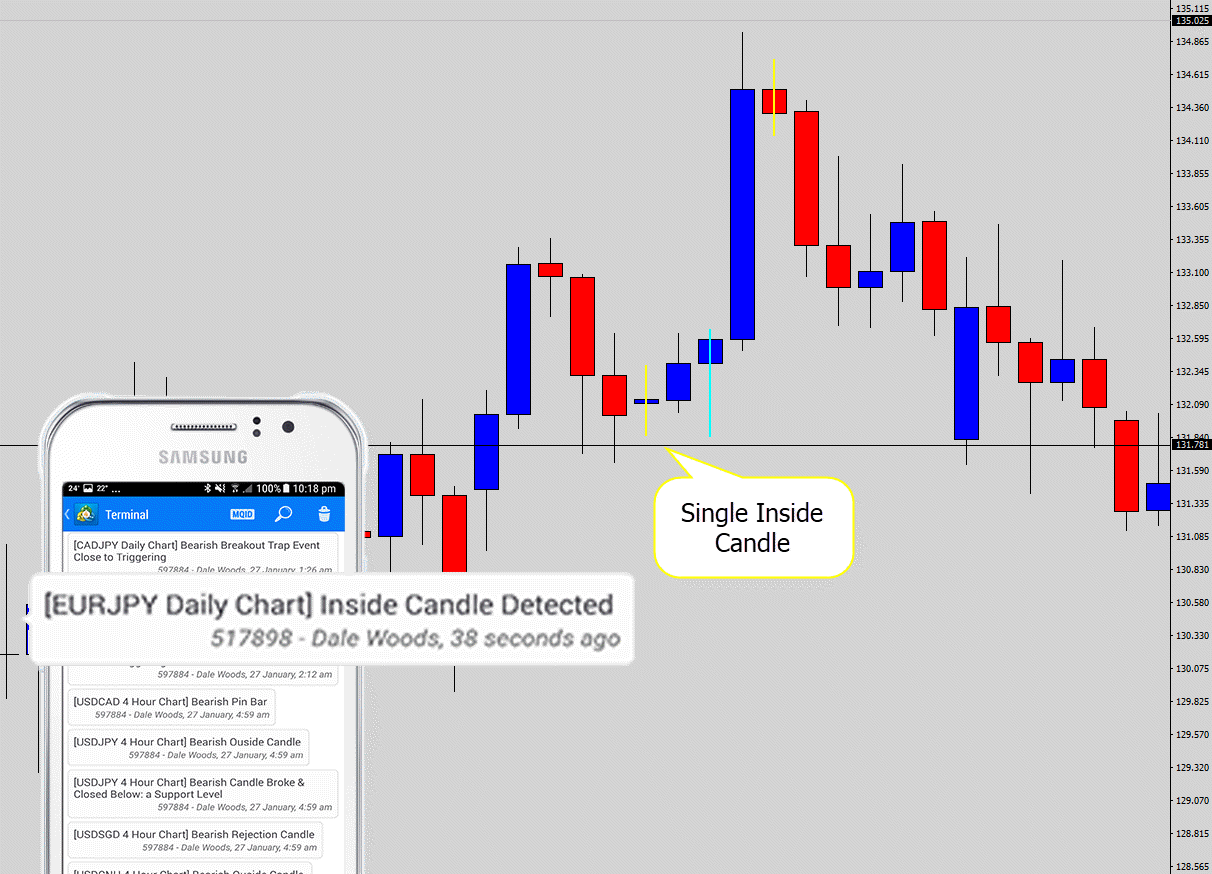

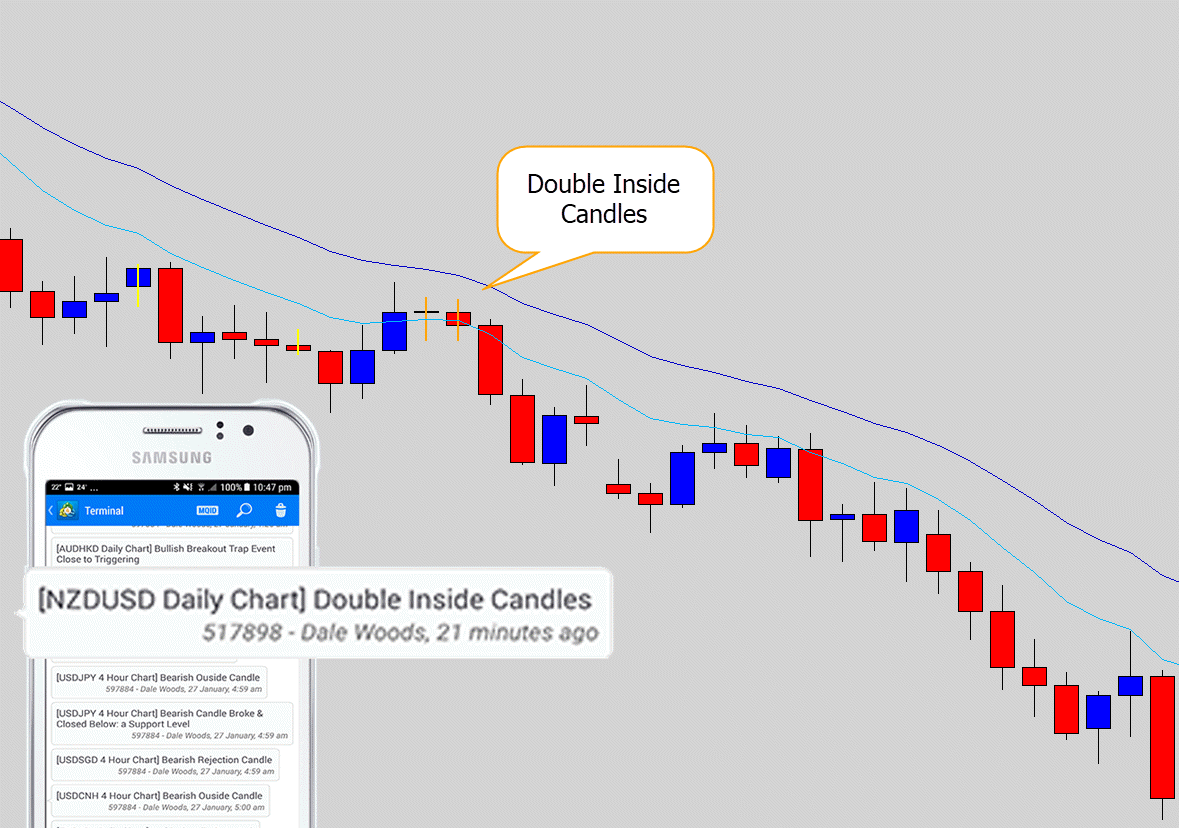

Above: Notification messages about single and double inside candle combos – there is also a custom alert sent if 3 or more inside candles form together too.

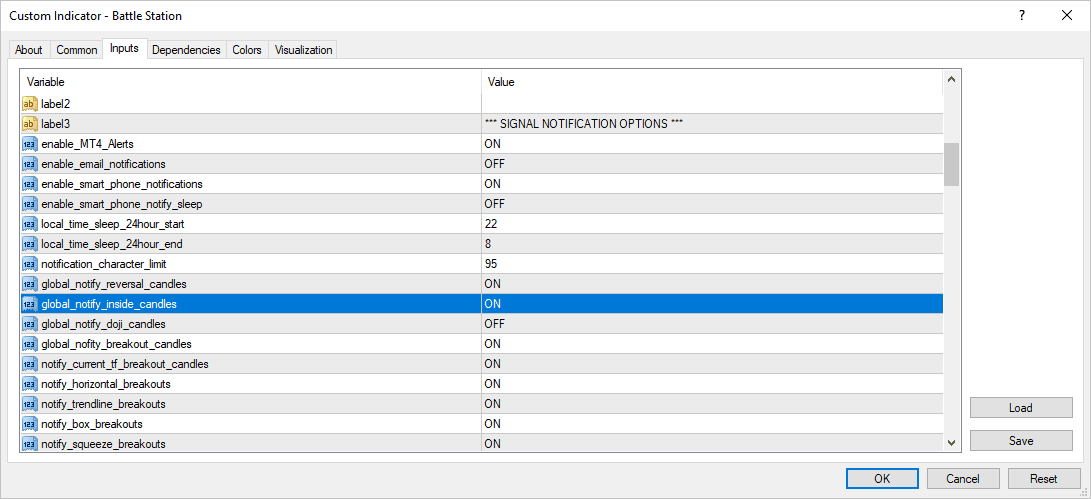

If you would like to get notifications about inside candles, make sure you first check the master switch is on…

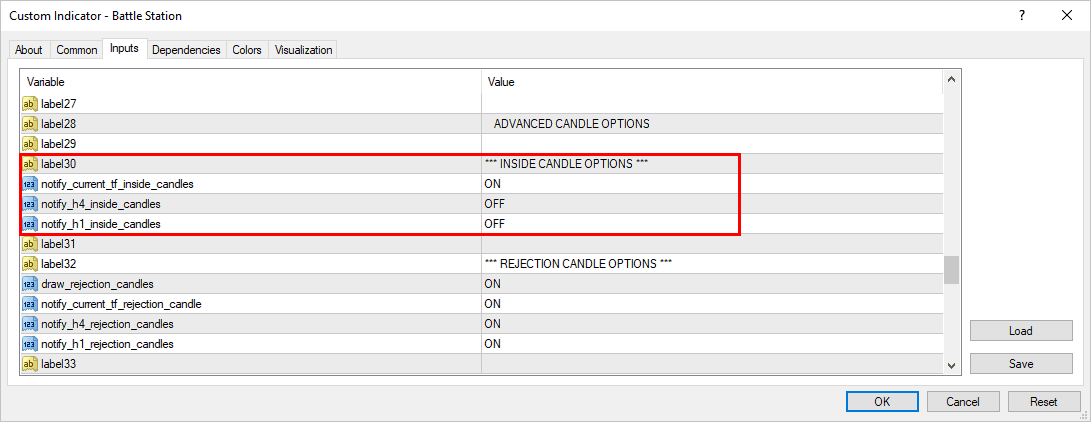

Then you can modify the individual time frame options…

Note: You can find an equal set of options for the chart marking of inside candles.

The Inside candle markers can be toggled by pressing the ‘i’ key, when the chart is selected and in focus.

Note: The ‘i’ hotkey will toggle both the single inside and multiple inside candle channel.

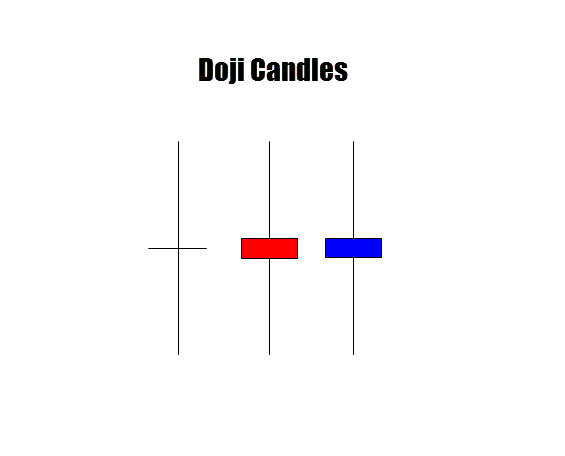

The Indecision Doji

The indecision Doji is another awesome breakout catalyst.

By default, its drawing and notification engine is switched off at the master switches. So turn these back on if you’re interested in tracking Indecision Dojis.

Above: Master switches for the indecision Doji candlestick pattern.

The criteria for a indecision Doji candle:

[block]

- Doji candles have a small body

- The candle body is centered within the candle range

- Wicks protruding out both ends of the body

[/block]

Doji’s have many names, and are effective when combined with key technical areas on the chart.

The reason Doji candle are switched off by default is because they form quite a lot.

When they are turned on, the Battle Station will constantly be firing off alerts at you – and it can get annoying. We can reduce this by using the quality filters (more on that later)

This is why I decided to make it your decision whether you want to track doji indecision candles, or not.

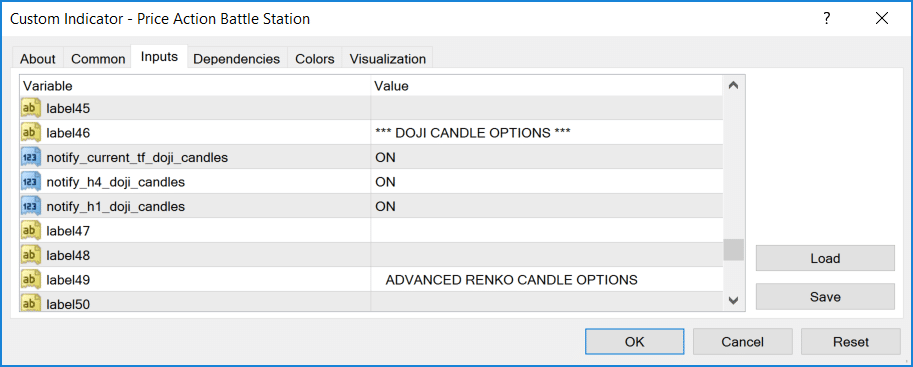

The indecision doji candle also has settings for current time frame, and the passive time frame scanning:

You can toggle the Doji Candle makers quickly by pressing the ‘d’ key when the chart is selected and in focus.

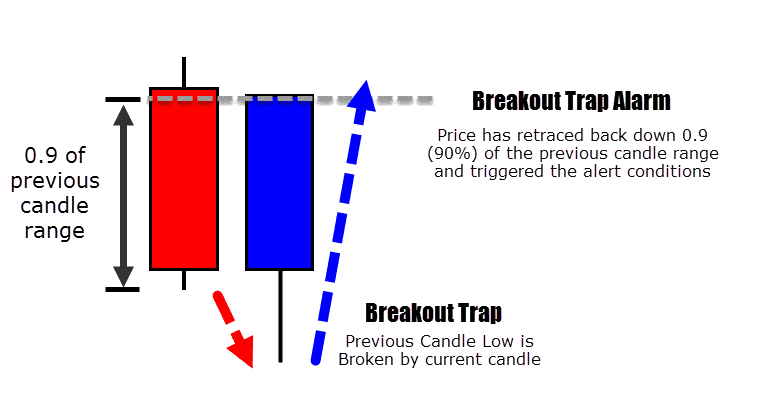

Breakout Trap & Reverse Event

The breakout trap & reverse trade is something we trade in the War Room.

It’s good to have alerts when this signal is close to triggering, so we have time to set up our trade.

Let me explain the breakout_trap_trigger_pct option.

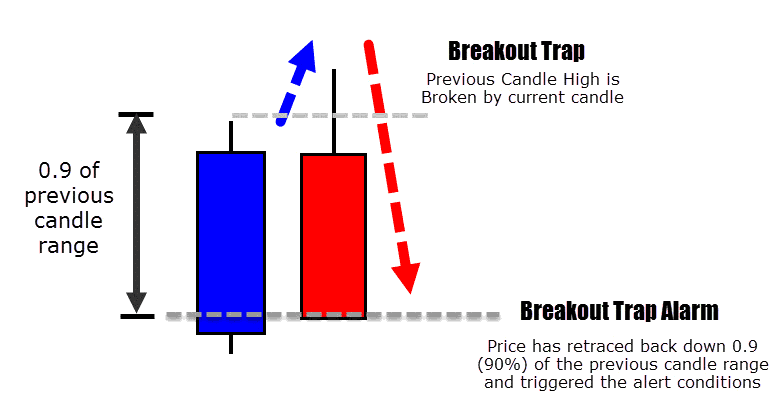

This is the ‘threshold’ to when the notification is triggered. As you know the breakout trap & reverse setup triggers when either the high or low of the previous candle is broken, then price snaps back the other way to break the other end of the previous candle.

The breakout_trap_trigger variable is set by default to 0.9, which equates to 90%. So instead of notifying you on the breakout trap and reverse trade trigger break, the indicator will try to anticipate the breakout by letting you know when price has retraced back up or down 90% of the previous candles range.

First the lows of the previous candle must be broken by the current candle. When the current candle retraces back up to the value of breakout_trap_trigger, which will be a percentage of the previous candles range, the alert will trigger.

The idea is to alert you before the setup actually triggers so you have time to set up the trade.

By default breakout_trap_trigger_pct is set to 90%.

If you set it to 50% – then you would receive a notification when price retraced up 50% of the previous candles range. This basically means you could be notified earlier of a potential breakout, but with a setting of 50% – you would most likely get a lot of notifications that don’t develop into anything.

I’ve set it to 90% by default, so the indicator alerts you -just- before the trade triggers. If you want a more conservative setting, try 75% for an even earlier warning.

This is exactly the same for the bearish breakout trap pattern…

The bearish scenario is basically the same, just flipped upside down.

The options will affect both bullish and bearish breakout trap and reverse alarms.

Summary

Hopefully this gives you a good basic idea how the battle station candlestick pattern recognition tool works, and how it can be customized for you. The bottom line is you can walk away from your charts and allow the battle station to contact you, when it finds something of interest.

Getting better quality signals

As I mentioned before, these notifications are fantastic if you don’t want to have to sit and wait in front of the charts for hours or have to keep coming back to check the charts at key times.

See you in the next chapter of the guide.

Mohammad HN

Tnx man good indicator

Panithan

It is a good indicator

Erebus

Hello, awesome instructions, to be clear, there is a hotkey for Doji (D) and Inside Candle (I) but not for Engulfing or Outside Candle? Any chance to add that option? Keep the chart cleaner with only Bullish and Bearish candles showing and hotkey to show the extra analysis, thanks

Replying to: Erebus

Dale WoodsAuthor

Press R for reversal patterns 😉

Zethembe

forex guy you the authority of price action i dont know how you stay calm

in these market conditions.i also want to be like you one day ,how can i reach my goal

emy

thankyou

Chandra

Excellent indicator covering all candlestick patterns and no need to look for any other scanner or indicator. Good description about settings and usage of indicator

Thankyou very much

Jürgen

thank’s for your tool

stephen lee

great article, many thanks for sharing.

CHOON YEW

Great learning. look forward to implement it

alkan

indicator

KiteRunner

Hi,

how to get Battle Station? Is there trial version available?

Replying to: KiteRunner

Dale WoodsAuthor

No trial version available at the moment, it’s only available to war room members. https://www.theforexguy.com/price-action-war-room/