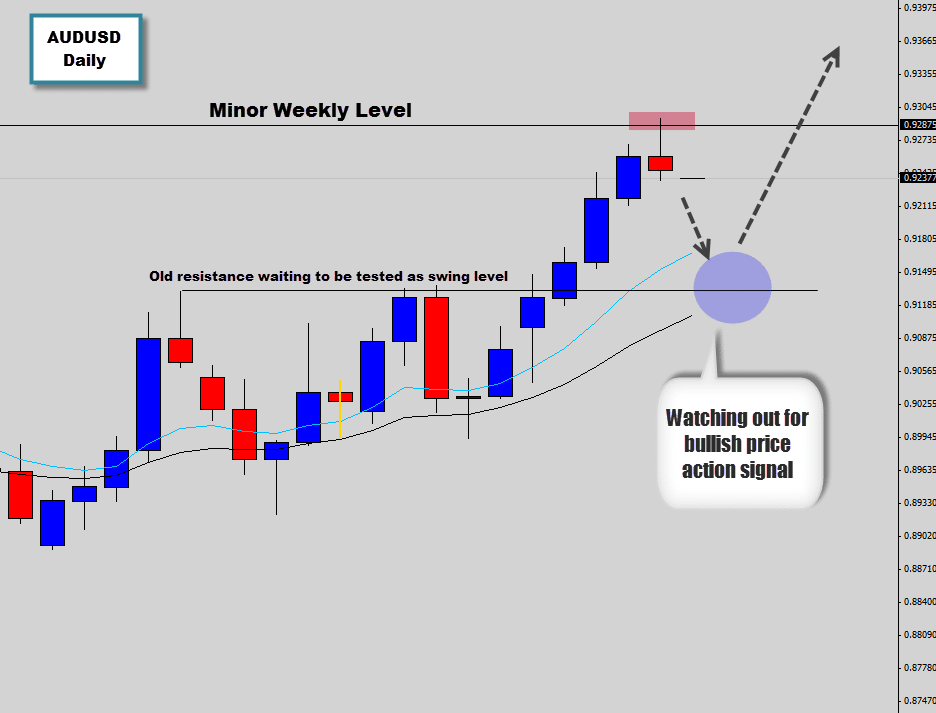

The Australian Dollar has been a great performer during the last two weeks of trading, with the AUDUSD daily chart pushing into higher highs. The rapid acceleration into higher prices as caused the market to gap away from the mean value, creating a situation where the market considers the price to be ‘too expensive’.

As a result of these expensive prices a bearish rejection candle has formed when the market reacted with a minor weekly resistance level while price is overextended. Given the decent gap between the mean value and price, plus the other variables mentioned, it’s left the AUDUSD vulnerable to a bearish mean reversion move.

Price action traders could look to short the break of the low with the bearish momentum. A good target would be the old resistance level which is expected to act as support and play out as a swing level within this trend. This area also co-insides with the mean value, so we anticipate this level to be a “hot spot” for buyers and will be watching for any bullish price action signals to manifest here to help us position in long with the overall upward momentum.