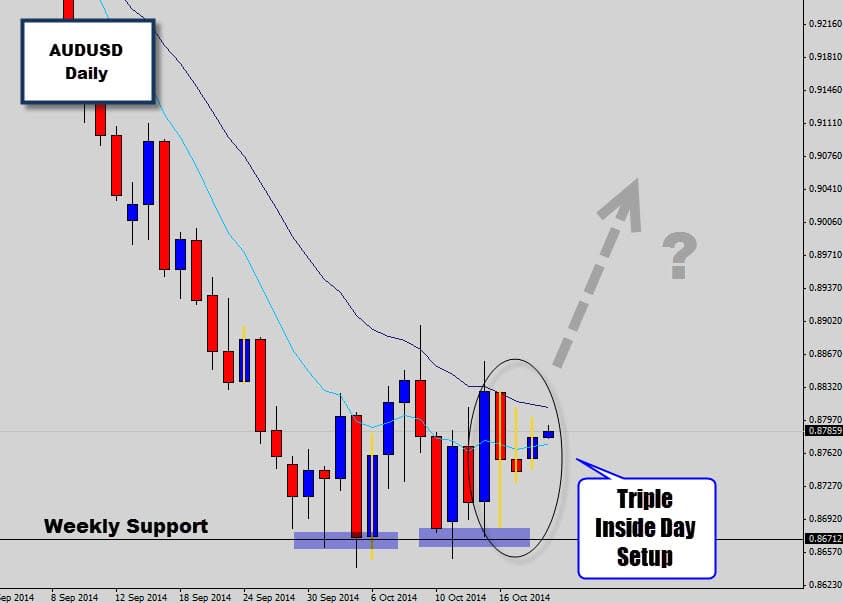

The AUDUSD has been considered a ‘no trade zone’ after the market has jammed up against a weekly support level and congested heavily in consolidation. This is why is a good idea to map out weekly support and resistance levels on your chart, because they can stop a major trend in their tracks – like the recent downtrend. They are the major turning points of the market and you will do well to notice when price approaches them.

Now the market has tonight consolidated for 3 days, causing a tight wedging pattern on the 4 hour chart. This type of price ‘squeezing’ usually leads to a very strong breakout. This is why double, and even better – triple inside day setups have massive potential to produce very explosive breakouts.

What we’re waiting for here is price to break the highs of the inner Inside day – this is how we catch breakout momentum ‘as-it-happens’. The downtrend looks like it has ran out of steam and ‘bottomed out’ on weekly support – I believe there will be an upside move generated from this. Conservative traders who want extra confirmation could use breaks of the other Inside Days, but your stop loss will need to increase as a result.