How we react under pressure, the decisions we make, and our feelings towards the markets play a key role in our chances of success.

Forex is a psychological journey, but our own biology may have a significant role to play as well. Research shows it could be down to our genes and hormone make up.

Hormones are the chemical messengers our body uses to control functions in our body. They have a huge impact on our daily lives including our: mood, behavior, and the ability to learn from our mistakes.

Biological influences, like hormones and neurotransmitters, have been speculated to be the major cause of: boom and bust cycles in the market, market bubbles, and financial crisis.

In today’s article we are going to have a look through some of the major biological influences that can effect you and your Forex trading.

After reading today’s article, you may actually be surprised how many times you may have suffered a hormone meltdown, or been chasing a Dopamine rush.

Testosterone & Risk Appetite

Since the financial markets are dominated by males, we can safely say Forex its a testosterone fulled industry. This hormone has been the culprit to blame for many run away bull-trend ‘bubbles’, market crashes and financial crisis.

The bottom line is; too much testosterone can cause problems.

The male dominant hormone fuels men to make riskier decisions, more frequently, and for higher rewards (or losses). Young males are always picking fights with one another, are more competitive and tend to be involved in more dangerous activities like extreme sports.

This reflects what’s going on in the animal kingdom.

Male animals pick fights with one another to win their status as the ‘alpha male’. The alpha male gets all the girls, so testosterone drives them to take the risk and pick fights with the biggest and baddest rival.

After a win, the body releases more testosterone – causing the animal to take even higher risks and bigger challenges. Eventually they go too far and pick a fight they can’t win, which is their ultimate downfall.

This isn’t too far off with what’s going on in front of some trader’s Forex charts. The stronger male prevails, which makes evolutionary sense. Thanks Darwin.

Males on winning streaks are pumped up with so much T, they get the alpha male euphoric feeling of ‘invincibility’ and ‘no one can stop me’ – which encourages them to take on higher risk trades, which ultimately leads to their destruction.

Don’t let looks fool you though – one article states a person may appear cool calm and collected on the outside, but can be raging with testosterone on the inside and making high risk decisions.

Research has also shown that those exposed to high testosterone levels for prolonged periods, can suffer negative effects on the brain which affect the trader’s ability to understand what effect their actions in the market will have on the outside world. So in other words, they’re so overloaded with testosterone that they lose the ability recognize the consequences for their actions. [1]

This makes sense, as I’ve heard of male traders basically gambling with large amounts of money that they couldn’t afford to lose, which was acquired from extending their mortgages. Really dangerous stuff, and it didn’t end well either.

I am sure the testosterone meter would have been off the dial when one particular guy I knew was risking $50,000 at a time with a $350,000 account. Now it’s all gone.

Bull markets are said to be fulled by the influences of male hormones. Testosterone surges through market participants altering the crowd behavior, pushing prices to extreme highs – creating a market ‘bubble’.

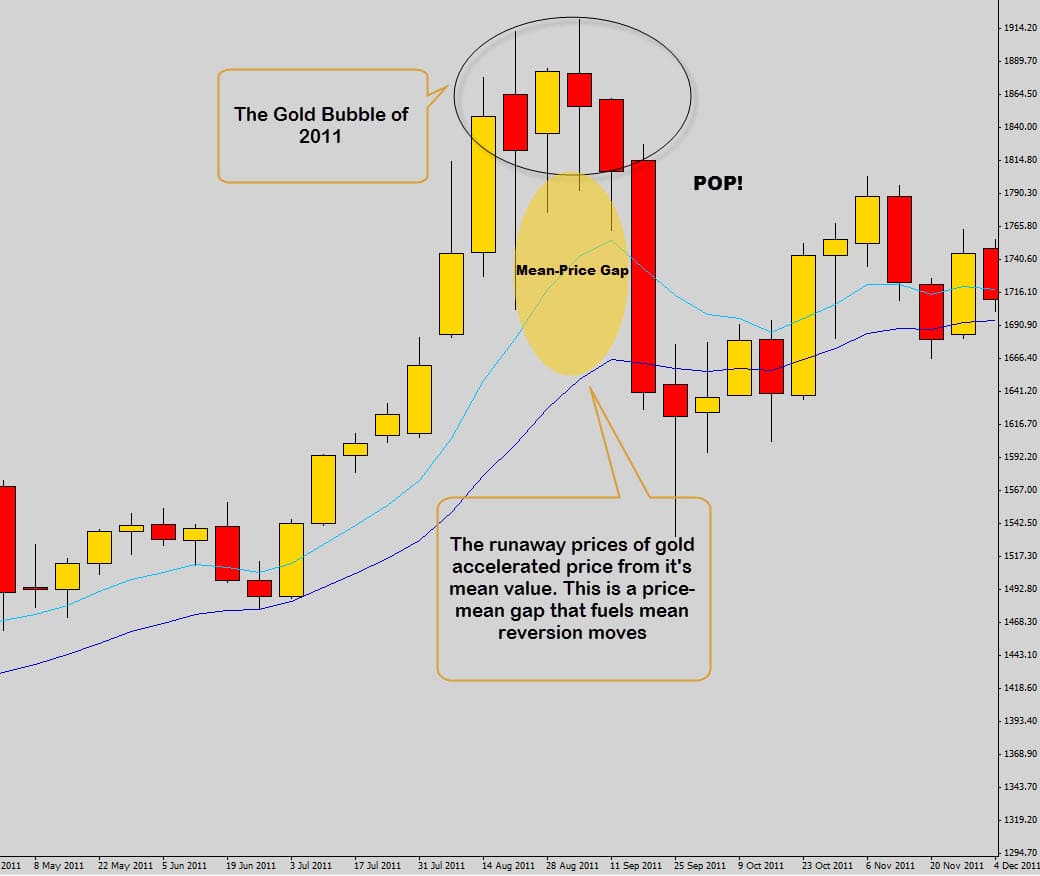

We seen this happening in the Gold bubble of 2012…

The interesting thing to note here, which I see time and time again, is how the market actually accelerates really aggressively once is starts to reach into extreme prices.

This is what a lot of traders will refer to as a ‘trend climax’.

Its easy to see how these scenarios are the result of testosterone fulled ‘high risk’ buyers inflating the crap out of the market, which causes the bubble in the first place. [2][7]

We see this every day on the charts – markets gaping from the mean, and crashing back down.

In the War Room, we teach traders how to take advantage, and profit from these mean reversion moves in our price action course. They can provide really fast returns as the market ‘corrects’ back to value.

Checkpoint

Coritisol & Risk Aversion

In small amounts it is considered healthy and performs vital functions in the body – but large amounts can lead into depression, anxiety attacks, high blood pressure and low self esteem.

Remember that high risk trade you took, but wished you didn’t? You’re constantly checking the status of the position and are losing sleep over it. There is a good chance you were under the influence of high levels of coritsol.

After these run away bull trends exhaust out, we generally see those mean reversions we spoke about earlier fire off – which switches traders into panic mode.

It has been shown in studies that trader’s cortisol levels rise and fall with the changing market conditions. [3]

Fast moving bear markets can switch a trader from the ape banging his chest, into a scared little mouse as price turns against them.

A trader who suffers a bad losing streak may start to experience depression and anxiety, and become a negative person to be around as cortisol levels rise to dangerous levels.

Traders who took part in a study were administered with a pharmaceutical version of cortisol. The traders were less likely to take risks. Cortisol also rises powerfully in situations of uncertainty, such as volatility in the financial markets. [4]

So during market crashes, investors are too scared to buy assets when they really need, and therefore they go into ‘free fall’- Good one Cortisol.

After the SnB released their currency peg with the Euro, we seen the Swiss Franc rally extremely fast. This put a lot of stress on Forex brokers because they couldn’t keep up with the accelerating CHF – causing expensive price quote gaps.

Some brokers just raised the bankruptcy flag at point blank, but FXCM announced they were in trouble an needed bailing out.

There was a panic sell off in their stock. I am sure this news raised cortisol levels for those who were holding FXCM positions and make them slam that big red sell button.

Cortisol would also be the biological driving force behind traders not wanting to buy the FXCM stocks as it switches on all the risk aversion signals in the brain.

Now FXCM prices are at rock bottom prices, the higher risk testosterone influenced traders may start to swoop in and buy it while it’s low?

Checkpoint

Serotonin & dopamine

Seratonin is best described as a calming chemical signal, controlling things like carbohydrate cravings, sleep cycle and pain control. [5]

Dopamine is the opposite, it excites. At elevated levels, this neurotransmitter drives your motivation, regulates your behavior and makes you want things. Dopamine is quite often tagged as the ‘reward motivator’. [5][8]

When you eat chocolate, get attention from the opposite sex or win a massive trade in Forex, your brain ‘rewards’ you by releasing dopamine. Your body likes this feeling and makes you want more.

A healthy mind will have a nice balance of serotonin and dopamine. But if one increases, the other must decrease – moving our mindset to one extreme.

If you keep eating chocolate cake, or have a huge winning streak in Forex – your brain may shift to dopamine dominant state, making you want more and more. Serotonin is weakened, reducing your your brains ability to regulate these processes. [6]

This is how addiction starts.

Things like alcohol, cigarettes, high calorie foods and drugs can effect the dopamine – serotonin balance.

The highs and lows Forex trading pushes us through wild emotional states. This trader blames a dopamine high for his dangerous over-trading.

He explains a winning streak of a couple of months caused him to become addicted to the feeling of winning, and was risking higher amounts of money, over leveraging his account to chase a bigger ‘high’.

Under these circumstances, trading transforms into a high-risk gambling addiction, which is just as addictive as cocaine.

Ever thought to yourself why the stereotyped big time financial guys are well known to be cocaine addicts? I guess we can point the finger at dopamine again. They are addicted to dopamine.

During dopamine highs, and serotonin lows – we are not really happy, and we don’t feel content. Instead of focusing on what we have, we focus on what we don’t have.

Ever caught yourself saying things like, “if I could just win another $1000 today, I would be happy”, or “If I can just build my account up to 100k, I will be happy”.

Dopamine doesn’t have time to wait for results – it needs the unlimited money potential of the market that you ‘don’t have’, right now! So you start forcing trades to make things happen faster.

If you think you’re out of control and suffering from the effects of dopamine highs, this website suggests some supplements and exercises you can do to help raise serotonin again.

Checkpoint

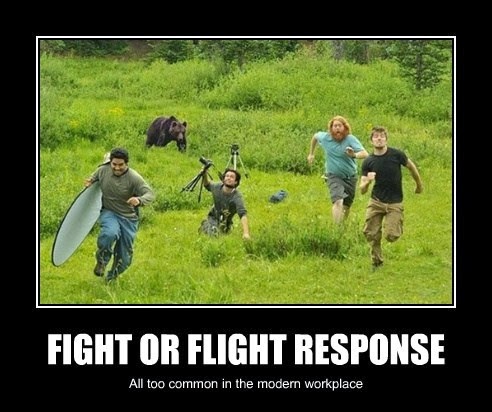

The ‘Fight or Flight’ Response

The ‘fight or flight’ response is an evolutionary trait that was programmed into the sympathetic nervous system. If our ancestors were confronted by a large roaring bear – the flight or fight response mechanism would kick in.

The brain needs to make a snap decision weather to run like crazy, or fight to the death by performing some super quick risk evaluation.

In any case, the adrenal glands pump out adrenaline which increases our heart rate, lights our eyes up like a Christmas tree, increases our alertness and response time – basically preparing us for battle, or a fast getaway.

The fight or flight response has helped man kind survive the dangers of the land, but today we’re not as much at risk of being mauled by a random lion or that angry bear, but it is triggered by modern day dangers.

If we have a near miss with an out of control car, or someone pulls a knife out on you – the fight or flight response kicks in.

At the trading screen, fight or flight will surface when you look at your trading screen, and see a trade which you thought was doing well, now aggressively moving against you.

How many times have you been in a situation where you’ve looked at the charts and felt your heart start beating faster? Your body is reacting and releasing adrenaline to help you deal with the ‘threat’ better.

People who put too much on the line, or risk money they shouldn’t be, will experience these moments more than others. Because so much is a stake, it’s the ‘oh crap’ moment which triggers all the emergency signals in your body.

Generally the fight or flight response is the reason why traders freak out, and exit trades too early, or try to micro mange their positions.

Or, on the other hand, the flight or fight response may be responsible for traders jumping into fast moving markets, because they don’t want to miss out on the opportunity.

It’s that “I have to quickly react right now” feeling, and it generally screws us.

This is why it can be dangerous to stare at charts, especially when you have trades open. It’s better to set key times to check the markets and evaluate the situation at these set intervals.

Like making trading decisions at the New York close – to see how the daily candle closed for the session, or checking the markets before the London open to observe the Asia session price movements.

We do this in the War Room to identify any failed Asia breakout trades.

Checking the markets in the middle of an NFP release, or a central bank policy update is going to cause chaos on the charts, and trigger the flight or fight response with your open positions.

It has helped us in the outside world, but it’s not very helpful in the financial world. Don’t let fight or flight mess your trading up, keep your eyes off the chart and let your trades complete their course.

Checkpoint

Conclusion

Basically, all our biological mechanisms that helped us stand through the trials of evolution don’t actually do much good for us in the Forex market.

Although testosterone has been shown to help young males earn more profits by taking a more aggressive trading approach, an overload of the hormone can send these traders spiraling out of control.

It seems like women and older men are better suited biologically for more longer term trading success by taking risk more seriously, and opting in for the conservative approach.

Many big financial institutes and banks are catching onto this and are actively seeking out more woman for high ranking financial management positions.

Your trading ‘personality’ will be heavily influenced by your biology. It’s important to recognize when you’re under the spell of your body’s feedback loops, and try to do everything you can to keep them operating within normal parameters.

Your trading will be all the better for it.

Please let me know in the comments below if you can recall times when your biology has taken a firm grip over your trading behavior, or if you currently have trouble controlling your behavior while trading.

All the best with your trading this week!

Brou Ebo

Thank you so much for that

thiru

Good information. I am new to this market. This gives an idea for all financial markets. Keep it up.

abeauty

outstanding…….

Kevin

In addition to these bio-chemical influences there is this…

Cognitive dissonance – the concept of being exposed to information or having experiences that conflict with our existing base of personal and subjective knowledge. The theory holds that our minds are not always flexible or rational when it comes to evaluating uncomfortable information or questioning our own beliefs.

Replying to: Kevin

Dale WoodsAuthor

That’s a good one Kevin, Thank you.

pikkie123

Wow so powerful and true.!!!