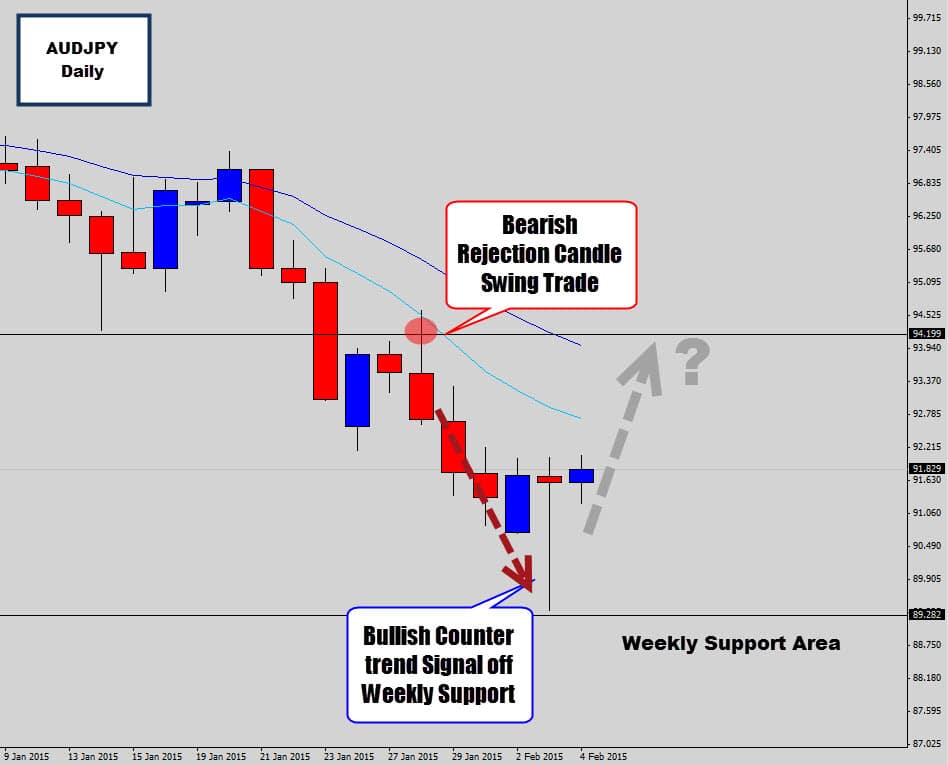

The Australian Dollar showed significant weakness last session when some critical levels were tested. The AUDJPY daily chart demonstrates the rejection of a previous swing low as it held as new resistance. At the new york close, we got a bearish rejection candle, which also closed much lower than the open price – giving the setup some more bearish weight.

War Room member Erebus reported that the RBA is expected to also lower their interest rates, which will be negative for the Australian Dollar. So with technical and fundamental factors pointing towards further AUD weakness, we could see lower prices develop off this setup this session.

THE AUDJPY REJECTION CANDLE PUSHES PRICES LOWER

The bearish rejection candle off the swing level worked out nicely as lower prices fell out of this price action setup. These ‘breakout and re-test’ around important levels on the daily chart generally work out very nicely.

A big ‘red flag’ has formed for anyone who is still holding short positions here as a very large, counter-trend bullish rejection candle formed off a weekly support area.

When these large reversal candles form off weekly support, it’s generally something you want to take seriously. Due to the large anatomy of this bullish rejection candle, and the significance of this level, we will most likely see a bullish move out of this setup. Whether it’s just a short term correction, or the bottom of a large upward move is something we can’t answer. But traders looking to get in for the ‘long haul’ should just play the setup candle-by-candle.