When you’ve racked up a few years’ worth of screen hours, monitoring different markets behavior when price tests support or resistance levels, trend lines, or even dynamic support, you naturally start to spot reoccurring patterns that keep forming over and over again.

When these patterns are producing the same behavioral response from the market, it becomes clear there is an edge to take advantage of. In this article we wanted to introduce our newest edition to our price action trading strategy: the candlestick signal we have appropriately called the ‘Power Candle’.

What is a Power Candle?

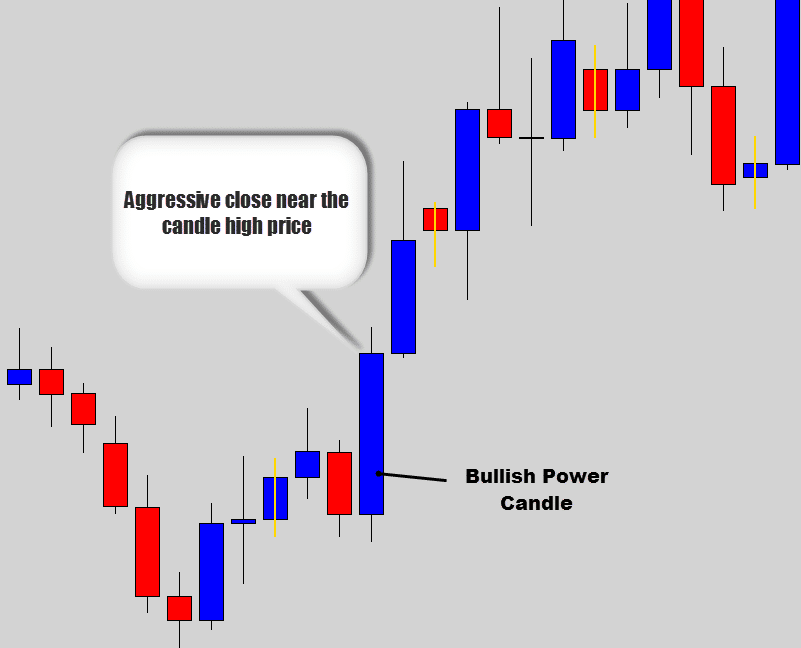

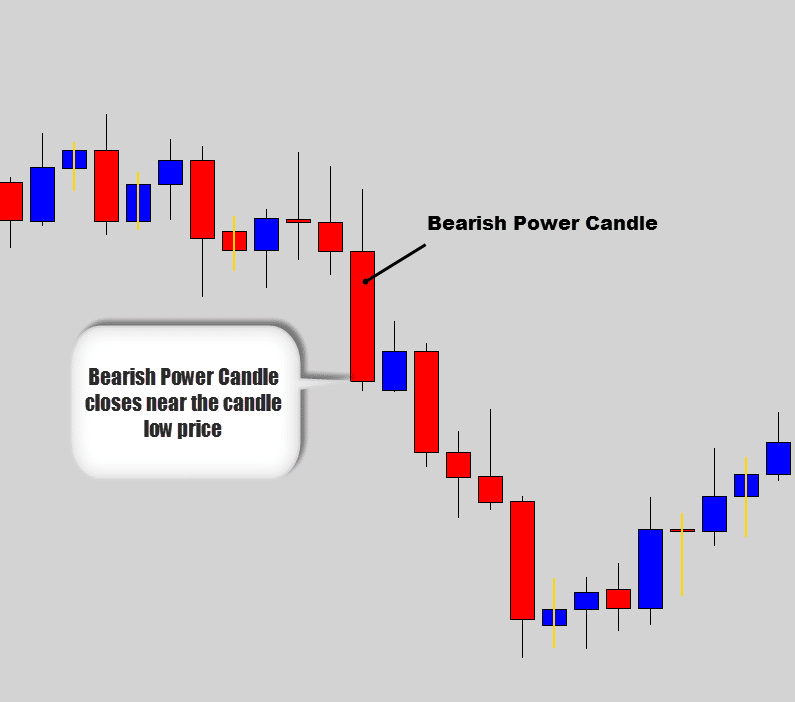

A power candle is a basic single candle formation containing a very large and thick body; think along the lines of a marubozu). At the closing end of the candle, there shouldn’t be any large wicks producing from the body, and the closing price must be located aggressively towards the closing direction of the candle.

For example, if the candle closed higher than its open price (a bullish candle), then there must be no large upper wicks, closing nice and close to the candle highs. Alternatively, if it closed bearish (close price is lower than the open price), then we want to see the close price located near the low of the candle with no large lower wicks poking out the bottom of the body.

To qualify as a power candle, it’s important that the range of the candle (high-low) is larger than the surrounding candles. The candle must have a dominant presence on the chart that communicates a decisive move took place during the candle’s open period.

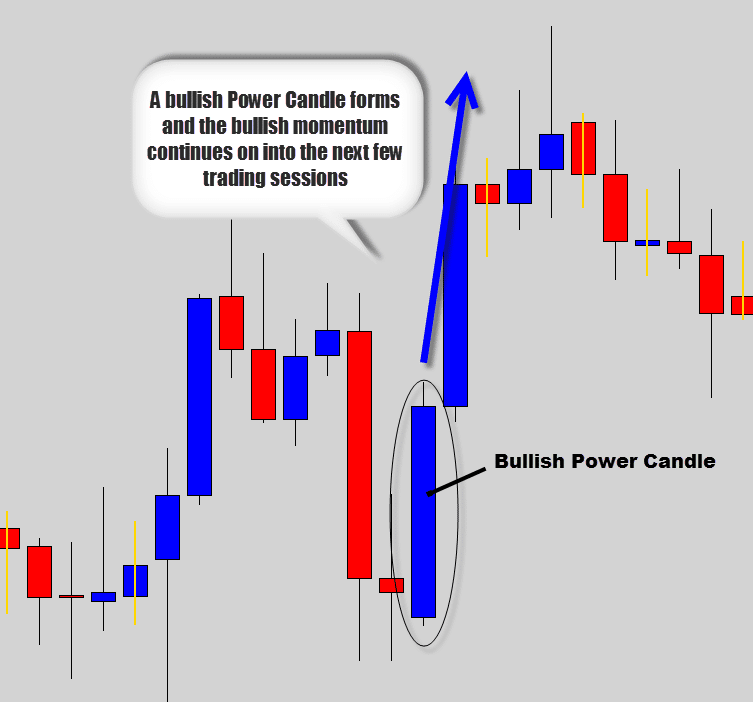

Below are some examples of Power Candles…

Notice how the bullish Power Candle is very large in range, and is larger than the surrounding candlesticks.

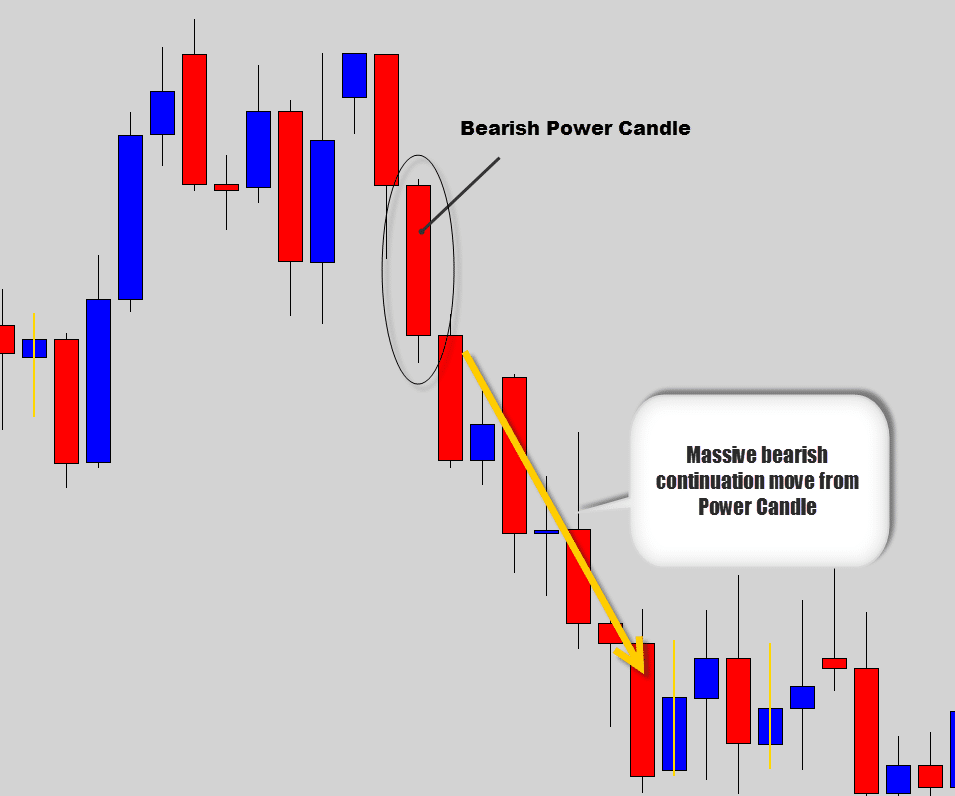

Above is the bearish power candle. The anatomy of the power candle is very large and should easily grab your attention when you first glance at the chart.

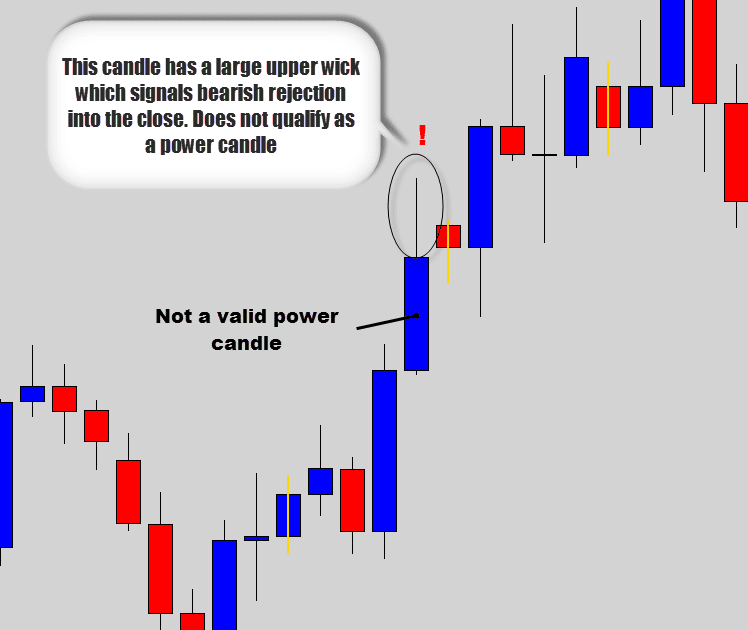

Below is an example of a candlestick that does not qualify as a Power Candle…

The candlestick in the above chart does not have a strong close near its high. The candle experienced some bullish rejection into the close of the candle, leaving an upper wick protruding from the body of the candle, which is no good to us.

What causes Power Candles?

There is no doubt that news related trading variables have a high impact on market movement, but it’s our opinion that news trading is dangerous, stressful, and can give a trader anxiety issues. This is no state to be in when you’re in front of the charts.

Bottom line, all the different economic and fundamental variables that are constantly been fed into the markets are being reflected in the raw price action on the charts.

We can observe the outcome of the markets response to the news by looking at how candlesticks close, not by trying to quickly make sense of the NFP data that has just been released and jumping in with dangerous volatility.

Power Candles are definitely one way to catch movement caused by fundamental variables without having to understand how the economics of the world affects the global market movements.

It’s very clear from the anatomy and structure of a Power Candle that they are caused by a very decisive and aggressive move in one clear direction. Power Candles can frequently be fueled by a high-impact news event that has taken place, which has caused a surge of orders in a specific direction.

Examples include an economy’s GDP figure release, interest rate statements, or a government official may give a speech about their country’s financial situation, and suggested or implemented new policy changes.

Now, understanding the impacts of major economic releases is important, BUT: we don’t have to predict how this data affects the market; you just need to look at the candlestick patterns and you can see that a market is bearish, bullish, or neutral on the event.

Power candles are the early warning sign that a decisive move has taken place and an ‘early warning flag’ to expect further continuation in that direction.

How Power Candles Can be Used in Price Action Trading

When a power candle forms, the momentum generally flows on into the next few candlesticks. This is the movement we want to catch…

The chart above shows a large bullish Power Candle setup. Notice how the bullish momentum continues into the next few trading sessions.

The chart above shows a bearish power candle, which signaled a landslide on the chart. This trade returned a massive amount on the initial risk. It’s definitely a lucrative opportunity to take advantage of the moves that power candles can warn us about.

As with most other price action signals, we prefer to trade power candles on the Daily time frame. We recommend this because they are generally caused during times of high volatility, so it’s good to get the extra clarity and stability from the daily candle using end-of-day trading strategies, rather than getting caught up in intra day noise.

As a Forex trader your job is not to make money; it is to be an expert at risk management. Risk/Reward balancing of your trades is crucial to long-term growth in this profession. We mention this because Power Candles have a fairly moderate risk profile due to the fact they only need tight stop loss levels.

However, the risk/reward mechanism is like a scale: if one end is more weighted, the scales tip and it leverages the other end. What I am saying here is the higher the risk of a setup, the higher reward potential it will have. The less risk the less reward.

Power candles have the potential to produce extremely high return rates. It’s not uncommon to nail a 1:10 return on a Power Candle trade.

The concept of trading the Power Candle is simple enough: we are looking for the aggressive momentum that caused the Power Candle in the first place to continue on into the next trading session or two. This is basically momentum trading and we are using it to catch the ‘overflow’ or ‘continuation’ of the move into the next session.

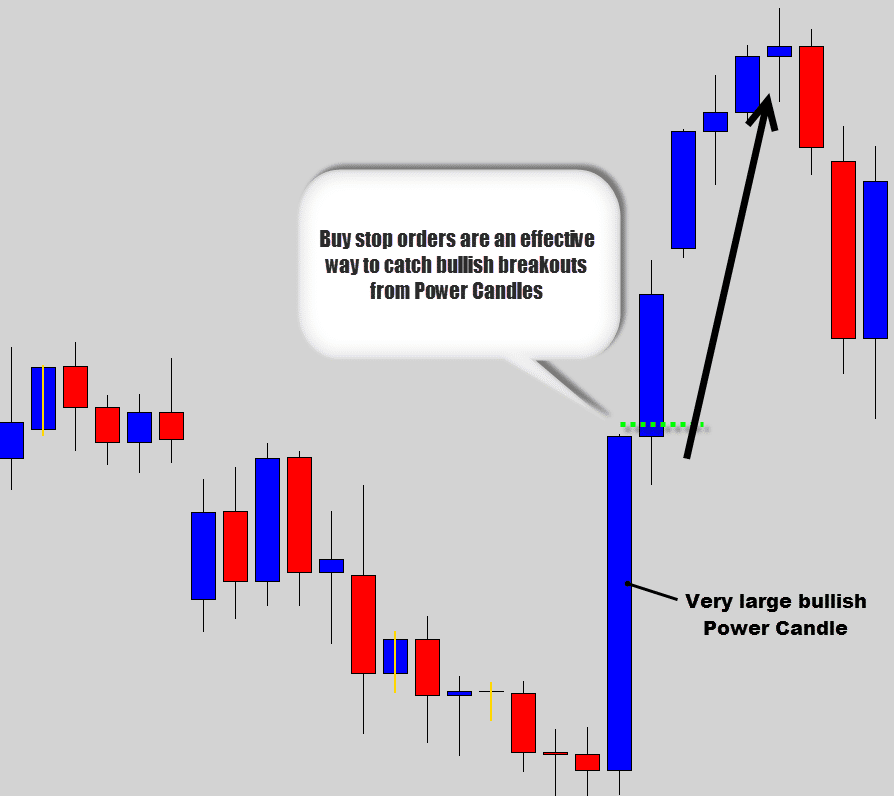

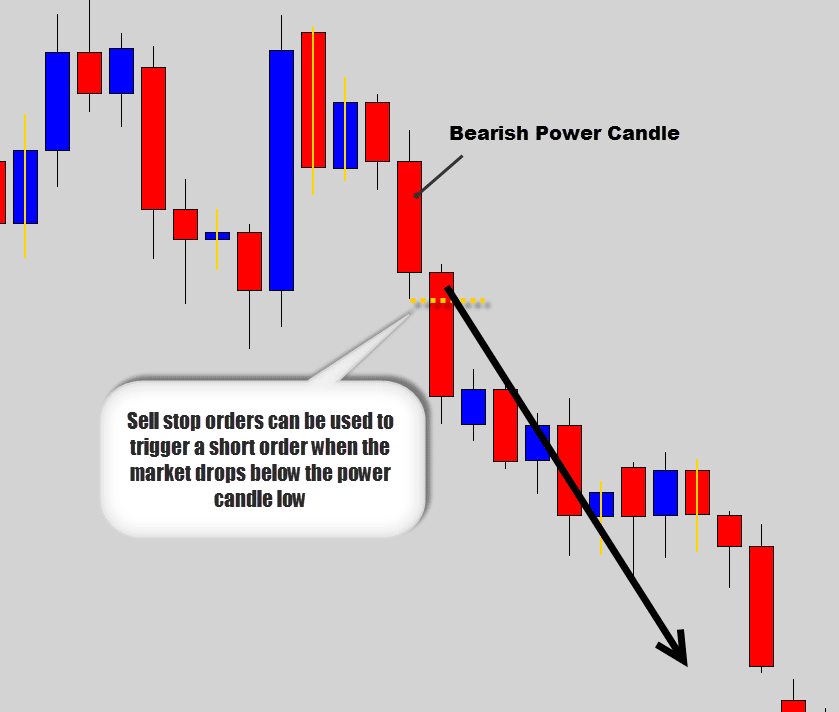

One way to do this is to use ‘stop orders’ above the power candle high or low to automatically trigger you into the breakout. You don’t want to have to sit there and stare at the screen for hours waiting for a breakout to occur; use stop orders to automatically enter the trade.

Take a look at the Power Candle trade in the above chart. The buy stop order would have triggered you into the momentum breakout without any intervention from you.

In the example above, a sell stop order can be used to automatically activate short trades when price breaches the low of bearish Power Candle setups. It’s best to enter in with the momentum like this for the extra confirmation the bearish pressure is still there to drive prices lower.

The Wrap Up

To finish up today’s introduction to Power Candles, it’s important to remember that this strategy does carry a moderate risk profile, but does make up for it by offering very explosive reward potentials, depending on how you structure your trade setups.

Power candle trading is for the trader that has the risk appetite, and the stomach to go for high-yield setups.

If the Power Candle strategy is something you think you could benefit from, or would like to integrate the concept into your trading, you can find out more about how we trade Power Candle and how we apply them to price action trading. Just check out our Price Action Protocol trading course, which is part of our War Room lifetime membership package.

All of us in the War room have been taking full advantage of the large lucrative movements that Power Candles have been producing across the markets recently, along with all the other awesome price action setups that have been dropping lately.

Thanks for reading, and if you liked this article please don’t forget to click the like button below!

Cheers to your trading success!

Brandon Williams

I thank you for the info! The thing is I also see many failed signals on the examples you provided. I do understand that not all signals will be profitable, but looking on my own charts, just trading these setups alone will destroy an account. I think this strategy needs more filtering.

Replying to: Brandon Williams

TheForexGuyAuthor

Yes there is specific criteria for entering this setups. It involves a London breakout strategy and certain conditions must be met before qualifying as a valid trade. I also use a special money management system for these setups also to remove risk from the market quickly. These setups tend to be very explosive, or stop out very quickly – so removing risk is important.

Z500T

One issue is that very commonly price retraces into the power candles range

tec.nacks

What’s the reasonable pip a power candle should have across all major timeframes?

Fredrick Mugo

Pls reach me

NILESH TANDEL

its work on intra day trading

koyes ahmed

many many tnx for your nice artical.

Bangladesh

asmadi

thank you very much .

Soren

This sure must come with some risk, look at the 1st picture, go 7 days back and see a clear bullish power candle, however this one was not followed by immediate bullish action, but quite the opposite. But I will surely try this one a demo account and see how it works 🙂

Replying to: Soren

Dale WoodsAuthor

Power Candles are a little more risky to today – but the point is to try catch overflow from the power move the next day. Timing is very important for these setups and it’s something that is discussed heavily in the Forex course – for all the signals.

Replying to: Soren

Mike

Soren, I think the power candle is more effective when it is located at a swing point. Eg. Swing low for a bullish power candle.

Michael

Hi,

I didn’t ask about the whole strategy but wanted to have a “flavor” of your approach to the subject.

Anyway, I respect your answer and your proprietary info.

Cheers,

Michael

Replying to: Michael

Dale WoodsAuthor

Sure thing Michael,

I’ve sent you an email 🙂

Michael

Great article.

I have a question.

Where do you put a stop loss order while trading Power Candles?

I guess it’s not at the bottom of the candle as it would be quiet difficult to reach risk/reward ratio or 1:3.

Thanks.

Replying to: Michael

Dale WoodsAuthor

I can’t give away too many details – that’s all covered in the price action course which you can find more about here.

Tracey

I have been doing this method successfully on the 4hr charts using divergence…… love it

Radi Cholakov (@RadiSpeculant)

Looking really intresting